In recent years, Bitcoin has gained traction as a treasury asset, with companies like MicroStrategy and Tesla making high-profile purchases to hedge against inflation and diversify corporate balance sheets. These moves sparked speculation that Bitcoin could soon become a mainstream financial tool among large public companies.

Yet, despite the buzz, major tech giants like Meta, Amazon, Apple, and Microsoft have notably stayed on the sidelines. While some of these firms have dabbled in blockchain technology or digital assets in other forms, such as Meta’s now-defunct Diem project or Amazon’s blockchain-as-a-service offerings, they’ve steered clear of holding Bitcoin directly on their balance sheets.

This raises a key question: Why are some of the world’s most influential tech firms avoiding Bitcoin, even as others embrace it?

The Promise of Bitcoin in Corporate Treasuries

Bitcoin is increasingly being viewed as a powerful tool for corporate treasury management, offering unique financial advantages that traditional assets often cannot match.

Inflation hedge

Amid global economic volatility and aggressive central bank policies, Bitcoin has become an attractive hedge against inflation, thanks to its fixed supply cap of 21 million coins. Unlike cash reserves, which lose value over time due to inflation, Bitcoin’s scarcity provides companies with a means to preserve purchasing power when fiat currencies weaken, making it an appealing alternative for forward-thinking financial teams.

Potential long‑term appreciation

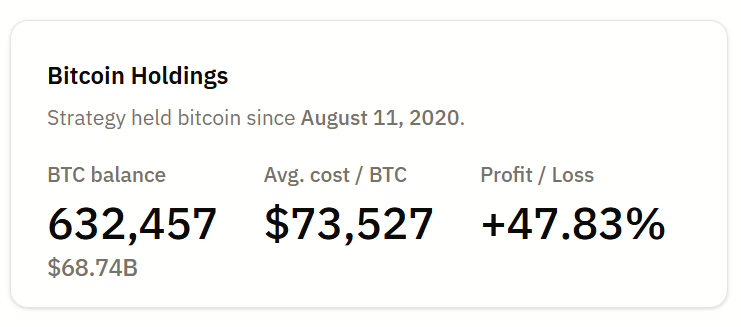

Companies that have allocated even small portions of their cash reserves to Bitcoin have seen significant returns. MicroStrategy, the leader in corporate Bitcoin adoption, has amassed hundreds of thousands of BTC since 2020. Many investors and analysts view these moves as long-term strategic investments, leveraging Bitcoin’s growth potential to amplify corporate balance-sheet performance over time.

Diversification from fiat currencies

Holding only fiat assets exposes companies to foreign exchange risk and interest rate fluctuations. Bitcoin offers a non-correlated asset class that can improve a treasury’s risk-adjusted returns. Research indicates that including Bitcoin in diversified portfolios can enhance overall performance, especially during periods of reserve currency debasement .

Why early adopters like MicroStrategy made the leap

MicroStrategy’s David pick-up, led by CEO Michael Saylor, sparked widespread attention after it parked 21,454 BTC for $250 million in 2020 and currently holds 632,457 BTC as of August 2025.

For these companies, Bitcoin was not just an investment but a strategic statement: a hedge against inflation, a move against systemic fiat risks, and an alignment with the future of digital finance.

Why Companies Reject Bitcoin

At the 2025 Bitcoin conference in Las Vegas, Matt Cole, CEO of Strive Asset Management, called on Mark Zuckerberg to support a proposal that would have Meta invest part of its cash reserves in Bitcoin.

“You have already done step one. You have named your goat Bitcoin. My ask is that you take step two and adopt a bold corporate bitcoin treasury strategy,” said Cole.

But when the idea was put to a vote at Meta’s annual shareholder meeting, it was shut down hard. Many shareholders voted against it. The proposal, introduced by Ethan Peck from the National Center for Public Policy Research, suggested that Meta consider converting some of its massive $72 billion cash reserve into Bitcoin.

Here’s how the vote went down:

$META joins Microsoft and Amazon in rejecting calls to add bitcoin to the balance sheet.

0.1% in favor

95% opposed pic.twitter.com/LGtvSvflvx— matthew sigel, recovering CFA (@matthew_sigel) June 2, 2025

Here are reasons why companies reject Bitcoin:

Despite all the buzz around Bitcoin, major tech giants like Meta, Amazon, and Microsoft are staying on the sidelines and here’s why:

1. Bitcoin is still too volatile

Bitcoin’s price swings wildly, often moving up or down by 10% or more in a single day. For individual investors, that might be exciting. However, for public companies, that kind of volatility poses a significant problem.

If a company holds Bitcoin, those price swings directly affect its earnings reports and financial statements, making them less predictable. This kind of uncertainty can spook shareholders, affect stock prices, and create major headaches for CFOs trying to maintain financial stability.

2. Crypto regulation is unclear and inconsistent

Unlike traditional financial assets, Bitcoin doesn’t have consistent rules. In the US, it’s not always clear which agency, like the SEC or CFTC, regulates it. Laws and tax guidelines can change quickly, and even small updates can impact how Bitcoin is treated on a company’s books. For public companies that need legal and tax clarity to manage billions in assets, the constantly shifting crypto space adds unnecessary risk.

3. Tech giants want to stay focused on their core business

Big tech firms are already competing in fast-moving areas like artificial intelligence, cloud services, and augmented reality. With so much at stake, leadership teams and investors are laser-focused on business growth and innovation.

Taking on something as uncertain and time-consuming as managing a crypto treasury could become a distraction. At a time when markets demand efficiency and results, speculative assets like Bitcoin just don’t fit the strategy.

4. Fiduciary responsibility means playing it safe

Public companies have a legal responsibility, called fiduciary duty, to act in their shareholders’ best interests. This means managing funds carefully and avoiding unnecessary risk. While Bitcoin might offer long-term upside, it’s still considered speculative by many financial experts.

If a company invests heavily in Bitcoin and the price crashes, board members could be accused of mismanaging funds. That’s a legal risk most executives just aren’t willing to take. Until Bitcoin becomes less volatile and regulation clears up, most major tech firms are likely to stay out of the crypto game, at least when it comes to putting it on their balance sheets.

Alternative Strategies: What They’re Doing Instead

As companies weigh their treasury strategies, many are avoiding Bitcoin and favouring traditional assets, business investments, and selective engagement with blockchain technology.

Holding cash and low-risk assets

Large firms often park cash in US Treasury bills or money market funds as a safe, liquid parking spot, particularly when uncertain about crypto’s volatility. These assets offer immediate liquidity, reliable returns, and government-backed stability, a more familiar choice than volatile digital assets.

Investing in growth, without crypto

Rather than betting on Bitcoin, many corporations are channeling capital into R&D, software development, and digital transformation projects. They also deploy funds through stock buybacks and strategic acquisitions, using capital to foster innovation, optimize operations, or strengthen market positioning without the regulatory and financial risks of crypto.

Exploring blockchain without BTC

Companies like Microsoft and Meta are actively building with blockchain, through Azure Blockchain Services or metaverse infrastructure, while avoiding Bitcoin. These projects focus on enterprise applications, such as smart contracts and Web3 platforms, allowing firms to gain blockchain expertise independently of crypto price exposure.

Interest in Stablecoins and Tokenized Assets

While many CFOs sidestep Bitcoin, some are exploring stablecoins or tokenized treasuries. Firms like Fiserv and major banks are piloting USD-pegged stablecoins for faster payments, liquidity management, and even yield, without incurring BTC volatility. Tokenized US Treasuries, including BlackRock’s BUIDL, also provide yield with a clear regulatory footing and institutional acceptance.

Could Their Position Change in the Future?

Several shifts could make Bitcoin a more attractive corporate treasury asset, potentially prompting hesitant companies to reconsider.

-

Reduced volatility

Bitcoin’s wild price swings have long made companies hesitant to hold it, but that’s beginning to shift. With institutional investors entering the market and the rise of Bitcoin spot ETFs, price fluctuations are becoming more stable. These large, steady investments help absorb shocks and reduce panic selling.

As volatility eases, Bitcoin is starting to look less like a gamble and more like a long-term asset. That shift could make CFOs and treasurers more open to including it in a diversified balance sheet.

-

Clearer regulations

Many companies are avoiding Bitcoin due to unclear rules and shifting policies. That’s starting to change. The Financial Accounting Standards Board (FASB) now allows fair-value accounting for crypto, making it easier for firms to report gains and losses.

At the same time, new laws, like stablecoin regulations, are giving clearer guidance on how crypto should be taxed and used. As rules become more consistent, legal teams can advise with more certainty, lowering risk and making adoption more likely.

-

Sustainable mining solutions

Bitcoin’s environmental impact has been a concern, especially for companies focused on ESG goals. But the mining landscape is evolving. More miners are using renewable energy, and some are even capturing methane from landfills to power operations.

As green practices and ESG standards become more common, companies will have stronger reasons to view Bitcoin as both a sustainable and strategic asset.

-

Crypto-native accounting standards

Beyond valuation rules, companies will need robust accounting frameworks for transactions, collateral, impairment, and yield on digital assets. As these systems mature, corporate finance teams will better manage Bitcoin, reducing operational risk.

Until Bitcoin becomes more stable and regulation is clearer, most tech giants are likely to watch from the sidelines. While a few bold companies have embraced crypto, the biggest players are sticking to safer, more traditional strategies to protect their shareholders and their reputations.

Final Thoughts

When companies like Meta, Amazon, and Microsoft stay on the sidelines, it’s not due to a lack of understanding; it’s a strategic choice. These tech giants face intense shareholder scrutiny and strict fiduciary duties, and avoiding Bitcoin reflects caution around the financial, regulatory, and reputational risks that still surround crypto at the institutional level.

Their caution isn’t a dismissal of Bitcoin’s potential; rather, it highlights the significant hurdles that remain. Volatility, regulatory uncertainty, ESG concerns, and unclear accounting frameworks are all real challenges for public companies that must manage long-term risk.

So the big question remains: Is Bitcoin destined to remain a hedge favoured by bold players like MicroStrategy, or can it evolve into an asset class mature enough to win the confidence of Fortune 500 boardrooms? The answer may depend not just on Bitcoin’s adoption, but on how quickly the financial and legal systems adapt to support it.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”