Last updated on February 25th, 2025 at 02:00 pm

The rave now is all about the newly launched spot bitcoin ETFs in the United States, and other countries are racing to emulate this feat.

Spot Bitcoin ETFs, designed to directly track the price of Bitcoin, are a game-changer. They bring the crypto sector to the traditional financial markets, making it easier for even a ‘non-crypto person’ to participate. These ETFs are traded on regulated stock exchanges, a familiar ground for traditional investors, and can be bought in standard brokerage accounts, ensuring a comfortable investment experience.

However, the U.S. is not the first market to embrace spot Bitcoin ETFs; some other countries have offered these products to investors for several years. In this article, we will explore the corners of the world where you could invest in spot Bitcoin ETFs in 2024.

Countries Where Spot Bitcoin ETFs Are Issued Around the World

Just a heads up before we begin: there aren’t many countries that have approved spot Bitcoin ETFs, but there are a couple of surprising names on the list:

- Australia (1 ETF)

- Bermuda (1 ETF)

- Brazil (2 ETFs)

- Canada (6 ETFs)

- Germany (3 ETFs)

- Guernsey (3 ETF)

- Jersey (5 ETFs)

- Liechtenstein (1 ETF)

- Switzerland (4 ETFs)

- United States (11 ETFs)

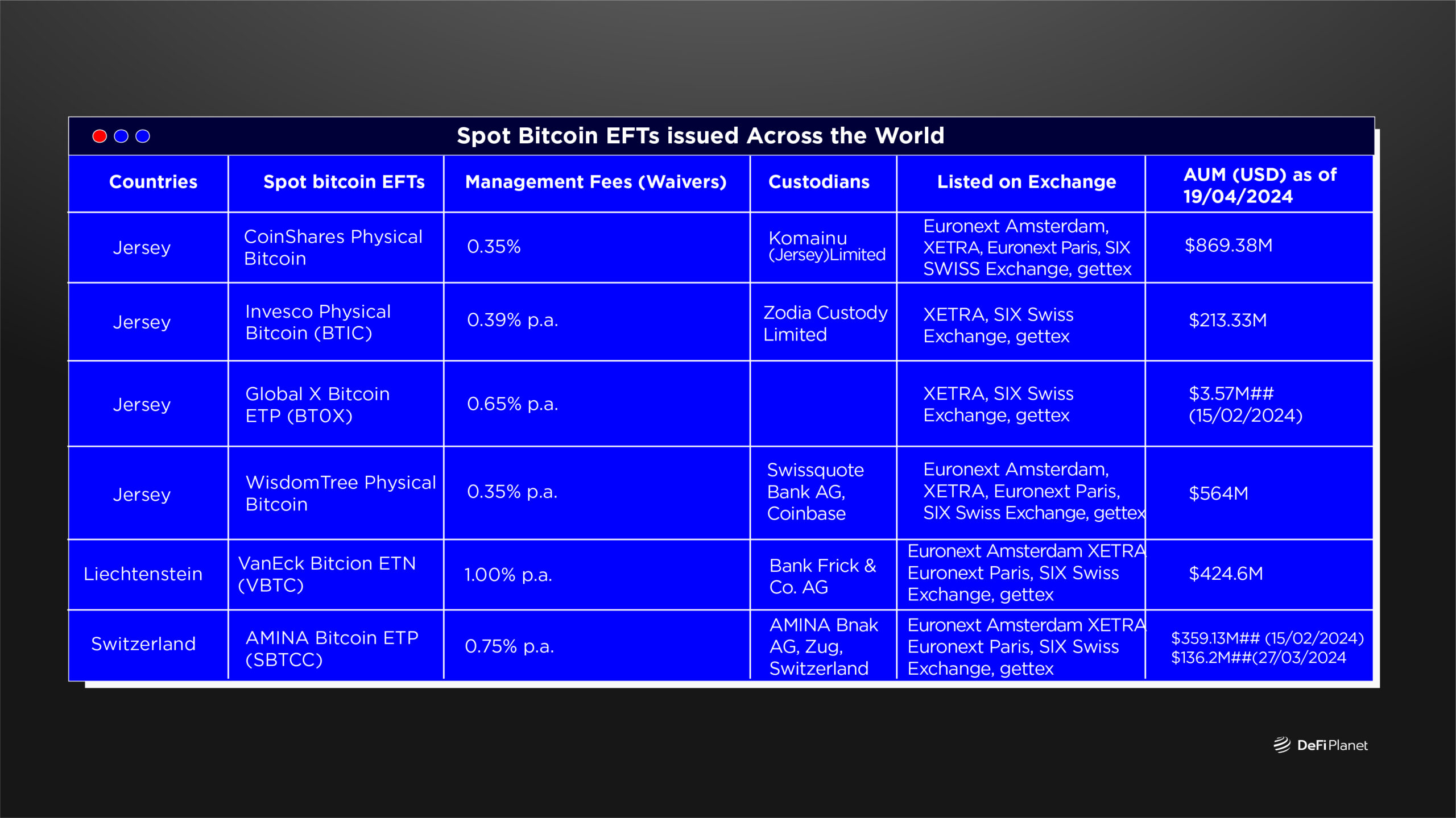

More than 30 spot Bitcoin ETFs are available globally and can be traded in five geographical regions. The U.S.’s addition of 11 funds made North America a bigger hotspot, but Europe had always been a much bigger market. The region collectively has 17 spot Bitcoin ETFs, with a combined market size of over $3 billion.

What’s particularly interesting is that the European market is not dominated by the usual big players. Instead, smaller nations, with their favourable tax rules, have contributed the bulk of the funds. In fact, 10 out of the 17 Funds in the European market are domiciled in Liechtenstein, Bermuda, and the British Crown Dependent Autonomous Territories of Jersey and Guernsey. This unique landscape hints at the potential for further growth and diversification in the spot Bitcoin ETF market.

The South American market is much smaller, with Brazil being the biggest fully active market. Notably, Brazil’s primary stock exchange, B3, hosts a variety of crypto-focused ETFs, with over 13 crypto ETFs and over $285 million in assets under management.

Despite the massive activity in those regions’ crypto markets, the Asian and African markets have yet to have a locally issued spot Bitcoin ETF. The government and traditional financial institutions in these places have not yet warmed up to allowing cryptocurrencies in mainstream markets.

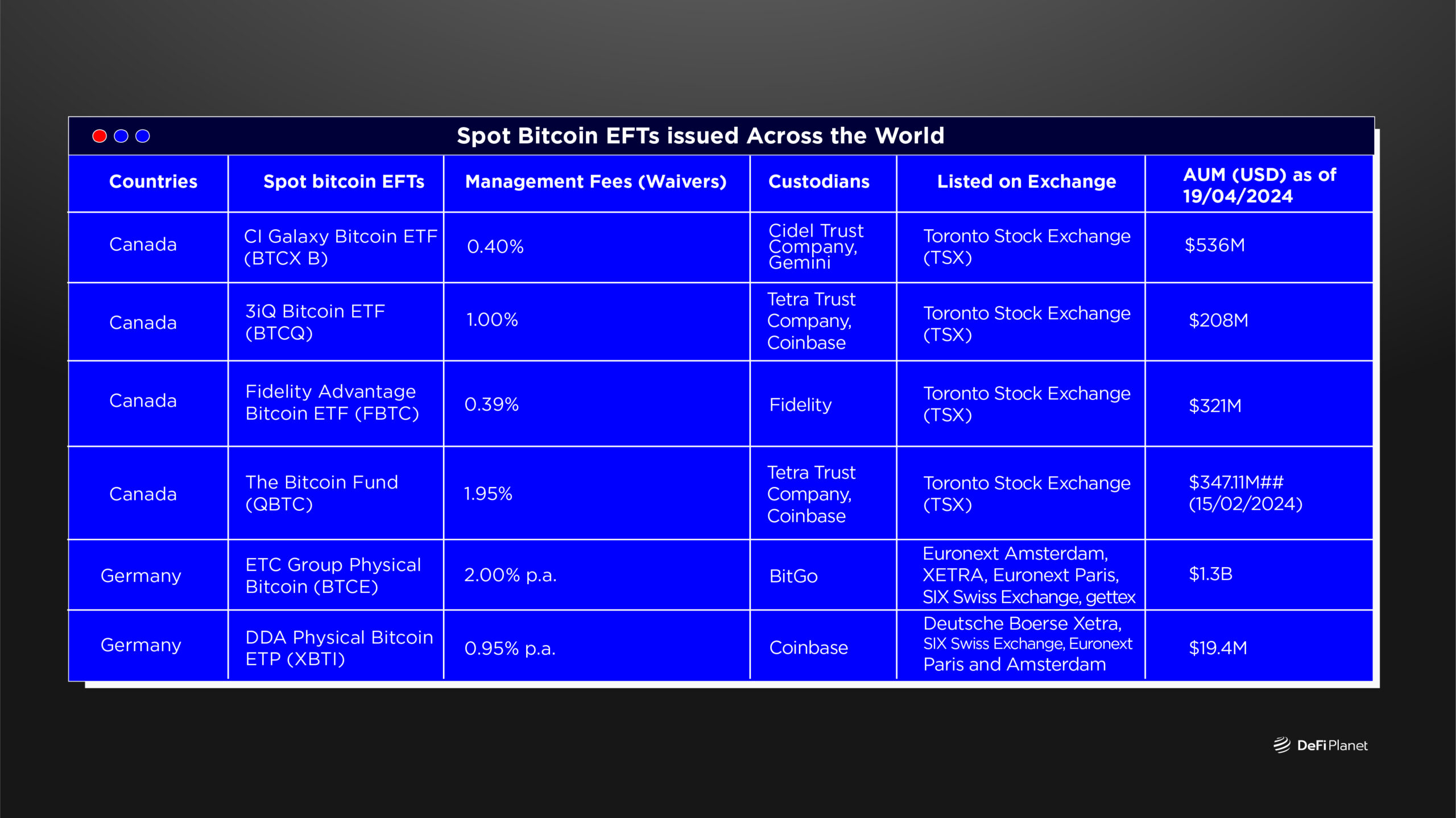

It’s a point of pride that Canada was the frontrunner in this financial product, with over six funds available for trading, even before the U.S. entered the scene. The country’s approval of the first pure-play Bitcoin ETFs for trading on the Toronto Stock Exchange (TSX) as early as February 2021 was a significant milestone.

What’s more, Canadians had the unique opportunity to invest in them via tax-sheltered accounts such as tax-free savings accounts or registered retirement savings plans, further demonstrating Canada’s progressive approach to financial innovation.

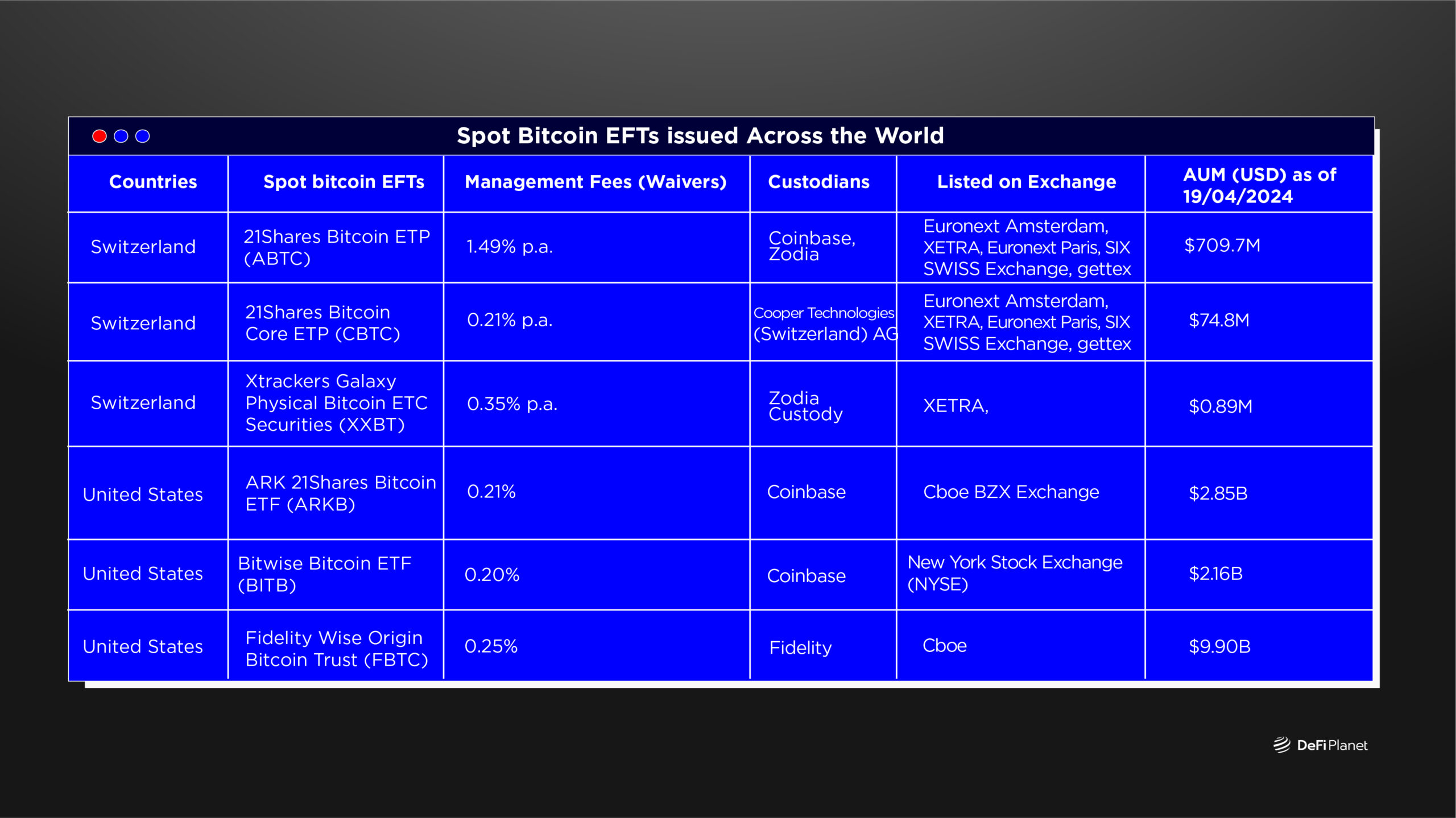

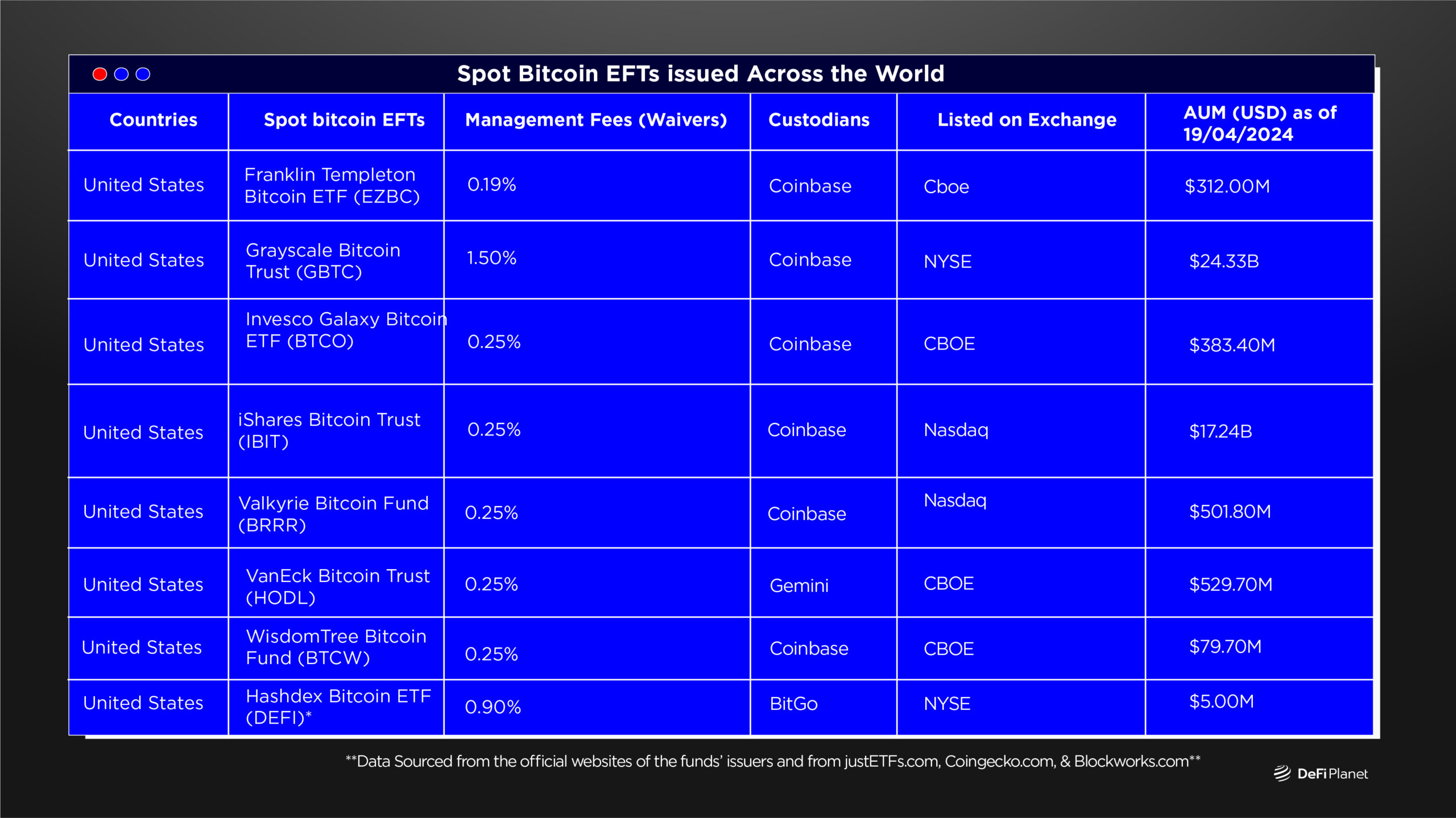

Figure 1: Spot Bitcoin ETFs issued Across the World

Trading and Issuing ETFs: What is the Difference?

Issuing spot Bitcoin ETFs involves creating and launching a new ETF that holds Bitcoin. This requires obtaining regulatory approvals, establishing custody solutions for securely holding the Bitcoin assets, and ensuring compliance with various requirements.

On the other hand, trading spot Bitcoin ETFs is a straightforward process. It simply involves the buying and selling of shares of these ETFs. These shares are commonly traded on stock exchanges, providing investors with a readily accessible avenue through brokerage accounts or specialized investment vehicles like retirement accounts.

Naturally, residents of any country where a spot Bitcoin ETF is issued can trade the fund. But sometimes, one might still be able to trade a fund legally even though it is not issued in one’s country of residence. For instance, in addition to a locally issued spot Bitcoin ETF, Brazilians can trade BlackRock’s $iBIT, issued in the U.S.

Other Places Where You Can Trade Spot Bitcoin ETFs

Apart from the countries where spot Bitcoin ETFs are issued, there are several other jurisdictions where investors can trade these ETFs, either through local exchanges or overseas platforms. Notable ones include:

1. Chile

Investors can trade the Purpose Bitcoin ETF from Canadian issuer Purpose Investments on the Santiago Stock Exchange. Additionally, they have the option to trade Brazil’s HASH11, though not as an ETF but as an investment fund which uses the ETF shares as the underlying asset.

2. India

Unlike Chileans, Indians, especially the wealthy ones, trade spot Bitcoin ETFs on overseas platforms, not local exchanges. Local platforms like Vested Finance and Mudrex enable them to buy units of U.S. spot bitcoin ETFs via a special avenue that allows them to maximize the 30% capital tax on crypto investments required by Indian laws.

3. Thailand

Following the approval of spot Bitcoin ETFs in the U.S., Thailand’s financial regulator has updated regulations to allow local professional investors to trade these funds. Retail investors can invest in funds set up by these professionals to gain exposure to the ETFs.

4. United Arab Emirates (Dubai)

A year after Canada’s 3iQ debuted its ETF in the Canadian market, it expanded to Dubai. The firm’s The Bitcoin Fund ETF became the first listed digital asset-based fund in the Middle East and North Africa region. The fund was listed on Nasdaq Dubai, and allows local investors to purchase shares.

To Sum Up

The introduction of spot Bitcoin ETFs to the U.S. markets without a doubt increased the popularity of this “niche” financial market and, by extension, the crypto sector. With the current climate in the financial sector, it is certain that many more territories will join the pack soon.

This boost in adoption and regulatory alignment of cryptocurrencies offer exciting opportunities for both seasoned cryptocurrency investors and those new to the space. Crypto ETFs are bridging the gap between traditional finance and crypto, which have been long viewed as two opposing forces. This was bound to happen, sooner or later in any case.

On the other hand, navigating the crypto market requires a balanced approach—enthusiasm for innovation coupled with a keen awareness of its complexities. Thus, as with any financial instrument, investors should conduct thorough research on each ETF and evaluate how it aligns with their individual investment objectives and risk tolerance before making decisions.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles (news reports, market analyses) like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”