Stablecoins like USDC and USDT have become the backbone of on‑chain settlement in decentralized finance (DeFi). They act like digital dollars, making it easy to move money in and out of cryptocurrency with minimal risk, but as their use spreads, new challenges around DeFi liquidity and regulatory risk are emerging. As of mid-2025, the global stablecoin market capitalization stands at approximately $252 billion, reflecting sustained demand as a core liquidity layer in crypto markets. The table below summarizes key stablecoins’ market positions and stability metrics:

Let’s explore why this battle for dominance matters, how it works, and what might happen next.

What Are Stablecoins and Why Are They Important?

Stablecoins are crypto assets designed to stay pegged to a stable value, usually the U.S. dollar and that means one USDC or USDT is always meant to equal one dollar. They are used for quick, cheap transactions and as trading tools within DeFi liquidity pools. If you wanted to trade tokens but didn’t want to deal with regular dollars or euros, you’d likely use a stablecoin.

Two leading options are USDT, issued by Tether, and USDC, issued by Circle. USDT remains the biggest, holding around 62% of the market cap, while USDC holds about 24%. These coins power billions of dollars in daily on-chain activity, helping everything from lending and borrowing apps to NFT buying, gaming rewards, and even payroll systems.

DeFi Liquidity: Why Volume and Stability Matter

In DeFi, liquidity is critical, it means there are always enough coins available to trade or borrow without causing big price jumps. High liquidity ensures markets run smoothly, and

USDT’s huge market share gives it deep liquidity in the crypto world, it’s widely accepted on exchanges and DeFi platforms . That often makes USDT the go-to for quick trades or swapping into and out of other tokens.

USDC, on the other hand, emphasizes compliance and safety. Issued by Circle, it continues to grow thanks to monthly audits and strict financial controls . With new laws like the GENIUS Act making stablecoin regulations clearer, USDC’s market share rose from 22% to 24.3%, showing investor confidence. In short, USDT offers deep liquidity and market availability, while USDC offers trust and compliance, critical for institutional use.

On‑Chain Settlement: The Role of Speed and Trust

Stablecoins enable almost instant settlement for on-chain transactions. For example, if you swap one token for another on a DeFi marketplace, the funds must move quickly to avoid price changes. This is where on‑chain settlement shines: once you hit “swap,” you see the result within seconds.

USDC supports this with reliable, fast settlements supported by strong infrastructure and compliance.

Regulatory Risk: Trust, Compliance, and the Threat of New Laws

Regulation is a major factor in the stablecoin wars, and USDT has faced controversies due to limited audits and regulatory scrutiny, even though it holds more than $118 billion in reserves. People worry it might not always be fully backed or transparent, which could pose risks during crisis moments. USDC, backed by Circle and audited consistently, aims to be a regulated stablecoin, making it more appealing to banks and regulators.

In June 2025, the U.S. Senate passed the GENIUS Act, demanding stablecoins be fully backed with reserves, regularly audited, and liquidated first in case of bankruptcy. It also requires issuers above $50 billion to publish audited financial statements; moves that favor fully transparent coins like USDC. The Act encourages major banks like JPMorgan, Morgan Stanley, and Bank of America to launch their own stablecoins, or to adopt USDC as a regulated option. This could drive even greater confidence in on‑chain dollars.

USDC vs. USDT: Comparing Despite Similarity

Though both aim to track the dollar, USDC and USDT differ sharply. USDT offers exceptional liquidity and is often used purely for trading. It facilitates huge volume in DeFi but lacks strong audit support, which introduces regulatory risk. USDC emphasizes on-chain settlement, transparency, and compliance. This makes it attractive for users and institutions who want stability and regulatory trust; even if liquidity is sometimes lower .

As regulatory clarity grows, stablecoins with transparency and reserves in U.S. dollars or Treasurys may become the default choice for conservative or institutional users.

Risks: What Can Go Wrong

No stablecoin is risk-free and as the S&P Global study warns: stablecoins can still de-peg or lose value due to market issues, reserve problems, or technical problems. USDT has had times when its peg slipped, and skepticism about its reserves has persisted . USDC remained stable during the Silicon Valley Bank collapse, but that event caused short-term market stress.

Both coins also rely on centralized reserves, which means if Circle or Tether face trouble, the coins could falter, favoring decentralized alternatives like DAI; but these still make up only a small fraction of market activity .

The Future of On‑Chain Dollars and DeFi

With the GENIUS Act and stronger global regulation, stablecoins are inching closer to mainstream finance. One major sign of this shift is Circle’s IPO (initial public offering), which brought even more attention to USDC. Circle is also forming big partnerships with companies like Visa, Mastercard, and Stripe, helping USDC get used for everyday payments, not just in crypto but in real-world shops and online platforms and because USDC is backed by fully regulated U.S. dollar reserves and undergoes monthly audits, it is winning trust from banks, fintech companies, and governments alike.

USDC is also making it easier to send money across borders. Normally, cross-border payments can take days and involve high fees. With USDC and on‑chain settlement, people can send money globally in seconds with very low costs. This is especially powerful for businesses in emerging markets and workers who need to send remittances to family members back home.

Meanwhile, USDT continues to play a huge role in the DeFi world. It still dominates in terms of market share, especially in trading and liquidity pools. Traders rely on its deep liquidity and fast movement between exchanges. Many DeFi apps and crypto exchanges use USDT as their base stablecoin, and in high-volume environments, that advantage is hard to beat.

However, as crypto matures and more regulation enters the scene, the pressure on USDT’s transparency will increase. Investors, governments, and financial institutions want more than just liquidity, they want clear proof of reserves, strong audit practices, and compliance with financial laws. To stay competitive long-term, Tether (USDT’s issuer) may need to follow Circle’s path by increasing transparency and securing regulatory approval in major markets.

Looking ahead, we might also see government-backed stablecoins, like central bank digital currencies (CBDCs), entering the conversation. If CBDCs are issued, they could coexist with USDC and USDT or even compete directly in some markets; but for now, on‑chain dollars, especially private stablecoins are leading the way. Ultimately, the rise of stablecoins is about more than crypto. It’s about making money move faster, cheaper, and more fairly around the world. Whether it’s for DeFi, gaming, savings, or business transactions, the stablecoin you use, USDC for trust or USDT for speed; will shape your experience in the evolving world of Web3 finance.

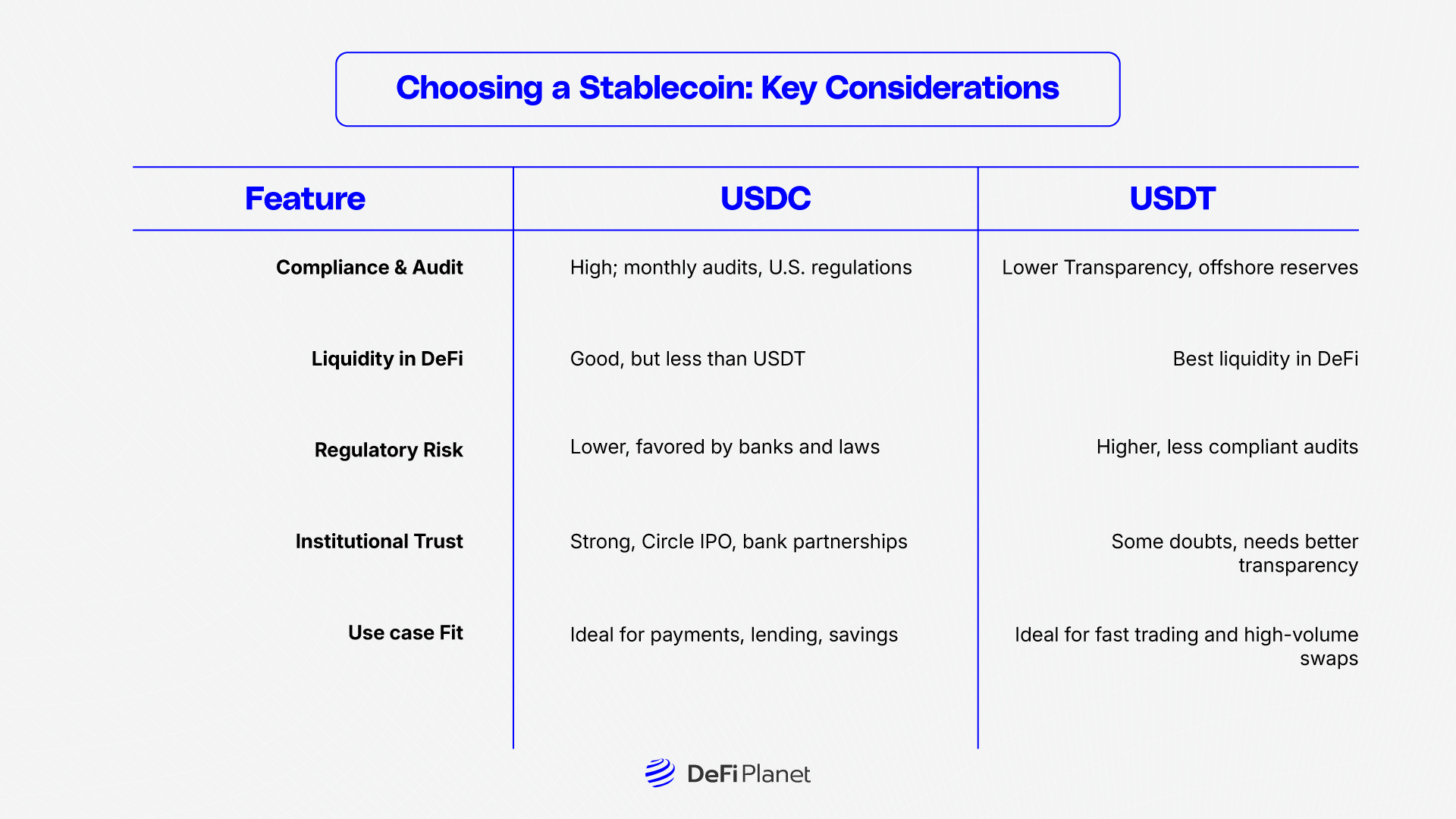

Choosing a Stablecoin: Key Considerations

In Closing: The Rise of On‑Chain Dollars

Stablecoin wars are far from over. But here’s what seems likely:

- USDC will continue to shine as a regulated, compliant stablecoin, ideal for institutional players and global settlement.

- USDT will keep dominating DeFi liquidity and trading, as long as its backers improve transparency.

- New regulations like the GENIUS Act will push issuers to prove their reserves and stability, shifting the market toward trusted, audited options

- On‑chain dollars will shape the future of DeFi and Web3, making finance more open, faster, and accessible.

Stablecoins like USDC and USDT are revolutionizing how we move money online, USDT brings unmatched liquidity to DeFi platforms, while USDC focuses on safety and trust through strong compliance. With the backing of regulators and big banks, USDC looks like the next big thing in official finance, while USDT remains the merchant of fast, decentralized swaps. As laws evolve, stablecoins will continue transforming digital money, and whoever wins the stablecoin wars could help determine the shape of tomorrow’s global economy.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”