Last updated on November 17th, 2022 at 02:07 pm

Introduction

For financial institutions that issue fixed-value liabilities that are backed by assets whose value is unknown, bank runs are a common phenomenon.

Recently, Iron Finance, a DeFi protocol, suffered a similar collapse in its infrastructure that saw the price of its token TITAN plummet from $64.19 to zero in a single day.

In this article, taking Iron Finance and the events that took place, we try to explain what a bank run is in DeFi and how even a seasoned investor like Mark Cuban got rekt[1] because of it.

Let’s dive in.

Understanding Bank Runs

In TradFi, a bank run happens when a large number of people withdraw their funds from the bank in a short span of time. This happens because people fear that the institution will run out of money and they will not be able to withdraw later on. Thus, it can be said that a bank run takes place as a result of panic created due to the fear of insolvency.

However, it is important to note that what does start as panic actually pushes the financial institution into actual insolvency. As individuals keep withdrawing funds in fear, the bank defaults. This denotes a classic example of a self-fulfilling prophecy.

In DeFi as well, we see something similar happen when people start withdrawing their liquidity from DeFi platforms. In the fear that a platform might default and the value of its token might plummet, liquidity providers start panic selling their holdings and withdraw their funds.

In June 2021, as whales began to remove liquidity from the IRON/USDC pool on Iron Finance, the DeFi protocol experienced what they called in their post mortem report, ‘a large-scale crypto bank run’.

Let’s take a look at what happened in more detail.

What Is Iron Finance?

Iron Finance was launched on the Binance Smart Chain in March 2021. The aim of the DeFi protocol is to create a multi-chain partially collateralized DeFi and algorithmic stablecoin ecosystem.

These days, building an algorithmic stablecoin that maintains its pet to the US Dollar has become the holy grail in DeFi. This is because building an algorithmic stablecoin [2] is hard and Iron Finance found this out the hard way.

By creating a partially collateralized stablecoin in the form of IRON, Iron Finance tried to address the problems with existing stablecoins such as the cost of either centralization or capital inefficiency.

The bank run event that took place wasn’t the first time that the IRON stablecoin failed to maintain its peg to the US Dollar. In the past, there were a few such short periods of time when IRON unpegged from USD. Moreover, there were also times where DeFi exploits affected Iron Finance users.

Despite these issues, the protocol kept moving forward with bullish momentum as people saw the protocol’s ability to recover from these issues as a positive sign, thus building a false sense of confidence in the protocol design.

The false sense of confidence led users to believe that they were interacting with a battle-tested project and as a result, Iron Finance saw parabolic growth. This growth was further fueled by the high yield farming rewards that the protocol offered. Moreover, the project was also mentioned by Mark Cuban in his blog post which brought even more attention to the protocol.

However, this attention and glory were short-lived as on June 16, 2021, the protocol experienced a large-scale DeFI bank run that saw the price of TITAN crash to 0.

Let’s take a look at how the events unfolded.

How The Events Unfolded

Here’s how the events played out in chronological order:

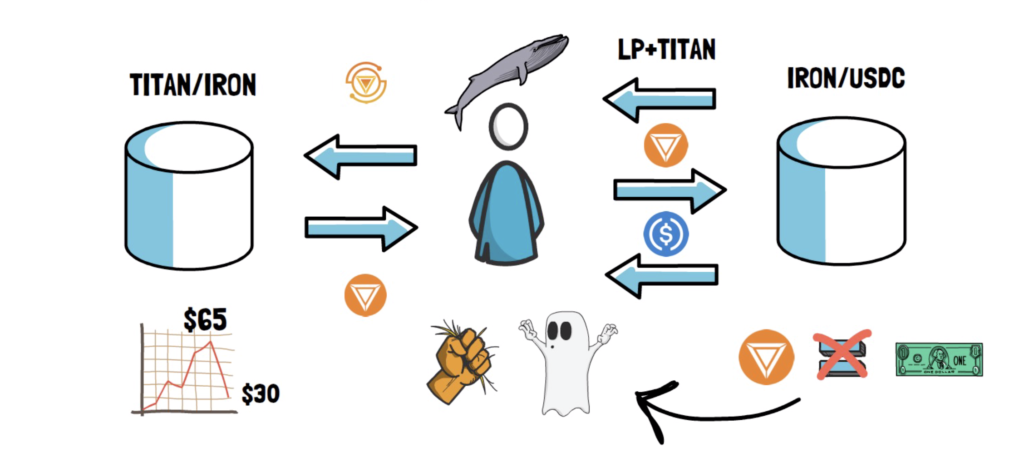

- Around 10 am UTC on June 16, 2021, the Iron Finance team noticed whales [3] had started removing liquidity from the IRON/USDC pool.

- Because these whales started selling TITAN to IRON and then IRON to USDC directly to liquidity pools instead of first redeeming IRON, it caused the IRON price to fall off its peg.

- As a result, the price of TITAN dropped from $65 to $30 in 2 hours. However, the price then recovered to $52 within an hour, and IRON also fully recovered its peg.

- The code of the protocol functioned as usual and the team was continuously monitoring the activity on the blockchain. Since the protocol had a history of its native token sharply falling in value and the IRON stabelecoin falling off its peg as a result, the Iron Finance team thought that it’s just another correction before recovery.

- However, problems started showing up again as later during the same day around 3 pm UTC, a few whales began selling again. While in the previous event the price recovered, this sharp selling from whales triggered panic selling from the users of the protocol and they began to redeem their IRON and sell their TITAN.

- Because of how the 10mins Time-weighted average price (TWAP) oracle is designed, the spot price of TITAN dropped even further in comparison to the redemption price. This happened because the oracle started reporting old prices that were still higher than the actual market price of TITAN.

- As a result, a negative feedback loop was created. Because of the protocol design, more TITAN was created as IRON was being redeemed. Thus, the price kept going down.

- The panic selling resulted in a bank run and a significant amount of liquidity was removed from the protocol. The Iron Finance team said in their report ‘What we just experienced is the worst thing that could happen to the protocol, a historical bank run in the modern high-tech crypto space.’

How Mark Cuban Got Rekt

In a blog post titled ‘The Brilliance of Yield Farming, Liquidity Providing and Valuing Crypto Projects’ he mentioned that he was a liquidity provider for a decentralized exchange called QuickSwap. In the post, he goes on to explain how he provides liquidity to the DAI/TITAN pool and talks about how it works.

As the price of TITAN crashed to almost zero, Billionaire investor Mark Cuban got hit like everyone else. Though it’s not clear how much money he lost, he told Bloomberg News that TITAN was a small percentage of his crypto portfolio and he lost enough in the trade that he ‘wasn’t happy.’

After the event, in a statement to Bloomberg News, Mark Cuban called for clearer rules and regulations for stablecoins and collateralization in DeFi.

Closing Thoughts

With every failure, there are always some lessons that we can learn. Looking at what went down with Iron Finance, while it might be difficult for them to bounce back from this major setback, it is an opportunity for other similar protocols to learn from their mistakes and improve upon their protocol design.

So, what do you think about what happened with Iron Finance and as a result with investors like Mark Cuban and others? Do you think we need stablecoins regulations?

Comment down below and let us know what you think!

If you would like to read more articles like this, follow DeFi Planet on Twitter and LinkedIn.

Terms:

- Rekt: The term Rekt is slang derived from the word ‘wrecked’. It is used to describe an event that completely destroyed an individual, institution, or platform in DeFi due to which they suffered severe financial loss.

- Algorithmic stablecoin: An algorithmic stablecoin is a stablecoin that keeps its peg to the underlying asset with the help of only software and rules as opposed to real assets like in the case of USDC or USDT.

- Whales: Large scale liquidity providers, generally institutions or high-net worth individuals.