In response to Western sanctions, Russia has increasingly turned to cryptocurrencies like Bitcoin, Ethereum, and Tether to settle oil transactions with major buyers such as China and India. Although crypto-based payments currently account for a small but growing share of Russia’s $192 billion oil trade, they mark a significant shift in global trade practices.

The use of digital assets in state-level deals is new, but shows a growing trend of sanctioned countries trying to get around traditional banking systems. Crypto offers faster settlements and reduced dependence on the U.S. dollar, making it an appealing alternative.

However, this raises a pressing question: Is Russia’s crypto oil trade a bold step toward decentralized finance in global commerce or just a short-term workaround to evade sanctions?

How Crypto Powers the Oil Deal

Russia’s crypto-powered oil transactions with countries like China and India operate through a streamlined digital mechanism. Payments are often settled using a combination of Bitcoin, Ether, and most notably Tether (USDT), a stablecoin pegged to the U.S. dollar.

Buyers convert their local currencies, like Chinese yuan or Indian rupees, into crypto, which is then used to pay Russian exporters. This bypasses the traditional banking system and sanctions-related restrictions on using SWIFT, offering an alternative channel for cross-border payments.

Tether plays a crucial role by providing price stability in an otherwise volatile crypto market. It helps both parties avoid the risk of sudden value fluctuations that could affect transaction amounts. Meanwhile, Bitcoin and Ether are used for their liquidity, wide acceptance, and ability to settle large volumes quickly across borders. These assets are particularly valuable when speed and decentralization are needed in high-value trades.

Smart contracts and blockchain technology further enhance the deal’s appeal. They automate payment execution once trade terms are met, thereby reducing the risk of fraud and disputes.

Blockchain’s transparency also offers a tamper-proof record of transactions. By eliminating intermediaries and reducing reliance on slow and expensive wire transfers, cryptocurrencies enable these deals to be faster and more cost-effective than traditional trade finance models.

Motivations Behind Russia’s Crypto-Fueled Oil Trade

Since the 2022 invasion of Ukraine, Western sanctions have heavily restricted Russia’s ability to participate in the global financial system, cutting off access to U.S. dollars, euro clearing systems, and SWIFT. These sanctions have made it difficult for Russia to process payments for exports like oil and gas, the lifeblood of its economy.

Turning to cryptocurrencies allows Russia to bypass traditional banking rails, enabling direct peer-to-peer settlements that are harder to trace and regulate. This move is not just about convenience; it’s a necessity for economic survival under pressure.

Pursuit of Financial Sovereignty

Russia’s embrace of crypto also reflects a broader effort to regain control over its financial operations and reduce vulnerability to external influence.

By using decentralized or semi-decentralized payment options like Bitcoin, Ethereum, and stablecoins such as USDT, Russia can settle cross-border transactions without being subject to Western oversight.

This aligns with its long-term ambition of building a sovereign financial ecosystem, independent of the West, where it can trade with partners under its own rules and terms.

The Role of China and India

Although China and India are not sanctioned, they have their own incentives to move away from the U.S.-centric financial order. China has been working on its own central bank digital currency (CBDC), the digital yuan, and sees blockchain as a strategic asset.

India, while more cautious, has not ruled out blockchain adoption in international trade, especially as it looks to strengthen its energy security and reduce dollar exposure.

Both countries recognize that using stablecoins or crypto rails in deals with Russia offers a quicker, cheaper, and geopolitically safer route, allowing them to maintain trade ties while sidestepping the complications of dollar-clearing systems.

Russia’s Crypto-Fueled Oil Trade Implications for the Global Financial System

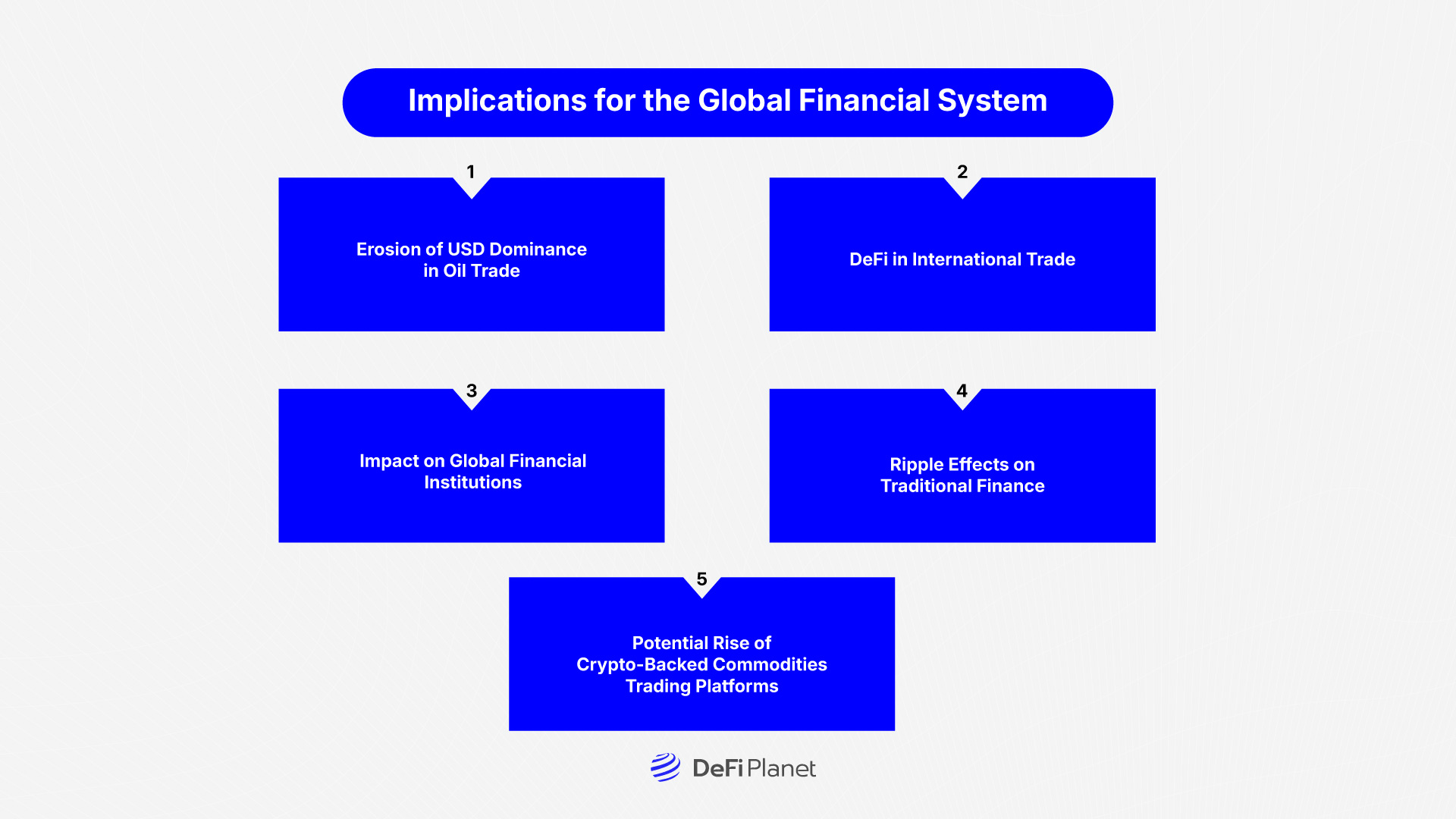

As Russia increasingly turns to crypto oil trade with China and India, the global financial system faces potential shifts that challenge traditional mechanisms and highlight the growing role of decentralized finance in international transactions.

-

Erosion of USD Dominance in Oil Trade

Russia’s use of cryptocurrencies for oil transactions marks a shift away from the petrodollar system, reducing reliance on the U.S. dollar in global oil sales. If other oil-exporting nations follow suit, it could undermine the USD’s dominance and weaken U.S. sanctions enforcement, signalling that alternative payment methods are viable.

-

DeFi in International Trade

Russia’s crypto use highlights a shift from traditional finance to DeFi, allowing cross-border trade without intermediaries like clearinghouses. By using stablecoins and smart contracts, transactions can be settled instantly, reducing counterparty risk and boosting transparency. This could spur the adoption of DeFi for global trade.

-

Impact on Global Financial Institutions

The rise of crypto challenges institutions like SWIFT, central banks, and commercial banks, which control international financial flows. These entities may need to integrate blockchain technology or risk becoming obsolete in key trade corridors, leading to a redefinition of global financial systems.

-

Ripple Effects on Traditional Finance

As crypto-based trade expands, private banks, investment firms, and payment processors could face lower transaction volumes and reduced revenue. More countries, particularly those under sanctions or seeking cost-effective alternatives, may adopt crypto, triggering reforms in trade finance and settlement processes.

-

Potential Rise of Crypto-Backed Commodities Trading Platforms

Crypto’s success in trade could lead to blockchain-native commodities platforms, where physical assets like oil and metals are tokenized and traded on-chain. These platforms would streamline logistics, automate payments, and reduce intermediaries, transforming the way commodities are priced and exchanged.

Risks and Criticisms of Russia’s Crypto-Fueled Oil Trade

As Russia’s crypto oil trade with China and India increases, several risks and criticisms emerge that could impact the long-term viability and global acceptance of such a move.

-

Volatility:

One of the primary risks of using cryptocurrencies like Bitcoin and Ether in large-scale transactions is their inherent price volatility. The value of these digital assets can fluctuate dramatically within short periods, making them less predictable for critical trades such as oil.

This volatility could potentially expose both Russia and its trading partners to significant financial risks if the value of their crypto holdings changes unexpectedly.

-

Regulatory Challenges:

Countries like the United States and members of the European Union could respond to crypto-fueled trade with increased scrutiny and regulation. Given that these regions have historically been cautious about cryptocurrencies. They might impose stricter regulations or even sanctions on countries adopting crypto in trade, further complicating the legal and financial space for Russia and its allies.

-

Security Concerns:

Cryptocurrencies are often targets for cyberattacks, including wallet hacks and transaction fraud. The risk of theft or manipulation of digital assets remains high, especially in cross-border transactions that bypass traditional banking systems.

Additionally, security vulnerabilities in blockchain platforms could make large-scale crypto transactions susceptible to exploitation by malicious actors.

-

Legal and Regulatory Grey Area:

The global regulatory environment for cryptocurrencies remains fragmented, with no clear consensus on their legal status. This lack of uniformity poses challenges for countries like Russia and its trading partners, as crypto transactions may not always align with international laws. The grey area surrounding crypto’s use in trade could also invite legal disputes or conflict with international trade agreements.

-

Environmental Concerns:

Cryptocurrencies such as Bitcoin, which rely on the energy-intensive proof-of-work consensus mechanism, have long faced criticism for their environmental impact.

The large-scale use of Bitcoin for crypto oil trade could exacerbate concerns over the carbon footprint of cryptocurrency mining, especially given the increasing global focus on sustainability and carbon reduction.

-

The Risk of Adoption by Bad Actors:

While cryptocurrencies offer benefits like decentralization and reduced reliance on traditional financial systems, they also present opportunities for illicit activities.

The anonymity and borderless nature of crypto could make it an attractive tool for bad actors engaged in money laundering, sanctions evasion, or other illegal activities, which could further complicate the legitimacy of crypto-powered trade deals.

Could Russia’s Crypto-Fueled Oil Trade Set a Precedent?

Russia’s crypto oil trade with China and India could inspire other countries facing economic sanctions or geopolitical challenges to follow suit.

As nations seek to bypass traditional financial systems, the flexibility and borderless nature of cryptocurrencies could present an alternative for countries looking to avoid sanctions and maintain access to global markets. If successful, this could lead to wider adoption of crypto for state-driven transactions, especially among nations facing similar economic pressures.

The influence of this shift could extend beyond crypto oil trade, potentially transforming global trade practices in multiple sectors. By reducing dependency on intermediaries, cryptocurrencies and DeFi platforms could streamline international transactions, lower costs, and increase transparency. Industries like agriculture, technology, and manufacturing could see benefits from faster cross-border payments and reduced friction in settling deals.

The future of DeFi in international trade looks promising, as blockchain technology could evolve into the backbone of trade agreements and financial transactions. As adoption increases, traditional industries may begin to integrate crypto into their operations, further bridging the gap between decentralized finance and established global commerce.

This trend may set a new standard for conducting financial transactions, with blockchain-based solutions providing greater efficiency, security, and cost-effectiveness on a global scale.

Final Thoughts

Russia’s crypto oil trade with China and India raises important questions about the future of global commerce. While it provides an alternative for nations under sanctions, the long-term impact on the global financial system is uncertain. Crypto-powered trade could become permanent, especially if more countries adopt blockchain and DeFi to bypass traditional financial systems. However, the volatility, regulatory uncertainty, and security risks of cryptocurrencies could limit widespread adoption, making it unclear whether this trend will last or remain a temporary fix.

As blockchain technology is explored for large-scale transactions, policymakers, financial institutions, and businesses must analyze the long-term implications of crypto adoption. This shift towards DeFi could reshape industries, challenge traditional financial practices, and democratize global trade, but it also comes with significant risks that require careful consideration. In-depth analysis is necessary to understand crypto’s potential role in international trade.

All stakeholders should closely monitor this trend and evaluate its broader impact. By encouraging discussions and research into the opportunities and challenges of crypto-powered trade, we can better prepare for the evolving financial landscape and its potential to transform global commerce.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”