Imagine you have two different video games, and each one uses its own special kind of coin. You’ve earned a lot of coins in one game, but you want to spend them in the other. There’s no built-in way to transfer the coins, so a third-party tool lets you exchange your game coins from one to the other. That’s kind of what a cross-chain bridge does in the world of crypto, and in simple terms, cross-chain bridges are tools that allow people to move their cryptocurrency or digital assets from one blockchain to another. For example, if you have Ethereum but want to use it on the Solana network, a bridge helps you make that move.

It might sound like a magic trick, and in some ways, it is, but like most magic tricks, it’s not foolproof. Cross-chain bridges have become a key part of DeFi, which is a system of financial apps and tools built on blockchains, where users don’t need banks to borrow, lend, or trade money. While DeFi has opened up tons of exciting possibilities, bridges have introduced one of its biggest weaknesses.

Let’s break this down and explore why these bridges are so important, and why they are also seen as the Achilles heel of DeFi.

Why Do We Need Cross-Chain Bridges?

Blockchains are like islands, and each one has its own rules, currency, and apps. Ethereum, Bitcoin, Solana, and Avalanche are all different blockchains. They don’t naturally talk to each other, but DeFi is growing fast, and users don’t want to be stuck on just one chain. They want to move their assets around freely. That’s where cross-chain bridges come in. They act like ferries, carrying your digital assets across different blockchains.

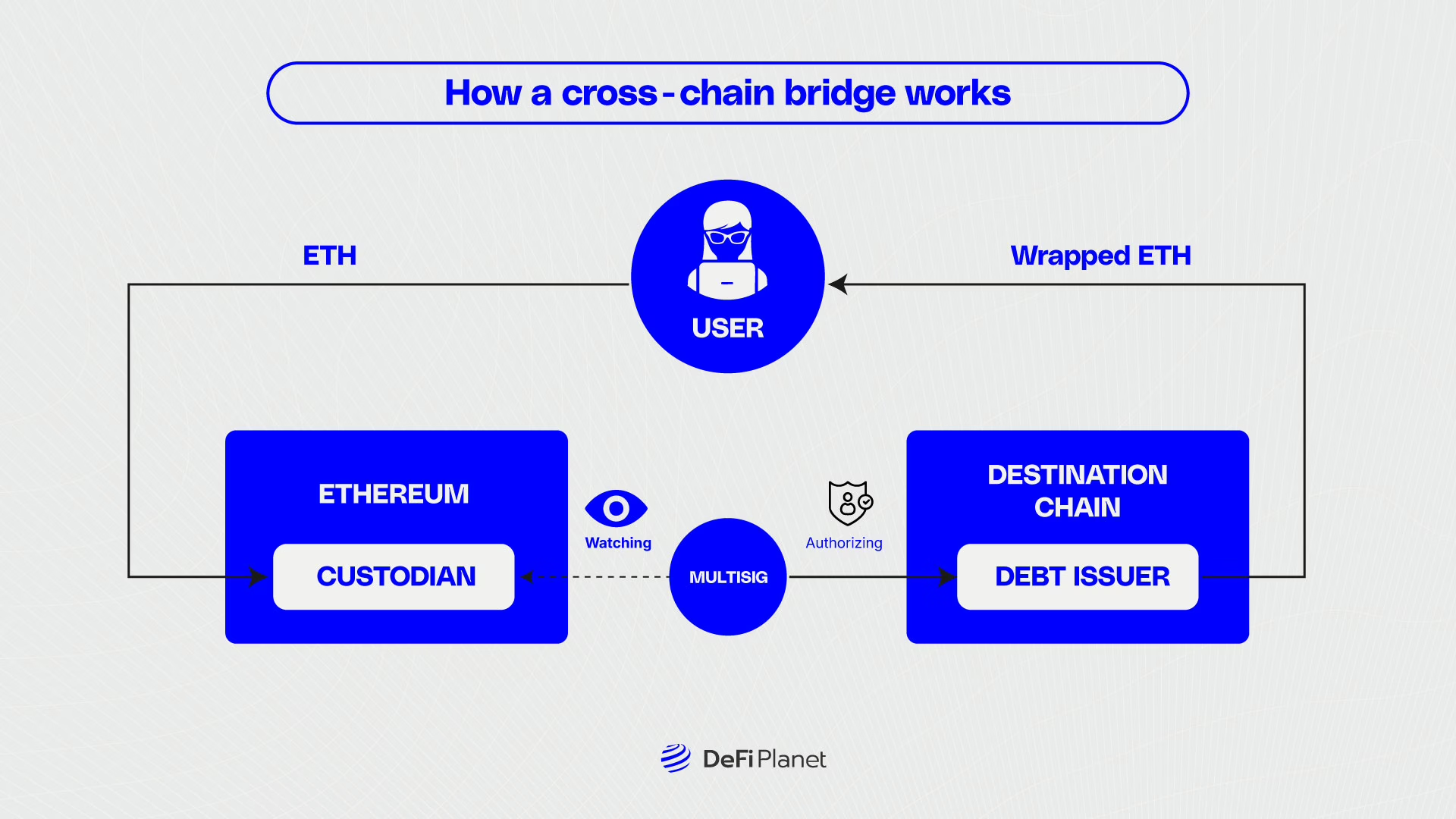

Let’s say you want to use Bitcoin to buy something on Ethereum. A bridge can help, and usually, it locks your Bitcoin on one side and then creates a new token on Ethereum that represents your Bitcoin. When you want your original Bitcoin back, the bridge burns the Ethereum version and unlocks the original Bitcoin. It’s like checking your coat at a coat check; your coat is kept safe, and you get a ticket that proves you own it.

This kind of blockchain interoperability, or the system of letting different blockchains work together, is essential for the future of Web3, which is the next version of the internet based on decentralization and user ownership.

RELATED: An Overview of Cross-Chain Bridges

The Hidden Danger: DeFi Security and Bridge Hacks

While bridges make blockchains more connected, they also make them more vulnerable. In Greek mythology, Achilles was a great warrior who could only be hurt in one spot: his heel. Bridges are like that weak spot for DeFi.

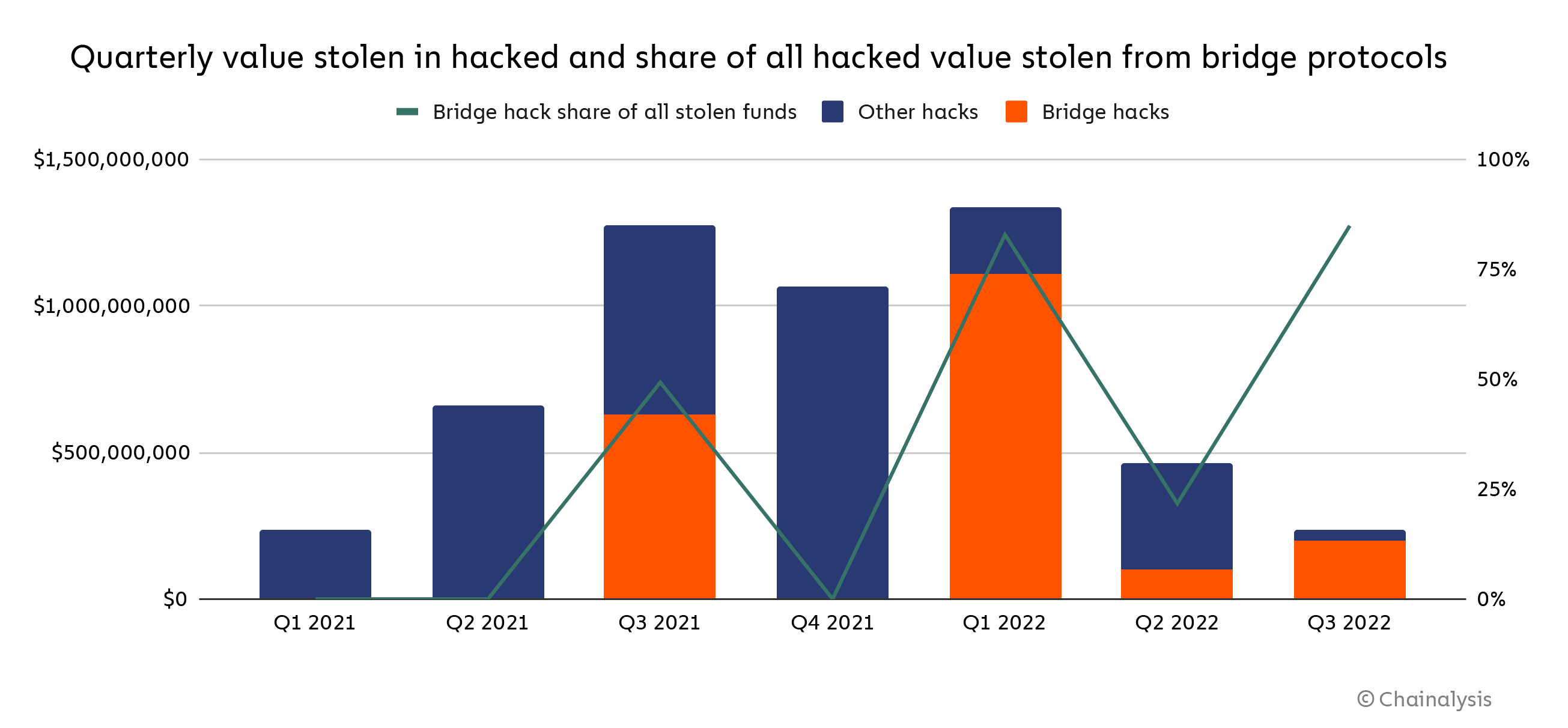

Why? Because bridges often hold huge amounts of money, and when you lock up your Bitcoin to get Ethereum tokens, that Bitcoin stays in the bridge. Now imagine thousands of users doing the same thing; that adds up to millions or even billions of dollars sitting in one place. Hackers see that as a giant piggy bank waiting to be cracked open, and they’ve already done it.

One of the biggest bridge hacks happened in 2022, when a platform called Wormhole was attacked. The hacker stole over $320 million worth of crypto by tricking the bridge into creating fake tokens. Another famous example is the Ronin bridge hack, where hackers drained over $600 million from a bridge used by the popular crypto game Axie Infinity. These attacks didn’t just hurt the platforms; they also shook people’s trust in DeFi itself. If bridges can be hacked so easily, how safe is the rest of the system?

RELATED: The Biggest Hacks and Exploits in DeFi History & What We Can Learn From Them

The Challenge of Trust: Trust-Minimized Bridges

To solve this problem, developers are trying to create trust-minimized bridges, and that means bridges that don’t rely on one company or group of people to be secure. Instead, they use smart contracts and cryptography to make the process automatic and safer.

In theory, these kinds of bridges are more secure because there’s no single person or team who can mess things up, or be bribed or hacked, but building trust-minimized systems is really hard. The technology is still new, and even small bugs in the code can lead to big problems.

Many existing bridges still rely on centralized systems, like a group of validators who decide whether a transaction is real. This centralization goes against the whole idea of DeFi, which is supposed to be trustless and open to everyone.

Why Are Bridges So Vulnerable?

Most cross-chain vulnerabilities come from the fact that these systems have to watch two blockchains at the same time, and that’s not easy. Each blockchain works differently, and keeping track of what’s happening on both sides is tricky.

Also, bridges often deal with wrapped tokens, which are copies of original tokens that can be used on other chains. If the bridge is hacked or the wrapped token is poorly designed, those copies can be used to steal real money.

Finally, because so much money is involved, bridges are a prime target for attackers. It’s like a bank with no security guards. Even if most people use it the right way, it only takes one smart thief to empty the vault.

The Future of Interoperability

So, where do we go from here? Should we stop using bridges altogether? Not necessarily. Blockchain interoperability is still incredibly important. For DeFi to grow and truly replace traditional finance, different blockchains need to be able to work together. But we need better bridges; ones that are secure, efficient, and decentralized.

Some projects are working on new ways to do this. They’re using advanced math, cryptography, and even zero-knowledge proofs (a way of proving something is true without revealing the details) to make cross-chain transactions safer. Other developers are looking at shared security models, where multiple chains work together to secure each other. These are complex solutions, but they show promise in fixing the problems we’ve seen so far.

So, the good news is that developers aren’t giving up. They’re working on new kinds of trust-minimized bridges, bridges that don’t rely on any single person or group to work correctly. Some are using zero-knowledge proofs, a kind of cryptographic magic trick that lets one blockchain prove something to another without revealing any private data. Imagine proving you’re old enough to drive without showing your exact birthday; that’s how these proofs work. This makes cross-chain communication much safer.

Others are building bridges that use shared security models. That means multiple blockchains team up to watch over and protect each other’s bridges, kind of like neighbourhood watch for crypto. There’s also work being done on light clients—small programs that can independently verify another blockchain’s data without trusting any third party.

These ideas are complicated under the hood, but the goal is simple: make DeFi security strong enough to handle billions of dollars flowing between blockchains without constant fear of hacks. We’re still in the early stages, but these developments show that it’s possible to fix what’s broken. With the right innovation, cross-chain vulnerability doesn’t have to be the Achilles heel of DeFi; it can become one of its strongest features.

An Achilles Heel We Can Heal?

Cross-chain bridges are one of the most important and most dangerous parts of today’s crypto world. They make DeFi security more complicated and introduce big risks, but they also unlock massive potential by making blockchain interoperability possible.

If we want a future where money and data can flow freely across chains, we need to build bridges that are as strong and trustworthy as the rest of the system. That means fixing the bugs, improving transparency, and moving toward trust-minimized bridges that don’t rely on any single person or group.

We’ve already seen what happens when bridges break; the Wormhole hack and the Ronin bridge disaster were wake-up calls, but they’ve also inspired a new wave of innovation. Developers and researchers are now working harder than ever to solve these challenges and protect the future of DeFi.

In the end, just like real-world bridges, cross-chain bridges need regular maintenance, strong foundations, and smart design. If we get that right, the Achilles heel of DeFi might just become one of its strongest assets.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”