Like traditional financial markets, the cryptocurrency market moves in cycles.

A crypto market cycle is a recurring pattern of upward and downward trends driven by a mix of economic factors, technology changes, investor behaviour, and sometimes even global events. These cycles are not perfectly predictable, but they tend to follow a general rhythm of growth (bull markets), correction (bear markets), and recovery.

Grasping the mechanics of these cycles is more than just a technical exercise; it is a key part of any savvy investor’s toolkit, especially in a market as dynamic and unpredictable as crypto. So whether you’re a seasoned trader or a newcomer to the digital currency space, a very clear understanding of these patterns can greatly enhance your ability to make informed investment choices.

The Bull Market: When Optimism Runs High

A bull market is a period of sustained price increases, and it usually entails many different market sentiments that typically tend to keep these prices up. Investors are confident, new people are entering the market, and there’s a general feeling of optimism. During bull runs, it’s common to see all-time highs, new projects launching, and the media buzzing about the next big crypto token.

Bull markets are often triggered by strong investor sentiment, institutional interest, or significant events like the Bitcoin halving. The Bitcoin halving, which is a scheduled reduction in the reward for mining Bitcoin, tends to decrease the rate at which new coins are introduced into the market, and major bull markets have followed these halvings, as the supply shock creates more demand for Bitcoin.

The Bear Market: The Cooling Phase

In contrast, a bear market is when prices fall sharply and stay low for an extended period. When this happens, confidence drops and many investors sell off their assets to cut losses, with media coverage tending to focus on crashes, scams, or failed projects.

This is the painful phase of the cycle, but it’s also a time when the strongest crypto projects prove their long-term value. Risk management becomes critical here, as it helps investors avoid panic-selling or making emotionally driven decisions.

RELATED: Bull vs Bear: Key Indicators to Spot Market Trends Before Everyone Else

Market Psychology: The Driving Force Behind It All

One of the most important factors in these cycles is market psychology, which is the collective emotions and behaviours of investors in the market that cause the fluctuations that mark either the influx of profits or losses. In bull markets, greed takes over, and people fear missing out (FOMO) and typically invest blindly, pushing prices even higher. In bear markets, most of the time, fear dominates, and people panic and sell at a loss, even if the fundamentals of the asset haven’t changed.

This emotional rollercoaster creates the volatility that crypto is known for, and understanding how investor sentiment swings between extreme optimism and fear can help you avoid common traps and make rational decisions in the long run.

READ ALSO: FOMO vs FUD: Behavioural Patterns Driving Crypto Volatility

The Role of Macroeconomics

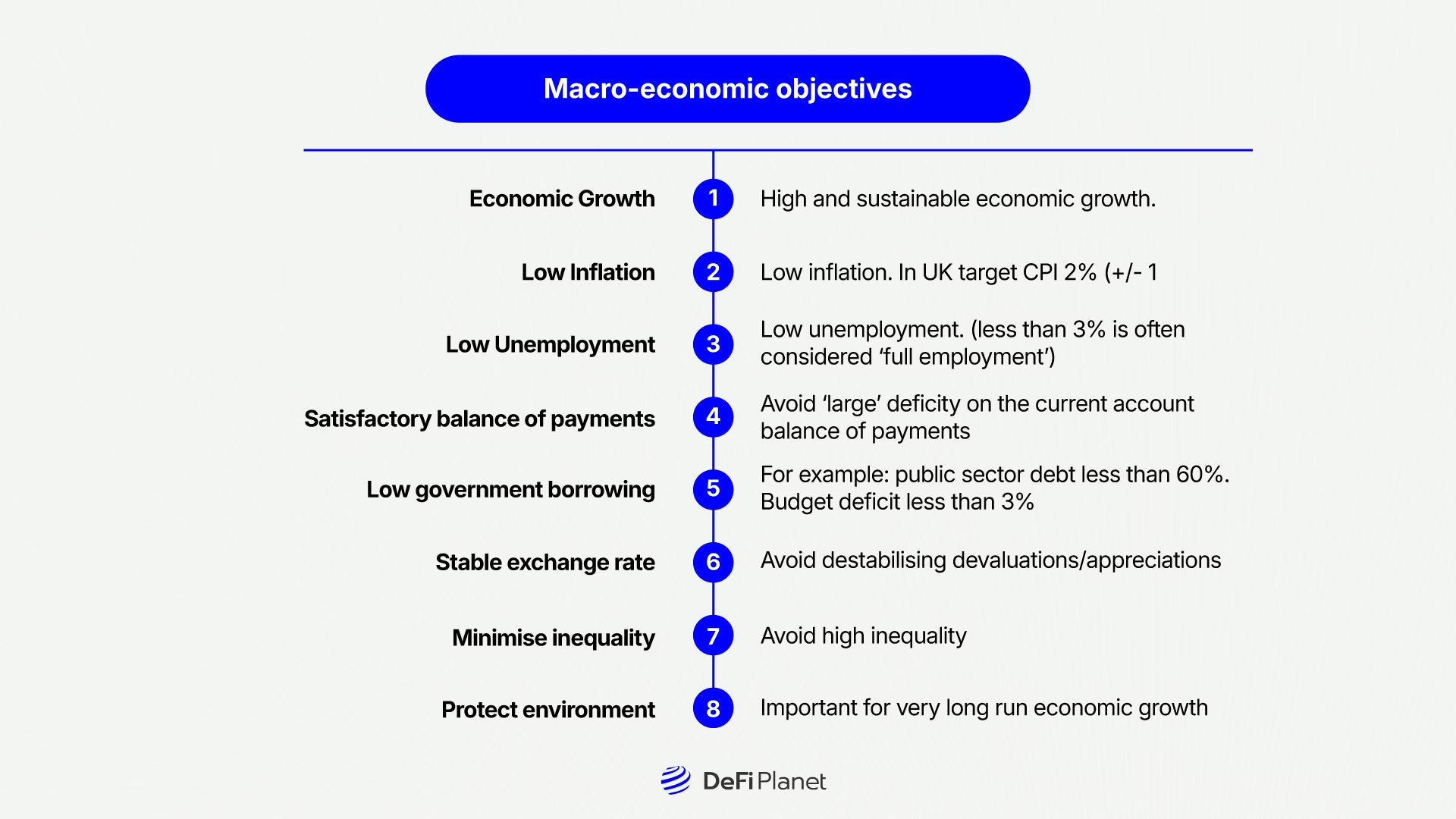

Macroeconomics, which is the study of the overall economy, also plays a major role in crypto cycles; Interest rates, inflation, and global financial trends all affect how people invest.

When interest rates are low and governments are printing more money, people are more likely to invest in crypto as a hedge against inflation. On the other hand, when inflation is high or regulations tighten, crypto investments may dry up.

For example, in 2020 and 2021, massive stimulus packages and low interest rates during the COVID-19 pandemic helped fuel a bull market. But as inflation picked up in 2022 and central banks raised interest rates, the market shifted to a bearish phase.

Volatility: A Double-Edged Sword

One of the defining features of crypto is its volatility—prices can swing wildly in a short period of time, and while this can create big opportunities for profits in bull markets, it also leads to massive losses in bear markets. This volatility is what makes timing the market so difficult, and yet so important.

When you understand the market cycles, it can help you develop better market timing strategies—knowing when to buy, when to sell, and when to simply hold.

Why Market Timing Matters

While no one can perfectly predict market tops and bottoms, it pays to have a sense of where we are in the crypto market cycle, and this can help investors make more informed decisions about where the market might be moving over time. For example, entering the market during a late-stage bull run is risky because prices are inflated and a correction may be around the corner. On the other hand, entering during a bear market, when prices are low and sentiment is negative, can offer the best long-term opportunities.

This doesn’t mean you should try to trade in and out of the market constantly, but instead, it means that when you understand the timing, it tends to help significantly with managing emotions and applying smart risk management.

RELATED: A Step-by-Step Guide to Using Crypto Correlation for Smarter Risk Management

Bitcoin Halving and the Four-Year Cycle

Historically, the Bitcoin halving has had a major influence on market cycles. Since new Bitcoin is created every 10 minutes as a mining reward, halving that reward makes Bitcoin scarcer over time. The halvings, which occur approximately every four years, have historically triggered strong bull runs about 12 to 18 months afterwards.

For example, the 2012 halving led to the 2013 bull market, the 2016 halving preceded the 2017 boom, and the 2020 halving contributed to the 2021 bull cycle. The next halving is expected in 2024, and many analysts believe it could kick off another cycle of growth.

Risk Management: Protecting Your Investments

Understanding crypto market cycles is key to effective risk management, and investors who fail to recognize the signs of a cycle shift often find themselves buying high and selling low. By identifying whether you’re in a bull or bear phase, you can better manage your portfolio. This is done chiefly by taking profits during peaks or preserving capital during downturns.

Risk management also involves setting stop losses, diversifying your portfolio, and not investing more than you can afford to lose. While no strategy can eliminate risk, good planning can reduce the chance of catastrophic loss.

Lessons from Past Cycles

Looking at past crypto cycles reveals common patterns. The 2017 bull market saw the rise of Initial Coin Offerings (ICOs), which eventually led to a massive crash in 2018. The 2020–2021 cycle introduced DeFi and NFTs, driving huge investor interest. But by 2022, market corrections wiped out many speculative investments.

Each cycle brings innovation, hype, and speculation—but also teaches the importance of patience and resilience. Crypto is still a young industry, and these cycles are part of its growing pains.

Navigating the Next Cycle

If you’re investing in crypto in 2025 and beyond, understanding these cycles will help you avoid emotional decisions. Here are some questions to ask yourself:

- Are we in a phase of hype or consolidation?

- What is the broader macroeconomic landscape saying?

- Has a major event like the Bitcoin halving recently occurred?

- What is the current investor sentiment—are people greedy or fearful?

Answering these can give you clues about the current cycle and help you position yourself accordingly.

In summary

Crypto market cycles are not just charts and price patterns; they are reflections of human behaviour, economic forces, and technological growth. Knowing how to navigate a bull market or survive a bear market isn’t about guessing the future; it’s about understanding the present.

If you want to thrive in this space, study market psychology, learn from history, and practice smart risk management. Whether you’re a seasoned trader or a curious newcomer, recognizing the patterns of crypto market cycles will give you a major advantage.

As the crypto industry matures, these cycles may become more predictable, but they will never disappear. By understanding volatility, the effects of Bitcoin halving, and the role of macroeconomics, you’ll be better equipped to make informed choices—whatever the market throws your way.

Disclaimer: This piece is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”