Last updated on July 29th, 2025 at 01:07 pm

The DeFi ecosystem has long promised users enhanced security and the freedom to participate in various financial activities without the intervention of external authorities, such as banks. However, recent concerns about vulnerabilities within DeFi protocols threaten to undermine these promises.

One particular vulnerability that has garnered significant attention is Miner Extractable Value (MEV). MEV has sparked discussions among developers and traders primarily because it exploits an inherent capability of DeFi protocols.

This vulnerability poses significant risks to the growing adoption of DeFi because it essentially erodes trust when unsuspecting users discover they’ve been taken advantage of.

This article comprehensively explores the concept of MEV, how it works, and the implications it holds for the crypto community if left unaddressed.

What Is Miner Extractable Value (MEV)?

MEV, short for “Miner Extractable Value,” refers to the additional value miners can access from transaction fees and block rewards in a blockchain network or DeFi protocol.

In a blockchain network employing a Proof-of-Work (PoW) consensus mechanism, when you initiate a transaction, your transaction details are temporarily stored in a “mempool.” These transactions remain in the mempool until a miner includes them in a block.

Subsequently, nodes validate these blocks before they are added to the blockchain. Node operators and block producers are rewarded with a fraction of the transaction fees for performing these roles.

However, certain miners have discovered a method to extract more profit than they would typically receive. They accomplish this by manipulating the order of transactions within a block, either by adding or removing transactions while they are in the mempool. This additional value is what we refer to as MEV.

Despite some networks transitioning from PoW to Proof-of-Stake (PoS) systems, where validators assume the roles miners held in PoW, mempools continue to exist. Consequently, the manipulation of the mempool to extract “MEV” remains possible. This is why the term MEV has evolved to take on a new name: “Maximal Extractable Value.”

How Does Miner Extractable Value (MEV) Actually Work?

Video showing How MEV works

Understanding MEV requires a basic grasp of the roles played by block producers, whether they’re miners or validators.These players are critical in keeping blockchain networks secure and operational. Their responsibilities include confirming transactions and appending them to the network as linked data “blocks.”

Block producers are responsible for adding new data into the blockchain. They collect user transaction data and organize it into blocks that become part of the blockchain. The key decision of which transactions to include in their blocks is up to these block producers.

For block producers to benefit from MEV, they choose transactions based on their potential profitability. They prioritize certain transactions and arrange them strategically to maximize profits. This can result in extra earnings through opportunities like arbitrage or on-chain liquidation.

During peak periods, when the mempool is flooded with transactions, users are willing to pay higher fees to get their transactions processed faster. Block producers looking to make the most of MEV tend to select transactions with high fees, as this is the primary way to increase their earnings. Consequently, transactions with lower fees may face delays in being included in a block.

In simple terms, this is how MEV works. Miners and validators use various strategies to take advantage of MEV while performing their roles on the blockchain network. Some of these strategies include front-running, back-running, and sandwiching.

Front-Running

Front-running is a strategy where a miner places their own transaction before another one in a block to make more money. Miners do this when they expect significant transactions on a decentralized exchange (DEX) and want to benefit from potential price changes. This tactic is known as Miner Extractable Value (MEV), and miners use it to avoid losing money when mining cryptocurrencies. Recent research shows that front-runners can make a lot of profit through MEV and often compete to maximize their gains.

Back-Running

Back-running involves miners searching the mempool for transactions, like token swaps, that they can profit from. Once they find a profitable pair, they quickly buy tokens from that pair before others. This way, they get priority over others when the transactions are validated. Then, they hold onto these tokens until their value increases, allowing them to sell for a profit.

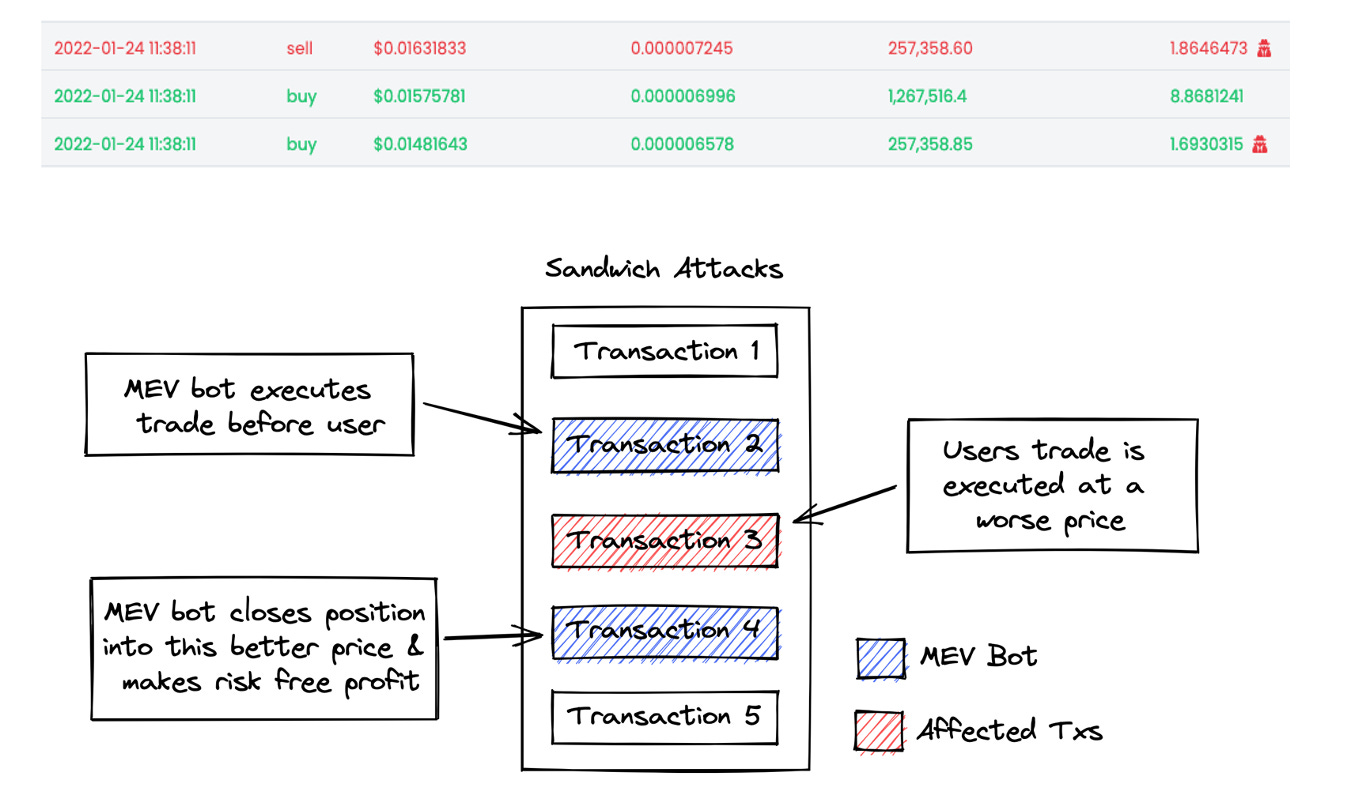

Sandwiching

Sandwiching is a combination of both front-running and back-running techniques. Miners who use this method spot transactions before they happen and cleverly “sandwich” their own buy-and-sell transactions around them. This increases the gas fee for the transaction, instantly earning them a profit without extra costs.

Malicious actors use sandwich attacks on unsuspecting participants in DEXes, causing price slippages from which they profit.

The Impact of MEV on the Crypto Industry

MEV comes with its complexities and downsides. While there are arguable benefits to it, there are also highly detrimental effects on the crypto industry as a whole.

The idea of influencing transaction order for profit has given rise to a multitude of MEV bots, which continuously scan the blockchain in search of opportunities to exploit. Their operational scope spans from arbitraging price differences across decentralized exchanges (DEXs) to efficiently resolving unfavourable loan positions.

In some extraordinary cases, they even play a role in mitigating security breaches.

However, the intense competition among these MEV bots, as each strives to outdo the other in securing lucrative opportunities, can lead to network congestion and exorbitant transaction fees.

While those controlling the bots may find this financially rewarding, traders and other participants often bear the brunt of their actions. These bots frequently undermine the principles of a fair and equitable trading environment, directly impacting the user experience by diminishing the value of trades.

In April 2023, a white hat hacker discovered a vulnerability in SushiSwap’s RouterProcessor2 contract and successfully accessed 100 Ethereum (ETH) from a user’s funds. Acting in good faith, the hacker expressed a willingness to return the funds upon contact. Unfortunately, swift actions by MEV bots undermined efforts to secure the platform.

These bots duplicated the attack by deploying contracts before the vulnerability could be fully patched, resulting in a loss of approximately $3.3 million (1800 ETH). Despite extensive recovery efforts, not all the lost funds were returned to the affected user.

The harsh reality is that as long as transactions are prioritized within blocks based on transaction fees, there will always be cases of MEV exploitation.

As we have witnessed, this dynamic has both positive and negative implications for the blockchain ecosystem as a whole. Therefore, addressing these concerns thoughtfully and proactively is crucial to ensure that the promise of DeFi remains intact and that users can continue to enjoy its numerous benefits.

It is worth noting that researchers are actively developing solutions to reduce or entirely prevent MEV exploitation by creating protocols for reasonable transaction ordering. Some of these solutions include Offchain Labs’ Abritrum, ChainLink’s Fair Sequencing Service, and Automata Network’s Conveyor.

Implementing these solutions will help maintain the integrity and benefits of DeFi, enabling users to enjoy its potential without the risk of MEV exploitation. Ultimately, more users can be encouraged to fully embrace DeFi without concerns about unfair advantages or manipulations.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles (news reports, market analyses) like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”