Last updated on September 7th, 2025 at 07:08 pm

Introduction

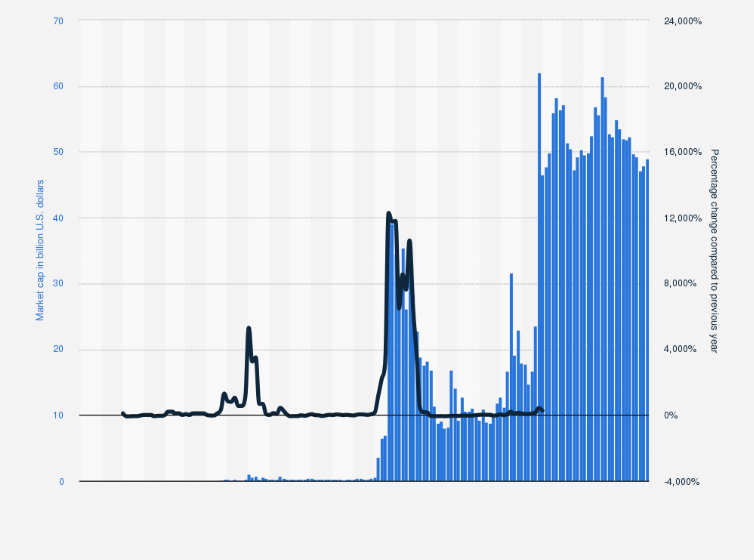

The story of Dogecoin is nothing short of remarkable. What started as a sheer joke and a fun project has now transformed into a digital asset with a market capitalization exceeding a staggering $10 billion. Who would have thought something born out of humour could turn into such a valuable crypto venture?

Against the backdrop of all this, we can’t ignore the influence of one person who played a significant role in Dogecoin’s meteoric rise—Elon Musk. It’s impossible to talk about Dogecoin without mentioning Musk, as his involvement has been an integral part of its narrative (and yes, you’ll come across his name multiple times in this piece).

Who can forget the time when Musk playfully changed the bluebird logo of Twitter, a multi-billion dollar company, to feature the iconic face of Dogecoin, the Shiba Inu? That moment perfectly captured the connection between Musk and Dogecoin.

While Musk isn’t part of Dogecoin’s founding team, his involvement has added an intriguing and captivating element to this meme-inspired cryptocurrency. What exactly has fascinated Elon Musk and piqued the curiosity of countless others?

If you’re curious to unravel the reasons behind Dogecoin’s immense popularity, you’ve come to the right place. This article explores the origins, evolution, unique characteristics, and impacts of Dogecoin in the crypto space. Brace yourself for an insightful adventure into the world of meme-inspired cryptocurrencies.

What is Dogecoin and How Did It Come to Be?

Dogecoin (DOGE) is a blockchain-based peer-to-peer, open-source digital currency. Originally created as a joke and a crypto meme, DOGE has now turned into a top contender in the space. It shares its codebase with Litecoin and employs the Proof-of-Work consensus mechanism.

In late 2013, Billy Marcus (also known as Shibetoshi Nakamoto) and Jackson Palmer brought DOGE to life. The coin was conceived as a satirical response to the growing seriousness of the cryptocurrency industry. Inspired by an internet meme featuring a Shiba Inu, it became the pioneer of meme coins.

Now, Marcus and Palmer were both software engineers at the time, working for IBM and Adobe. Jackson set up the Dogecoin website, while Billy focused on developing the actual DOGE token. Finally, on December 6, 2013, Dogecoin made its big debut and entered the mainstream.

Remarkably, Dogecoin quickly gained traction, with over a million visitors to the DOGE website within a month of its launch. Some Reddit users actively contributed to its early success, aiming to boost its value.

However, by the end of 2015, both Marcus and Palmer had distanced themselves from Dogecoin and disassociated from the meme coin. Jackson, in particular, openly expressed skepticism toward cryptocurrencies, including Bitcoin and Dogecoin. Nonetheless, the development of Dogecoin continued as a community-driven project that is still going strong to this day.

Dogecoin’s journey from a funny meme to a crypto powerhouse is definitely one of those unique and quirky success stories in the cryptocurrency world!

The Dogecoin Ecosystem

The Dogecoin Blockchain Network uses the Proof-of-Work (PoW) consensus mechanism to verify transactions, mine new blocks, and secure the network. This means mining a new block on the network involves using computers to solve complex mathematical problems.

Dogecoin mining requires high-performance computers and consumes a significant amount of energy. Considering the current price of Dogecoin, solo mining may not be profitable. Joining a mining pool that combines resources provides better incentives for miners. There is a detailed explanation by the Dogecoin team on how to mine on the network.

The mining reward for successfully mining a new block is capped at 10,000 DOGE.

Use Cases For Dogecoin

Despite its origins as a meme coin, Dogecoin has evolved to include features commonly found in more established cryptocurrencies. It serves multiple purposes, such as facilitating payments for goods and services, acting as a speculative asset in cryptocurrency trading, and functioning as a store of value.

One interesting aspect of DOGE is its usefulness as a payment method in online casinos and as a way to tip content creators on different platforms.

On May 11, 2021, Elon Musk conducted a Twitter poll asking whether Tesla should accept DOGE as a form of payment. The poll garnered over 3 million votes, with 78% expressing their desire for Tesla to accept DOGE. By May 27, 2022, Elon Musk confirmed that Tesla would indeed accept DOGE as a payment option for its merchandise.

Interestingly, Dogecoin has also been associated with charitable initiatives. In 2014, the Dogecoin community raised 26.5 million Dogecoins (equivalent to around $30,000 at the time) to fund the Jamaican Bobsled Team’s participation in the Sochi Winter Olympics.

Similarly, in March of the same year, the community contributed 40 million Dogecoins (equivalent to around $30,000 at the time) to a clean water project in Kenya. Since then, the Dogecoin community has made numerous charitable contributions, supporting a wide range of causes.

How to Buy Dogecoin

Due to its relative popularity, it’s easier to buy Dogecoin compared to other meme coins. Dogecoin is listed on popular exchanges such as Binance and Coinbase. Additionally, decentralized exchanges like Uniswap and Pancakeswap support trading DOGE.

You can use hot wallets like Metamask, Dogecoin Core, and Trust Wallet to hold DOGE. Similarly, cold wallets like Ledger support DOGE.

Why and How Dogecoin Become So Popular

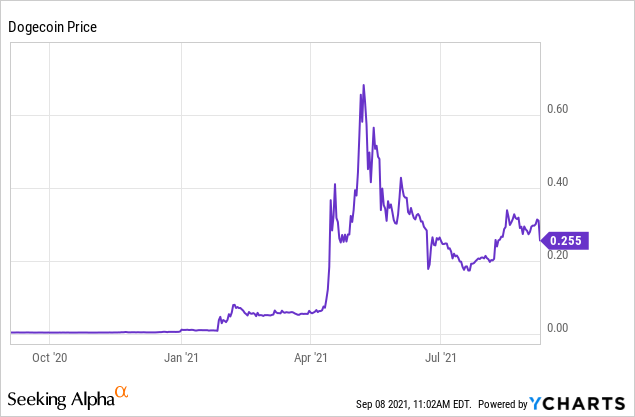

The surge in Dogecoin’s popularity can be attributed to a combination of positive and negative engagement from various stakeholders. The combined influence of high-profile individuals and their endorsements significantly contributed to the memecoin’s fame.

Notably, in 2021, Elon Musk and Mark Cuban played influential roles in promoting Dogecoin. Musk, referring to it as the “people’s crypto,” championed the memecoin through his massive social media presence.

Musk’s tweets and public statements regarding Dogecoin had an undeniable effect on its value and popularity. He expressed his fondness for the coin, shared memes, and even playfully entertained the idea of Dogecoin becoming the currency of choice on Mars.

Billionaire investor Mark Cuban, on the other hand, proudly proclaimed himself as the largest Dogecoin merchant and enabled DOGE payments for ticket purchases related to his NBA team.

The engagement of other celebrities, such as Snoop Dogg, Lil Yachty, and Gene Simmons, further fueled the public’s interest in Dogecoin. Such endorsements from prominent figures provided further validation and exposure for Dogecoin, driving interest from a broader audience.

The peak of Dogecoin’s popularity came on May 8, 2021, when it reached an all-time high of $0.73. This milestone spurred a social movement within the Dogecoin community, with enthusiasts rallying to push its value beyond the coveted one-dollar mark. However, the coin experienced a sharp decline of over 34% on the same day Musk appeared on Saturday Night Live. As of the time of writing, Dogecoin has experienced an 89% decrease from its all-time high.

Dogecoin and the Rise of Meme Coins

It’s quite interesting to see how Dogecoin’s relative success has birthed a whole new culture in crypto – meme coins. Meme coins, as the name implies, are tokens based on hype and have no inherent value. They rely heavily on marketing tactics that aim to create FOMO (fear of missing out) among potential investors.

The motivation behind creating meme coins often stems from the hope of replicating the trend set by Dogecoin. While most meme coins in the crypto market have questionable origins, they still enjoy significant demand from the crypto community.

From animal-themed coins like Shiba Inu, Floki Inu, and Samoyedcoin to internet-inspired ones like PepeCoin, there is a wide variety of meme coins to choose from. These coins have managed to amass large market capitalizations despite lacking practical utility.

While some critics may disagree, it’s fair to consider meme coins as a category of altcoins, as they have introduced a completely unexpected dimension to the crypto market. One of their key appeals is their affordability, making them easily accessible to a wide range of investors.

Concerns and Criticisms Surrounding Dogecoin

Investing in cryptocurrencies can be a financially risky endeavor, especially given the sector’s current state. With meme coins like Dogecoin, the risks are further amplified due to their extreme volatility.

Dogecoin has some features that set it apart from more established cryptocurrencies such as Bitcoin. These features have resulted in some of the following criticisms:

Price stability

Dogecoin does not come with a guarantee of stability. While it enjoys popularity as a cryptocurrency, it has yet to achieve the same level of widespread acceptance. As a result, some investors find it difficult to trust the project.

Energy consumption.

Dogecoin has been criticized for using the Proof-of-Work (PoW) consensus mechanism, which is considered inefficient and environmentally unfriendly.

Utility

Dogecoin has been criticized for lacking significant utility beyond its hype-driven success. It is perceived to have fewer real use cases compared to other established cryptocurrencies.

Inflationary Risk

Critics also argue that Dogecoin’s unlimited supply will inevitably cause its value to decline. However, it’s important to note that while Dogecoin does not have a fixed supply cap, its inflation rate actually decreases as time goes on. The token has a yearly issuance of 5 billion Dogecoins, resulting in a lower inflation rate compared to its overall supply.

Regulatory Risk

Regulatory bodies and governments worldwide have been increasingly scrutinizing and attempting to regulate the crypto market. There have been instances where cryptocurrencies have been misclassified as securities, leading to restrictions on trading for certain investors.

This hazy regulatory landscape poses a significant risk for Dogecoin and other cryptocurrencies. If Dogecoin were to be categorized as a security, current holders might be unable to trade the token legally, essentially rendering it worthless.

In Conclusion,

- Dogecoin’s journey from an internet joke to a prominent digital asset highlights the dynamic nature of the crypto industry.

- Its strong community and attention from influential figures such as Elon Musk have fueled its journey to the spotlight.

- However, Dogecoin, like other cryptocurrencies, carries inherent risks due to its high volatility. Its future success depends on development, utility, and addressing regulatory uncertainties.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”