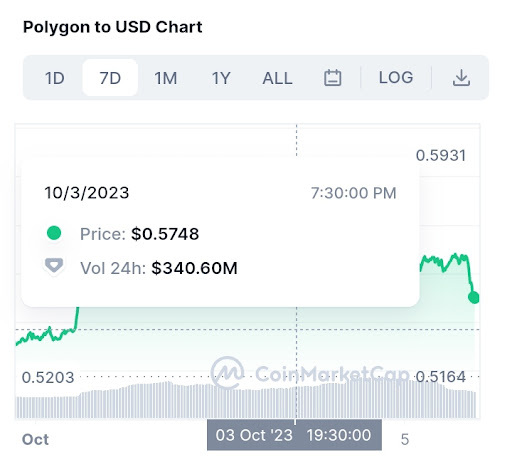

In stark contrast to the broader cryptocurrency market, which is currently in a downturn, Polygon (MATIC) has witnessed a price surge. What’s even more remarkable is that this positive momentum has been maintained in the past week.

As of October 3, MATIC was trading at $0.5748, reflecting a 4% increase in the past 24 hours, according to data from CoinMarketCap. MATIC broke the critical $0.56 resistance level, and its trading volume has increased by 35.13%.

Crypto Whale Influence On MATIC’s Price

The token’s price hit its highest point since August after a crypto whale moved 37 million MATIC tokens (valued at approximately $20.7 million) from one wallet to another. According to Santiment, that is the biggest transfer on the Polygon network since July 2023.

🐳 37M $MATIC was moved from a whale PoS address to a 3 year-old wallet today, coinciding with a mild +4% price rise for the 13th market cap asset while the rest of #crypto slumps. This was the largest single transaction on the #PolygonNetwork since July. https://t.co/MKKNKDuQJU pic.twitter.com/dTI0qiB1zX

— Santiment (@santimentfeed) October 3, 2023

Data from IntoTheBlock’s on-chain analysis highlights an increase in the activity of Whale investors. These whale transactions on Polygon have amounted to $17.49 million, marking a 16.96% rise.

The consistent buying behaviour exhibited by these whales can propel MATIC’s price even higher. Over the past 24 hours alone, there have been more than 50 whale transactions, indicating that this bullish trend may have some staying power.

A Promising Future for Polygon: Exciting Developments in Q4 2023

MATIC current upward price trajectory can also be attributed to another thing: a bullish bet by traders on the project, particularly in light of the project’s scheduled and ongoing developments.

The Polygon development team has consistently tried to enhance its capabilities and push it to retain its position as a top-tier Layer 2 scaling protocol. The network might be on the path to gaining widespread adoption thanks to its well-defined roadmap and upcoming upgrades.

Q4 2023 is a beehive period for Polygon, with the introduction of Polygon 2.0, a set of proposed upgrades designed to revolutionize the ecosystem.

The Implementation of Polygon 2.0

Polygon 2.0 has begun its upgrade journey with Phase 0, introducing three Polygon Improvement Proposals (PIPs) set to take effect in the last quarter of 2023.

Several changes will be implemented in the project’s Ethereum contracts as part of this upgrade. One of these changes is the introduction of the “Staking Layer” and the migration of Polygon’s public chains to utilize this new layer. This new layer is structured to incentivize validators to stay committed to their role, and thus crucial for network security.

Notably, Phase 0 of the Polygon 2.0 upgrade ensures that users and developers using Polygon PoS and Polygon zkEVM chains won’t need to take any additional actions.

MATIC to POL Token Migration

Another important milestone that would be attained during Phase 0 is a shift from MATIC to POL as the project’s token designation. This change is not in name only; POL is designed to be a next-generation token that supports staking community ownership and is adaptable for ZK-based Layer 2 chains.

Also, POL will now be the primary (gas) token for Polygon PoS. This shift from MATIC won’t affect the properties of the native token or how contracts on Polygon PoS work, but it might impact Ethereum contracts relying on MATIC from the native MATIC Bridge.

The project’s improvement proposals outline that POL allows a direct migration from MATIC while ensuring compatibility with existing systems, and it would start with the introduction of 10 billion tokens and an annual increase of 2%. These new tokens will be distributed between validator rewards and a community fund.

Polygon PoS Adopting Circle’s Native USDC

Polygon PoS has become a prominent solution for making Ethereum faster, and it plans to strengthen its position by making a big change to how it handles non-native tokens on its platform by reducing its reliance on bridges. Circle‘s USDC is the first to benefit from this; from October 10, 2023, Polygon will support native USDC.

This move to native USDC offers some important benefits. It means that USDC from Circle will always have a dollar reserved for each token, and you can easily swap it for real US dollars.

Circle would also update its APIs to handle native USDC on Polygon PoS, with different codes for native and bridged USDC. This change will also simplify institutions getting in and out of the Polygon PoS network using Circle Account and its tools.

In the future, Polygon PoS plans to enhance cross-chain capabilities with the Cross-Chain Transfer Protocol (CCTP), allowing for quick transfers of USDC between Polygon PoS and Ethereum, among other supported chains. The Polygon PoS community has described this as a positive step because it promises improved stability and accessibility for users.

In Conclusion

- MATIC’s resilience and positive momentum in the cryptocurrency market, despite the decline experienced by other tokens, is quite an exciting market phenomenon to observe.

- However, only time will tell whether the current upward price trajectory is just a mere result of crypto whale activities or the excitement over the new upgrades to the Polgyon network.

- Finally, the cryptocurrency market is highly volatile; thus, past performance is never an accurate indicator of future performance. Therefore, stay informed about new developments before you make any investment decisions.

Disclaimer: This piece is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more market analysis articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.