Quick Breakdown

- Strategy acquired 390 BTC worth $43 million, expanding its total holdings to 640,808 BTC valued at $47.44 billion.

- The purchase was financed through the sale of STRF, STRK, and STRD shares, not MSTR stock.

- Bitcoin trades above $116,000, while markets await the FOMC decision and U.S.–China trade talks.

Strategy expands Bitcoin treasury with $43M addition

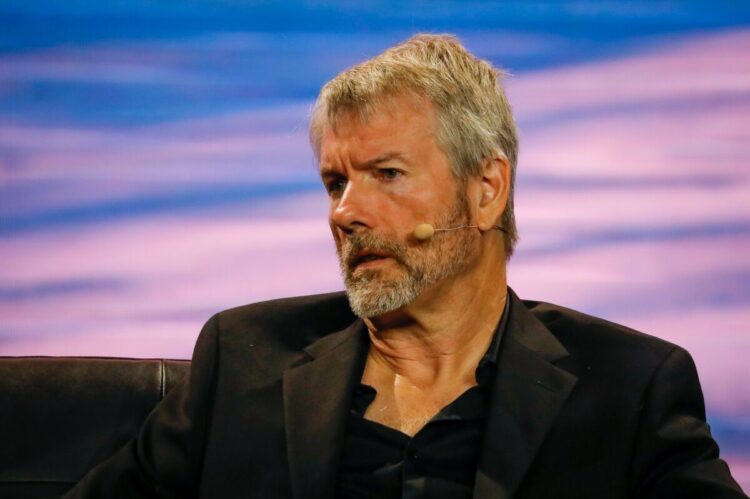

Michael Saylor’s business intelligence firm, Strategy, has continued its aggressive Bitcoin accumulation, announcing another multimillion-dollar purchase as the cryptocurrency’s price extends its rally.

According to a press release, the company acquired 390 BTC worth approximately $43 million at an average price of $114,562 per Bitcoin, strengthening its position as the largest corporate holder of BTC globally.

With this latest buy, Strategy’s total Bitcoin stash now stands at 640,808 BTC, valued at around $47.44 billion, with an average cost of $74,032 per coin. The firm also reported an impressive 26% year-to-date (YTD) return on its BTC portfolio.

Saylor hints at purchase before official disclosure

The acquisition follows Michael Saylor’s trademark teaser on X, where he posted Strategy’s Bitcoin tracker with the caption, “It’s Orange Dot Day.”

It’s Orange Dot Day. pic.twitter.com/5FSGmxwoNS

— Michael Saylor (@saylor) October 26, 2025

\

Interestingly, the latest purchase wasn’t funded by selling MSTR shares, Strategy’s publicly traded stock. Instead, the company raised about $44.7 million by offloading other share classes—STRF, STRK, and STRD, as confirmed in an SEC filing.

This move marks the firm’s third straight weekly Bitcoin purchase after a short break earlier in October. Just last week, Strategy picked up 168 BTC worth $18.8 million, continuing its disciplined accumulation strategy.

Bitcoin and MSTR continue momentum ahead of key economic week

Strategy’s Bitcoin buying spree coincides with a bullish streak in the crypto market. Bitcoin has surged to $116,000, maintaining three consecutive days in the green. Meanwhile, MSTR shares climbed nearly 2%, trading around $289, according to TradingView data.

The market’s focus now shifts to a crucial economic week featuring the FOMC meeting on October 28–29, where investors anticipate potential Federal Reserve rate cuts that could influence crypto prices.

Meanwhile, Micheal Saylor stated during CNBC Closing Bell Overtime that Bitcoin could be poised for another strong rally toward the end of 2025 as corporate and institutional demand continues to absorb the market’s natural supply. Saylor said that large corporations and ETFs are buying more Bitcoin than miners are producing, creating a sustained supply squeeze.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”