Cryptocurrency started with a radical dream: give everyday people financial freedom, no middlemen, no barriers. Fast forward to 2025, and the question looms large: is crypto becoming too complicated for the average person? For many newcomers, navigating DeFi protocols, staking systems, wallets, and bridges feels more like solving a tech puzzle than managing money. So why is crypto so complicated in practice, and what needs to change to bring billions on board?

The Growing Complexity of Crypto

Crypto was meant to break down barriers, not build new ones. But as the space has evolved, so too has its complexity, often rooted in the very tools designed to empower users with financial autonomy.

Take DeFi, for instance. On the surface, it’s a revolutionary concept: lending, borrowing, and earning without the need for traditional banks. But once you step into the ecosystem, it quickly becomes overwhelming. Before you can even participate, you’re expected to set up a wallet, learn how gas fees work, and wrap your head around concepts like slippage, liquidity pools, and yield farming. That’s just the beginning. Soon you’re navigating APYs, decoding tokenomics, and weighing the risks of interacting with unfamiliar smart contracts.

Staking seems straightforward—lock your tokens and earn rewards, but quickly unravels into another maze. You’re presented with choices like solo staking, liquid staking, re-staking, and delegation. Each option comes with its own technical requirements and risks, from validator uptime to slashing penalties, all of which vary across different chains. Instead of financial freedom, it starts to feel more like financial gymnastics.

And then there’s bridging—moving assets across blockchains. This task demands you choose the right bridge, understand which chain uses which gas token, and pray you don’t lose your funds due to an address error or failed approval.

Even wallets, the supposed entry point into the crypto, pose significant hurdles.

Scams, Scare Stories, and Skepticism

Where there’s confusion, there’s vulnerability—and in crypto, confusion isn’t just common; it’s systemic.

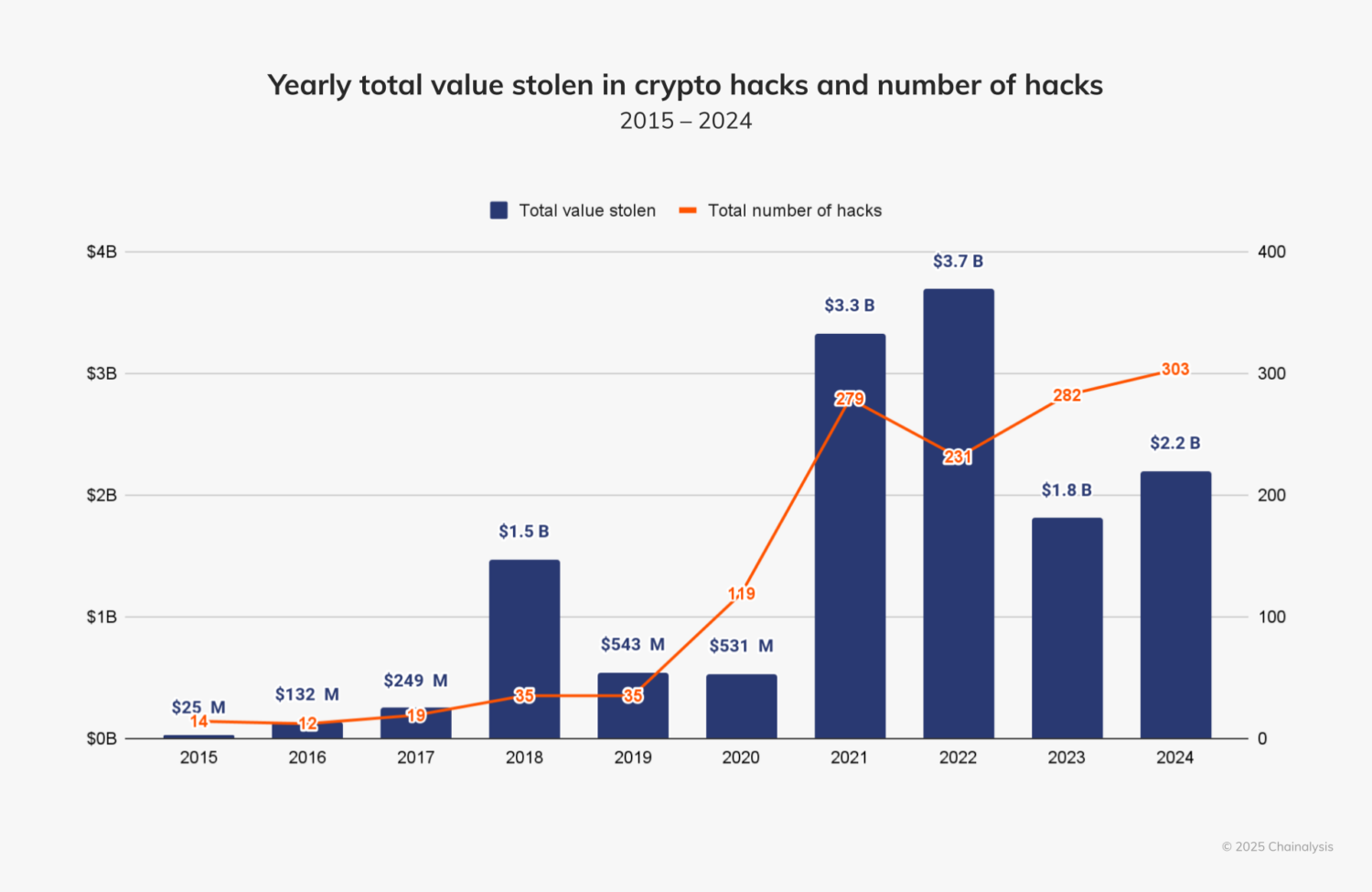

Between 2015 and 2024, more than $12 billion was lost to crypto hacks and scams, according to Chainalysis.

When users wonder what percentage of people lose money in crypto, the answer is unsettling: a significant share. Without clear design and support, crypto isn’t just hard; it’s perceived as unsafe. In 2024 alone, nearly 150,000 scam complaints were filed by U.S. citizens, according to CoinLedger. And the public sentiment reflects that damage: 75% of Americans who’ve heard of crypto say they don’t trust its safety or reliability.

This trust gap is no accident. The complexity of the ecosystem has become fertile ground for manipulation. Phishing links disguised as wallet logins, fake airdrops offering too-good-to-be-true rewards, rug pulls draining liquidity overnight, and malicious smart contracts that look legitimate to the untrained eye- these are everyday traps for new users. Many don’t just lose a few tokens; they lose entire life savings.

The impact goes beyond financial loss. The crypto space now carries an air of danger. People share cautionary tales: a friend who clicked the wrong link, a cousin who got tricked by a scam token, a parent who lost their seed phrase and couldn’t recover their funds. These stories travel fast and shape public perception.

Also Read: Are Scams Damaging Crypto’s Reputation?

For many, crypto doesn’t just feel complicated; it feels unsafe. And unless the industry takes usability and security seriously, skepticism will only grow. Until crypto becomes easier to use and harder to misuse, it will remain out of reach for the very people it was supposed to empower.

Why Crypto UX Still Feels Like a Developer’s Playground

Why is crypto so hard for everyday users? Despite all its innovation, the crypto world continues to fall short in one crucial area: user experience. For everyday users, interacting with decentralized platforms often feels like stepping into a world built by and for developers. What should be a gateway to financial freedom too often turns into a maze of technical jargon, confusing interfaces, and unsupported missteps.

While DeFi promises banking without banks, the reality is far less accessible. Tasks that should be simple, like buying Ethereum, moving it to a wallet, bridging it to a cheaper chain like Arbitrum, and staking it in a protocol, quickly unravel into complex, multi-step processes. Each stage demands a grasp of concepts such as slippage, gas fees, liquidity pools, and smart contract risks. Unlike traditional fintech platforms, there’s no “help” button, no support team on standby, and no undoing a mistake. One wrong click, and your funds could be gone permanently.

Compare that to the experience offered by mainstream fintech apps like PayPal, Cash App, or Revolut. These platforms have refined the art of making complexity invisible. Their interfaces are clean, buttons use familiar language like “Send” or “Top Up,” and user flows are broken down into easy-to-follow steps. If anything goes wrong, customer support is just a click away. You don’t need to understand the backend of banking systems to complete a transaction; you just need to follow the prompts.

Crypto, on the other hand, greets even the curious with interfaces that resemble engineering terminals more than financial tools. Wallet addresses are long, unreadable strings. Error messages are cryptic. Terms like “RPC,” “slippage tolerance,” and “validator uptime” dominate the screen. For non-technical users, this isn’t just inconvenient; it’s intimidating and high-risk.

Yet, there’s proof that better design can make a meaningful difference. In a recent case study by Phenomenon, a UX team working on a Solana-integrated wallet tackled their 62% KYC drop-off rate by rethinking the onboarding process. Through a step-by-step wizard, real-time photo validation, simple illustrations, and reassuring copy like “Takes less than 2 minutes,” they managed to reduce drop-off to 27%. Onboarding time dropped from 4.5 minutes to 1.9, and verified user conversions jumped by 38%.

The lesson here is simple but powerful: better UX isn’t optional—it’s the key to adoption. Progress bars, clear instructions, and intuitive design are not bells and whistles; they’re the bridge between crypto’s promise and real-world usability. Because in the end, the most powerful technology isn’t the one with the most features—it’s the one people can actually use.

Crypto UX vs. Traditional Fintech UX

|

Aspect |

Crypto UX |

Traditional Fintech UX |

| Interface Design | Complex, technical | Clean, intuitive, user-friendly |

| Language & Labels | Jargon-heavy | Familiar terms |

| Onboarding Process | Multi-step, fragmented, self-guided | Streamlined, guided, beginner-friendly |

| Error Handling | Cryptic messages, irreversible mistakes | Clear prompts, recovery options available |

| Customer Support | Rare or non-existent | Accessible help desks or live chat |

Wallet Abstraction and Simplified Interfaces

The crypto space is finally waking up to one of its biggest hurdles: poor usability. As more users struggle with complex wallet setups, long seed phrases, and clunky interfaces, the industry is shifting toward a more seamless experience and at the heart of this movement is wallet abstraction.

What is abstraction in crypto? Wallet abstraction is a game-changing design approach that hides technical complexity and brings crypto closer to the ease of Web2. Imagine accessing your wallet with a Google login, paying gas fees in any token you hold, and recovering your account with the help of trusted contacts or your email, no cryptographic acrobatics required. This isn’t a far-off dream; it’s already taking shape. According to the 2025 Coinbase Outlook, integrated key logins and in-app wallets are becoming more common. Examples include Coinbase Smart Wallet’s key login and Google login integrations in tools like Tiplink and Sui Wallet.

Fueling much of this evolution is Ethereum’s support for ERC-4337, also known as Account Abstraction. This upgrade empowers developers to build “smart accounts” with programmable logic, enabling features like batched transactions, automated approvals, and custom rules for wallet behaviour. In short, it gives wallets the power to do more for the user behind the scenes.

Together, wallet abstraction and simplified interfaces represent a critical leap forward. They make crypto not just more accessible, but more human. And in a space that often feels built for engineers, that shift could make all the difference in bringing the next wave of users into Web3.

RELATED: Account Abstraction Adoption: Are Users Ready for Smart Wallets?

The Need for Education and User-Centric Design

While the technical infrastructure of crypto is steadily improving, two crucial gaps remain: education and user-centric design. Many DeFi platforms still operate under the assumption that users are technically fluent, offering dense documentation instead of simple, intuitive guidance. As a result, newcomers often find themselves overwhelmed and unsupported.

There are exceptions—projects making genuine efforts to educate and simplify, but these are still few and far between. The overwhelming majority pointed to confusing jargon and poor user experience as the primary obstacles.

RELATED: Why Crypto Needs to Fix Its ‘Dangerously Low’ Knowledge Gap

To truly unlock mass adoption, crypto developers must shift their focus toward human-first design. This means reducing the number of clicks, using clear and familiar language, offering undo options for mistakes, and creating onboarding experiences that mirror what users already understand from Web2. The future of crypto doesn’t just depend on better tech; it depends on making that tech accessible, understandable, and usable for everyone.

From Possibility to Practicality: Bridging the Crypto Usability Gap

Crypto was born from a desire to democratize finance, to remove gatekeepers and empower individuals. But in its current form, the user experience is failing that mission. The technology may be powerful, but power alone doesn’t drive adoption; accessibility does.

What we’ve seen across DeFi, wallets, staking, and cross-chain tools is a widening gap between innovation and usability. For the average person, crypto still feels too technical, too risky, and too unsupported. Tasks that should be as intuitive as sending money or checking a balance become high-stakes exercises in trial and error. This isn’t a question of intelligence; it’s a matter of design.

The good news? Solutions are within reach. Wallet abstraction, simplified interfaces, social logins, and gas flexibility are already proving that crypto can be more human-centred. But these improvements need to become the standard, not the exception.

Ultimately, crypto’s next chapter won’t be written by developers alone. It will be shaped by how well the industry listens to users, especially those outside the tech bubble. If we want billions to join the Web3 revolution, we must meet them where they are, not where we wish they were.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with Markets PRO, DeFi Planet’s suite of analytics tools.”