Last updated on May 29th, 2023 at 11:19 am

The DeFi industry is becoming increasingly complex with the constant introduction of new protocols and dApps. This means that there are always new ways to make money in the DeFi space, but getting there may require navigating multiple protocols and layers.

This can result in longer wait times for each protocol action and higher fees. The best way to avoid these difficulties is to combine the necessary components into a single protocol, creating a new protocol capable of performing all required actions from a central location.

This article explores how composability makes this solution possible. It also sheds light on what composability is and why it is significant.

What is Composability?

The significance of scalability is easy to understand; it is the capacity to process more transactions simultaneously without increasing costs. But what exactly is composability, and why is it crucial for DeFi?

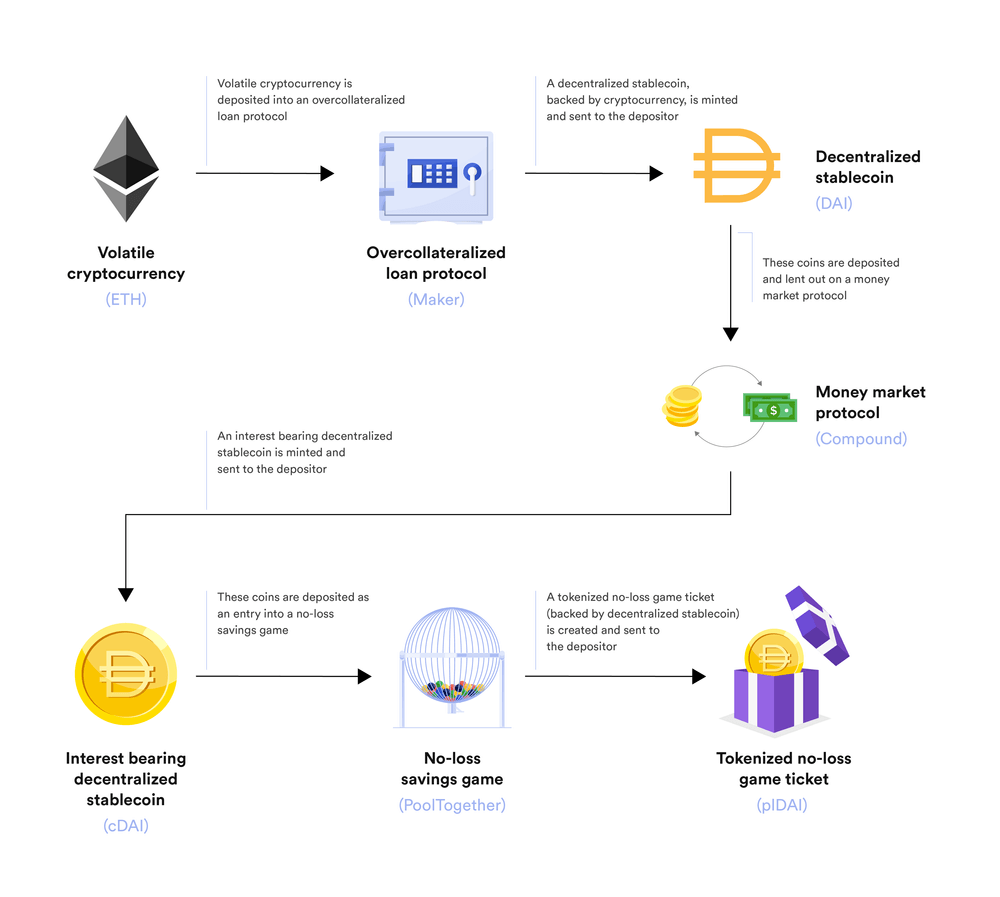

DeFi applications are often referred to as “Money Legos” due to their modular nature. Each “Lego brick” within the DeFi app represents a distinct financial offering that can be combined in any way the user sees fit. A new DeFi app could combine several of these Lego-brick products and services into one that is more powerful or better fits the needs of each user.

These Lego pieces are dynamically reassembled in each transaction, making this feature invaluable. This allows people to be more flexible and creative than they could be in traditional, bank-controlled systems.

To build this “Money Lego” system, the DeFi platform on which the apps run requires the following:

Standardization

Just as Lego bricks require standard bricks and holes to fit in different ways, DeFi apps should also be able to connect in a standard and open manner.

Atomicity

DeFi apps must be capable of connecting in a single transaction (just like a set of Lego bricks needs to be in the same box and easy to reach for a builder to put them together however they want).

DeFi composability is the practice of combining different DeFi protocols and software programs. This is accomplished without requesting permission or spending any money.

Anyone, anywhere, can create a product by combining existing protocols or tapping into preexisting networks. “Money Legos” is another name for it.

For DeFi to thrive, it requires a platform that can provide the robust composability essential to its operation. Without composability, DeFi becomes a place where apps run like they do in traditional financial systems. The apps may be decentralized but have lost most of their flexibility and transformative power.

Examples of Composability in DeFi

Here are some DeFi applications that demonstrate the value of composability:

Flash Loans

The concept of a “flash loan” is unique to the DeFi industry and is an excellent illustration of atomic composability.

Aave is a cryptocurrency lending protocol. Borrowing typically involves securing a loan against an asset (typically other tokens). The “flash loan” feature offered by Aave allows tokens to be borrowed without collateral as long as they are returned in the same transaction (so there is no risk of default). You pay only a small fee for this service.

What’s the point in getting a loan that you can repay within the same transaction? Composability makes it a valuable activity. Suppose multiple applications can be combined and used in a single transaction. In that case, a loan can be used to conduct other business with the apps (provided the result generates enough tokens to pay back the loan).

An example is Arbitrage trading. Let’s say a trader discovers that the price at which he can buy Token A from Uniswap is lower than the price at which he can sell on Binance; that’s an arbitrage opportunity.

However, suppose the trader’s current financial resources prevent him from taking advantage of the opportunity. In that case, Aave makes it possible to borrow funds and buy a lot of Token A on Uniswap, then sell it all on Binance immediately for a profit. This can help the trader pay back the loan.

Composability not only makes this possible, but it also guarantees the security of all parties (as long as the smart contracts involved are bug-free) by ensuring that the entire transaction follows the rules set by each app. This kind of complicated transaction is impossible on DeFi platforms that try to be scalable by putting different applications on independent shards or separate side chains.

Automated Investment

Yearn offers a practical application of composability; the ability to automatically invest in different DeFi apps (such as Aave, Compound, Curve, and dYdX) that offer different rates of return on the tokens staked.

The Yearn app leverages its ability to quickly check the current return on investment for these other apps through open interfaces to automatically move its investment pool to the app that will make the most money.

Users can treat Yearn as a managed investment fund where tokens can be invested with little thought, and the user will receive returns. But unlike the traditional financial sector, this “fund manager” is open, cheap, and responds quickly.

Yearn made it much easier for people to get returns on their token holdings without constantly comparing and moving tokens between apps. This sparked the recent DeFi yield farming craze.

Yearn requires a platform that instantly checks the other Lego bricks in the box and chooses which one to plug in for each transaction to function. In a nutshell, there will be no Yearn without composability.

Decentralized Exchanges

Tokens are individual financial products. For instance, each token on Ethereum is a separate smart contract. DEXs (i.e., decentralized exchanges) function through the composition of trade transactions across multiple token smart contracts.

This is made possible by Ethereum’s ERC-20 token standard, which has been adopted as a model by a wide range of other platforms for token implementations.

Atomicity is lost, and a truly decentralized exchange is impossible if token smart contracts are run on separate shards or side chains, as on Cosmos, Polkadot, and other newer scalable platforms.

Risks of Composability

Failure in the base layer

Ethereum serves as the base layer for most protocols. Ethereum’s shortcomings (such as longer transaction times and higher gas costs) often affect these protocols. The applications built on top of the base layer are vulnerable to any changes made to the base layer itself.

Smart contract failure

Every smart contract is potentially vulnerable to failure or abuse. Even if a protocol codes its smart contracts perfectly, it may still fail if they encounter bugs or are otherwise unprepared for the unexpected. Developers must investigate the protocol’s history of security audits, its open-source status, and the amount of time and energy spent securing its smart contracts.

Compound security

The interaction of two secure protocols can occasionally open up new vulnerabilities. Since it adds new security loopholes, there is no guarantee that this system will be as safe as the one it replaces.

Complex

Excessive risk-taking can occur as a result of limited knowledge of the numerous possibilities. It is, therefore, important to understand the steps taken and be aware of the consequences of each action.

Top Composable DeFi Protocols

In Conclusion,

- The ability of DeFi to freely take, integrate, and recycle components from different technologies makes it possible to discover useful combinations. More so, the interoperability of DeFi protocols enables the ecosystem to capitalize on derivative gains.

- Hence, as DeFi becomes more permissionless and open, it becomes more robust, and more users benefit from a genuinely frictionless financial reality.

- Composability plays a crucial role in DeFi’s functionality. The permissionless nature of Ethereum’s network allows the protocols to be combined like “Money Legos,” thereby giving everyone access to the ecosystem’s numerous benefits. The fact that developers can deploy their contracts amplifies the Ethereum network’s impacts.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, and Instagram.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”