Last updated on June 23rd, 2025 at 08:04 pm

The DeFi space is full of incredible success stories—but also spectacular failures. Some projects launch with big promises, attract millions in investment, and then vanish without a trace. Others seem unstoppable until a single flaw brings them crashing down. This industry has seen it all.

The general wisdom is that roughly 90% of startups fail across all industries, and DeFi is no exception. But unlike other sectors, when a DeFi project collapses, it can take millions—or even billions—of dollars with it. Investors in DeFi aren’t deep-pocketed venture capitalists who hedge risk across portfolios. Many are retail participants who can’t afford to absorb heavy losses or spread capital thinly across diverse sources.

Now combine crypto’s extreme volatility with DeFi’s experimental design, and you get a level of risk most everyday investors can’t stomach.

DeFi was supposed to rewrite the rules—no banks, no middlemen, just decentralized financial freedom. And for a while, it worked. Between 2020 and 2022, total value locked (TVL) in DeFi exploded from under $1 billion to over $100 billion. Investors were throwing money at anything with a “DeFi” label, and developers were launching projects at lightning speed, hoping to cash in on the frenzy.

But in the rush to build and capture hype, long-term sustainability was often overlooked. It turns out, just because a project has a fancy whitepaper and a token with a cool name doesn’t mean it’s built to last.

Why Most DeFi Projects Fail

1. Flawed Tokenomics: When Free Money Isn’t Really Free

Ever heard the phrase “too good to be true”? That’s exactly what happened with failed DeFi projects that promised sky-high yields to attract users. To get people excited, they offered insanely high Annual Percentage Yields (APYs), sometimes in the thousands of percent, but there was a catch. These rewards were often paid out in freshly minted tokens, which meant that instead of growing in value, the token supply kept inflating like a balloon about to pop.

Many projects are built on unsustainable ponzinomics backed by inflationary tokens.

It’s important to identify projects with TRUE revenue sources, where much of that revenue goes to token holders (i.e – you).

— Shiv (@shivsakhuja) May 29, 2022

This unsustainable approach has led to numerous DeFi project failures, where early investors profit at the expense of those who join later, creating a cycle that inevitably collapses.

Without a sustainable revenue model, even the most exciting DeFi projects can turn into failed projects overnight.

2. Security Risks

DeFi runs on smart contracts. While this is a revolutionary solution (because what’s better than no middlemen and no human error), there’s a major downside—one tiny flaw in the code can lead to catastrophic financial losses. It is one of these reasons hackers have made the sector their playground.

Take Yam Finance, for example. It launched in 2020 with an innovative rebasing mechanism (essentially an automated way to adjust supply), but a single coding error caused its collapse within days. The project’s governance model failed, and billions in potential value disappeared overnight.

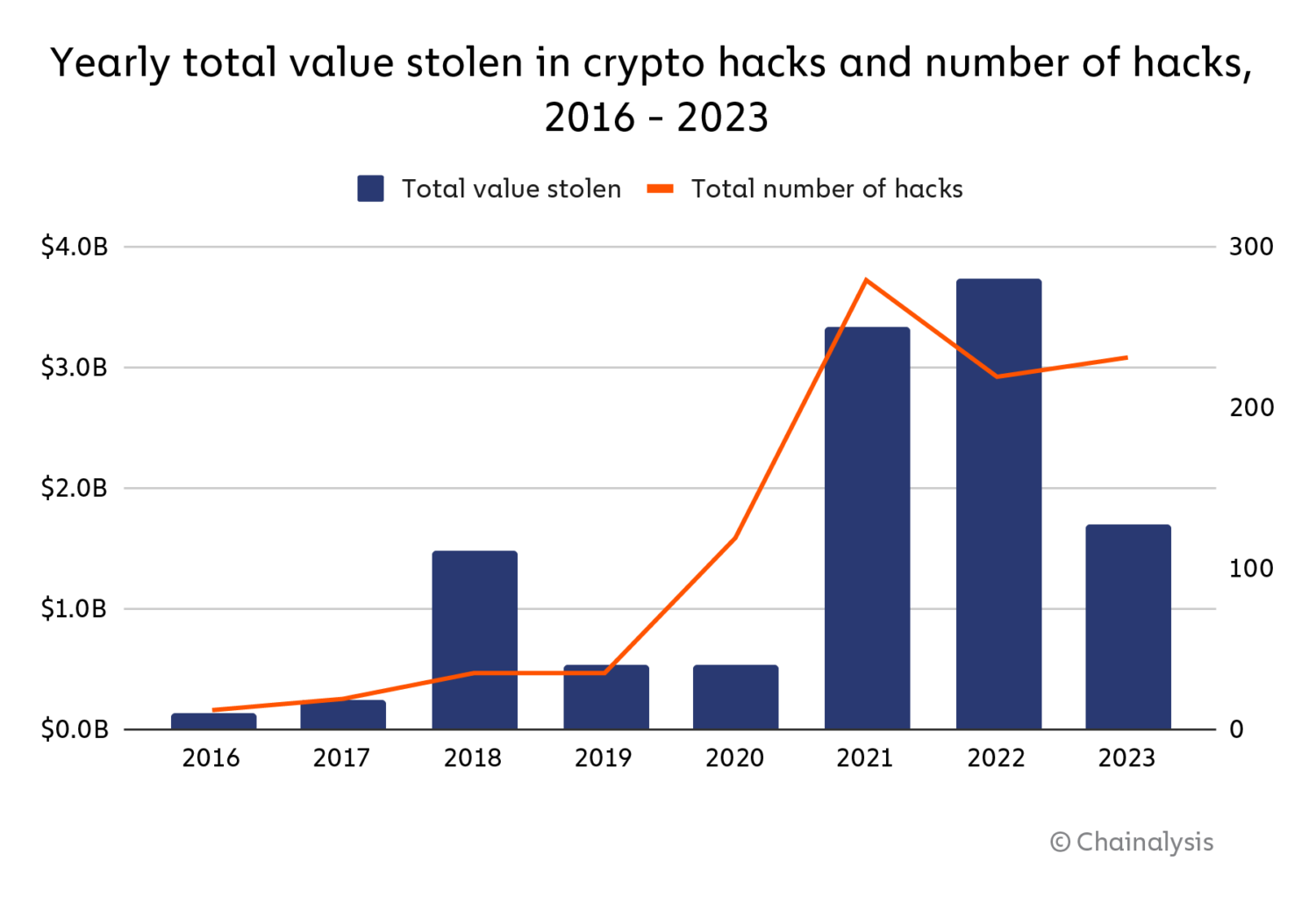

Yam isn’t an isolated case. According to Chainalysis, hackers stole over $3.1 billion from DeFi protocols in 2022 alone. The attack surface is large, and the stakes are high.

3. Lack of Real Utility: Speculation Over Substance

Many DeFi projects sound cool on paper, but when you dig deeper, you realize they don’t really do anything useful.

Instead of solving real problems, many projects exist just to pump their own tokens. They rely on new investors coming in, which works for a while—until the hype dies down and the whole thing crumbles. If a project’s main selling point is “number go up,” it’s probably doomed.

Worse, the space is flooded with copycat protocols—clones of existing platforms offering nothing new except a different logo and a promise of 10,000% APY. Real, successful DeFi projects solve problems.

4. Malicious Intent: Some Projects Were Never Meant to Last

Somehow, we can trace all the reasons mentioned above to a singular truth: the motive behind instituting the project itself. While some projects start with genuine vision but collapse due to poor execution, others are conceived with bad faith from day one.

Rug pulls aren’t accidents. They’re often planned from the start. The decentralized and trustless nature of DeFi is supposed to be its security feature, but some take advantage of it for their own desires, especially because they know they can exploit the system without facing immediate consequences.

However, the problem is deeper than just financial loss. These scams damage trust across the entire ecosystem. Each one reinforces public scepticism, making it harder for legitimate builders to gain traction.

RELATED: Crypto Scams Are Never Going Away. Here is Why

What Needs to Change?

If DeFi is to move beyond speculation and short-term hype, fundamental shifts are needed—shifts that prioritize security, sustainability, and real-world utility over quick profits. While decentralization remains a core principle, it can’t come at the expense of accountability and investor protection.

Better tokenomics and economic models must become the standard.

Projects that rely on inflationary rewards and unsustainable APYs will always collapse under their own weight. Instead of promising unrealistic returns, DeFi protocols need to design tokenomics that encourage long-term growth, actual utility, and value creation. This means tying token value to real-world use cases, limiting unnecessary inflation, and ensuring that incentives align with the long-term health of the ecosystem rather than short-term speculation.

MakerDAO is an example of a project that successfully implements a sustainable economic model. By introducing DAI, a decentralized stablecoin backed by over-collateralization, MakerDAO has built a system that maintains stability without relying on endless token inflation.

Security must become a priority, not an afterthought.

DeFi runs on smart contracts, and even a single vulnerability can result in catastrophic losses. Additionally, developers need to embrace formal verification and rigorous stress testing of smart contracts before launching them to the public.

Aave, one of the most successful lending protocols, has demonstrated the importance of strong security frameworks. With features like isolation mode for riskier assets, supply caps, and continuous protocol upgrades, Aave has built a lending system that prioritizes risk management while maintaining decentralization.

More transparency is needed to reduce fraud and rug pulls.

Anonymous teams launching projects with no accountability have been one of the biggest enablers of DeFi scams. While anonymity has its place in crypto, investors should at least be able to verify a project’s legitimacy through transparent roadmaps, public audits, and multi-signature treasury management. Greater transparency in fund allocations and team ownership structures can go a long way in reducing the number of malicious projects that prey on unsuspecting investors.

Uniswap has set an example by embracing full transparency with its open-source protocol and clear governance model, allowing the community to participate in decision-making rather than relying on a centralized team.

Regulatory clarity must improve.

DeFi currently operates in a grey area, with unclear and evolving regulations. This uncertainty discourages institutional investors from entering the space and makes it easier for bad actors to exploit loopholes. While overregulation could stifle innovation, clear guidelines on Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) compliance could help establish a safer environment without undermining DeFi.’s core principles. If the industry fails to self-regulate, harsher external regulations will eventually be forced upon it.

The industry must focus on real-world use cases rather than speculation-driven projects.

Many DeFi platforms today exist primarily as financial experiments that rely on constant inflows of new investors. To build a sustainable future, DeFi projects need to solve real financial problems—whether it’s improving remittances, expanding financial access, or enabling decentralized identity solutions.

The Future of DeFi: Boom, Bust, or Breakthrough?

DeFi isn’t over—but it is changing. The next phase belongs to projects that deliver value, security, and real-world utility.

Examples like Aave, MakerDAO, and Uniswap prove that sustainable DeFi is possible. Meanwhile, regulators are slowly catching up, opening doors for broader adoption.

But the risk of failure is still high. If builders continue to chase fast profits over real impact, the cycle of boom and bust will continue.

DeFi’s future depends on its builders, users, and the industry chooses to prioritize next. Will they push for innovation that lasts—or let history repeat itself? The choice is ours.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”