In just nine months, spot Bitcoin ETFs have gone from the new kid on the block to the life of the party. Over $4.6 billion worth of units of these ETFs were traded within 24 hours of their approval. By March, daily trading volumes had surged to nearly $10 billion. Could a debut be better than this?

Beyond the apparent benefits of facilitating a greater integration between crypto and traditional finance, spot Bitcoin ETFs have influenced both the cryptocurrency market and broader financial systems in various ways. This analysis explores the impacts these ETFs have had over the past nine months.

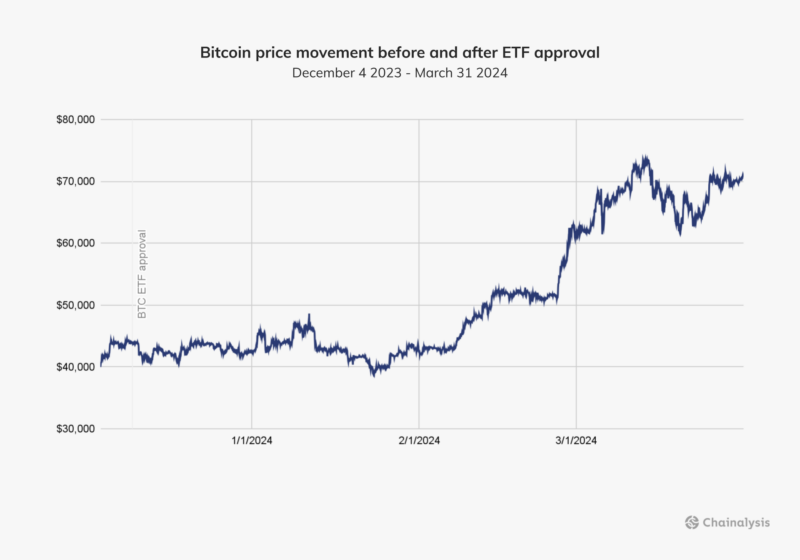

Impact on Bitcoin’s Price

The first quarter of 2024 concluded with Bitcoin ETFs attracting about $12.1 billion in inflow. This surge in trading volumes and capital influx drove Bitcoin’s price up by 37.8%, from $46,121.54 on January 10 to $63,585.64 by the end of February.

By March, Bitcoin reached a record high of $73,750.07, marking a 16% increase in just two weeks. However, by the end of the quarter, the price had retreated to around $71,000.

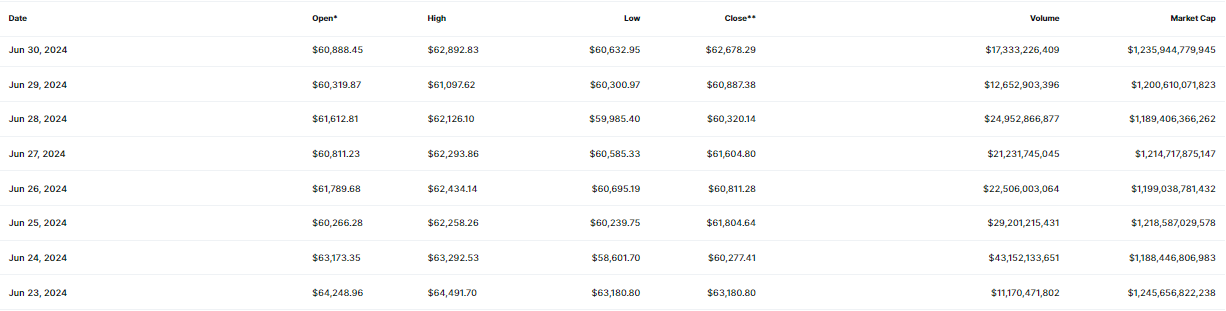

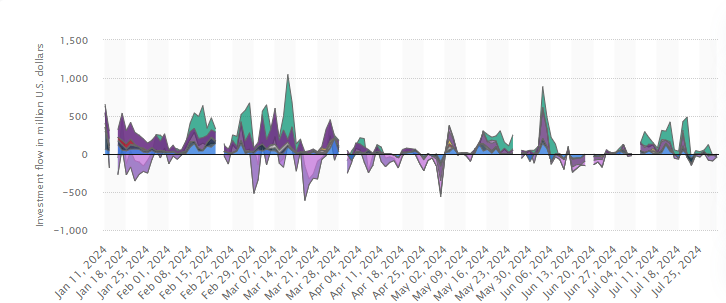

The momentum behind Bitcoin spot ETFs slowed in the second quarter of 2024, as did their effects on Bitcoin’s price. Notably, inflows into these ETFs dropped to $2.5 billion, down from $12.1 billion in Q1.

Also, Bitcoin’s price dropped by 9.35%, from $71,377.78 on March 31 to $64,703.33 by the end of April. After a further decline in early May, the price rebounded to $68,999.57 by the month’s end, only to close Q2 at $62,892.83, reflecting an 8.85% drop from its May peak.

Shifts in Investor Behavior

U.S. Securities and Exchange Commission (SEC) ‘s approval of Bitcoin spot ETFs for public trading changed investors’ participation in the market. Retail and institutional investors who had previously found direct Bitcoin investment too complex or risky showed widespread enthusiasm for these ETFs.

In the months after their launch, more than 600 financial firms disclosed significant investments in spot Bitcoin ETFs, reaching $3.5 billion in total holdings by these firms. Millennium Management stood out as the biggest investor. The disclosed allocating $1.9 billion into various Bitcoin ETFs, including significant shares in BlackRock’s IBIT and Fidelity’s Wise Origin Bitcoin Fund (FBTC), alongside smaller stakes in Grayscale Bitcoin Trust (GBTC), ARK 21Shares Bitcoin ETF (ARKB), and Bitwise Bitcoin ETF (BITB).

Despite Bitcoin’s volatility during Q2, these hedge funds and institutional investors remained optimistic about the Funds. According to Matt Hougan, Chief Investment Officer of Bitwise Asset Management, most institutional investors who allocated funds in Q1 either maintained or increased their positions in Bitcoin ETFs during Q2. Specifically, 44% increased their holdings, 22% held steady, 21% decreased their positions, and 13% exited.

Hougan noted that 1,924 institutional strategies held Bitcoin ETFs by the end of Q2, a 30% increase from Q1.

Impact on Broader Financial Markets

Spot Bitcoin ETFs have introduced a new dimension to the traditional financial market. These spot ETFs have somewhat amplified the transmission of Bitcoin’s price volatility to traditional markets. Cryptocurrency-exposed companies, particularly in mining, saw stock gains in response to Bitcoin price fluctuations. Firms like Cipher Mining and Core Scientific experienced gains of 5% to 15% in late January.

Bitcoin’s correlation with other asset classes has also evolved since the launch of these ETFs. Once considered non-correlated, Bitcoin now shows a growing correlation with tech stocks and broader equity indices, while its relationship with gold, a traditional inflation hedge, remains unstable. Although Bitcoin’s link with fixed-income securities is weak, the rise of Bitcoin ETFs has drawn interest from bond investors seeking alternative assets.

Spot ETFs have shifted attention from Bitcoin Futures, which were the primary regulated investment vehicle before now, to spot markets, especially because they offer institutional investors more direct exposure. This shift has enhanced liquidity in the spot market and could help reduce volatility in futures markets over the long term.

Final Thoughts

The 2024 approval of spot Bitcoin ETFs followed a legal ruling that criticized the SEC’s prior rejections. While this approval marked a significant step forward, SEC Chair Gary Gensler, at the time, emphasized that it does not signal broader acceptance of other crypto assets as securities. Well, this has not proven entirely true since then.

RELATED: Where on Earth Can You Trade Spot Bitcoin ETFs Legally?

The success of spot Bitcoin ETFs, among many other factors, has paved the way for similar financial products focused on other major cryptocurrencies like Ethereum, Solana, and XRP. As competition among ETF providers intensifies, investors will benefit from lower fees and improved terms. According to Lasanka Perera, CEO of Independent Reserve Singapore,” this is just the beginning.”

Looking ahead, the introduction of crypto ETFs will definitely bring an increase in capital inflows to the cryptocurrency market. It may help introduce more stability and encourage further innovation. The market may become less speculative and more mature, attracting a broader range of participants. This could strengthen the role of digital assets within the global financial system.

However, as more capital flows into the market, we must ask: Could this growing integration with traditional finance come at a cost? Could the very nature of cryptocurrency, with its decentralized ethos, be diluted by increased institutional involvement? Is this the price the crypto community is willing to pay for broader adoption?

READ MORE: Crypto ETFs May Not Be the Boon for the Ecosystem As Some Believe

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more market analyses like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”