Last updated on March 27th, 2023 at 03:59 am

Since the emergence of Bitcoin in 2008, the blockchain industry has undergone significant changes that have transformed the entire ecosystem and financial markets. One such trend that has emerged is decentralized finance, or DeFi.

DeFi represents a pivotal moment in the history of finance. The traditional finance industry has been consolidating for decades, stifling innovation and excluding many individuals from accessing financial services. However, the launch of tokens like Compound and Sushiswap in the summer of 2020 helped DeFi gain momentum.

DeFi lays the foundation for permissionless, blockchain-based financial services in the growing digital economy. Decentralized platforms and digital currencies have the potential to provide an alternative to the traditional finance model. The exponential growth of the DeFi market is evidence of this potential.

DeFiChain is a DeFi protocol dedicated to the principle that people should have complete control over their finances. The current traditional financial system lacks financial services that users can tailor to their specific needs. DeFiChain aims to provide easy access to decentralized financial services for everyone in the bitcoin ecosystem.

This article comprehensively explores DeFi Chain, examining the platform’s unique features, how it works, its token, as well as the challenges surrounding its adoption.

What is DeFiChain?

DeFiChain is a decentralized blockchain platform that offers transparent financial products and services. The platform was launched to improve different kinds of financial services, like lending, borrowing, saving, and investing, by making them available on the decentralized Bitcoin market.

DeFiChain leverages the security of the Bitcoin blockchain by anchoring every few blocks through the Merkle root. Due to the non-Turing completeness of DeFi transactions on the DeFiChain, there is a lower possibility of having issues with the smart contract.

Currently, DeFiChain supports tokenized ETH (Ether), BTC (Bitcoin), LTC (Litecoin), DOGE (Dogecoin), USDT (Tether), and BCH (Bitcoin Cash) on the DeFiChain DEX. It was intended that this would encourage liquidity mining for these coins.

Features and Benefits of DeFiChain

The key features of the DeFiChain ecosystem include the following:

Decentralized Lending

DEFiChain allows individuals and groups to borrow and lend assets without intermediaries.

Due to the volatile nature of cryptocurrencies, customers who want to use DeFiChain’s fully collateralized decentralized loans must over-collateralize their positions. This approach allows users to borrow money based on how much cryptocurrency they own. They don’t need to liquidate their cryptocurrency assets to meet their immediate cash needs.

Decentralized Token Wrapping

One of the main problems with many DeFi protocols is that they can’t interact directly and on-chain with many digital currencies. Things are different with DeFiChain.

DeFiChain can use ETH, BTC, and other cryptocurrencies via token wrapping. Wrapping increases the utility of a token by allowing it to be used on another chain.

The decentralized token wrapping feature of DeFiChain is essential because it allows users to hold any cryptocurrency and look for new ways to invest.

Decentralized Exchanges (DEXs)

DeFiChain’s DEX functionality facilitates peer-to-peer (P2P) crypto atomic swaps. Thanks to this feature, those who want to transact directly without using an exchange can do so. By doing this, consumers are guaranteed to keep custody of their funds, and the risks associated with using exchanges are minimized.

In addition, since the system’s P2P is based on the fair market price of an item, it eliminates the custodianship risk from the exchange itself.

Asset Tokenization

Asset tokenization is the process of representing physical assets or real-world assets such as real estate, jewellery, firm shares, works of art, debt, and bonds on the blockchain. The process is one of the most exciting investment opportunities for crypto holders.

The DeFiChain platform can tokenize assets. The process on the platform is trustworthy because it is legal, decentralized, and approved by different jurisdictions.

DeFiChain Token

The DeFiChain ecosystem has a native currency called the DeFiChain (DFI) token. The token powers every operation on the platform. The DFI token has several use cases, including:

- Payment for transfer of assets

- Payment for DEX transactions

- Collateral for borrowing assets on the platform

- Voting on governance proposals, and

- Staking.

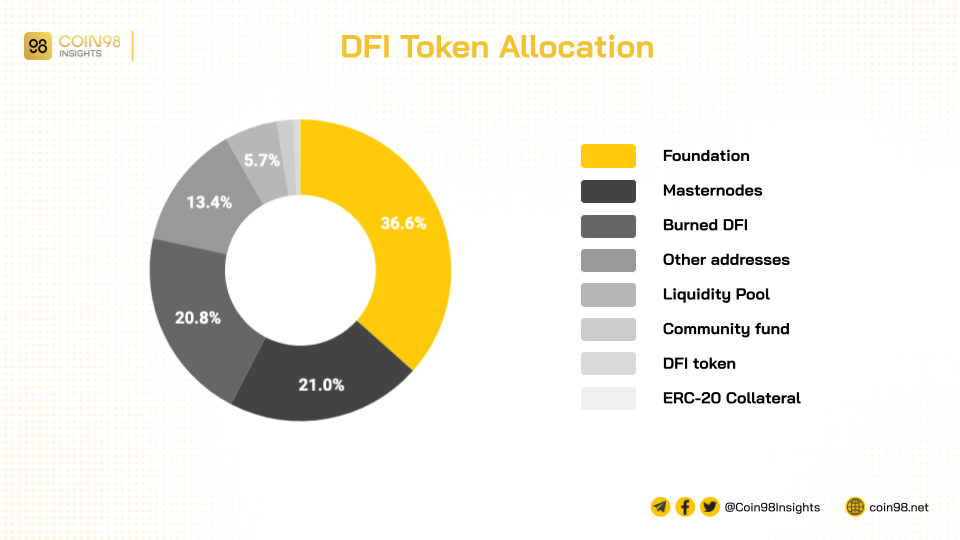

Unlike many other blockchain platforms, DeFiChain did not hold a public sale, initial coin offering (ICO), or initial exchange offering (IEO) at its inception. Instead, 49% of the total amount of DFI tokens were put into circulation, and the DeFiChain Foundation received 49% of the coins that are currently in use

To prevent the tokens from becoming too centralized, the Foundation is limited to owning up to 49% of all tokens in circulation. The remaining tokens were distributed to reputable investors and external partners to fund the platform’s development.

How DeFiChain Works

DeFiChain was created to address scalability, security, and governance challenges that plague the current DeFi systems. Let’s take a closer look at how DeFiChain addresses these problems.

Scalability

DeFiChain uses a Proof-of-Stake (PoS) consensus process (unlike Bitcoin, which relies on a Proof-of-Work; PoW consensus). The PoS mechanism is more energy-efficient and scalable than PoW.

Unlike the PoW, where the network chooses a random network validator for a given block period to determine the subsequent network state, nodes must deposit a minimum of 20,000 DFI tokens into the DeFiChain treasury system to become network leaders or masternodes and determine the network state in the PoS.

Security

DeFiChain uses a non-Turing complete language to write smart contracts to address the security issue with DeFi. Additionally, DeFiChain creates cryptographic snapshots of its most recent state and stores them on the Bitcoin network, a process known as anchoring. This anchoring ensures that DeFiChain is anchored to the Bitcoin blockchain for security reasons.

Just like backing up your computer files to the cloud, stakers occasionally upload DeFiChain block hashes to the Bitcoin network, enabling block anchoring and public audit. The DeFiChain blocks may be validated against the most recent records anchored to Bitcoin.

Governance

DeFiChain’s governance system is community-driven. Users who hold at least 500 DFI tokens can propose solutions through DeFi Improvement Proposals (DFIPs), and masternodes with at least 20,000 DFI tokens can vote on them. Each masternode has one vote, and voting takes place on GitHub.

By prioritizing community participation and governance, DeFiChain can adapt and grow in a way that aligns with the needs and goals of its users.

Many cryptocurrency projects like Bitcoin and Ethereum prioritize security and community participation, and this limits their ability to adapt and grow.

One example of this is Ethereum’s response to the DAO attack in July 2016, which resulted in a hard fork and the creation of two networks: Ethereum (ETH) and Ethereum Classic (ETC). This decision went against the original vision of Ethereum, which was to support decentralization and independence from outside politics—those who disagreed with the change created ETC.

How Does DeFiChain Compare to Other DeFi Platforms

DeFiChain is based on the DeFi blockchain, a fork of Bitcoin that was made exclusively for this purpose. This sets it apart from other DeFi platforms, such as Balancer and Uniswap. DeFiChain offers better security, faster and cheaper transactions, and easier programming, which makes development much faster.

One key difference between DeFiChain and other decentralized exchanges is that while other DEXs are centralized on a website, DeFiChain is completely decentralized. It can be downloaded as an app on the user’s computer. This ensures that decentralization won’t be compromised while maintaining and improving the exchange.

DeFiChain is built on the Bitcoin blockchain, which makes it highly secure. There are fewer DeFiChain alternatives, which means there are also fewer opportunities for attacks on the system. Therefore, maintaining DeFiChain’s security is significantly simpler than on Ethereum, where it is almost impossible to foresee every possible attack scenario.

Though the DeFiChain DEX and the entire blockchain are not yet fully developed, they provide the necessary functionalities and development opportunities for decentralized financial applications.

How Does DeFiChain Compare With Traditional Banking Systems

To better understand the differences between DeFiChain and traditional banking systems, let’s take a look at the following comparison:

Accessibility:

- Traditional banks require customers to physically visit a branch to open an account, which may not be possible or practical for those living in rural areas or with limited mobility.

- DeFiChain, on the other hand, is accessible to anyone with an internet connection, regardless of location or time of day.

Ownership of Funds:

- In both cases, the money belongs to the customer.

- However, with traditional banks, the institution holds the customer’s money and transactions must be completed through the bank, which can result in delays or restrictions.

- With DeFiChain, customers have full control over their money and can choose where and how to use tokenized money.

Processes and Intermediaries:

- Traditional banks rely on manual procedures and intermediaries, which can cause delays and increase transaction costs.

- In contrast, DeFiChain eliminates intermediaries and uses autonomous smart contracts to execute transactions quickly and transparently.

Overall, DeFiChain provides greater accessibility, ownership, and efficiency compared to traditional banking systems.

How Can DeFiChain Be Used in the Real-World?

DeFiChain can be used to develop decentralized versions of well-known asset management solutions, such as borrowing and lending platforms and stablecoins. Additionally, it can be used to create digital wallets and systems for processing decentralized payments.

With DeFiChain’s extensive suite of decentralized apps, anybody can securely and independently manage their digital assets. Users have a secure and convenient method of creating, storing, and trading digital assets while receiving DFI tokens for helping to secure the network.

DeFiChain does not require a central exchange or custodian. Instead, users can directly interact with each other using the platform’s existing atomic swap feature. Furthermore, DeFiChain offers liquidity mining for a broad range of crypto and token pairs, allowing users to profit from their digital assets.

Challenges of DeFiChain

The biggest challenge facing DeFiChain is its reliance on Bitcoin as its underlying blockchain technology. As of now, there is over $236 billion locked in DeFi projects. Most of these projects are on Ethereum. Only around $2 billion are locked in DeFiChain. Thus, the platform needs more funding to expand its user base and grow.

In Ethereum, the DeFi projects can move around “more” readily, albeit with the added cost of gas fees. However, it is currently more difficult to transfer funds from Ethereum to DeFiChain without using a third-party option.

To address this issue, a group of programmers is working on a protocol for fully decentralized and trustless fund transfers between DeFiChain and Ethereum. Hopefully, this protocol will incentivize more people to join and use DeFiChain.

In Conclusion

- Innovation is key to the future of finance, and currently, decentralized blockchain services such as DeFiChain are leading the way.

- DeFiChain offers a more comprehensive system and surpasses what can be accomplished in the centralized finance world and the existing DeFi protocols.

- Through continuous upgrades and improvements, the performance of DFI is expected to surpass its current all-time high (ATH) of $5.61 in the future

Disclaimer: This article is intended solely for informational purposes only and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, and Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”