Imagine you spend years collecting rare NFTs, stacking crypto, and building a digital identity you’re proud of, but what happens to all of it when you’re gone? Does it just vanish into the internet forever? Well, the answer is actually Yes, all of it…poof…gone!

This raises the strange but important question of crypto inheritance and digital legacy.

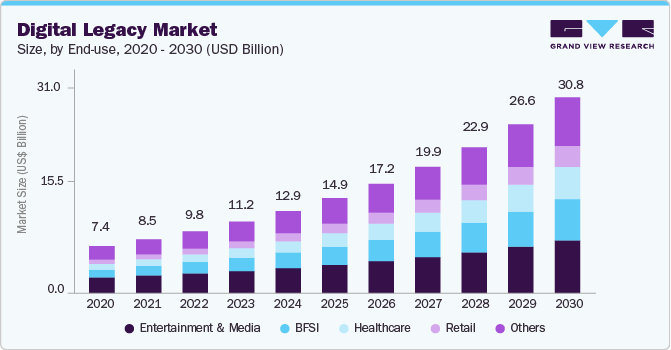

As we live more of our lives online; buying art, investing, gaming, and socializing, our digital belongings are becoming just as valuable as our physical ones and in the world of blockchain, NFTs, and crypto wallets, planning for the future isn’t just about houses and bank accounts anymore, it increasingly involves making sure our digital treasures don’t get lost after we die.

Let’s dive into this growing conversation around digital legacy and what it means for all of us.

Why This Matters: The Value of Our Digital Lives

In the case of social media accounts, when one passes away, different platforms have various rules for how to operate these accounts. Facebook, for instance, lets family or friends memorialize an account (it stays up but can’t be changed). It also allows you to choose a legacy contact to manage parts of your account in the event of your demise.

Instagram offers a similar memorialization option. It keeps the profile online, with a “Remembering” label, but nobody can log in or post. While social media accounts can remain present online indefinitely, allowing a crypto account or wallet to suffer the same fate will amount to waste, especially when such funds in said account could have been passed to a family member or next of kin.

Today, a single NFT artwork can sell for millions of dollars (remember Beeple’s $69 million NFT sale in 2021?). Some people own wallets full of Bitcoin, Ethereum, and rare digital collectibles, and for many, their online identity — X (formerly Twitter) accounts, Discord communities, DAOs they’ve joined — are a huge part of who they are. All these digital assets have real value. Losing them would be like losing a house, a car, or a family heirloom.

But unlike traditional items, crypto and NFTs don’t have a phone number you can call if you forget your password. If no one knows how to access your private keys after you’re gone, your digital fortune could be locked away forever, lost in the blockchain with no way to recover it.

Crypto Wallets: Why They’re Hard to Inherit

Your wallet is protected by private keys, secret codes that prove you own what’s inside. The hallmark of these codes is that they are almost impossible to hack or break. While this is good news, as it offers a high layer of protection, the flip side is the inability to access an account in the event that these keys are lost or forgotten. If you lose your private keys, you lose access to everything.

There’s no “Forgot Password” button in blockchain, and after you die, your family won’t automatically inherit your crypto unless you specifically plan for it. In 2021, Chainalysis reported that about 20% of all Bitcoin , worth billions of dollars, is trapped in wallets that can no longer be accessed, often because the owners lost their keys or died without sharing them.

There are even heartbreaking stories of people who have millions of dollars’ worth of Bitcoin locked away on hard drives they can no longer access. One famous example is Stefan Thomas, a programmer who lost the password to a hard drive containing 7,002 Bitcoin (worth hundreds of millions of dollars at today’s prices). He had only a few guesses left before the drive permanently erased itself. These stories remind us that crypto isn’t just “money you can’t see”; it’s a huge responsibility, and owning digital assets means being your own bank, but it also means planning for the future like a banker would.

Without estate planning tools like blockchain wills, multi-signature wallets, or trusted guardians, your crypto could be lost forever, along with any NFTs, tokens, or digital identities you spent years building. In Web3, your private keys are your legacy’s lifeline. If you don’t protect and plan for them, future generations might never know what you left behind.

Blockchain Wills and Multi-Signature Wallets: Securing Your Digital Legacy

As we move deeper into the world of digital ownership, a big question arises: How do we make sure our crypto assets are passed down after we die?

In the traditional world, people write wills that explain who gets what. But in the world of crypto, it’s a little more complicated. Private keys are everything. If you lose them, or no one knows them after you’re gone, your assets could be locked away forever.

This is where blockchain wills and multi-signature wallets come in.

Blockchain wills are smart contracts — pieces of code on the blockchain — that automatically carry out your wishes. They can be programmed to transfer your crypto assets to a loved one if certain conditions are met, such as if no activity is detected on your wallet for an extended period. Some companies are even developing platforms that combine estate planning with crypto management.

Meanwhile, multi-signature wallets (or multi-sig wallets) add another layer of safety. These wallets require more than one person to approve a transaction. For example, you might set up a wallet that requires two out of three people —perhaps you, your lawyer, and a trusted family member—to sign off before any cryptocurrency can be moved. If you pass away, the others can still unlock the wallet without needing your private key alone.

Using blockchain wills and multi-sig wallets together is becoming one of the smartest ways to protect your digital legacy. It means you’re not leaving your loved ones guessing or struggling — you’re giving them a clear, secure path to what you leave behind.

In a world where everything is becoming digital, planning for the future is no longer just about houses and bank accounts. It’s about planning for wallets, NFTs, and the memories locked inside them. Some companies, like Casa, offer services where you can securely pass down your keys when you die. There are also blockchain inheritance protocols, which are new smart contracts being developed that can automatically transfer crypto assets after death. For example, Safe Haven offers tools for setting up decentralized inheritance plans.

Still, it’s tricky. One would need to balance security (protecting your keys while you’re alive) with accessibility (making sure someone trustworthy can access them if something happens to you).

Posthumous Access: How to Make Sure Your Digital Legacy Lives On

There are many steps one can take to ensure that one’s digital assets are not lost or remain inaccessible in the event of a demise, some of which include:

- Document Your Digital Assets

Make a private list of all your wallets, NFTs, and crypto accounts. Include details like which blockchain they’re on (Bitcoin, Ethereum, Solana, etc.).

- Secure Your Private Keys

Store your seed phrases (the special words that can recover your wallet) in a safe location, preferably in a hardware wallet, encrypted drive, or secure password manager.

- Choose a Trusted Person

Pick someone you deeply trust to inherit your digital assets. Teach them how crypto works if they don’t already know.

- Write a Digital Will

As earlier mentioned, including clear instructions about your crypto in your will, or better yet, using services designed for crypto estate planning, could safeguard against loss.

- Keep It Updated

Every time you create a new wallet or buy an NFT, update your documentation.

A Future of Blockchain Wills?

Some blockchain projects are imagining a world where inheritance is automatic. Imagine a smart contract that knows your public key, and if, after, say, 5 years of inactivity, it sends your funds to a backup wallet you chose earlier. This concept is known as posthumous access via smart contracts. It removes middlemen, such as lawyers, and allows you to manage your inheritance in a decentralized manner.

Projects like Dead Man’s Switch (an Ethereum tool) already experiment with this. If you don’t regularly confirm you’re alive (say, every year), your assets could automatically transfer to a backup address. Although the idea is still relatively new, it is a noteworthy alternative that could help prevent the loss of funds.

The Philosophical Side of Digital Immortality

Beyond the practical stuff, there’s a big, deep question: What does it mean to live forever through your digital identity? Every NFT you mint, every DAO you help build, every token you own, leaves a trace on the blockchain. Unlike Facebook posts that can be deleted or bank accounts that can be closed, blockchains are built to last.

This means parts of who you are might outlive your physical life. Your digital shadow — your creations, your communities, your investments — could inspire future generations, just like a painting or a book does today. In this way, Web3 offers a kind of digital immortality, if we plan for it carefully.

Final Thoughts: Taking Your Digital Legacy Seriously

We spend so much time thinking about how to buy, sell, and trade our crypto, but thinking about what happens to it after we’re gone is just as important. Planning for crypto inheritance isn’t just a technical task; it’s an act of love, ensuring your digital story doesn’t end suddenly but continues in the hands of those you care about. The decentralized world gives us more control than ever, but with great freedom comes great responsibility, and your digital identity is worth protecting, even into the next life.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”