Decentralized Finance (DeFi) is no longer a crypto niche. By 2025, it’s no longer just a baby industry, but a full-grown one, changing how people handle money, obtain credit, invest, and trade. It’s quick, borderless, permissionless, and gives power to millions who have been left behind by the traditional banking system.

If you’re considering building a DeFi app, you’re not too late. You have arrived just in time for the next wave of innovation. But first, it helps to know what building a DeFi app actually looks like — from brainstorming, through architecture and development, to security and launch.

So let’s guide you through each one to bring your DeFi product into existence.

Know What Problem You’re Solving

Every good DeFi app development journey starts by solving a real financial problem. It is 2025, and individuals are still facing high remittance fees, limited access to loans, slow transaction speeds and few yield opportunities. Your app doesn’t have to solve everything; it just needs to help ease one pain point.

Some popular paths include:

- Yield farming aggregators in order for users to maximise their returns

- Crypto lending platforms offering microloans

- Inflation-Prone Region Stablecoin Saving Apps

- Borderless cross-border payments and instant exchanges

- On-chain insurance protocols for safeguarding digital possessions

Take GoldBridge, for instance. It enables citizens of hyperinflation-affected nations to convert their local currency into a stablecoin backed by gold. And it doesn’t pretend to be another Uniswap: it solved a particular issue beautifully.

Discover your “why” even before you write a line of code. Everything else will follow it.

Choose Your Blockchain Wisely

Ethereum may have been the first, but it is no longer the only player in town. You may consider one of the following, depending on how you are using this:

- Ethereum if you need the most decentralization and liquidity.

- Polygon for cheap and fast transactions.

- BNB Chain to facilitate integration, and with a large retail user base

- Arbitrum or Optimism, if you want to reach Ethereum-level security with speed improvements.

- Solana if you want the ability to execute transactions in the blink of an eye, like when trading something in real time or playing a game with blockchain-based finance components.

Suppose you’re building a real-time yield payout system, where every few seconds, users see updated changes. You would be better with Solana speed than Ethereum block finality. Analyze in terms of scalability, cost-effectiveness, tools and how strong the ecosystem is.

Create and Test Your Smart Contracts

Your smart contracts will be the base of the whole app. If they don’t, the entire structure falls apart: often permanently. Jump in with Solidity (for Ethereum-compatible chains) or Rust (for Solana). Stick to modular, minimalistic contracts, and then test aggressively.

For example, let’s say you are creating a staking protocol. With Hardhat, you can simulate what happens when 10,000 users stake at once or when somebody tries to game a reward calculation.

Security is non-negotiable. Moreover, keep in mind that bugs in DeFi don’t just crash apps: they take the money and run.

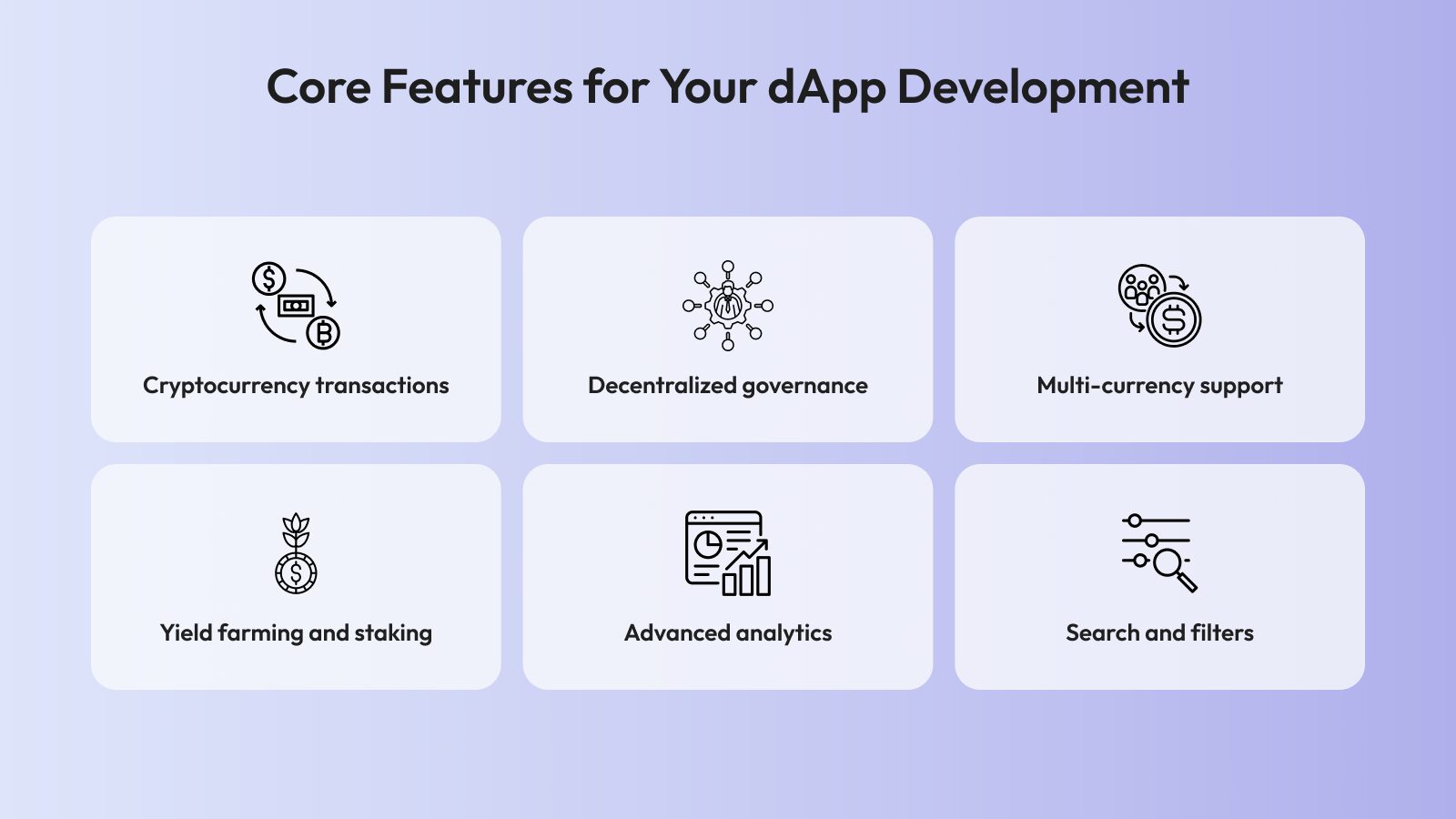

Building The Best Web3 UI/UX

Web2.0 users are spoiled with non-frictionless interfaces. By contrast, Web3 development is supposed to approve MetaMask pop-ups, handle gas fees, and hope every transaction goes through.

You can change that. It should be as intuitive to use as Venmo or Revolut. A good DeFi app looks and feels the same in 2025 as it does today: great design, takes no time to set up and can be used across any platform. That means:

- A simple wallet connection flow

- Gas fee estimations and explanations

- Light/dark modes for better accessibility

- Tooltips for DeFi terms (APY, impermanent loss, etc.)

- Dispensation results as soon as a transaction completes or can not be accepted

Look at Zapper or Zerion. They’ve made tracking your portfolio fun, including for those who are new to the cryptomarket. Now bring that same clarity and spark to your own product.

Integrate Wallets and Identity Solutions

Your users will need wallets to use your app. But wallets are not just means of payment: they are identities. Let users connect with:

- MetaMask (for browser users, most popular)

- Coinbase Wallet (growing quickly in North America)

- WalletConnect (for mobile users)

- Phantom (for Solana-based apps)

But even wallet login might not be all that’s needed.

More DeFi apps are putting ENS domains, Lens Protocol handles or even Soulbound tokens to use to help their users build reputation and social proof on-chain. This could mean that lending apps provide better rates to those who have shown a good record of repayment, or to those who participate in governance.

Ensure Security at Every Level

2025 has had plenty of DeFi hacks and exploits already. Millions can be lost to even the type of small bugs found. So don’t take your chances with in-house testing alone.

Do this instead:

- Ensure testing unit and integration tests

- Simulate edge cases with fuzz testing

- Engage an independent audit firm

- Set up a bug bounty on any of the platforms

- Imposition of bounds on protocol exposure.

Launch Your MVP on Testnet

Deploy your app to a testnet like Goerli (Ethereum), Mumbai (Polygon) or Devnet (Solana) before going live. Get early adopters to try the system and give you feedback. Track how real users interact:

- Where do they drop off?

- What frustrates them?

- What steps feel confusing?

You can incentivize testers with NFTs, early access bonuses, or airdropped governance tokens. This sort of gamified testing creates loyal enthusiasts.

And better yet, it’ll surface edge cases that you and your dev team likely overlooked.

Go Mainnet with a Rollout Plan

Deploy the Mainnet with a full go-live plan to minimize risk and maximize stability of your dApp. Deploy in tiers to try things out, handle issues as they arise, and monitor performance —not just flipping the switch. Phased approach, real-time adjustments, and a safer launch. A lot goes into building scalable production applications; however, with proper foresight in the application, you can always have redundancy and scaling in place to ensure a robust application.

Do it in phases:

- Restricted Beta: Every few trusted wallets given access

- Release to public: With real-time monitoring in place

- Post launch audit: Find bugs in real-time environments

- Governance onboarding: Allow token holders to vote

Also, prepare for traffic spikes. If your app goes viral overnight on Crypto Twitter or Reddit, you need to scale up, fast. Leverage analytics tools such as Dune or The Graph to get ahead of performance bottlenecks. If you’re launching a token, don’t forget to inform token aggregators like CoinGecko and CoinMarketCap.

Add Governance and Community Layers

In 2025, the ideal DeFi apps are not merely tools: they are communities.

After you’ve got users, have them direct the roadmap with governance tokens. Platforms like Snapshot or Tally enable token holders to vote on proposals such as:

- Adjusting interest rates

- Allocating liquidity mining rewards

- Adding new assets

- Making protocol upgrades

Uniswap is a perfect example. Its token holders vote on decisions affecting billions in TVL—a sense of ownership that even the most centralized apps can’t replicate.

Beyond governance, consider:

- Discord/Telegram channels to give feedback to someone.

- A weekly surfaced on Twitter/X to bounce around changes

- Ambassador programs to let the regional ambassadors promote your app

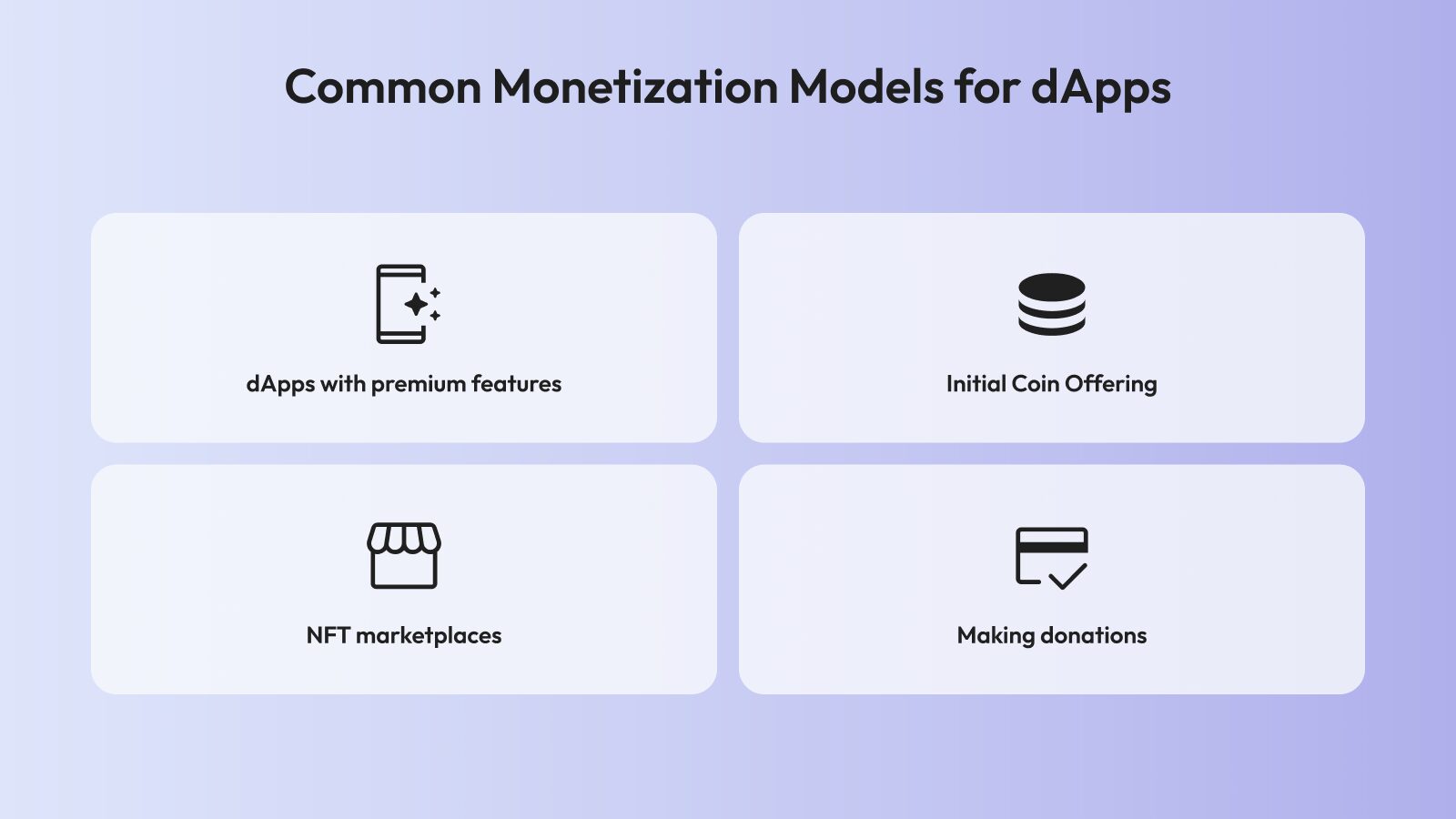

Monetize Without Compromising

Yes, you can still make money with a DeFi app and remain decentralized.

Here’s how:

- Protocol fees: Charging a small fee on each trade, staking or lending arrangement

- Premium features: Provide pro users with advanced analysis

- Token value: Empower governance with your native token or gain access to perks

- Bootstrapping Liquidity: Build Strong Upfront With LP Incentives

For example, both Balancer and Curve charge fees on trades, but their respective DAOs decide what to do with that revenue, whether it is to distribute it to users or use it. You don’t have to make a choice between profit and decentralization. You must simply be transparent and fair.

Keep It Compliant (Even if That’s Hard)

Regulations are catching up. Several nations have rolled out DeFi infrastructure in 2025. Even if you’re a pure crypto app, you might still have to consider:

- KYC for lending, stablecoin apps

- Transaction monitoring tools

- Geo-restrictions for sanctioned countries

- Legal disclosures and disclaimers

Work with legal counsel early. Even decentralized apps need clarity. You should also register in DeFi-friendly jurisdictions like Switzerland, Singapore or the UAE. You’re not looking to get around regulation: you’re trying to engage responsibly within a rapidly changing industry.

Final Thoughts

In 2025, it’s not all just code for a DeFi app, but it’s been about trust, usability, scalability and community. It means mixing smart contracts with smart design. It’s about listening to your users, securing your protocol, and iterating fast. And most of all, it means being part of a movement that’s fundamentally changing finance.

Whether you’re an independent developer or a team, there’s space for your idea in this decentralized future. And what is the best part? You don’t need permission: only vision, skill and a whole lot of testing.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”