Kyber Network is a DeFi cryptocurrency that focuses on building an alternative to traditional exchanges where the buying and selling of cryptocurrency assets can take place.

The platform’s exchange is powered by a distributed network of software users, code, and the Ethereum blockchain,

The Kyber team has developed three tools to run on Ethereum. These include a protocol for DEX, an API for asset conversions, and a cryptocurrency that users can use to govern their operation and maintenance (i.e., KNC).

These tools have helped launch KyberSwap, a DEX application that users use to swap cryptocurrency assets without any central authority or operator.

This guide comprehensively explores the Kyber network and how it makes DeFi tick.

An Overview of Kyber Network

Kyber Network is a decentralized, blockchain-based protocol that allows users to exchange tokens without an intermediary. The platform can be integrated into crypto wallets, dApps, and DeFi platforms. Kyber Network is governed by users holding the KNC token via KyberDAO.

In a nutshell, Kyber Network uses a decentralized blockchain protocol, thereby getting rid of the need for centralized token exchange. Users do not need to rely on any third party since cryptocurrency exchange is automated.

Kyber Network also serves as a source of liquidity for other DeFi applications. Liquidity is a crucial part of any financial service. It paves the way for trading an asset without causing major fluctuations in its value. A market cannot function properly without adequate liquidity. DeFi protocols often struggle with liquidity issues because they aren’t backed by big companies.

Kyber Network can be integrated into Ethereum-based decentralized applications because it is an open-source protocol built on Ethereum. More than 100 projects, such as DeFi protocols and e-commerce platforms, have adopted the Kyber Network protocol. Examples include imToken, Rarible, MyEtherWallet, EnjinWallet, Axie Infinity, ETHLend, and 1inch.

Technical Details of Kyber Network

Ethereum and other ERC-20 tokens can be traded on the network. Liquidity pools are used for this purpose.

Liquidity pools refer to smart contracts that store crypto tokens. They are crucial to the effective operation of decentralized exchanges because they enable instant transactions with readily available tokens.

Liquidity providers (i.e., LPs) are the individuals who supply these pools with tokens. These LPs risk their tokens in the liquidity pool in exchange for rewards proportionate to the amount of liquidity contributed.

When a trade is executed, the system looks at all available reserves to find the best exchange rate.

The Kyber Network uses three types of reserves to ensure a steady supply of liquidity. These include:

Automated Price Reserves

These reserves use smart contracts to determine the price of available tokens. Transactions using this reserve type can be found on the Kyber Network blockchain.

Price Feed Reserves

These reserves gather data from price feeds and save it in smart contracts. These function similarly to a market maker on the platform.

Bridge Reserves

These use the liquidity of other decentralized exchanges to increase the network’s liquidity. The network fees for these reserves are in the form of ETH. Depending on how much liquidity these fees generate, a portion is put back into the reserves.

What Makes the Kyber Network Unique?

The goal of the Kyber Network has always been to work with other protocols, so the company has made considerable effort to be developer-friendly by providing the framework required for the technology to be integrated with any blockchain that uses smart contracts. So many dApps, vendors, and wallets now rely on Kyber’s infrastructure, such as Set Protocol, InstaDApp, bZx, and the Coinbase wallet.

Kyber works not only with dApps, vendors, and wallets but also with other exchanges like Uniswap, allowing for the sharing of liquidity pools between the two protocols.

How Does the Kyber Network Work?

The smart contract built into the Kyber protocol facilitates user participation in the network. Users also can set parameters via a voting process embedded in the blockchain. Also, liquidity pools make it possible to trade ETH and other ERC-20 tokens quickly and without a central authority. This makes the platform useful for a wide range of projects.

Kyber’s DEX architecture makes it a user-friendly platform that doesn’t require sign-ups or accounts. As with other centralized exchanges, it serves two types of customers: “market takers” and “market makers.” The market makers put money into the reserve, and the market takers take money out of the reserve.

The asset price on various reserves is primarily determined by the supply of assets to the reserve. For instance, when investors liquidate their holdings, they reduce the available supply of USD coins while increasing the reserve. This means that the USDC reserves will be used up slowly, and a new rate for USDC will be set (ETH sellers will get less USDC).

The Kyber Network not only functions as an exchange but also as a platform for individual token transfers, making it suitable for P2P transactions and ICOs. Kyber is a trustworthy platform because users’ tokens never get lost in transit and don’t have to match the tokens the recipient wants.

What is KyberSwap?

KyberSwap is a trading platform powered by the Kyber Network. It is an Ethereum-based multi-chain decentralized exchange (DEX) that facilitates trading between various cryptocurrencies and blockchains, such as Ethereum, BNB, Polygon, Optimism, and Avalanche.

Due to its status as an aggregator, KyberSwap can draw liquidity not only from its pools but also from the more than 67 DEXs that are part of the networks it supports. As with other DEXs, users of KyberSwap have full authority over their orders and funds. KyberSwap was made to solve the problem of liquidity providers not getting enough liquidity, as well as the problem of liquidity shortages that many DeFi traders face every day.

With KyberSwap, users can effortlessly trade, earn, and participate in DeFi across all supported chains. KyberSwap is a permissionless and decentralized platform. As a result, customers can make changes to their orders and access their funds at any time.

What’s Unique About KyberSwap?

KyberSwap Classic uses DMM and Amplification to ensure adequate liquidity, while KyberSwap Elastic uses concentrated liquidity, auto-compoundability, multiple fee tiers, and JIT protection to make sure that liquidity providers can earn as much as possible without risk.

With sufficient liquidity, investors and traders can confidently buy and sell assets without experiencing significant price swings. Impermanent loss and slippage can occur as a result of low liquidity. High volatility also increases the risk that investors face.

Liquidity can be defined as the ease with which assets can be bought or sold. It keeps prices stable because more buyers than sellers mean fewer sellers have market control.

Kyber Network Tokenomics

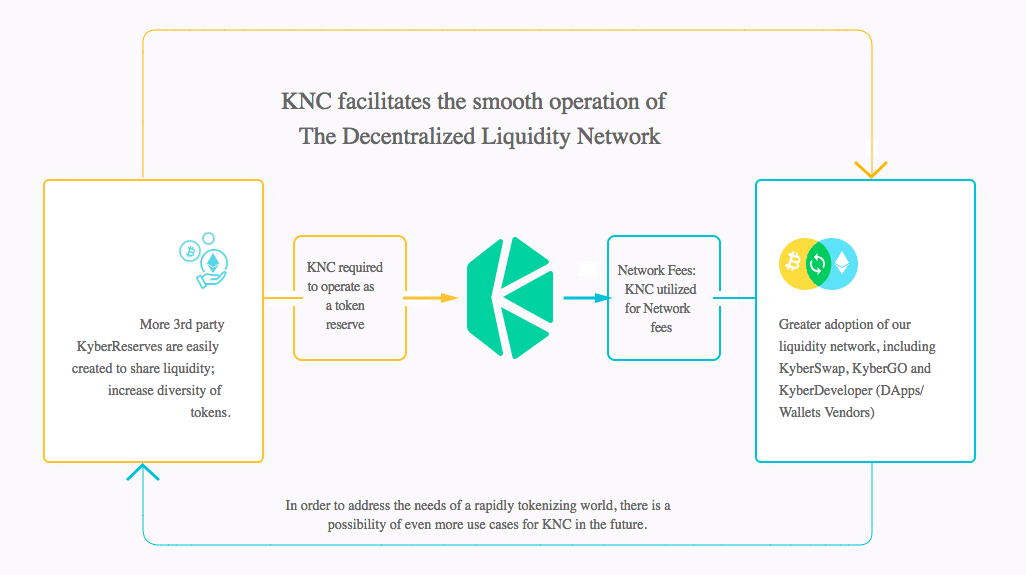

Since its inception, Kyber Network has been an active participant in the cryptocurrency market as a utility token-based project. The primary responsibility of KNC in the Kyber ecosystem is to oversee any alterations made to the network. Holders of KNCs can come up with ideas for governance and vote on them. Stakeholders may also get a share of the fees Kyber makes from the liquidity pool.

The network burns a portion of the tokens it earns to control its cryptocurrency’s inflation and increase its market value. Tokens worth 5 million KNC were burned recently, bringing the total supply down from 215 million to around 210 million.

By staking, users can profit from KNC coins’ potential appreciation in value. Those customers who want KNC to maintain a liquidity reserve can still make additional purchases. When a user makes a transaction through the network, fees are taken out of their balance.

KNC Ecosystem

Kyber Network Crystal (KNC) functions as the network’s native token. The Kyber ecosystem consists of three main components:

- KyberDAO

- Decentralized exchange, and

- Reserves

Users of the Kyber Network are empowered through the KyberDAO. It allows them to have a say in the project decisions and keeps everyone on the same page about where things are headed.

The decentralized exchange makes dApp developers and other users not fret over the safety of their tokens. It makes it easy to send and receive multiple ERC-20 tokens, which makes trading and using apps easier.

If reserves were not available, Kyber Network would not be able to provide liquidity to as many users simultaneously, and the exchange would not run smoothly.

Kyber Network’s Roadmap

Kyber is focused on becoming the one-stop solution for tokens providing liquidity and powering token swapping on the Ethereum blockchain.

Concerns about high Ethereum gas prices have prompted Kyber Network to investigate alternative Layer 2 protocols that could make using the platform cheaper and more efficient. However, this investigation is still in its early stages.

Kyber Network intends to create a permissionless structure for listing tokens. It also wants to lower gas fees by using a method called “reserve routing.”

In Conclusion

- Kyber Network is leading the charge toward becoming a trustless liquidity hub, which is crucial for the development of the DeFi ecosystem. Its innovative Kyber reserve models and protocol design have positioned it to become a key player in the decentralized economy’s liquidity infrastructure.

- KyberSwap, an Ethereum-based DEX, relies on the Kyber Network as its central source of liquidity. It’s a hub where DeFi fans can work together on projects, share information, and contribute to the growth of the overall crypto industry.

- As the DeFi landscape evolves, Kyber is constantly improving to include more dApps and add more assets to make token swapping as easy as possible.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, and Instagram.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”