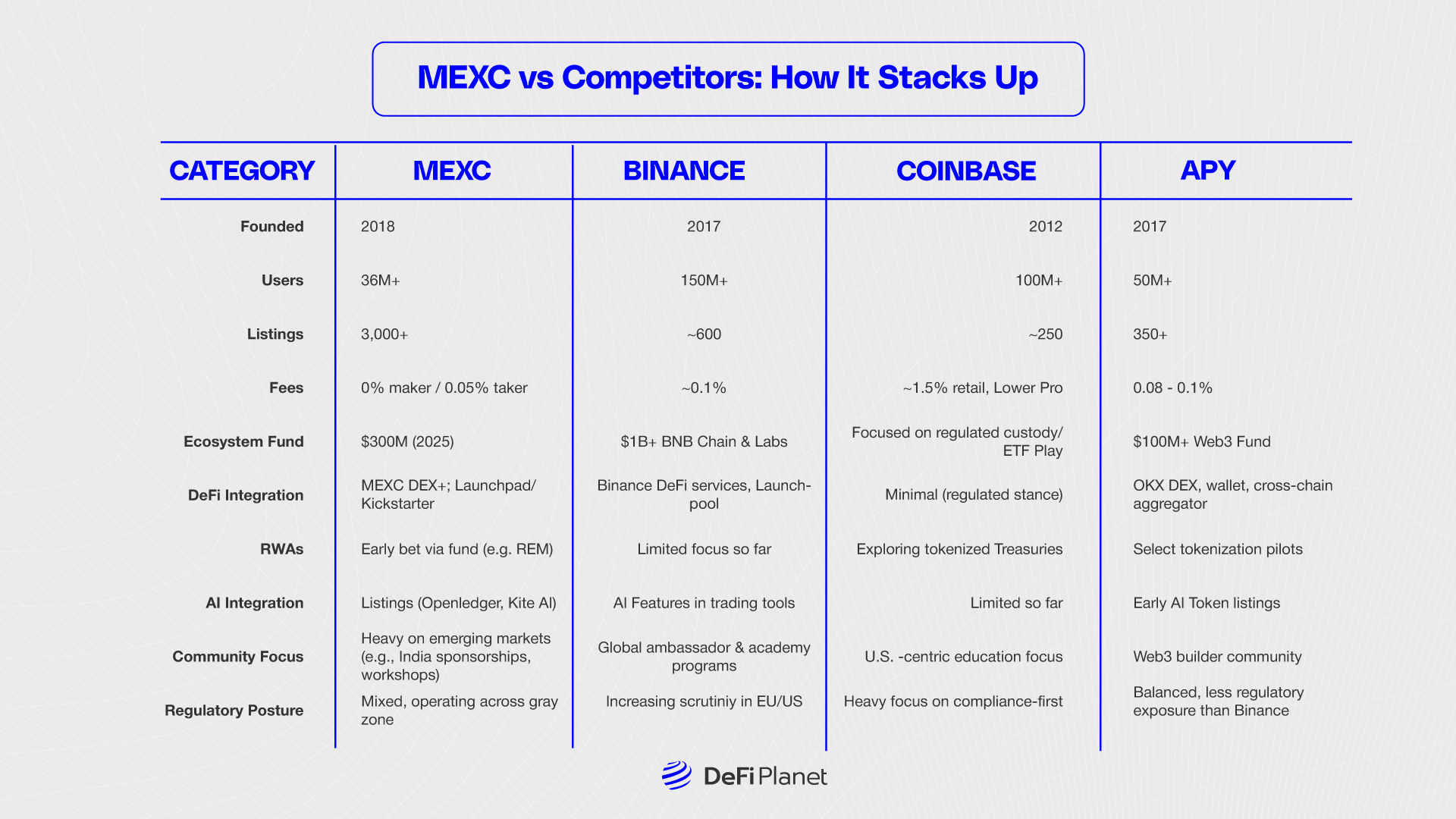

The cryptocurrency landscape in 2025 looks very different from just a few years ago. DeFi adoption is climbing, tokenized real-world assets (RWAs) are moving from theory to pilot programs, and artificial intelligence (AI) is beginning to intersect with blockchain technology in new ways.

Amid these, MEXC has emerged as a platform that is trying to do it all: exchange, ecosystem builder, investor, and educator. Founded in 2018, it now serves 36 million users across 200 countries, with more than 3,000 listed tokens and daily volumes that place it consistently in the global top 10. But is MEXC keeping up with the trends—or simply trying to cover too much ground?

This review takes a closer look.

From Trading Platform to Ecosystem Builder

MEXC’s early reputation was built on low trading fees and high liquidity, two things that helped it stand out in a crowded exchange market. In 2025, however, the exchange is positioning itself as much more than a trading platform.

- Scale: MEXC lists over 3,000 tokens, ranking among the top 10 global exchanges by daily volume.

- Ecosystem Investment: Through a $300 million ecosystem development fund launched at TOKEN2049 Dubai in April 2025, MEXC has started investing in public chains, wallets, stablecoins and even media platforms. This five-year initiative is offering not just capital but also operational synergies like liquidity support and global exposure.

- Developer Focus: MEXC’s IgniteX CSR program is a $30M initiative backing early-stage startups with mentorship, education, and seed funding—an unusual step for an exchange.

MEXC’s attempt to become an “ecosystem builder” mirrors moves by competitors like Binance and OKX. The difference is that MEXC seems to emphasize mid-tier and experimental projects rather than just chasing the biggest names. This strategy could prove forward-thinking—or risky—depending on how those projects play out.

DeFi Integration: Lowering Barriers or Spreading Too Thin?

The blockchain industry in 2025 is moving beyond speculative trading toward building sustainable, interoperable ecosystems. The mainstream adoption of DeFi is reshaping financial systems by eliminating intermediaries and enhancing transparency. MEXC’s early embrace of DeFi, as noted by COO Tracy Jin, stems from its recognition of decentralized technologies’ potential to democratize finance.

DeFi is projected to hit $200B in TVL by the end of 2025, and MEXC is clearly betting big here. Its dual-engine model “DEX+” combines centralized trading with DeFi functionalities. The DEX+ blends CeFi security with DeFi features, offering access to liquidity pools, yield farming, and early-stage projects via Launchpad and Kickstarter.

Pros:

- Trading structure: Over 2,000 pairs, with competitive 0% maker and 0.05% taker fees.

- Access to a wide variety of DeFi tokens, including newcomers like Hyperliquid (HYPE), which uses HyperBFT consensus and has market forecasts suggesting it could reach $87.42 in 2025 (though this is speculative).

- Onboarding tools: Demo trading features and educational resources make it easier for new users to explore staking, yield farming, and liquidity pools.

- Community access: Launchpad and Kickstarter allow retail users to join early-stage DeFi projects like Fly.trade, which aggregates cross-chain liquidity.

Cons:

- With so many tokens listed, quality control is an open question. Retail traders risk exposure to less-proven projects.

- Competing exchanges like Coinbase have leaned into regulatory clarity and blue-chip listings, while MEXC’s “long tail” approach may attract scrutiny.

If you’re an adventurous trader looking for new DeFi opportunities, MEXC has a lot to offer. If you’re cautious and want regulatory certainty, you may prefer a more conservative platform.

By integrating with protocols like TON and Aptos, MEXC is supporting scalable, user-centric blockchain solutions. For instance, its $1 million campaign with the TON Foundation promotes stablecoin adoption and DeFi applications, aligning with TON’s vision of revolutionizing Web3 accessibility. This synergy highlights MEXC’s role in amplifying emerging networks, ensuring they reach global audiences with robust liquidity.

The MEXC DEX+ platform represents an effort to blend the strengths of centralized finance (security, liquidity) with decentralized principles (non-custodial trading). This hybrid model is useful for newcomers who want to try DeFi without giving up all the safeguards of centralized exchanges. Still, it’s not yet clear if hybrid approaches like this will dominate or fade once DeFi user interfaces mature.

Real-World Assets: An Early Bet

The tokenization of real-world assets (RWAs) is a defining trend in 2025, with their potential to bridge traditional and digital finance. However, as MEXC COO Tracy Jin noted, the challenge lies in creating tangible value rather than chasing superficial trends. MEXC’s approach involves strategic support, including product exposure and launch infrastructure, to ensure RWA projects achieve scalability and compliance.

MEXC’s $300M fund prioritizes RWA tokenization via:

- Accessibility: Projects like Real Estate Metaverse (REM) let users buy fractional property stakes for as little as $100.

- Market growth: Blockchain in retail was valued at $5.4M in 2024 and is projected to grow at 41.3% CAGR through 2033, supported by brands like Gucci accepting crypto payments.

- Regional advantage: Markets like Singapore (no capital gains tax) and the U.S. (clearer legal frameworks) offer fertile ground for RWA adoption.

MEXC’s listings of RWA-focused tokens, such as those tied to real estate or commodities, provide investors with early access to this burgeoning sector. Tokenized RWAs could become a breakthrough for mainstream adoption. But legal enforceability and regulatory treatment remain unresolved in many jurisdictions. For investors, this is still a frontier play rather than a safe asset class.

AI and Blockchain Integration: MEXC’s Vision for the Future

The convergence of AI and blockchain is a transformative force in 2025, with projects like Openledger addressing centralized data pipeline limitations. MEXC’s partnership with Openledger, backed by $8 million in seed funding, exemplifies its commitment to AI-driven blockchain innovation. Openledger’s Layer-2 platform decentralizes data management through community-owned datasets, enhancing AI model training for applications in healthcare, IoT, and Web3 trading.

🐙 The future of AI is here and we’re building it.

Catch us live with MEXC for an AMA you won’t want to miss.We’re starting in just a few minutes https://t.co/L92KFkLrFE https://t.co/S6PKxTQHJ5

— OpenLedger (@OpenledgerHQ) September 16, 2025

AI as a Catalyst for Blockchain Scalability

AI-driven tokens are gaining traction, with projects like Kite AI raising $18 million for EVM-compatible Layer-1 blockchains tailored for AI agents. MEXC’s early listings of AI-focused tokens position it as a hub for this trend. By supporting platforms like Openledger, MEXC enables developers to leverage blockchain’s transparency and immutability for secure AI development, addressing scalability and security challenges.

Democratizing AI Innovation

MEXC’s involvement in AI-blockchain integration creates opportunities for developers and data contributors. Openledger’s testnet, for instance, incentivizes users with OPEN tokens for contributing to data networks. MEXC’s role as a listing venue and liquidity provider ensures these projects gain traction, fostering a collaborative ecosystem where AI innovation thrives.

Community Empowerment and Global Expansion

MEXC’s community-centric approach is evident in its 2.25 million Twitter followers and 193,000 Telegram members. Its title sponsorship of the India Blockchain Tour 2025, projected to reach India’s 156 million crypto users by 2027, underscores its commitment to grassroots engagement. By funding workshops on Solidity, Layer-2 development, and zk-rollups, MEXC nurtures talent in emerging markets, positioning itself as a global leader in Web3 education.

Localized Ecosystem Growth

India’s vibrant crypto ecosystem, despite regulatory challenges, is a testbed for scalable blockchain adoption. MEXC’s strategic investments in local talent and projects align with the trend of localized ecosystem growth. By offering early access to promising tokens, MEXC empowers regional developers to contribute to global Web3 innovation.

Regulatory Compliance and Security: Building Trust

As regulators worldwide tighten oversight, with the EU’s MiCA framework increasing compliance costs, MEXC prioritizes security and transparency. Its KYC and AML procedures, biometric authentication, and insurance models for DeFi risks ensure user trust. By structurally separating investment and listing teams, MEXC mitigates conflicts of interest, maintaining credibility in a volatile market.

Regulatory Clarity Driving Adoption

The U.S.’s pro-crypto administration and Singapore’s clear regulatory policies are accelerating blockchain adoption. MEXC’s compliance with these frameworks positions it as a trusted platform for institutional and retail investors, facilitating the mainstream integration of crypto assets.

Safe and Accessible Trading

MEXC’s focus on security, including fingerprint and facial recognition for high-value transactions, creates a safe trading environment. Its demo trading feature further empowers users to experiment risk-free, broadening access to crypto markets and fostering informed participation.

MEXC as a Catalyst for the Crypto Revolution

MEXC’s transformation from a trading platform to a Web3 ecosystem builder reflects its alignment with 2025’s blockchain trends: DeFi’s mainstream adoption, RWA tokenization, AI-blockchain integration, and localized ecosystem growth.

By leveraging its $300 million Ecosystem Development Fund, strategic partnerships, and community empowerment initiatives, MEXC is not just following trends but shaping them. Its commitment to regulatory compliance, security, and education ensures that it remains a trusted gateway for the next generation of crypto participants.

As the global blockchain market is projected to grow from $3 billion in 2020 to $39.7 billion by 2025 at a 67.3% CAGR, MEXC’s role in fueling innovation and unlocking opportunities is undeniable. By bridging CeFi and DeFi, supporting emerging technologies, and empowering communities, MEXC is igniting a crypto revolution that promises to redefine finance, technology, and global connectivity.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”