The AI rave has seen a lot of ingenious products, with many being able to autonomously handle complex operations as well as automate certain tasks on their own. From ordering groceries and paying for them online, to self-driving cars that fuel up and pay the gas station without a human involved. This is where AI and blockchain technology are heading, together.

AI agents are smart programs that can act on their own, like little digital workers, and as these agents begin to interact with money, services, and each other, a series of big questions emerge: Will AI agents need their own crypto wallets? Does AI use crypto? Can AI predict the crypto market? Does AI need crypto?

We’ll explore how AI agents, crypto wallets, and Web3 automation are creating a whole new digital economy, and what it means for the future.

What Are AI Agents?

An AI agent is a computer program that can make decisions on its own, based on the information it receives. It’s like a robot brain that doesn’t always need human input, and these agents are already used in trading bots, chatbots, and even self-driving vehicles, but here’s the twist: these agents are becoming autonomous; they don’t just follow orders; they analyze, decide, and take actions independently.

Some AI agents are now being given their own digital “tools”, like crypto wallets, to help them act on the blockchain. That means they can buy services, store tokens, and even interact with other AI agents, just like a human would.

These intelligent agents can be deployed across a wide range of enterprise applications, enabling businesses to tackle complex challenges with greater efficiency and precision. From automating software development workflows and managing IT operations to powering advanced code-generation platforms and conversational AI assistants, these agents are transforming how organizations operate.

Their functionality lies in the sophisticated natural language understanding capabilities of large language models (LLMs). These models enable agents to interpret user inputs with remarkable depth, engage in multi-turn interactions, and reason through tasks step by step. They can also identify when external tools, APIs, or systems need to be engaged, triggering them seamlessly to fulfil objectives or gather additional data.

As a result, these autonomous agents serve not just as reactive tools but as proactive collaborators; enhancing productivity, reducing human error, and accelerating decision-making across diverse domains such as customer support, DevOps, product development, and data analysis.

How AI Agents Store and Use Digital Money

To act independently in the Web3 ecosystem, AI agents require access to digital money, and that’s where crypto wallets come in. These AI wallets function as secure vaults, allowing agents to store tokens, execute transactions, and verify their identities on-chain; just like a human user, an AI agent can use its wallet to pay for services such as data access, compute resources, or gas fees.

What makes these wallets unique is that they’re often programmable, and developers can embed rules directly into the wallet’s logic, such as spending limits, allowed transaction types, or multi-signature approvals, ensuring the agent acts within safe boundaries. This automation is critical, especially as agents begin to interact with decentralized finance (DeFi), NFTs, and peer-to-peer protocols.

Some wallets even incorporate biometric-like identity layers, such as zero-knowledge proofs or soulbound tokens, allowing AI agents to build trust over time by proving past activity, reputation, or purpose, without revealing private data. In essence, these wallets empower AI agents not only to store and spend money but also to function as sovereign digital entities in a permissionless economy.

Why Would AI Agents Need Wallets?

1. Machine-to-Machine Payments

Imagine two machines communicating directly. For example, one drone needs data from a satellite. It could pay another machine in crypto to get that data, without a person involved. This is called machine-to-machine payments. AI wallets make this possible.

Projects like Fetch.ai and Ocean Protocol are working on these kinds of interactions, where machines can buy and sell services with one another.

2. Autonomous Agents Must Pay for Resources

AI agents often need to use computing power, data, or APIs to do their jobs, and if they’re fully autonomous, they need a way to pay for these services. This makes them truly self-sufficient. By having their own crypto wallets, they can:

- Rent computing time (like from decentralized clouds like Akash Network)

- Buy datasets (like from Ocean Market)

- Pay gas fees to interact with blockchains.

3. Establishing Crypto Identity

In the Web3 world, your wallet address is also your identity. If an AI agent is going to interact with apps, earn money, or build a reputation, it needs its own wallet to serve as its digital face. Some projects are developing soulbound tokens (SBTs) or other non-transferable credentials to prove that an agent is trustworthy or capable.

READ ALSO: What Will Happen When AI Gets a Wallet

Real-World Examples

-

Coinbase’s Smart Wallet Prototype :

In early 2024, Coinbase unveiled a prototype where AI agents could create and manage MPC (Multi-Party Computation) wallets. These wallets are split among multiple parties for added security.

-

Circle’s USDC Payments for AI Agents

Circle (creator of USDC) demonstrated AI agents earning USDC for completing tasks. They used programmable wallets to manage funds securely.

-

Mode Network & Giza

Mode’s “Giza” platform enables the deployment of AI agents to perform smart contract interactions, yield farming, and other tasks automatically. These agents use smart wallets to interact with DeFi protocols.

How These Wallets Work

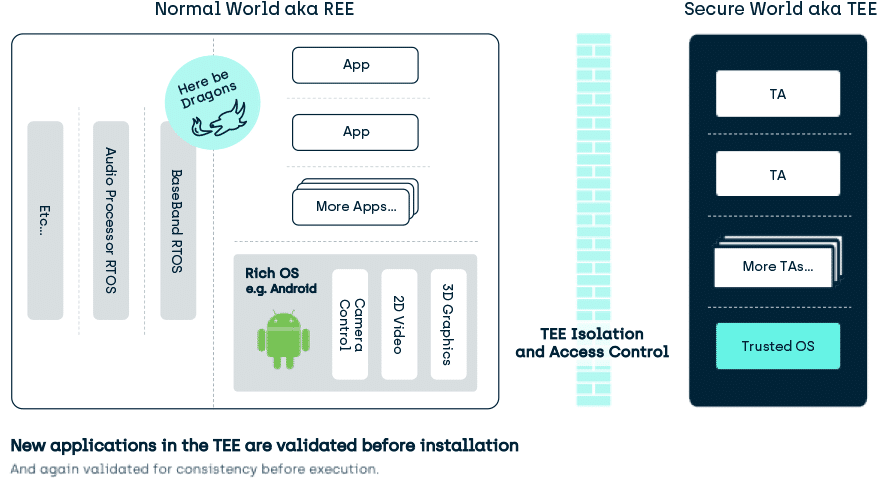

An AI wallet is far more advanced than a regular crypto address, and it’s designed with built-in security, automation, and identity verification to ensure safe and intelligent asset management by AI agents, with one of the key technologies being the use of Trusted Execution Environments (TEEs). These are secure areas within a computer’s hardware where sensitive data, like private keys, can be safely stored. Even if an AI agent is compromised or attacked, TEEs help ensure the wallet itself remains protected.

To further enhance security and prevent unauthorized actions, many AI wallets rely on Multi-Signature (Multi-Sig) or Multi-Party Computation (MPC) systems. These wallets require multiple approvals before a transaction is completed. In the context of AI, this might involve the AI agent, a human supervisor, and a predefined smart contract rule, all needing to agree before any funds can move. This setup greatly reduces the risk of rogue AI behaviour or unintended transactions.

Another powerful feature of these wallets is their programmable logic. This means the AI wallet can follow automated rules like: “Only spend 0.1 ETH per day,” or “Avoid transactions with suspicious addresses,” or “Pause all activity if there’s a major price drop.”

These rule-based systems are an example of Web3 automation, where the wallet functions like a smart, self-regulating accountant, executing only approved tasks without constant human input. By combining these technologies —TEE, MPC wallets, and programmable smart contract logic —AI wallets enable autonomous agents to store, use, and manage digital assets responsibly within a blockchain environment.

Challenges and Risks

AI wallets bring exciting possibilities to the world of crypto and Web3 automation, but they also introduce new challenges, and one major concern is security. Hackers might attempt to deceive AI agents or break into their wallets, or worse still, AI itself can be manipulated through adversarial attacks, where it’s fed misleading or fake data to provoke harmful or incorrect actions.

There are also pressing legal and ethical questions, like if an AI agent violates a contract or steals digital assets, who takes the blame? Is it the developer who programmed the agent, the company providing the wallet infrastructure, or the AI agent itself? These questions highlight the urgent need for regulatory frameworks to define AI accountability in blockchain environments.

Then there’s the issue of trust: just because an AI has a wallet doesn’t automatically make it reliable. That’s where crypto identity tools like Soulbound Tokens (SBTs) and reputation scores come into play. They help establish whether an agent is credible or potentially dangerous, adding a layer of verification in decentralized ecosystems.

The Future of AI + Web3

AI agents equipped with crypto wallets are still a fresh development, but their adoption is accelerating. According to Cointelegraph, an increasing number of companies are combining AI and crypto to power intelligent automation across various areas, including DeFi protocols, gaming bots, market-making agents, and customer service AI.

As this trend continues, we can expect AI agents to autonomously earn on-chain income, pay for services, and build digital reputations based on their transaction history and behaviour. They’ll interact not only with humans but also with other AI agents, reliably and securely, within a decentralized framework. The age of autonomous blockchain agents has already begun, and yes, AI agents will need crypto wallets, not just because they handle money, but because they’re becoming autonomous players in a digital economy. Crypto wallets will be their:

- Bank account

- ID card

- Passport to the Web3 world

As this trend grows, we must think carefully about security, ethics, and regulation, but the future of AI and Web3 automation is incredibly exciting, and it’s already unfolding.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”