A beginner in the DeFi space will likely get overwhelmed by the many concepts and terms they must understand to effectively navigate the sector.

This learning process is further complicated by the rapid pace of innovation in the sector; new ideas are often introduced before you fully understand previous ones. However, getting started in DeFi doesn’t have to be that difficult; there is a way to make it simpler.

Some concepts are fundamental to DeFi, and grasping these makes understanding the ecosystem’s intricacies easier. This article will offer a concise but brief explanation of these concepts and provide references for a deeper understanding.

Let’s get to it!

An A to Z Glossary of DeFi Terms

APY(Annual Percentage Yield)

In DeFi, APY represents the interest rate you earn by locking your tokens in a protocol. For example, if you stake 1000 USDT with a guaranteed annual interest rate of 9% on a DEX, you can earn approximately 0.24 USDT the following day. This calculation is done as follows: 1000 × (0.09 ÷ 365) = 0.2465 USDT.

APY can vary depending on the platform and protocol. For instance, the APY can reach up to 5.05% on Aave, while on Compound Finance, it can go as high as 10%.

APR (Annual Percentage Return)

APR has the same meaning in crypto as it does in traditional banking. It’s a metric for calculating simple interest on a loan or investment without taking compound interest into account.

APR is usually calculated per annum, but interest is pro-rated if an investment or loan is for less than a year. For instance, a 6-month investment with a 5% APR would earn 2.5% interest on the principal.

ATH (All-Time High) & ATL (All-Time Low)

A cryptocurrency’s All-Time High (ATH) is the peak price in its history; conversely, its All-Time Low (ATL) is the lowest price it has ever achieved.

AMM (Automated Market Makers)

AMMs are algorithms used by DEX protocols to facilitate order matching and pricing. They serve as the foundation of a DEX protocol and enable users to trade digital assets in a peer-to-peer, trustless manner without requiring the involvement of custodians or third parties. In essence, AMMs allows DEX users to trade directly with one another based on current market prices.

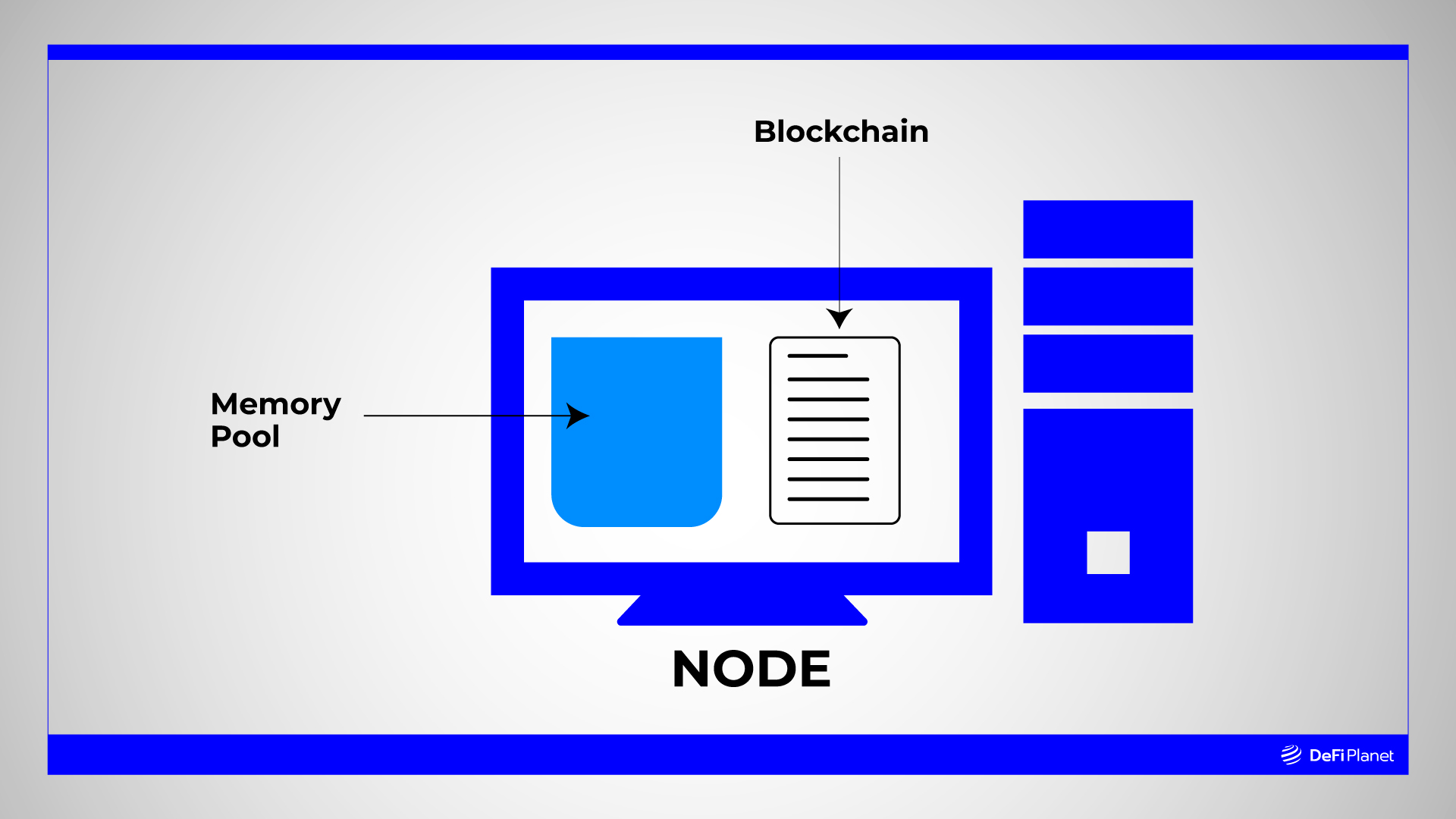

Blockchain

A blockchain is a distributed ledger system that operates via a network of computers (known as nodes), and is secured by cryptography. This system allows data to be securely recorded, verified, and managed without the need for a central authority. Blockchain technology is essentially the cornerstone for all things DeFi.

Block

Blocks are the basic units of a blockchain, the forms in which data are stored. They are the equivalent of pages in a notebook. However, the blocks are arranged in such a way that they are all linked together like in a chain. Thus, it creates an immutable record that is difficult to alter but open for everyone to see and add to.

CeFi (Centralized Finance)

CeFi describes crypto and blockchain companies that function similarly to traditional financial systems. They act as central authorities and third-party agents when users transact on their platforms. A prime example of such an institution is a Centralized Exchange (CEX).

CEX (Centralised Exchange)

A centralized exchange is a platform operated by a single entity that connects crypto buyers and sellers. It functions as an intermediary by providing liquidity for crypto tokens and uses an order book system to establish prices, similar to how a bank operates. Users typically deposit funds into the exchange, which in turn manages and safeguards these funds. Popular examples of CEXs are Coinbase, Binance, and Kraken.

DAO (Decentralized Autonomous Organization)

A DAO is simply a self-governing organization. It is “self-governing” because it doesn’t require a central authority to make and execute decisions. Instead, members collectively vote on what to do, and the decisions are executed automatically via computer code. DAOs enhance transparency and security in decentralized systems by enabling trustless, open, and democratic governance.

DeFi Oracles

DeFi oracles serve as intermediaries that enable blockchain smart contracts to access external real-world data. They provide real-time data, such as asset prices, not found on the blockchain. Oracles verify and relay crucial on-chain data to smart contracts.

DEX (Decentralized Exchange)

A DEX is a cryptocurrency platform where traders can directly buy, sell, and swap digital assets with one another. Unlike CEXs, DEXs eliminate the need for intermediaries by leveraging blockchain technology for transactions. Popular ones include PancakeSwap, UniSwap, and SuishiSwap.

Flash Loan

A flash loan is a type of loan where borrowers can access assets without the requirement of providing collateral. They must repay the borrowed assets within the same blockchain transaction. Importantly, the loan must be repaid promptly within the same block where it was borrowed. Failure to do so results in transaction cancellation, and the lender retains the funds.

Gas/Gas Fees

Gas refers to the fee paid for transactions on the blockchain, covering the resources needed for actions such as depositing, withdrawing, or trading assets in decentralized systems like exchanges, wallets, and DeFi pools. For example, in Ethereum, gwei is commonly used as the unit for specifying Ethereum gas prices, with one gwei representing one billionth of a single ETH, making it the preferred unit for everyday transactions.

Impermanent Loss

Impermanent loss is a financial risk that can occur when an investor provides liquidity to an automated market maker (AMM) platform in the decentralized finance (DeFi) ecosystem. This risk arises due to crypto market price fluctuations and the design of AMMs.

Liquidity

Liquidity measures how easily you can swap a crypto token for cash or another digital asset without altering its price. It depends on factors like the token’s trading volume, trading frequency, and the specific exchange used.

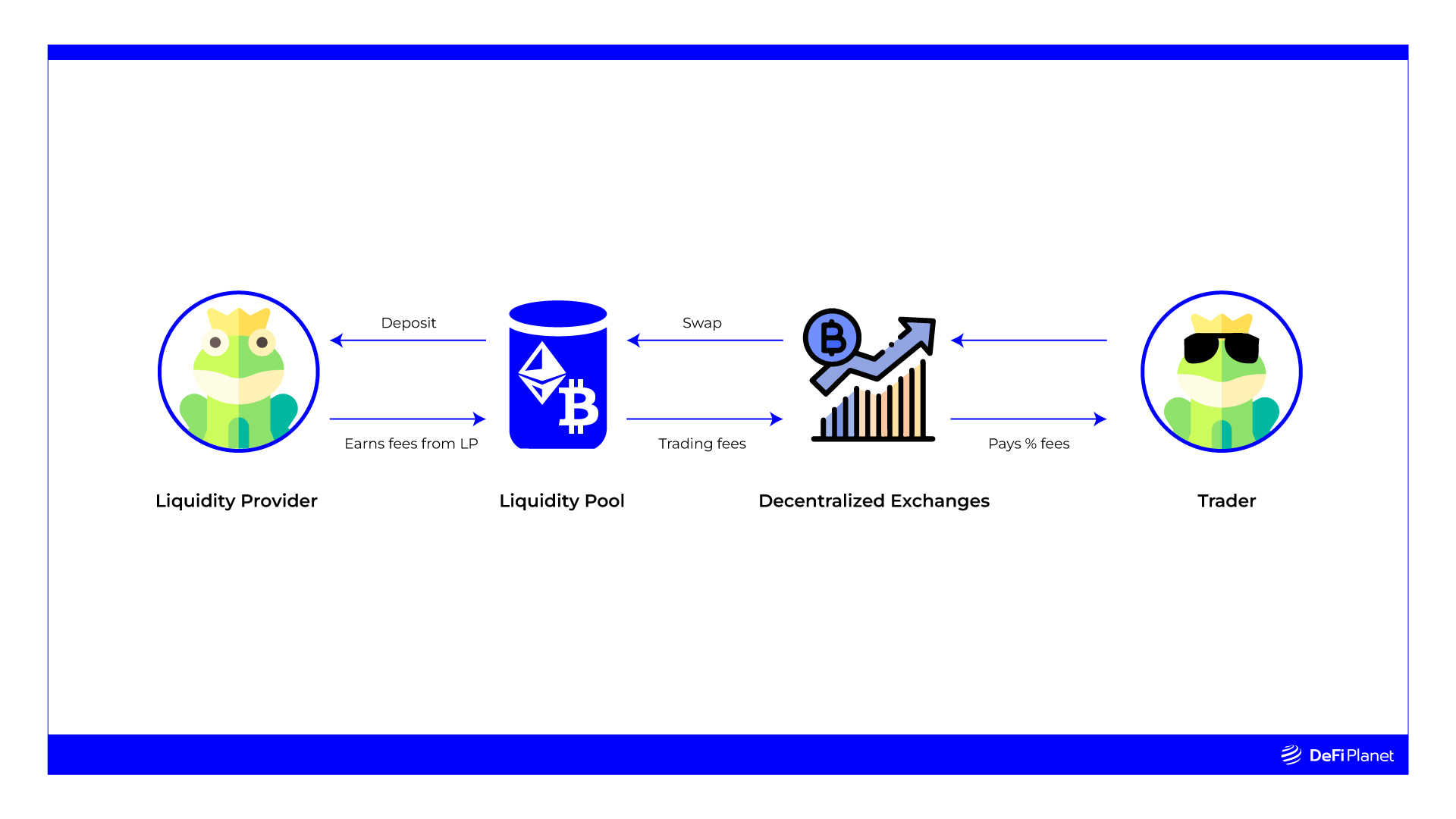

Liquidity Mining

In DeFi, liquidity mining involves depositing your tokens into a decentralized exchange or liquidity pool. By doing so, you increase the protocol’s liquidity, and in return, you receive additional tokens, often in the form of the protocol’s native cryptocurrency.

Liquidity Pool

Liquidity pools are collections of crypto tokens locked in smart contracts. They help provide liquidity in DEXs and reduce issues caused by low trading activity. Liquidity pools also refer to price levels created by orders, and they can determine if the price of an asset goes up or down.

Liquidity Providers

Liquidity Providers (LPs) are individuals or entities that add buy and sell orders to financial markets. They boost market liquidity by creating a consistent source of trading activity.

LPs can be market makers, high-frequency traders, banks, or other financial organizations. Their role is crucial because they keep the market active and ensure there are enough buyers and sellers, even when demand is low.

Mempool

A mempool is like a waiting room for cryptocurrency transactions that haven’t yet been confirmed in a block. It’s where unconfirmed transaction data is temporarily stored by cryptocurrency nodes.

Slippage

Slippage (or price slippage) is the difference between what you anticipate a cryptocurrency trade will cost and its actual price. It is very common in cryptocurrency trading.

Smart Contract

Smart contracts are computer programs on a blockchain that automatically execute transactions when specific conditions are met. They remove the need for intermediaries and delays and, thus, guarantee and expedite agreement outcomes.

Smart Contract Audits

Smart contract audits are careful examinations of a DeFi platform’s code to find vulnerabilities, bugs, and inefficiencies that might put users at unwanted risks in their execution or lead to attacks by malicious agents. Independent auditing firms like Certik, Cyber Scope, Hash Lock, and others usually do these assessments to protect against possible attacks.

Stablecoin

A stablecoin is a cryptocurrency designed to maintain a consistent value, often pegged to assets such as the US Dollar, gold, or another cryptocurrency. Its primary purpose is to reduce price fluctuations, making it useful for financial transactions and as a store of value.

Staking

Staking is a process where users lock up some of their cryptocurrency tokens to support a blockchain network, with the potential to earn additional tokens as rewards for their contribution.

Staking offers benefits like passive income and strengthens the security and decentralization of blockchain networks. It’s commonly used in Proof-of-Stake and Delegated-Proof-of-Stake blockchains like Ethereum 2.0, Cardano, Tezos, etc, but variations of staking can be found in different blockchain ecosystems.

Tokenomics

Tokenomics refers to the economic rules governing a cryptocurrency or token within a blockchain system, encompassing aspects like creation, distribution, management, and token usage.

TVL (Total Value Locked)

TVL represents the assets staked within a specific protocol. It does not include outstanding loans but rather reflects the total secured supply within a particular application. Assets are secured through smart contracts and initial investments from users. TVL encompasses protocol rewards from activities such as staking, lending, liquidity pools, and yield markets.

Wallet/Wallet Address

A wallet is like a digital bank account. It can be software on your computer or phone or a physical device. It helps you store and use your crypto assets safely.

While a wallet address comprises a collection of randomly generated alphanumeric characters, typically spanning a range of 26 to 35 characters in length. These characters form a unique code necessary for various digital asset transactions and are generated by the wallet software or platform.

Yield Farming

Yield farming in DeFi involves lending or staking cryptocurrencies in a liquidity pool to earn rewards, such as interest and additional crypto. It is similar to lending money to a bank in traditional finance.

For example, investors can earn by lending or depositing assets like ETH or BNB in DeFi platforms, including decentralized exchanges, lending platforms, yield aggregators, liquidity protocols, and options/derivatives protocols, rather than keeping them idle in their wallets.

ZK Proof (Zero Knowledge Proof)

A zero-knowledge proof is a cryptographic technique that demonstrates knowledge without revealing the actual information, allowing the exchange of private data while preserving confidentiality. It enables one party (the prover) to convince another party (the verifier) that they possess specific information or a secret without disclosing the content of that information.

In Conclusion

DeFi is a dynamic and ever-evolving ecosystem filled with innovative concepts and technologies. Throughout this article, we’ve explored key terms and concepts essential for anyone looking to navigate the DeFi landscape effectively.

Whether you’re seeking to provide liquidity, explore new investment opportunities, or better understand the DeFi landscape, this knowledge will serve as a solid foundation for your journey in the decentralized financial world. You can bookmark the page and refer to it occasionally to refresh your mind.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles (news reports, market analyses) like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”