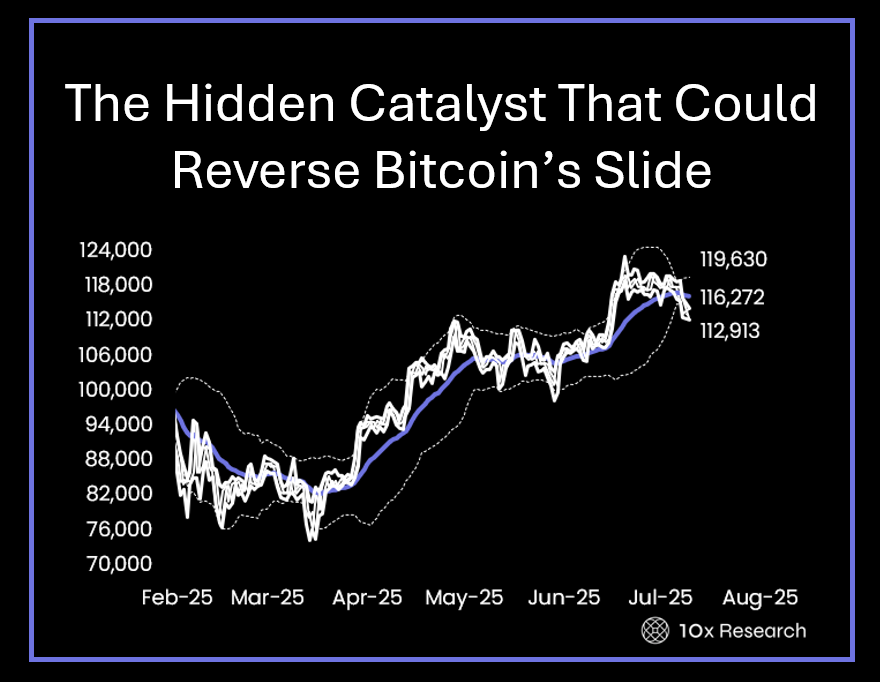

Bitcoin has fallen below $112,000, but analysts believe the drop could be laying the groundwork for a strong rebound. A new market update from 10x Research points to seasonal trends, weakening U.S. labor data, and expected Federal Reserve policy shifts as factors that could create favorable conditions for a recovery.

The report notes that Bitcoin’s decline follows its typical August correction pattern, which has coincided with downward revisions in U.S. labour market data. This has raised concerns that the economy may be weaker than previously indicated by Fed Chair Jerome Powell.

Analysts highlight similarities with last year’s market behavior when signs of labor market softness prompted the Fed to deliver an unexpected 50-basis-point rate cut in September. That decision triggered a broad rally across risk assets, including Bitcoin, which surged into year-end.

If this pattern repeats, 10x Research expects further short-term weakness before a confirmed rate cut sets the stage for a sharp recovery. The firm emphasizes that the Fed has historically treated market stress, particularly in equities, as an early signal of broader economic strain, allowing asset prices to indirectly influence monetary policy decisions.

With markets now pricing in two rate cuts for 2025, the first likely to come in September, Bitcoin may be nearing a key inflection point. “This setup mirrors some of Bitcoin’s most powerful recoveries,” the report stated, adding that technical factors and macroeconomic shifts could align to favor crypto in the weeks ahead.

In addition, a previous report from 10x Research revealed that a large share of inflows into U.S. spot Bitcoin exchange-traded funds is being driven by short-term trading rather than long-term investment. Since their launch in January 2024, these ETFs have attracted about $39 billion in net inflows. However, only $17.5 billion, or roughly 44 per cent, appears to be held for long-term positions, according to Markus Thielen, head of research at 10x Research.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”