As the world becomes more digitized, the demand for seamless and lightning-fast digital transactions is increasing by the day.

Bitcoin, the first and most popular cryptocurrency, has revolutionized how we think about money and payments.

Bitcoin’s decentralized nature has empowered millions to take control of their finances, liberating them from the clutches of traditional intermediaries. Yet, beneath this monumental achievement lies a critical challenge – the need to beat the limitations of its transaction processing capacity.

“Why does this matter,” you ask?

Well, consider this: as of 2022, Bitcoin could handle a mere 7 transactions per second (TPS), while traditional payment giants like Visa routinely manage thousands of TPS. With an ever-growing user base and increasing adoption, Bitcoin’s sluggish transaction speeds can be likened to a traffic jam on the information superhighway.

The Bitcoin Lightning Network is a groundbreaking solution that aims to solve this challenge and unleash the full potential of Bitcoin.

The Lightning Network isn’t just an upgrade; it’s a quantum leap for Bitcoin. Picture this: It can process hundreds of thousands of transactions per second at a fraction of the cost, making slow Bitcoin throughput a thing of the past.

In the following sections, we will delve into what the Lightning Network is, how it works, and what it means for the future of digital payments.

What is the Lightning Network?

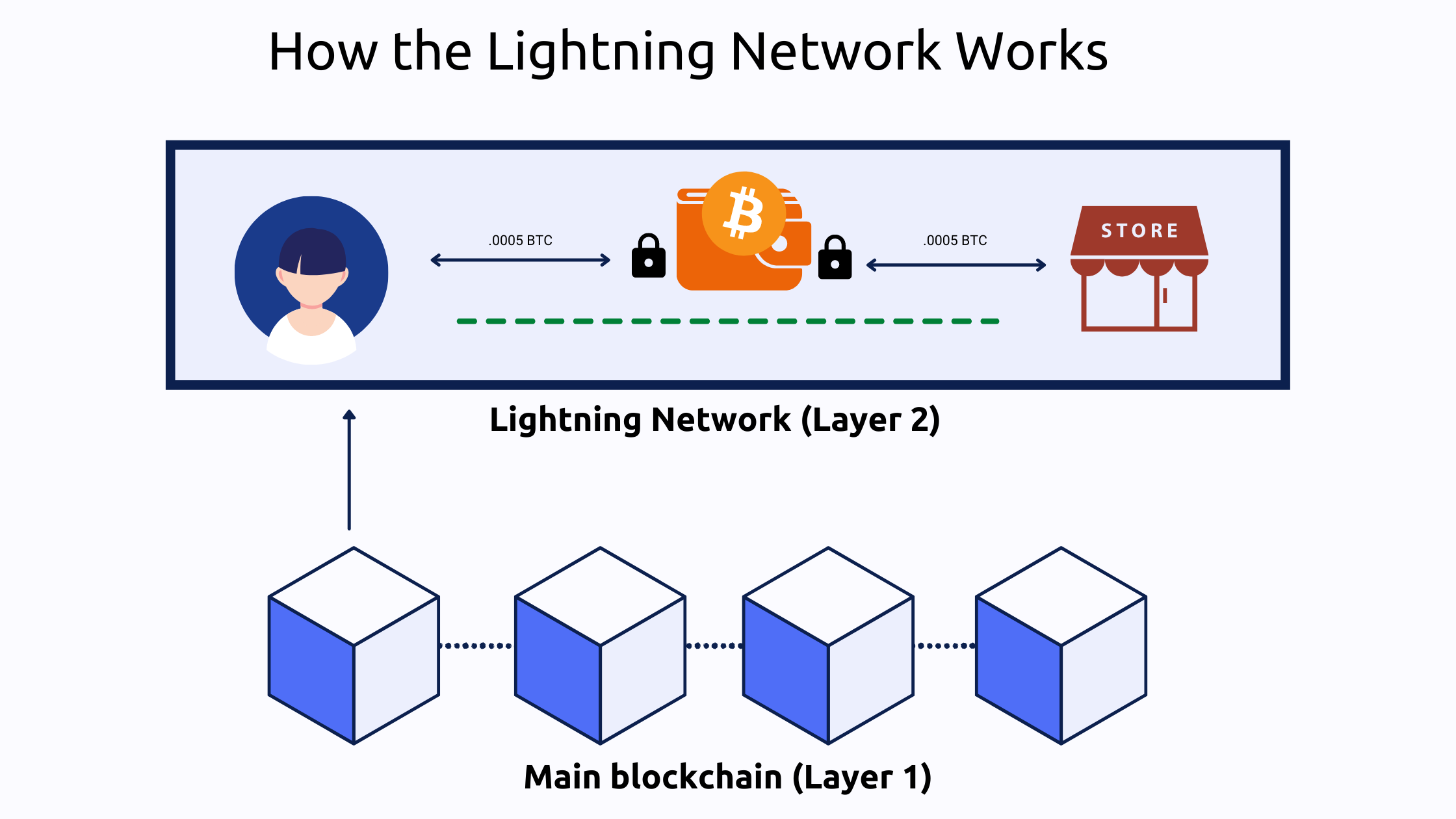

The Lightning Network represents the second layer of the Bitcoin Blockchain infrastructure. This layer uses micropayment channels to enhance the efficiency of the blockchain and its transaction capacity.

The creation of Bitcoin stemmed from the necessity for a decentralized payment system that would facilitate anonymous transactions from any location. However, as Bitcoin’s popularity surged, issues regarding transaction speed and cost emerged as significant drawbacks.

To tackle these challenges, developers introduced blockchain layers, with the primary blockchain serving as the initial layer. Each layer within this system contributes additional functionality to the layer above it.

The Lightning Network consists of payment channels connecting various parties, enabling two-way transactions among Bitcoin users. Consequently, transactions conducted via the Lightning Network are faster, more cost-effective, and easier to confirm than those executed directly on the Bitcoin blockchain.

Furthermore, the Lightning Network serves as an efficient off-chain transaction solution for cryptocurrency exchanges.

How the Lightning Network Works

The Lightning Network operates through smart contracts which enable multiple parties to facilitate off-chain payments—transactions outside the main blockchain.

Imagine a user wants to pay for their daily coffee at a café. They can set up a payment channel with the café. This payment channel maintains its ledger, distinct from the main Bitcoin blockchain, where all transactions are recorded. Both the user and the café can choose when to start or stop this payment arrangement.

Once this payment channel is established, the user can make as many instant payments as they want to the café, and the transaction fees are much lower than using the main blockchain.

When both the user and the café agree to end the payment channel, all transactions recorded on it are aggregated and added to the main Bitcoin blockchain.

Now, if the user decided to pay for their coffee with a regular Bitcoin transaction, they would have to pay network fees each time. These fees can sometimes be more than what the coffee costs. However, with the Lightning Network, users only pay fees when opening and closing payment channels.

Additionally, consolidating smaller transactions expedites the validation of larger transactions. Without payment channels, these small transactions could slow down the whole Bitcoin network for everyone.

Current Use Cases of the Lightning Network

The Lightning Network has grown rapidly since its inception in 2018. As of May 2022, the Lightning Network had 17,535 online nodes, 85,000 active channels, and a capacity of just over 3900 BTC.

The image below shows the global visualization and the node connections of the Lightning Network:

As more people, entrepreneurs, and businesses try out and use this new technology, more use cases are coming to light. These include:

Cross-Border Remittances

The Lightning Network’s utility in cross-border remittances stems from its capacity to facilitate fast and cost-effective international money transfers. An excellent example of this is El Salvador’s Chivo wallet.

In September 2021, El Salvador became the first country to adopt Bitcoin as legal tender. In response, the government developed Chivo, a Lightning-compatible wallet. This wallet has gained significant traction, with over 4 million people using it for various transactions since its launch.

Chivo allows Salvadorans abroad to send money back home instantly and at a fraction of the cost associated with traditional remittance services.

The Lightning Network, by enabling these low-fee and swift cross-border transactions, has the potential to revolutionize the remittance industry by providing financial services to unbanked or underbanked populations globally.

Other notable Lightning Network wallets like Strike, WalletofSatoshi, and Moon also contribute to the cross-border remittance use case by offering similar capabilities to individuals and businesses worldwide.

Micropayment Streaming

One of the unique features of the Lightning Network is that it doesn’t have a minimum transaction value. This means it’s perfect for micropayments, which are small money transfers.

Unlike the Bitcoin network’s base layer, where transaction fees and confirmation times can be prohibitive for small payments, the Lightning Network enables efficient micropayments.

This capability has ushered in new models for digital businesses. Content creators and websites, for instance, can now charge users based on how much content they view or read. This has given rise to pay-per-use content platforms and paywalls.

Users can pay tiny amounts, like a fraction of a cent, to see specific articles, videos, or other digital content. This helps creators make money and keeps users engaged without needing subscriptions or ads.

Micropayment streaming has the potential to transform how digital content is monetized, offering a fairer and more flexible approach for content creators and consumers alike.

Tipping on Social Media

The Lightning Network has also found a unique use case in social media platforms. Users can now send and receive Bitcoin “tips” via the Lightning Network on platforms like Twitter and Substack. This feature has several implications:

- Content Reward: Users can directly reward content creators for their valuable posts or articles, bypassing traditional advertising models. This encourages quality content creation and provides creators with immediate financial incentives.

- Engagement Incentives: Tipping fosters engagement within online communities. It enables users to express appreciation for insightful comments, witty remarks, or helpful advice with small, tangible gestures. This micro-interaction level is not possible with conventional social media platforms.

- Global Accessibility: Since the Lightning Network operates on top of Bitcoin, it offers a globally accessible way for users to participate in financial transactions across borders, making it easy for international followers to support their favourite content creators.

Advantages of the Lightning Network

The Lightning Network addresses various challenges faced by the Bitcoin blockchain, offering several advantages, some of which include:/

Speed and Confirmation

The Bitcoin blockchain can be slow, with confirmation times varying depending on network congestion. Lightning Network facilitates rapid transactions between users. Parties can transfer funds within open channels without waiting for confirmation on the main network. Transactions are settled on the main net when the channel is closed.

Energy Efficiency

The energy consumption required for Bitcoin mining is substantial, making it unsustainable in the long term. By reducing the need for on-chain transactions, the Lightning Network alleviates the strain on the Bitcoin blockchain, making it more energy-efficient and sustainable.

Smart Contracts and Multi-Signature Scripts

Traditional Bitcoin transactions lack programmability and flexibility. The Lightning Network is based on smart contracts and multi-signature scripts. These features enable secure, trustless, and customizable payment channels, ensuring funds reach their intended recipients.

Cost-Effective Transactions

Lightning Network transactions are cost-effective, with significantly lower fees compared to on-chain Bitcoin transactions. This makes micropayments and frequent, small transactions feasible.

Lightning Network allows users to transact with parties indirectly connected through a network of payment channels. This scalability feature reduces congestion on the main Bitcoin blockchain and supports a higher transaction throughput.

7 Challenges You Might Face When Using the Lightning Network

The Lightning Network, while promising, comes with its fair share of challenges. Here are 7 common hurdles users might encounter:

- Initial Wallet Setup: To get started with the Lightning Network, you need a compatible wallet. While finding one isn’t too difficult, it’s an extra step compared to traditional Bitcoin wallets.

- Funding from Traditional Wallets: Your Lightning Network wallet must be funded from a traditional Bitcoin wallet. The initial transfer incurs a fee, resulting in a loss of some Bitcoin value.

- Locking Funds: Depositing Bitcoin into your Lightning Network wallet locks those funds in a payment channel, making them temporarily inaccessible for other uses.

- Transfer Costs: Transferring Bitcoin between wallets can be costly and inconvenient. However, some wallets offer options for on-chain and off-chain payments without fees.

- Channel Closure: To access your funds, you need to actively close the payment channel. You can’t withdraw a partial amount, and both parties must initiate this process, incurring additional fees known as “routing fees.”

- Offline Transaction Fraud: If a channel is closed by one user while the other is offline, there’s a risk of fraud. The closing party might misappropriate the funds, leaving the other party with no recourse.

- Stuck Payments: “Stuck payments” are transactions that aren’t promptly verified. Bitcoin prioritizes valid transactions, potentially causing delays in refunding stuck payments that can take days.

In Conclusion

- The Lightning Network could transform the payment industry with its quick and affordable transactions. It has the potential to introduce a new era of instant money transfers, similar to how we stream audio and video content today.

- As the Lightning Network continues to develop as a layer-two solution for various projects, more exchanges are adopting it. This makes it available to a wider audience of traders. Through these exchanges, traders can withdraw smaller amounts of Bitcoin faster and at a lower cost, even when Bitcoin is experiencing high congestion.

- Without the Lightning Network, Bitcoin transactions tend to be slow and expensive due to its standard technology. But with the Lightning Network in place, Bitcoin could replace traditional person-to-person transactions like credit card and cash payments with quick, fee-free options.

- While the Lightning Network still has some way to go before becoming fully operational, its importance cannot be overstated, especially considering the limitations of Bitcoin.

Disclaimer: This article is intended solely for informational purposes only and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, and Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”