Quick Breakdown

- Promise and Potential: Interoperability enables seamless asset transfers, deeper liquidity, and innovation across DeFi, NFTs, and gaming, with potential to attract institutions and improve risk management.

- Regulatory Challenges: Lack of unified global rules, jurisdictional conflicts, and KYC/AML uncertainty create hurdles for adoption and compliance in multi-chain ecosystems.

- Balancing Growth and Risk: Without clear guardrails, risks like bridge hacks, illicit activity, and loss of investor confidence remain high, making regulatory collaboration and global standards essential for sustainable adoption.

As crypto projects span more blockchains than ever, the promise of cross-chain interoperability is tantalizing, but without clear regulatory guardrails, seamless token transfers and multi-chain applications could run into costly legal roadblocks.

Bridges like Wormhole and platforms like Polkadot are connecting networks like never before, but the future of these innovations depends on regulators keeping pace with the technology.

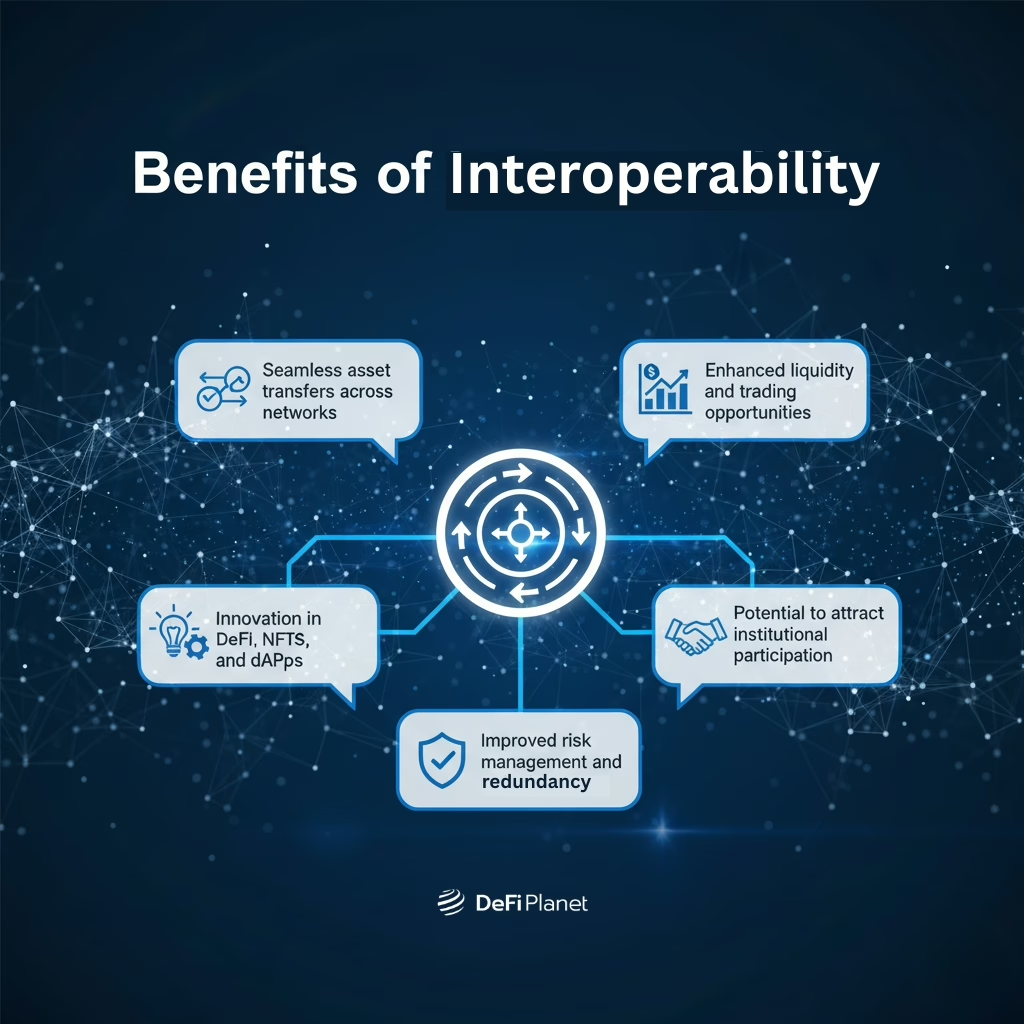

Benefits of Interoperability

Cross-chain interoperability is unlocking new possibilities in crypto, and some of the benefits include:

Seamless asset transfers across networks

Interoperability allows tokens and assets to move easily between blockchains without relying on centralized exchanges.

This reduces friction for users, lowers transaction costs, and supports faster, more efficient Cross-chain interoperability and operations. It also enables developers to integrate multi-chain functionality directly into their applications, expanding user reach and functionality.

Enhanced liquidity and trading opportunities

By connecting multiple blockchains, liquidity pools can merge across networks, enabling larger trading volumes and tighter spreads.

Traders can access deeper markets and arbitrage opportunities, boosting overall efficiency in the crypto ecosystem. This also encourages a more competitive market environment, benefiting both traders and project teams.

Innovation in DeFi, NFTs, and dApps

Developers can create decentralized applications that draw on resources from multiple chains, opening new possibilities for cross-chain lending, NFT marketplaces, and gaming ecosystems.

This fosters creativity and accelerates the growth of multi-chain projects. Users can interact with richer ecosystems without being limited to a single blockchain, increasing engagement and adoption.

Potential to attract institutional participation

Institutions are more likely to engage with crypto when markets are interconnected and efficient. Cross-chain interoperability reduces operational barriers and offers scalable solutions for trading, custody, and asset management. It also signals a more mature and organized market, giving institutional investors greater confidence in infrastructure stability.

Improved risk management and redundancy

Cross-chain networks provide alternative pathways for asset transfers and smart contract execution, reducing reliance on a single chain.

This redundancy can protect users and developers from network congestion, outages, or attacks, enhancing system resilience. It ensures that even if one network experiences downtime, critical operations can continue on alternative chains, minimizing disruption.

Regulatory Hurdles Today

Cross-chain interoperability and decentralized finance innovations face significant regulatory challenges that slow adoption and create uncertainty for users and developers.

Lack of Unified Global Rules for Cross-Chain Transactions

Different countries have varying approaches to regulating digital assets, making it difficult to implement standardized rules for transactions that span multiple blockchains. This inconsistency complicates compliance for platforms operating internationally.

Jurisdictional Challenges and Compliance Uncertainty

Cross-border transactions often trigger conflicting legal requirements. Companies must navigate multiple legal systems simultaneously, which increases risk and raises the cost of ensuring compliance.

Issues with KYC/AML, Securities Classification, and Taxation

Regulators worldwide continue to debate how decentralized platforms should enforce Know Your Customer (KYC) and Anti-Money Laundering (AML) standards. Ambiguity around whether tokens are considered securities or commodities, coupled with unclear tax obligations, adds further complexity for both users and operators.

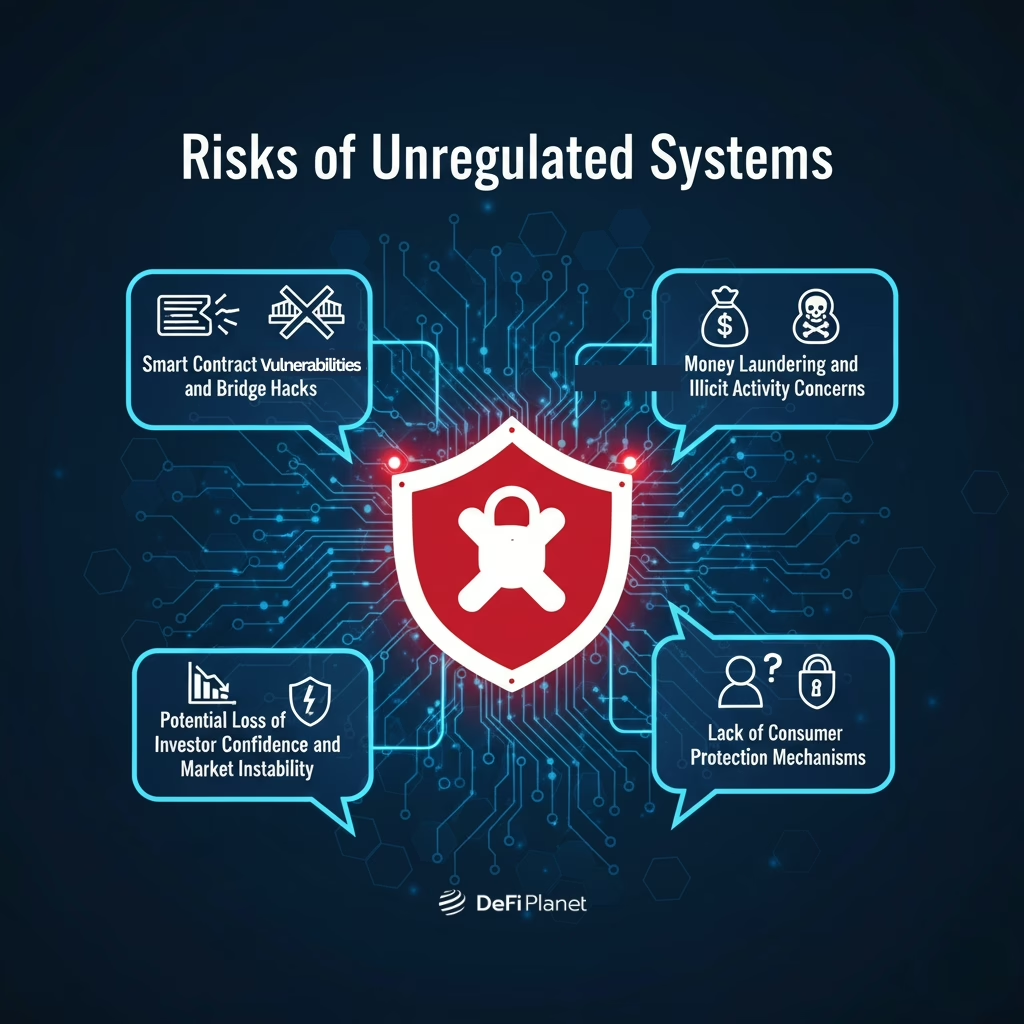

Risks of Unregulated Systems

While cross-chain and DeFi ecosystems offer innovation, operating without clear regulations exposes users and platforms to serious risks.

Smart Contract Vulnerabilities and Bridge Hacks

Cross-chain interoperability rely heavily on smart contracts and bridges to move assets between networks. If these contracts contain coding flaws or are poorly audited, hackers can exploit them, leading to massive losses for users and shaking trust in the entire ecosystem.

Money Laundering and Illicit Activity Concerns

Without regulatory oversight, some platforms may unintentionally facilitate illegal activity. Criminals can exploit unregulated systems to launder funds or conduct transactions that would normally be flagged under KYC/AML requirements, putting both platforms and users at legal risk.

Potential Loss of Investor Confidence and Market Instability

Frequent hacks, scams, or regulatory crackdowns can erode trust in unregulated crypto markets. When confidence declines, investors may pull out funds quickly, causing extreme price swings and market instability.

Lack of Consumer Protection Mechanisms

In unregulated systems, users have little or no recourse if they lose funds due to fraud, hacks, or platform mismanagement. Unlike traditional financial institutions, these platforms may not provide insurance, refunds, or dispute resolution, increasing the risk of permanent financial loss.

Roadmap to Regulatory Readiness

Achieving regulatory readiness is essential for the sustainable growth of Cross-chain interoperability, ensuring innovation can thrive while protecting users and markets.

Collaboration Between Regulators and Cross-Chain Developers

Open dialogue between policymakers and blockchain developers is crucial. By sharing insights, challenges, and best practices, both sides can design regulations that are practical, enforceable, and supportive of innovation rather than overly restrictive. This collaboration also helps anticipate potential legal gaps and ensures new technologies can be adopted without unnecessary delays or conflicts.

Establishing Standards for Security, Reporting, and Compliance

Clear, globally recognized standards help platforms implement robust security protocols, accurate reporting, and proper compliance measures. Standardization reduces risk for users and creates a predictable environment that encourages institutional participation and investor confidence. Adopting such standards also helps platforms demonstrate accountability and transparency, which can attract more mainstream users and investment.

Steps for Gradual, Responsible Adoption

Adoption should be incremental, with pilot programs, audits, and phased rollouts of new protocols. Gradual implementation allows regulators and platforms to monitor risks, address vulnerabilities, and ensure that users are adequately protected while scaling cross-chain solutions responsibly. This step-by-step approach also provides valuable data and feedback that can guide future regulatory adjustments and technological improvements.

Key Takeaway

Regulatory clarity is a critical prerequisite for the sustainable growth of Cross-chain interoperability and DeFi ecosystems. Without clear rules and standards, innovation is hampered by uncertainty, security risks, and potential legal challenges.

At the same time, regulators and developers must work together to strike a balance, fostering technological advancement while ensuring investor protection and market stability. Achieving this balance will pave the way for a resilient, trustworthy, and scalable cross-chain future that benefits both users and the broader financial ecosystem.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”