In a bold show of confidence amid global turmoil, major crypto investors are placing high-stakes bets on the recovery of Ether (ETH), even as escalating geopolitical tensions rattle markets and dampen investor risk appetite.

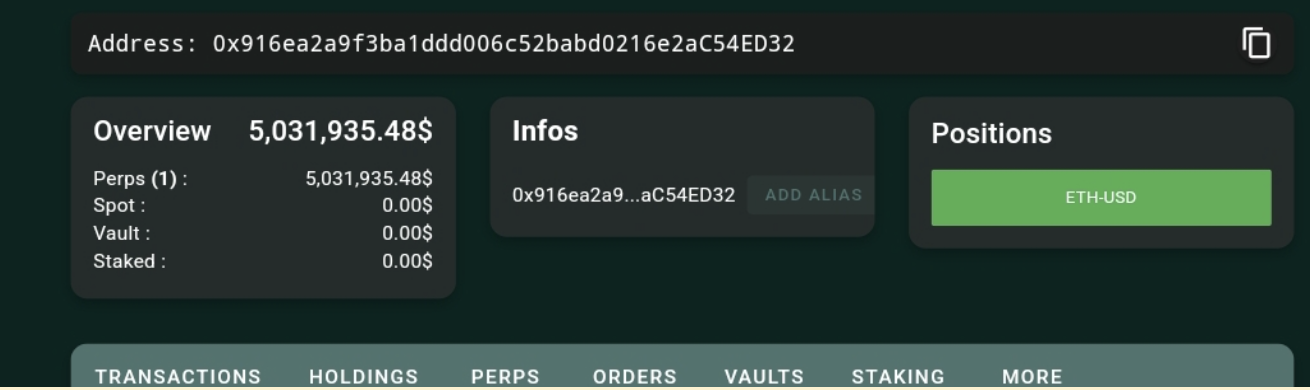

According to blockchain data from Hypurrscan, one prominent whale has opened a massive $101 million long position on ETH, using 25x leverage at an entry price of $2,247. While the position has so far generated nearly $900,000 in unrealized profits, the investor has already paid over $2.5 million in funding fees. The trade risks liquidation if Ether dips below $2,196.

Hours later, a second large-scale investor made waves by withdrawing over $40 million worth of ETH from Binance, pushing their total holdings to $112 million, according to data from Onchain Lens. These moves come in stark contrast to market sentiment, which has been weighed down by ongoing conflict in the Middle East.

Ether recently plunged to a one-month low of $2,113 following U.S. airstrikes on Iranian nuclear sites, a military action President Donald Trump hailed as a “spectacular success.” Tensions have intensified since Israel launched major strikes against Iran on June 13 — its most aggressive military engagement with the country since the 1980s Iran-Iraq War. The mounting conflict has triggered broader market fears of sustained volatility, Reuters reported.

In the wake of these developments, the majority of top-performing cryptocurrency traders appear to be taking a bearish stance. Data from HyperDash indicates that 64% of elite traders on the Hyperliquid platform are currently shorting Bitcoin (BTC) and Ether, while 36% maintain long positions.

Binance Research echoed this sentiment, pointing to geopolitical risks as the key driver of recent price declines. “A broader correction may still unfold,” the team noted but added that macro-driven selloffs are still largely being seen as buying opportunities rather than indicators of a long-term trend reversal, a report released Friday stated.

Additionally, investor sentiment in the crypto market is beginning to shift from Bitcoin (BTC) to Ethereum (ETH), according to top analysts, despite lingering caution fueled by past market downturns.

If you want to read more news articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”