Last updated on September 11th, 2025 at 07:31 am

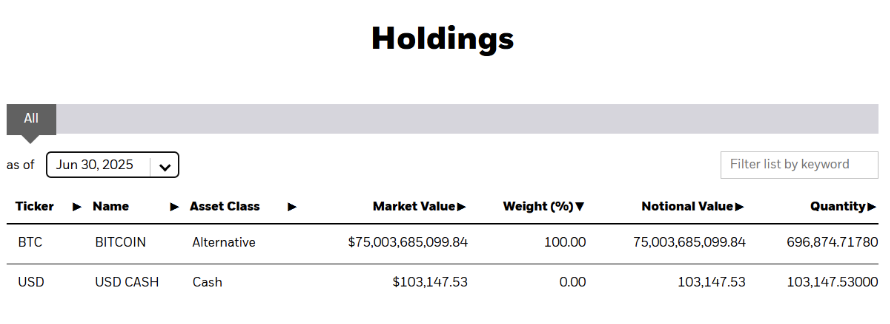

Launched on January 11, 2024, BlackRock’s spot Bitcoin ETF, iShares Bitcoin Trust (IBIT), has done what few imagined possible: amassed over 680,000 BTC, or more than 3% of Bitcoin’s total supply, by June 10, 2025.

That’s over $71 billion in Bitcoin exposure, more than most crypto exchanges and even heavyweight corporate holders like MicroStrategy. Only Satoshi Nakamoto holds more.

To put that in perspective, it took the SPDR Gold Shares (GLD) over 1,690 trading days to cross the $70 billion mark. iShares Bitcoin Trust achieved this milestone in just 341 days, officially becoming the fastest-growing ETF in history.

So, what’s fueling this historic move? Let’s break down the key driving forces behind BlackRock’s Bitcoin holding and what it could mean for the future of crypto.

Key Drivers Behind BlackRock Bitcoin’s Supply

-

Strategic Portfolio Diversification

BlackRock recognizes Bitcoin as a distinct asset class with asymmetric risk-reward potential, especially appealing in a world of low yields and economic uncertainty. By allocating just 1–2% to Bitcoin in diversified portfolios, BlackRock believes investors can improve risk-adjusted returns without significantly increasing volatility.

Bitcoin’s lack of correlation with traditional assets like bonds and equities makes it an ideal candidate for diversification. For BlackRock, it’s about mathematically improving portfolio construction.

READ ALSO: A Step-by-Step Guide to Using Crypto Correlation for Smarter Risk Management

-

Belief in Bitcoin as a Legitimate Asset Class

Once dismissed as a fringe experiment, Bitcoin has now earned institutional credibility. BlackRock’s top leadership, including CEO Larry Fink, have shifted their tone dramatically over the past few years. According to Mariblock in 2023, Larry said that Bitcoin would revolutionise finance.

During a CNBC interview in 2025, Fink also endorsed digital assets, stating their potential to democratize investments. This pivot shows thatBlackRock sees Bitcoin as part of a larger macro trend toward digitization, monetary debasement hedging, and generational wealth transfer.

-

Market Demand and First-Mover Advantage

The iShares Bitcoin Trust (IBIT) exploded out of the gate in January 2024 and never slowed down. With $71 billion in assets under management as of June 2025, IBIT became the fastest-growing ETF in US history, outpacing even SPDR Gold Shares (GLD).

This blistering growth reflects immense pent-up demand from both retail and institutional investors. To keep pace with inflows and maintain trust unit backing, BlackRock had to accumulate large amounts of Bitcoin quickly. Their early dominance also gives them leverage to shape the future structure and rules of the Bitcoin ETF market.

-

Scarcity and Store-of-Value Narrative

Bitcoin’s fixed supply, capped at 21 million coins, and its halving schedule make it increasingly attractive in a world grappling with inflation and sovereign debt. BlackRock is now turning to Bitcoin, but with enhanced liquidity, portability, and 24/7 access.

As governments continue to print money and inflate fiat currencies, BTC’s scarcity becomes not just a theoretical selling point but a real advantage for long-term capital preservation.

-

Legitimization and Mainstream Adoption

BlackRock’s sheer size and reputation act as a stamp of approval for Bitcoin among risk-averse institutions. Pension funds, insurance companies, and sovereign wealth funds often wait for a signal from a credible leader before stepping into volatile markets. BlackRock’s Bitcoin holding and exposure now help break that psychological barrier.

By holding such a large share of BTC through iShares Bitcoin Trust, BlackRock lowers the reputational risk for other conservative allocators and accelerates institutional onboarding across global markets.

-

Tactical Positioning in a Transforming Financial System

BlackRock likely sees Bitcoin as a foundational building block in an emerging digital financial architecture. Tokenized assets, DeFi protocols, programmable payments, and smart contracts all rely on decentralized trust, and Bitcoin is the root layer of that trust. By holding Bitcoin now, BlackRock gains strategic exposure to this shift and positions itself at the forefront of the next wave of financial infrastructure.

-

Control Over Market Liquidity and Influence

With over 680,000 BTC under custody, BlackRock now rivals major exchanges in terms of Bitcoin holdings. This accumulation gives them a unique kind of soft power. They don’t just have exposure; they can influence Bitcoin ETF flow dynamics, shape public perception, and even impact short-term price discovery through liquidity aggregation.

BlackRock’s scale enables it to move markets quietly, collaborate with regulators, and shape the industry’s institutional framework from within.

What BlackRock BTC Holding Means for the Future of Crypto

BlackRock’s Bitcoin holding has quietly reshaped the future of crypto. This move isn’t just about one asset manager taking a bold bet; it signals a deep shift in how digital assets are viewed in traditional finance.

As the fastest-growing ETF in history, BlackRock’s (IBIT has brought liquidity and legitimacy to the Bitcoin market. It boosted confidence across the board, from institutions to retail investors, and set a new standard for what crypto-backed investment products can achieve.

At the same time, BlackRock’s position gives it serious market influence. Their Bitcoin holdings rival those of major exchanges, meaning they now play a central role in price discovery, ETF flows, and overall liquidity. This pushes regulators, service providers, and competitors to step up, setting the stage for better infrastructure and clearer rules.

Perhaps most importantly, this signals that Bitcoin isn’t just surviving, it’s becoming part of the global financial system. BlackRock isn’t betting on hype.

They’re positioning themselves for a long-term future where tokenized assets, digital identities, and decentralized networks sit alongside traditional investment tools. Bitcoin, once considered a fringe experiment, is now one of their key entry points into that future.

Final Thoughts

BlackRock’s aggressive move into Bitcoin isn’t just a milestone; it’s a message. With over 680,000 BTC under management and the fastest-growing ETF in history, BlackRock has signalled that Bitcoin is becoming foundational to modern finance.

As institutional adoption accelerates and regulatory frameworks evolve, this level of involvement by the world’s largest asset manager sets a powerful precedent. Whether you’re a retail investor or part of a large financial institution, the path forward is clearer than ever: Bitcoin is here to stay, and it’s entering the mainstream at full speed.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”