Bitcoin’s market performance in the third quarter of 2024 was a rollercoaster of volatility. Starting on shaky ground, Bitcoin dropped to a low of $54,321.02 on July 8, sparking concerns about a potential bearish trend. However, within just 48 hours, it bounced back by 9.27%, reaching $59,359. By the end of July, Bitcoin had broken through key resistance levels, surging 12.55% to $66,810, which renewed market optimism.

August brought a wave of uncertainty. Early in the month, Bitcoin’s price dipped to $54,766, though it recovered to $59,838 by mid-August. Unfortunately, this recovery was short-lived, as Bitcoin closed August at $58,768, slightly below its mid-August high. Despite this, the market sentiment remained cautiously optimistic.

September, however, marked a turning point. Bitcoin gained bullish momentum, starting at $57,217 and steadily climbing to $65,635 by the end of the month, representing a 14.71% increase. Trading volumes also surged, increasing by 46.06% from $25.4 billion at the beginning of Q3 to $37.1 billion by September’s close, signaling growing investor confidence.

Comparing Bitcoin’s Q3 Performance to Historical Trends

When comparing Bitcoin’s Q3 2024 performance to previous years, the price growth has been relatively subdued.

Bitcoin’s Q3 performance in the last four years

| Year | Start Price (July 1) | End Price (Sept 30) | % Price Change | Start Trading Volume | End Trading Volume | % Volume Change |

| 2020 | $9,104.73 | $10,847.26 | 19.14% | $12.3 billion | $44.2 billion | 259.51% |

| 2021 | $35,035.98 | $44,092.60 | 25.86% | $24.4 billion | $31.1 billion | 27.46% |

| 2022 | $19,073.71 | $20,109.85 | 5.43% | $30.8 billion | $44 billion | 42.91% |

| 2023 | $30,328.86 | $27,091.80 | -10.67% | $9.1 billion | $5.3 billion | -41.34% |

| 2024 | $62,495.51 | $65,635.05 | 5.02% | $25.5 billion | $37.1 billion | 45.74% |

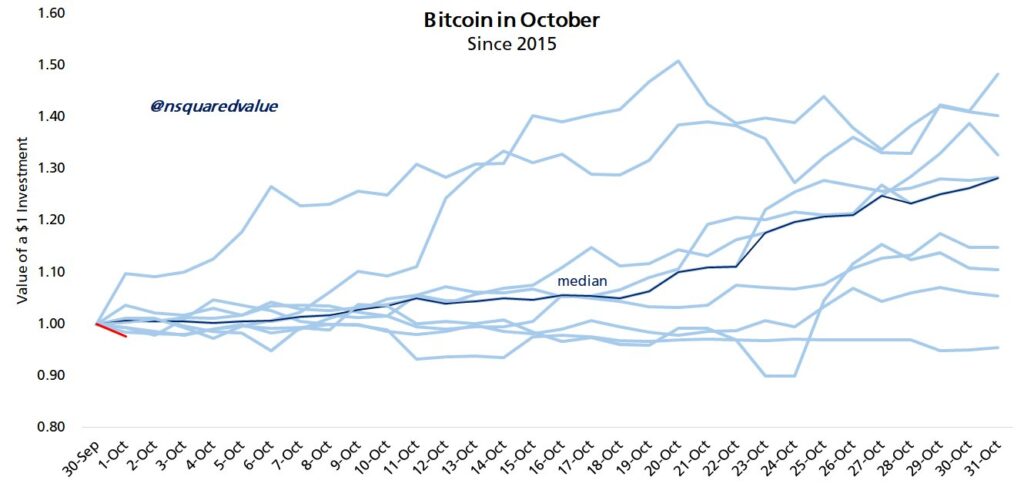

Historically, September has been a bearish month for Bitcoin. However, 2024 bucked this trend, with positive performance attributed to global monetary easing, increased institutional investments, and rising demand. This momentum has sparked hopes for a strong Q4, with October—often referred to as “Uptober”—typically one of the best months for Bitcoin.

Despite this seemingly bullish outlook, Bitcoin’s Q3 close isn’t as convincingly positive as it may seem when compared to historical trends. Previous bull runs, such as those in early 2021 and late 2020, were characterized by stronger trading volumes and more significant upward price movements.

In Q3 2021, for example, Bitcoin’s price rose by 25.86% from $35,035.98 on July 1 to $44,092.60 by September 30. During that same period, trading volume increased by 27.46%, moving from $24.4 billion to $31.1 billion. In contrast, the price growth observed in 2024 has been relatively gradual and lacks the vigorous intensity typically seen during prolonged bull cycles.

Sentiment Among Institutional and Retail Investors

Analysts at QCP Capital observed that Bitcoin managed to recover by the end of September thanks to more than $1.1 billion in inflows into Bitcoin-focused ETFs during the last week of the month. This surge in institutional interest is likely due to favorable economic policies, such as the U.S. Federal Reserve’s 50 basis point rate cut and China’s economic stimulus, creating a “risk-on” environment that favored Bitcoin.

The analysts noted that both Bitcoin and U.S. stocks performed better than expected, avoiding the usual September slump, and that brings hope for more gains heading into Q4.

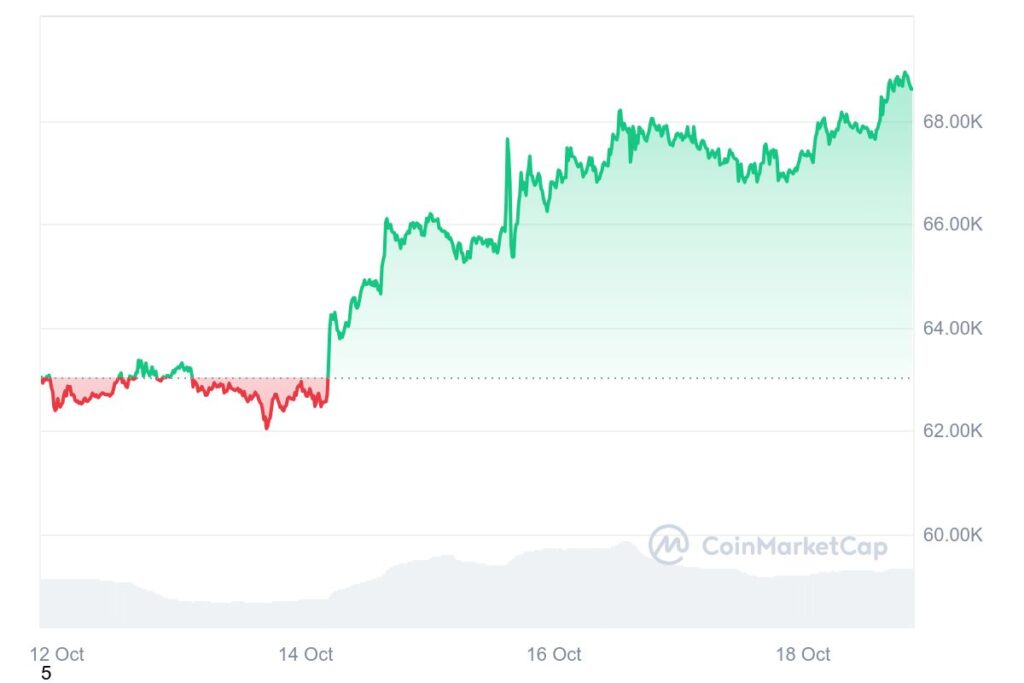

While the popular sentiment among retail investors would be to hopeful about Bitcoin’s historical performance in October, seasoned investor Oliver L. Velez warns that the real gains usually happen in the second half of the month, not the first.

Similarly, Timothy Peterson, a crypto investment advisor, recently posted on X that Bitcoin’s usual “Uptober” rally typically starts around October 19. His advice is to wait patiently, as the big price jumps might not happen until mid-October.

Factors That Could Shape Bitcoin’s Momentum

The current market momentum is driven by institutional inflows and favourable macroeconomic conditions, but caution is warranted. The mixed sentiment among retail investors and the relatively slow price growth compared to past bull cycles suggest that the current rally might not signal a full-blown bull market. The next few weeks, particularly mid-October, will be crucial in determining whether Bitcoin can maintain its upward trajectory or if this is a temporary market hype.

External factors play a major role in determining whether Bitcoin’s upward momentum is sustainable. Ongoing inflation and central banks raising interest rates make investing harder. The U.S. Federal Reserve’s interest rate policies are especially important. When rates are low, risky assets like Bitcoin tend to do well. But when rates go up, investors may lose interest in such assets.

Global issues like the Russia-Ukraine war also affect how people feel about investing. When things are uncertain, some turn to Bitcoin, seeing it as a “digital gold” or a safe asset. But the same instability can make investors, especially large institutions, avoid risky investments like Bitcoin.

Regulations also matter a lot. In the U.S., many are watching for possible new rules after the election in November, especially around Bitcoin ETFs. The specifics of these rules could either help or slow down Bitcoin’s growth.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more market analyses like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”