Whether you’re a newcomer or an experienced crypto trader, prioritizing using trusted platforms is essential to avoid falling prey to scams. The cryptocurrency world, ever-expanding, introduces new trends—some beneficial, others potentially harmful.

One such trend is the emergence of nested exchanges, also known as “instant exchanges.” These platforms act as intermediaries between users and other service providers.

While decentralization in the crypto space often aims to enhance anonymity, it should not come at the cost of compromising security, which is paramount for safeguarding users’ crypto assets. Unfortunately, when dealing with nested exchanges, there’s no guarantee of the safety of your funds.

In the following sections, we discuss what nested exchanges are, how they function, and the potential risks associated with using these platforms.

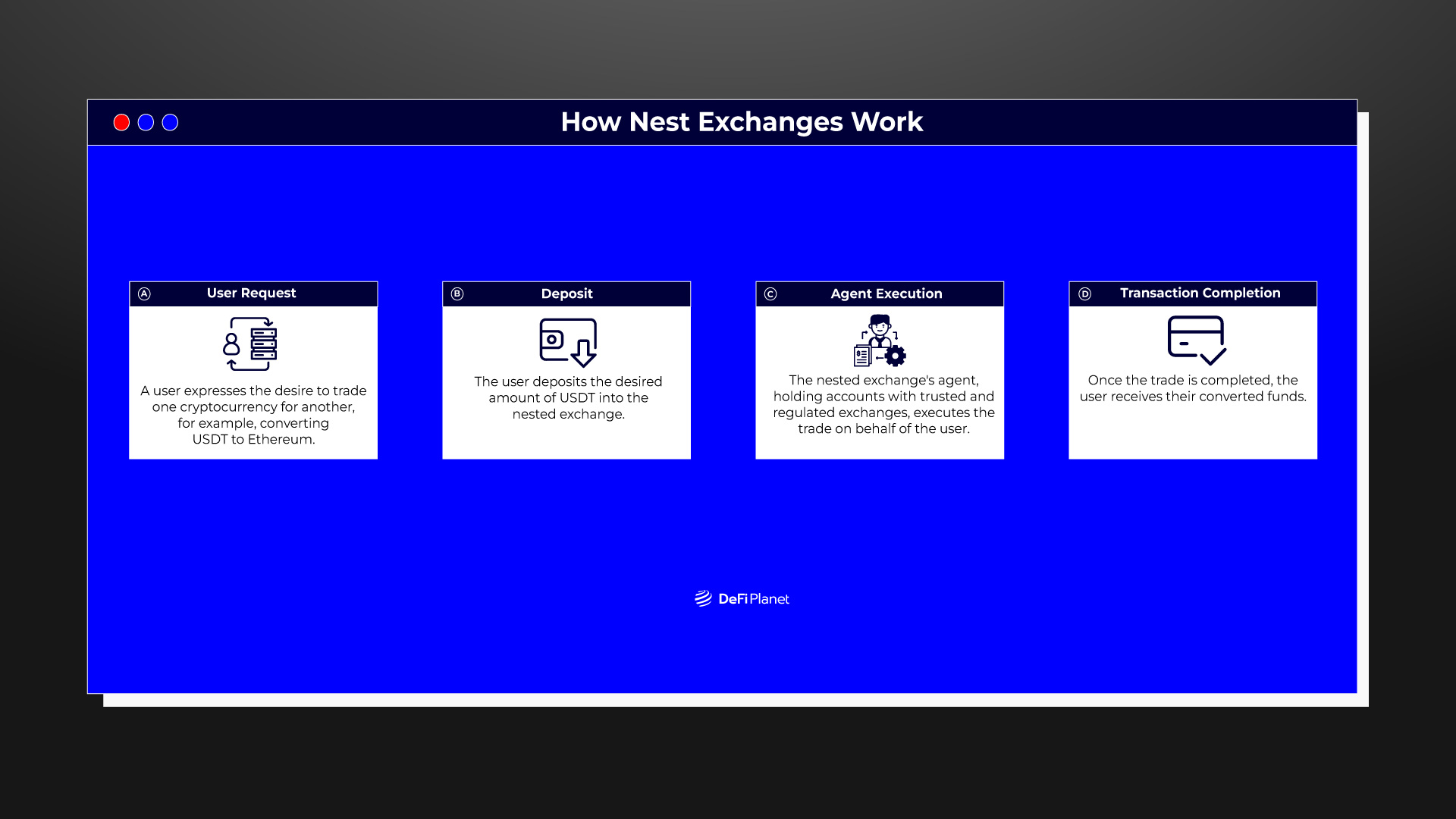

How Nested Exchanges Work

A nested exchange is operated by an “agent” who possesses one or more accounts with a trusted and regulated exchange. These accounts are utilized to execute trading activities on behalf of interested parties. Essentially, nested exchanges act as intermediaries between users and crypto trading service providers, whether the provider is aware of this intermediary role or not.

Here’s a simplified explanation of how nested exchanges function:

The entire process is designed for instant execution and happens without the user interacting with the trusted exchange directly. Some nested exchanges even facilitate in-person crypto transactions using cash payments.

While this process may seem convenient for users, as they can trade without registering or undergoing KYC processes, it introduces certain risks. Understanding these risks is crucial for users navigating the cryptocurrency trading landscape. One has to be cautious about the anonymity provided by nested exchanges, as it may attract illicit activities and compromise the integrity of the crypto ecosystem.

Dangers of Using Nested Exchanges

Utilizing nested exchanges comes with various risks that users should carefully consider. In the fast-paced cryptocurrency space, impatience with Know Your Customer (KYC) and Anti-Money Laundering (AML) processes might drive individuals towards nested exchanges. These platforms operate discreetly, offering swift trading with minimal or no registration requirements. However, the ease of access presents potential risks that users need to be cautious about.

The following are some highlighted dangers of using a nested exchange:

Potential for Manipulation or Fraud

Nested exchanges typically lack transparency and auditing capabilities, making it challenging for users to determine if the trading process is fair and reliable.

The lack of transparency in the operation of nested exchanges makes monitoring and confirming trades across multiple platforms challenging for users. This opacity raises concerns about potential manipulation or fraudulent activities that users may not be able to detect.

Lack of Security Guarantees

Nested exchanges do not offer guarantees of fund security during transactions. Users entrust their funds to unfamiliar accounts, creating a situation where the recovery of funds is not assured.

The lack of security guarantees in nested exchanges makes them attractive targets for scammers and fraudsters. Unsuspecting users may fall victim to malicious activities without being aware of the dangers.

Security Vulnerabilities

Nested exchanges introduce additional points of vulnerability, increasing the chances of security breaches. Each added exchange in the nested system represents a potential weakness. If any platform in the chain is compromised, it puts all connected exchanges and user funds at risk.

Privacy Risks

Using a nested exchange means sharing personal info, trading history, and account details across multiple platforms. This increases the risk of data breaches or unauthorized access and threatens user privacy.

Considering these dangers, users should exercise caution and prioritize security when engaging with nested exchanges. Patience in adhering to proper KYC and AML processes on reputable platforms is essential to ensure the safety of funds and protect against potential risks in the crypto trading landscape.

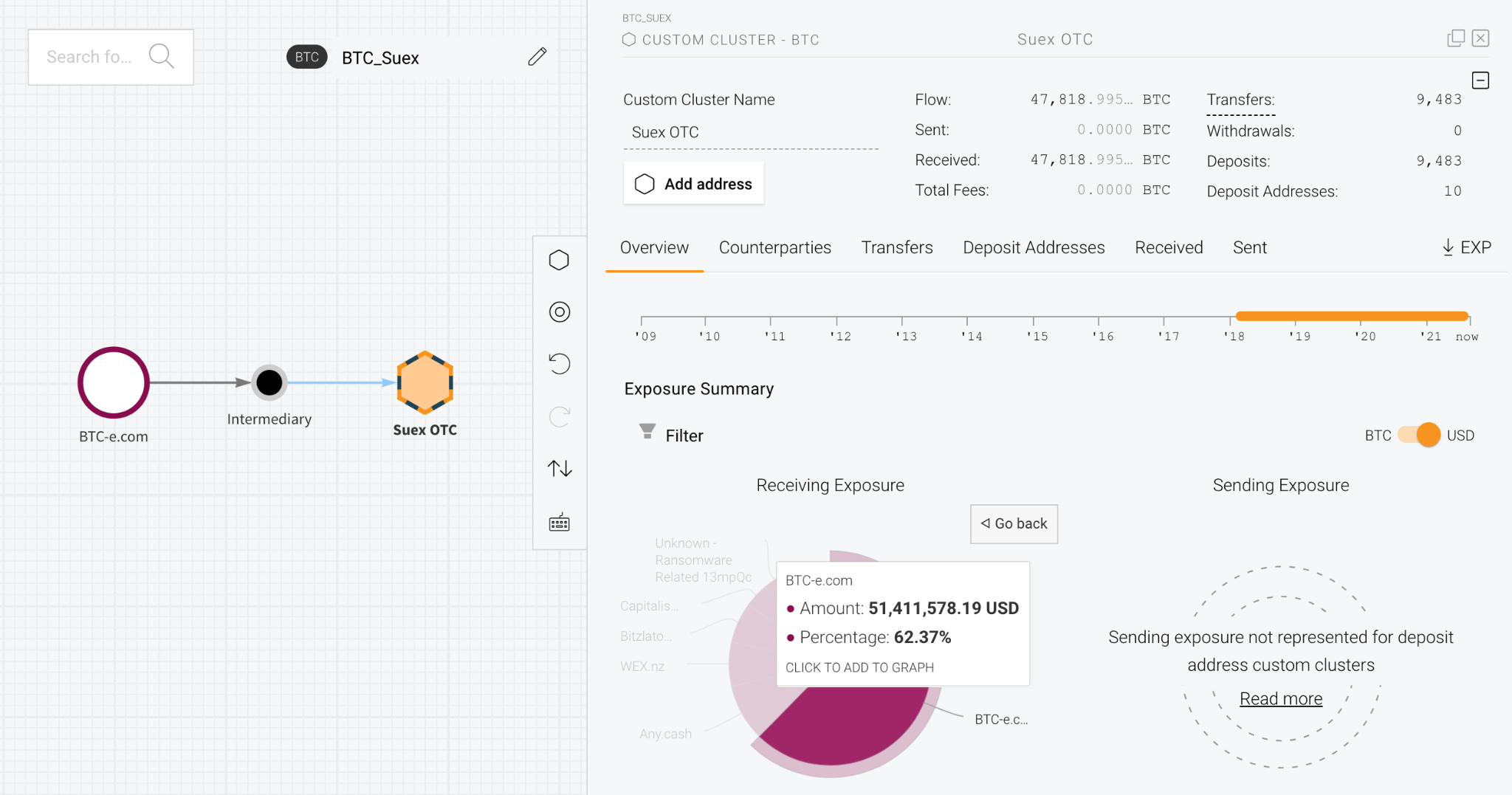

The Suex Nested Exchange Event

To illustrate the real concerns associated with nested crypto exchanges, let’s examine a concrete case. On September 21, 2021, the Suex crypto exchange, based in the Czech Republic but operating outside Russia, faced sanctions from the U.S. Office of Foreign Assets Control (OFAC).

Suex OTC utilized the nested crypto exchange service provided by major platforms such as Binance for its customers. Notably, Suex maintained lenient Know Your Customer (KYC) processes, even allowing face-to-face cash transactions for purchasing crypto.

Chainalysis, a prominent blockchain analysis company, reported Suex’s involvement in laundering funds from hacks and ransomware attacks. In response, Binance deactivated all known accounts associated with Suex. Furthermore, the OFAC blacklisted over 30 wallets holding Bitcoin, Ethereum, and Tether.

Everyone involved with Suex was exposed to damning legal risks.

Chatex, a crypto bank associated with Suex, was affected by this; OFAC imposed sanctions on Chatex. Subsequently, Suex and Chatex took down their websites.

How to Spot a Nested Exchange

Newcomers to the crypto space may be susceptible to potential pitfalls associated with nested exchanges. Here are some ways to spot a nested exchange:

Lack of Emphasis on AML and KYC.

Nested exchanges often prioritize swift account setup, with minimal focus on Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements. Importantly, this accelerated setup doesn’t impose any immediate limitations on how you can use the account.

Unfriendly User Interface

The user interface (UI) of the nested exchange’s website or mobile app may not be user-friendly, making it challenging to locate the trading sections. Legitimate exchanges typically invest in intuitive UI design for user convenience.

Unclear Handling of Trades:

A nested exchange may not provide a clear statement about whether they directly handle cryptocurrency trades. Legitimate exchanges explicitly mention that trading occurs on their platform, ensuring transparency and building trust with users.

Varied Rates for Transactions

Nested exchanges often present users with multiple rates to choose from for transactions. This complexity arises from utilizing nested accounts within different exchanges, each offering distinct rates for trading. This practice can be a red flag indicating potential risks.

If you suspect your cryptocurrency exchange may be a nested one, using a blockchain explorer can provide clarity. In cases involving a nested exchange, your cryptocurrency will typically pass through an additional wallet linked to a different exchange, separate from your primary one. Verifying this through a blockchain explorer can help confirm the presence of a nested structure.

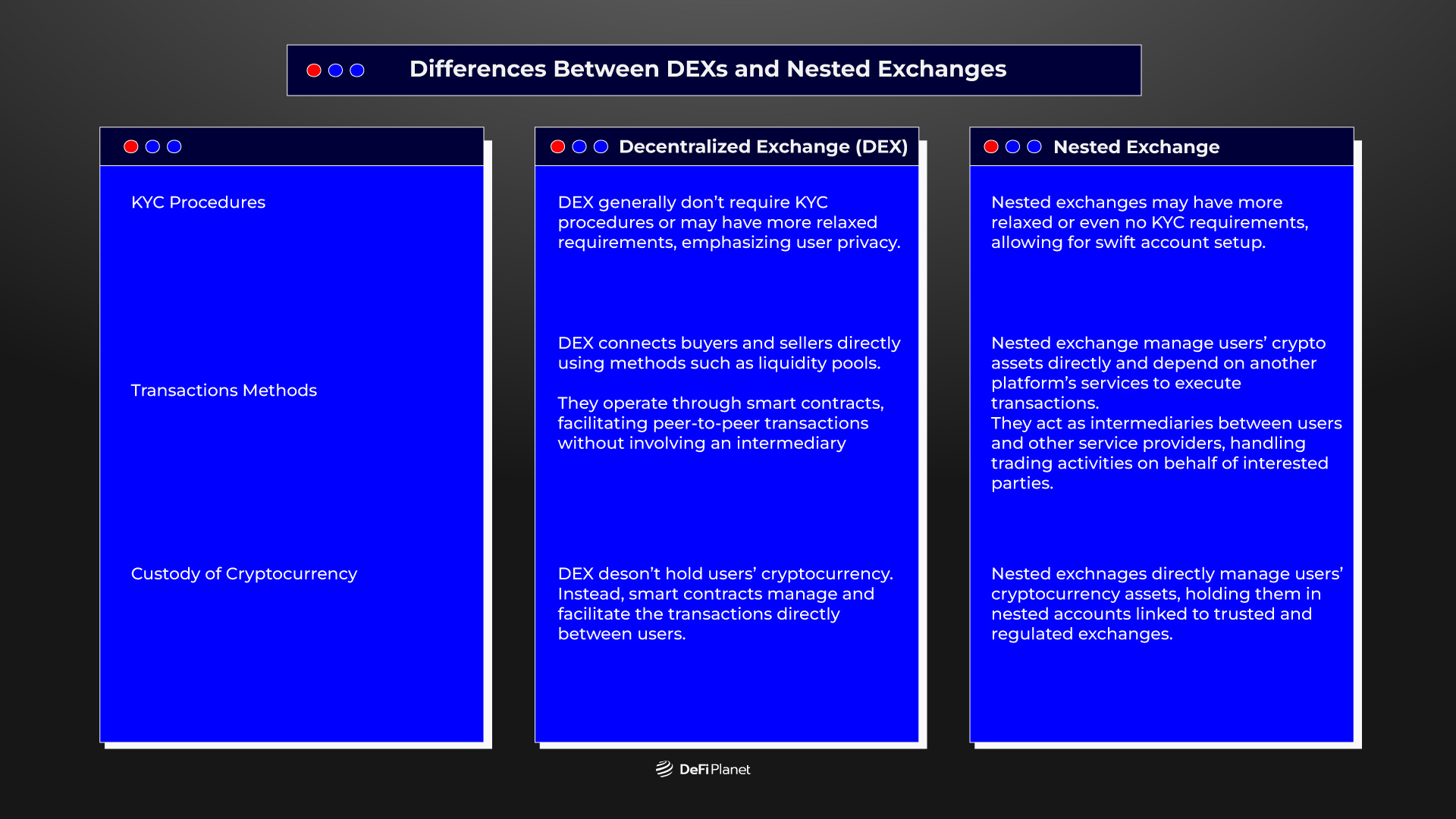

Differences between Decentralized Exchanges and Nested Exchanges

While there are some initial similarities between nested exchanges and decentralized exchanges, particularly in their approach to Know Your Customer (KYC) procedures, they significantly differ in their transaction methods.

The key distinction lies in the transaction methods and custody of cryptocurrency, with DEX emphasizing decentralization and user control, while nested exchanges involve a more centralized approach.

In summary, decentralized exchanges prioritize direct peer-to-peer transactions facilitated by smart contracts, maintaining user privacy. In contrast, nested exchanges act as intermediaries, managing users’ crypto assets directly and relying on the services of another platform to execute transactions.

In Conclusion,

Nested exchanges can easily operate in the cryptocurrency space because it’s still growing and open for all. However, it is up to investors to take adequate care in ensuring the safety of their funds.

Nested crypto exchanges are best avoided, even if they promise enticing rates and returns. When an exchange allows immediate access to all its features without at least verifying your address, it should raise red flags. It’s a vital signal to exercise caution.

Lastly, it’s strongly recommended to stick with well-established and trusted cryptocurrency exchanges to shield your funds from potential risks of theft or misappropriation. Your security and peace of mind should always be top priorities in the cryptocurrency space.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles (news reports, market analyses) like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”