Bitcoin’s downward price trend may not be over, as various indicators and metrics suggest that a price correction may not occur until a new price surge is in view.

Despite the recent successes of Bitcoin ETF issuers in acquiring operational approval from the US SEC, Bitcoin continues to decline, and its reversal could take longer than expected. Since Monday, January 15, 2024, the price of the world’s largest cryptocurrency has fluctuated between $43,565 and $42,064 and in the previous week, it dropped to as low as 8.39%.

An analysis of the technical indicators used to determine the projected direction of a pair, such as $BTC/USD, reveals a neutral stance towards the coin’s movement. Indicators like the Relative Strength Index read 47, Stochastic 17, and the commodity channel index -17; thus, it is hard to determine whether Bitcoin is heading for a bullish or bearish trend. Furthermore, the moving average convergence/divergence (MACD) indicator is at 83, and the momentum indicator is at -1365, pointing towards a strong bearish projection in the coming days.

Among the speculations for Bitcoin’s slow decline are the massive outflows that Grayscale’s Bitcoin Trust Fund (GBTC) recorded in the last few days. Investors are reportedly exiting their positions on the fund and switching to the newly approved ETFs.

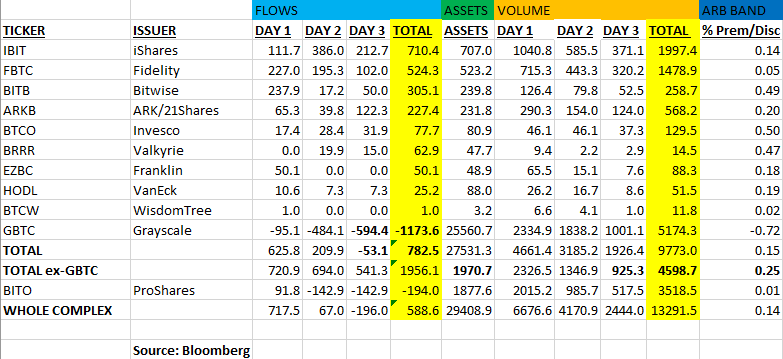

Grayscale, which is the asset management firm with the largest Bitcoin holdings, also launched its spot Bitcoin ETF alongside eight other ETF issuers after the U.S. SEC approved their filings on January 10, 2024. Following the SEC’s approval, Grayscale ranked the most volumes on Thursday and Friday, which were $2.3 billion and $1.8 billion, respectively.

However, CoinShares data revealed that these volumes didn’t imply net inflow for the ETF provider, but it revealed that GBTC saw $579 million in outflow.

Bloomberg’s Intelligence analyst, Eric Balchunas, via a recent post on X, revealed that BlackRock (IBIT), Fidelity Investments (FBTC), and Bitwise (BITB) ETFs accumulated more than $1.5 billion in inflows within the first three trading days. In contrast, Grayscale Bitcoin Trust Shares (GBTC) saw nearly $1.2 billion in losses.

If you want to read more news articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”