Last updated on May 19th, 2025 at 01:02 pm

DeFi changes how we handle money – banks, payment processors and almost all financial intermediaries we use today will become obsolete, practically, with DeFi. But this shifts the responsibility of securing our money to us and the platforms we entrust it to. You could argue that this was always the case, but DeFi takes it to a whole new level. We don’t have to go too far to see the consequences of this. The incessant hacks, attacks, and exploits on current DeFi protocols and platforms are sufficient evidence.

However, artificial intelligence (AI) could offer hope for handling this heavy responsibility. Thanks to the sheer power and efficiency of these new AI based models, we have seen instances and potential ways that AI can be harnessed to make DeFi even safer.

This article explores how AI can be implemented in DeFi to make it safer and secure.

Understanding DeFi Security Challenges

The basic premise of DeFi is to eliminate intermediaries in financial transactions, which was previously impossible because of the limits of available technology. However, the decentralized nature of DeFi platforms introduces significant security risks which could be platform-borne or from the user themselves.

- Software/Code Vulnerablities

A good example of a sort of security risk are bugs or flaws in smart contracts, the backbone of DeFi operations, that hackers can exploit. For example, malicious actors exploited a flaw in The DAO’s smart contracts, resulting in the theft of millions of dollars’ worth of Ether in 2016. Also, Bancor, a DEX, lost $23.5 million when hackers exploited a vulnerability in its smart contracts in 2018.

Other forms of security risks that could be code-based are flash loan attacks, oracle manipulation, cross-chain vulnerabilities and many more as we have seen with recent exploit cases.

- Liquidity Risks

DeFi relies heavily on liquidity pools, where users contribute funds to enable trading. These pools are vulnerable to impermanent loss, where the value of assets changes, and they can also be targeted by hackers to steal funds directly from the pools. We see this in front-running attacks, On the other hands, it could be the platform developers themselves that have malicious intents–Rug Pulls,

- User Error

The complexity of DeFi platforms can lead to user mistakes, such as sending funds to incorrect addresses or interacting with malicious contracts. Users could also be susceptible to phishing scam and give out their details to malicious agents unknowingly.

How AI can make DeFi Secure and Safe

AI can be a powerful ally in securing DeFi platforms. It can be used to buffer various aspects of security and make the ecosystem more robust and trustworthy for both protocol providers and users.

On Protocols’ Part

From the standpoint of DeFi protocols and platform providers, AI is an indispensable tool for maintaining robust security measures and staying ahead of malicious agents.

- Advanced Threat Detection and Prevention

AI-powered systems can monitor network traffic and transaction patterns in real-time, identifying anomalies that may indicate potential attacks. These systems analyze vast amounts of data, detecting threats before they materialize and triggering immediate responses to security breaches, thereby minimizing potential damage.

User authentication in DeFi platforms is strengthened through AI-driven biometric methods, such as facial recognition or fingerprint scanning. Behavioral analysis powered by AI can detect unusual account activity, adding an extra layer of security. You can also get multi-factor authentication systems that adapt to user patterns and potential threats which further enhance the overall security posture for individual users.

- Fraud Detection and Prevention

AI significantly enhances fraud detection and prevention in DeFi platforms. By identifying suspicious transaction patterns, AI systems can flag potentially fraudulent activities for further investigation. Advanced authentication mechanisms powered by AI help prevent unauthorized access, while machine learning algorithms continuously learn from new fraud attempts to improve detection capabilities. This adaptive approach ensures that security measures evolve alongside emerging threats, keeping DeFi platforms one step ahead of potential attackers.

- Smart Contract Optimization

AI can play a crucial role in smart contract security by automating the auditing process, reducing human error, and identifying vulnerabilities before deployment. It can also optimize gas usage and suggest improvements in smart contract design based on historical data and best practices.

- Regulatory Compliance

Regulatory compliance is another area where AI proves invaluable for DeFi platforms. As the regulatory landscape continues to evolve, AI assists in staying compliant with changing requirements through automated policy updates. It enables more effective implementation of Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, crucial for maintaining the integrity of DeFi platforms. Additionally, AI-driven systems can generate comprehensive audit trails for regulatory reporting, streamlining the compliance process.

On Users’ Part

From the user perspective, AI technology offers significant benefits in terms of improved security and enhanced decision-making capabilities.

- Decision-Making Support

AI provides users with real-time market analysis and predictions, empowering them to make more informed investment decisions. Personalized risk assessments based on individual user profiles and market conditions offer tailored insights, while automated portfolio rebalancing suggestions help optimize returns and manage risk effectively.

- Personalized Security Recommendations

AI also plays a crucial role in educating and protecting users through personalized security recommendations. By analyzing user activity and risk profiles, AI can offer tailored security advice and alert users to potential vulnerabilities in connected wallets or decentralized applications (dApps). This proactive approach helps users stay informed about best practices in DeFi security, reducing the risk of falling victim to scams or attacks.

- Automated Security Operations

Automated security operations driven by AI benefit users by continuously monitoring account activity and alerting them to any unusual behavior. These systems can automatically execute stop-loss orders to protect investments during market volatility. Moreover, AI facilitates secure key management and recovery processes, addressing one of the most critical aspects of user security in the DeFi space.

Examples of How AI is Currently Used For DeFi Security

Chainlink

Chainlink provides decentralized oracles that deliver off-chain data to smart contracts, and AI plays a crucial role in enhancing the security of this process. AI algorithms aggregate and verify data from various sources, ensuring that only accurate and reliable information is fed into smart contracts.

By detecting and filtering out anomalous data points, AI helps prevent potential threats that could compromise the integrity of smart contract executions. This use of AI strengthens the security of decentralized applications that rely on Chainlink’s oracles, providing a robust and trustworthy data feed.

Chainalysis

Chainalysis specializes in blockchain analysis using AI to monitor transactions across diverse networks, enhancing DeFi security. AI algorithms detect transaction behavior patterns indicative of suspicious activities such as money laundering or terrorist financing. This capability enables Chainalysis to track illicit activities and flag transactions linked to criminal organizations.

For enhanced security, Chainalysis uses AI to assign risk scores to addresses and transactions based on historical data analysis, identifying risky behaviors like large fund transfers or interactions with high-risk entities. This AI-driven approach ensures robust monitoring and compliance with financial sector regulations.

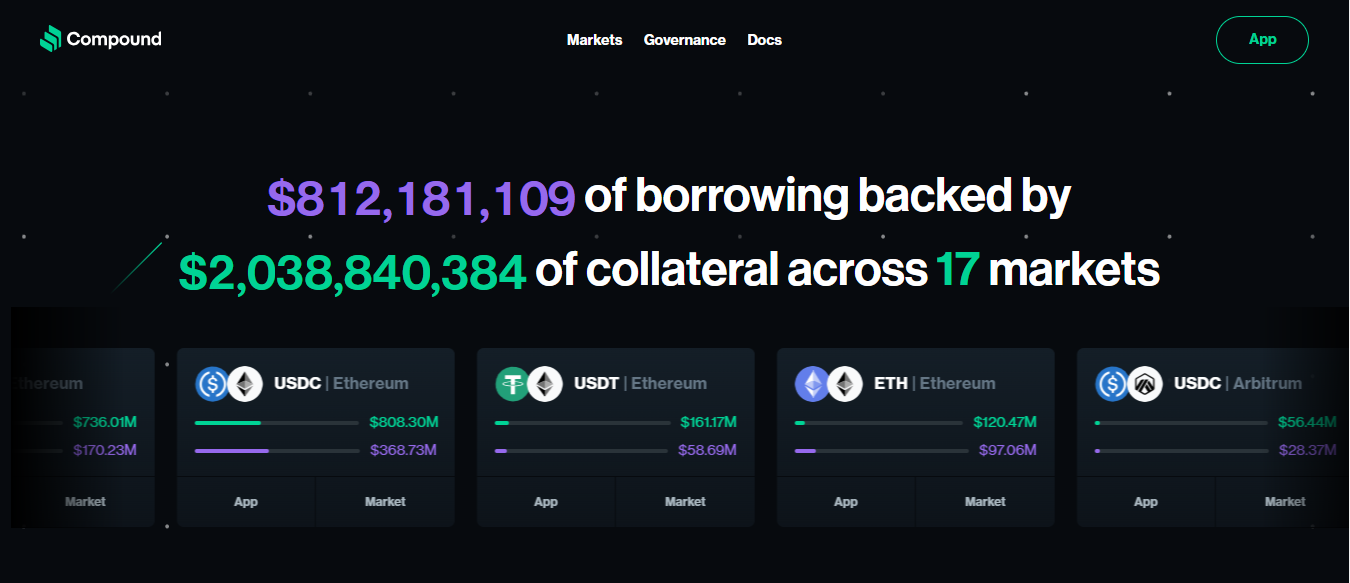

Compound Finance

Compound Finance is a DeFi protocol that allows users to earn interest on their crypto assets through yield farming. The platform uses AI to optimize yield strategies and manage risks. Its AI algorithms assess supply and demand in real-time to set competitive interest rates for both lenders and borrowers, ensuring users receive the best possible returns on their crypto assets.

The AI also analyzes users’ transaction history and other relevant data to assess their creditworthiness, reducing the risk of defaults by ensuring that only reliable borrowers can access loans.

Furthermore, Compound Finance uses AI to analyze market trends and liquidity, suggesting the best yield farming strategies to maximize your returns. These AI models continuously assess market risks and adjust strategies in real-time to protect your assets from adverse market conditions.

Aave

Aave is a DeFi platform where you can borrow and lend cryptocurrencies. It uses AI to make the platform safer and faster. Using AI algorithms, Aave analyses market trends to set interest rates, making sure they’re competitive for both lenders and borrowers. The AI also checks users’ transaction history to gauge their creditworthiness, which helps lower the risk of missed payments.

Aave enhances user authentication with AI-driven biometric verification methods like facial recognition and fingerprint scanning, minimizing the risk of unauthorized account access. Furthermore, Aave employs machine learning algorithms to continually refine security protocols, promptly adapting to emerging threats and vulnerabilities within the DeFi ecosystem.

UNISWAP

Uniswap is a decentralized exchange (DEX) that uses an automated market maker (AMM) model, allowing users to trade cryptocurrencies directly from their wallets without a centralized intermediary. AI plays a crucial role in optimizing liquidity provision and trading efficiency on the platform.

AI algorithms analyze trading patterns and liquidity pool data to optimize asset distribution within pools. This maximizes returns for liquidity providers while maintaining market stability, preventing over or under-representation of assets in the pool and reducing slippage for traders.

By continuously analyzing market conditions, AI models identify the most profitable liquidity pools, helping liquidity providers earn the highest possible returns. AI also predicts price movements using historical data and market sentiment, assisting traders in making informed decisions.

AI-powered systems are also used to monitor price discrepancies between different trading pairs and exchanges, identifying arbitrage opportunities to ensure consistent prices and enhance trading efficiency. It also continuously assesses market risks and adjusts strategies in real-time to protect users’ assets.

Challenges of AI in DeFi Security

Despite the exciting potential of AI in DeFi, there are several challenges to know and they include:

Technical Integration

Integrating AI with DeFi involves making different blockchain systems work together and managing the computing power needed. Ensuring that AI systems can effectively analyze and respond to real-time data without compromising platform performance is a significant challenge. For instance, integrating AI algorithms that detect anomalies in transaction patterns across diverse blockchain networks like Ethereum, Binance Smart Chain, and Solana faces technical challenges due to varying data structures and transaction speeds of these blockchains.

Data Privacy and Security

AI in DeFi relies heavily on vast amounts of data, which raises concerns about privacy and security. Balancing the need for data accessibility with robust privacy protections is crucial.

For example, the biggest hack in DeFi history happened on August 10, 2021, and targeted Poly Network, a platform for swapping cryptocurrencies across different blockchains. The hacker exploited a smart contract on the platform and stole $610 million, transferring the funds to their addresses on Ethereum and Binance Smart Chain (BSC).

The DeFi protocol suffered a data breach where sensitive user information was compromised due to inadequate security measures in place for AI-powered analytics tools used for user behaviour analysis and risk assessment.

Regulatory Compliance

DeFi platforms already operate in a complex regulatory landscape. Coupled with the fact that this regulatory climate is constantly evolving, developing AI systems that can adapt to varying regulatory requirements across different jurisdictions would be a big challenge.

For instance, regulatory scrutiny over AI-powered automated trading algorithms in DeFi has intensified, with regulators in major financial markets like the United States and the European Union issuing guidelines to ensure fairness, transparency, and consumer protection.

Cost and Accessibility

Implementing AI technologies in DeFi can be costly and this essentially becomes a barrier to entry for smaller projects and startups. Finding cost-effective AI solutions that maintain high performance and security standards is crucial for promoting accessibility across all scales of the sector.

For example, high licensing fees for AI models used in risk assessment and fraud detection can strain the budgets of emerging DeFi platforms, limiting their ability to deploy advanced security measures effectively..

Final Thoughts

The DeFi ecosystem has a lot to gain by implementing AI-powered solutions in the ongoing efforts to enhance security and safety. From improved threat detection and smart contract optimization to enhanced user authentication and personalized security recommendations, AI’s impact can be felt in every aspect.

However, DeFi platforms already struggle with scalability, and adding AI makes this problem worse because the scale of computing power that would be required.Going forward, solving these problems would be the bane of most endeavours in the sector.

Finally, this journey toward full realization of a safe and secure DeFi sector has only just begun, and there are so many opportunities to make it work.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles (news reports, market analyses) like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”