In crypto trading, where emotions often outweigh logic and volatility rules the charts, deceptive strategies can easily slip through the cracks. One such tactic is spoofing, a form of market manipulation that misleads traders, distorts price trends, and undermines market integrity.

But what is spoofing in investment terms, especially when it comes to the crypto market? How does it work, and what can be done to avoid it? This article will break it all down—simplified, insightful, and packed with everything you need to know.

Definition and How Spoofing Works

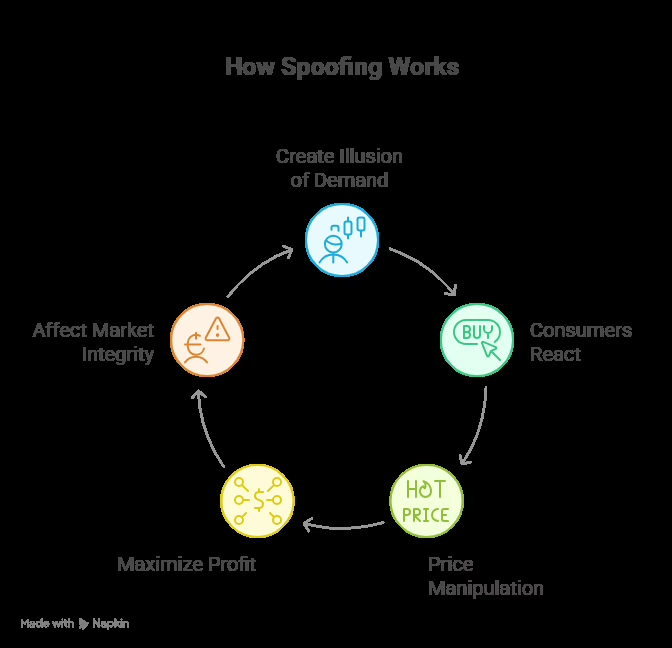

At its core, spoofing in investment is a manipulative trading strategy where a trader places large buy or sell orders with no intention of executing them. The aim? To create a false sense of supply or demand, influence market sentiment, and manipulate the price in a favourable direction.

Here’s how spoofing is done in trading: A spoofer begins by placing a large buy order just below the current market price, creating the illusion of strong demand. This massive order isn’t meant to be executed; instead, it serves as bait. Other traders, interpreting this as a signal that prices are about to rise, quickly jump in to buy. Just before the large order gets filled, the spoofer cancels it and takes advantage of the temporarily inflated price to sell their own assets at a profit.

The same tactic can be reversed: the spoofer places fake sell orders to generate panic, triggering a price drop. Once prices fall, they buy in cheaply. How spoofing is done typically relies on the rapid placement and cancellation of these deceptive orders using bots or advanced trading software, allowing spoofers to stay one step ahead of detection and manipulate markets in real time.

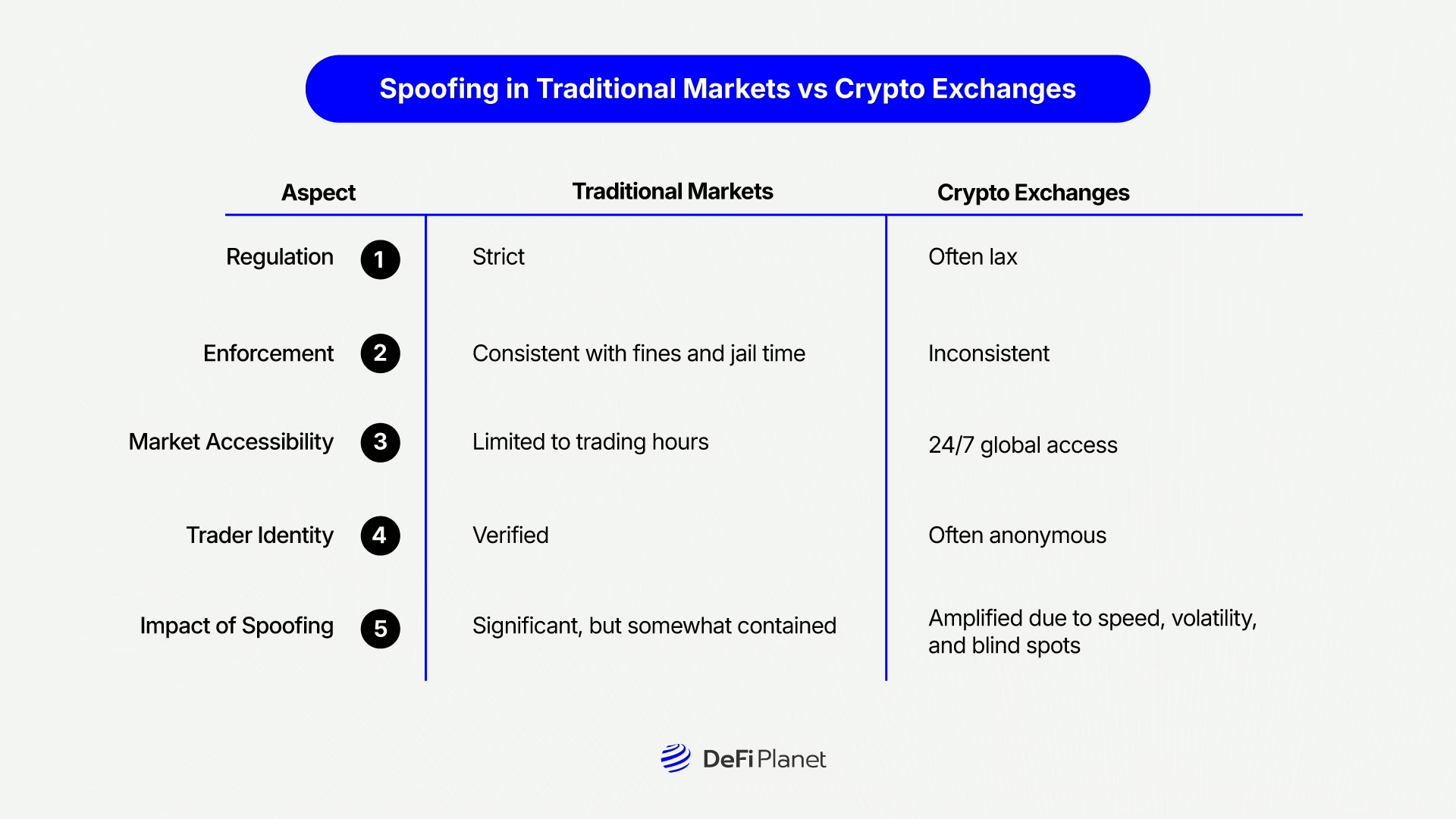

Spoofing in Traditional Markets vs Crypto Exchanges

Spoofing in Traditional Markets vs Crypto Exchanges reveals a tale of two very different regulatory worlds. Spoofing isn’t a new trick—it first emerged in traditional financial markets such as stock and futures exchanges. There, it has faced strong regulatory pushback. Regulators like the SEC and CFTC have cracked down hard on spoofers in traditional markets, enforcing strict rules, imposing heavy fines, and even pursuing criminal convictions. These markets are under tight regulatory oversight, with advanced surveillance systems designed to detect and penalize manipulation in real-time.

In contrast, crypto exchanges, particularly those that are unregulated or offshore, still operate in legal grey zones. This lack of uniform regulation allows spoofers to thrive. Unlike traditional markets, many crypto platforms lack real-time spoofing detection systems, creating blind spots for manipulation.

The anonymity and accessibility of crypto trading further widen this gap. Many platforms have minimal or no KYC (Know Your Customer) protocols, allowing bad actors to operate behind pseudonyms with little accountability. Combined with crypto’s 24/7 global accessibility, this creates a fertile ground for spoofing.

What’s more, the speed and volatility of crypto markets intensify spoofing’s impact. Trades execute in milliseconds, and both humans and bots are quick to react to deceptive signals—often before they can even verify them.

So, is spoofing in trading illegal? Yes, in jurisdictions like the U.S. and U.K., it is unequivocally illegal, with penalties ranging from hefty fines to prison time. However, when it comes to crypto, enforcement remains inconsistent, leaving a loophole that manipulators continue to exploit.

Comparison Table: Spoofing in Traditional Markets vs Crypto Exchanges

How Spoofing Affects Market Sentiment and Pricing

How Spoofing Affects Market Sentiment and Pricing is rooted in its ability to exploit human psychology—particularly emotions like FOMO (Fear of Missing Out) and FUD (Fear, Uncertainty, and Doubt). Picture this: you’re watching the order book, and suddenly it’s flooded with massive buy orders. Naturally, you assume a rally is coming. You jump in. The price begins to rise. But then, those large buy orders disappear. The price crashes. You’ve just been spoofed.

This kind of manipulation doesn’t just mislead individual traders—it disrupts the entire market. Spoofing influences short-term price direction, creating artificial momentum that tricks others into reacting. It also erodes trader confidence and trust, as participants become unsure of whether the signals they see are real. Beyond that, spoofing affects market liquidity and volatility, often draining liquidity after luring it in under false pretences. Even algorithmic trading behaviour is thrown off, since many trading bots are designed to respond instantly to order book activity, making them easy targets for manipulation.

At its core, spoofing distorts the market’s natural equilibrium. Prices become detached from genuine supply and demand, replaced by an illusion of activity. It’s a con job dressed up to look like ordinary trading.

So, is spoofing the same as scamming? Not exactly. While it’s not a scam in the traditional sense like phishing or rug pulls, spoofing is a deceptive and unethical form of market manipulation, and in many jurisdictions, it’s illegal.

How to Detect Spoofing in Crypto

Detection is still a major challenge for regulators and traders alike. This is mainly because spoofers have become increasingly sophisticated in their tactics. For example, they often use layered spoofing, placing multiple fake orders at different price levels to create an illusion of market depth. These orders are then cancelled within milliseconds, making it difficult for traditional tracking tools to register them. Additionally, spoofers take advantage of exchange latency and weaknesses in surveillance technology, especially on platforms with limited regulatory oversight.

For retail investors, catching spoofing in real time is even harder. However, there are key red flags to watch for:

- Large orders that disappear suddenly as the price approaches them.

- A high frequency of order placements and cancellations, particularly without any execution.

- Unusual liquidity movements are visible through advanced heatmaps or trading dashboards.

- Price jumps or dumps without any news catalysts, suggesting manipulation rather than organic activity.

Why do traders spoof? The answer is simple: profit from price manipulation. By exploiting predictable behaviours of both human traders and algorithmic bots, spoofers use deceptive signals to trigger reactions, moving the market in their favour before reversing the trade.

Although it’s difficult, understanding how spoofing is detected and recognizing suspicious patterns helps reduce your risk.

How to Protect Yourself

While you can’t fully prevent spoofing, you can take proactive steps to reduce your risk:

- Use limit orders, not market orders

Limit orders help you avoid buying or selling at manipulated prices, giving you more control and reducing the chance of reacting impulsively to deceptive order book activity.

- Check order books for patterns like repeated large orders vanishing too fast

Sudden disappearances of big buy or sell walls are a common spoofing tactic. Watch for these repeated patterns as a sign that something suspicious may be influencing the price.

- Cross-check prices across different platforms and news outlets to verify if moves are organic

If a major price swing happens without corresponding news or consensus across exchanges, it could be the result of manipulation rather than genuine market sentiment.

- Don’t trade based on the order book alone

Relying solely on order book data is risky. Use it alongside technical analysis, real-time news, and market sentiment tools to make more informed and balanced trading decisions.

So, can you prevent spoofing entirely? No. But awareness and strategic trading can significantly reduce your exposure to it.

Final Thought: Staying Smart in a Manipulated Market

Spoofing in the crypto market isn’t just a clever trick—it’s a form of market manipulation that strikes at the heart of what crypto claims to stand for: decentralization, transparency, and equal access. In a space already flooded with volatility, speculation, and emotion-driven decisions, spoofing adds another layer of chaos by creating false impressions of supply and demand. It misleads traders, distorts price signals, and erodes trust, especially among new or retail participants who may not spot the signs until it’s too late.

While traditional financial markets have responded with stricter rules, surveillance systems, and prosecution by agencies like the SEC and CFTC, the crypto world is still catching up. Many platforms—particularly smaller or unregulated exchanges—remain vulnerable to spoofing and similar schemes like wash trading and pump and dump tactics.

Until regulation and enforcement improve across the board, your best defence is knowledge. Knowing how spoofing is done, why spoofers do it, and what red flags to watch for—such as sudden order book fluctuations that vanish in seconds can help protect your capital. In crypto, hype can be loud and fast-moving, but your decisions should be data-driven and deliberate. Staying informed isn’t just smart—it’s essential.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with Markets PRO, DeFi Planet’s suite of analytics tools.”