Cosmos (ATOM) started to recover after Bitcoin (BTC) hit $16.19K on November 22nd. Notably, the correction of ATOM’s price occurred on November 28 after BTC’s price fell from $16.60K on November 27.

The market structure for ATOM was still bearish at the time of writing. As a result, risk-averse traders may wait for a breakout and retest of this Fibonacci level in the next day or two before placing any buy orders.

Can the Upside Momentum Be Sustained By the Bulls?

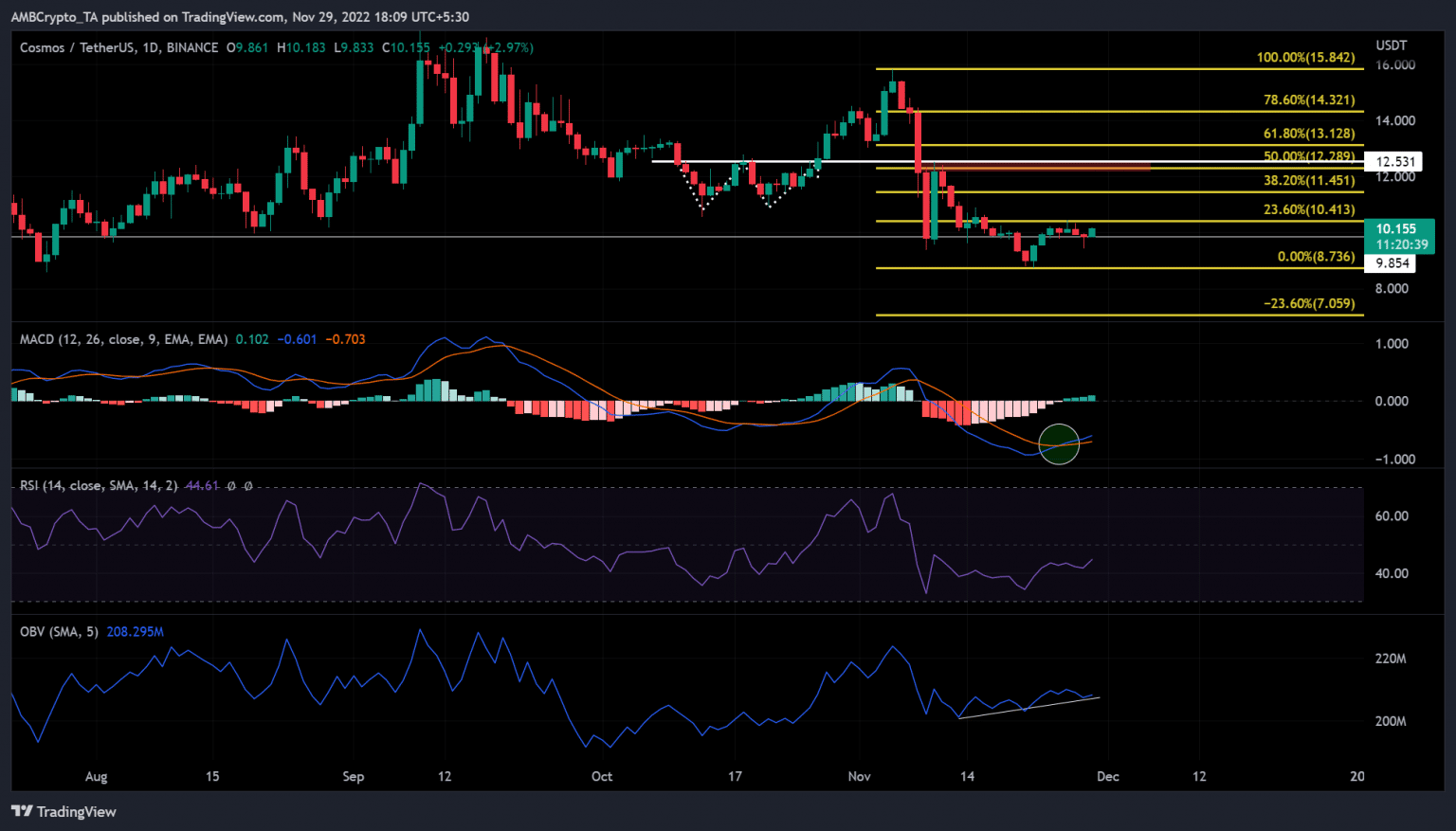

A developing uptrend and a subsequent bullish MACD crossover may be interpreted as a buy signal. However, the Fibonacci retracement analysis between November’s highest and lowest ATOM prices didn’t produce convincing results.

The 23.6% Fibonacci level ($10.413) proved to be a strong resistance for ATOM to overcome. Traders can consider $9.854 support to be stable if the bulls break above it and then retest it, at which point they can enter long positions.

For a long position, the bearish order block at the 50% Fibonacci retracement level ($12.289) represents the target. A pullback occurred on the Relative Strength Index as it neared the oversold area. Consequently, it indicated that selling pressure was beginning to subside. Furthermore, this indicated that the bulls were gaining ground.

With this, the on-balance volume (OBV) has been steadily climbing since around mid-November. Evidence of rising trading volumes suggested that buyers might be exerting more pressure in an attempt to push prices above key resistance levels.

This inclination, however, would be nullified by an intraday close below $8.736. In this scenario, a level of $7.059 or lower could provide new support for another downward trend.

Traders who prefer to minimize their risk exposure shouldn’t act hastily to buy after seeing a bullish MACD crossover. The 23.6% Fibonacci resistance level should be tested before any significant action is taken. However, if the uptrend persists without retesting the level, waiting for a retest could result in a missed opportunity.

Until there is a clear breakout above the 23.6% Fibonacci level, traders should proceed with caution.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more analysis articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, and Instagram.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”