Quick Breakdown

- Rising inflation and weak currencies are driving stablecoin adoption in Africa, as dollar-pegged coins offer stability and faster cross-border payments.

- Adopting stablecoins for remittances cuts costs significantly and speeds up transfers. Many businesses are beginning to use stablecoins for trade and payroll efficiency.

- Regulation and trust will determine the sustainability of stablecoin adoption in Africa.

The Rise of Dollar-Pegged Digital Money in Africa

To understand the growing wave of stablecoin adoption in Africa, it helps to start with the continent’s economic reality. Across many nations, inflation and currency instability continue to erode purchasing power, leaving people searching for a safer way to save and transact. Sending money across borders doesn’t make things easier. Remittances remain slow and expensive, with high fees eating into even the smallest transfers.

At the same time, Africa’s mobile-first culture has produced millions of people who are more comfortable with digital wallets than traditional banks. This digital familiarity has made stablecoin adoption a natural evolution. With their speed, low transaction costs, and global accessibility, stablecoins are filling real gaps in economies where stability and inclusivity are often out of reach. The result is a quiet but powerful shift in how Africans store, move, and trust money.

Africa’s Stablecoin Boom

Across the continent, stablecoin adoption in Africa has moved beyond a niche crypto trend—it’s becoming a genuine financial movement. The reason is simple: local currencies fluctuate, U.S. dollars are hard to access, and people need something more reliable. Stablecoin bridges that gap by offering digital money that moves quickly, holds its value, and is easier to use than foreign bank accounts or cash.

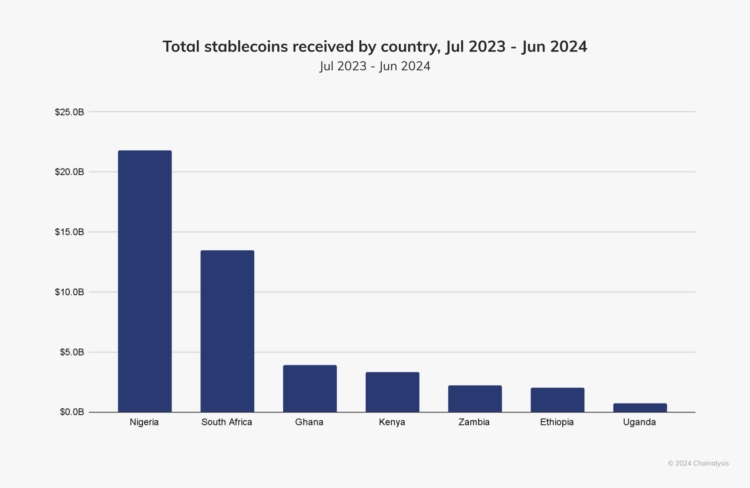

Nigeria stands out as one of the strongest examples. Between July 2023 and June 2024, stablecoins accounted for about 40% of all crypto inflows, according to Chainalysis. This shows how citizens are adapting to inflation and limited foreign exchange access.

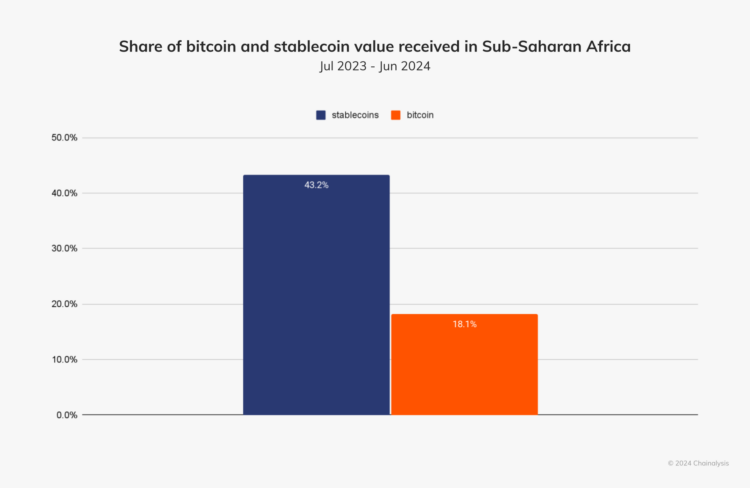

In places like Gabon, traders use stablecoins to settle cross-border transactions when dollar liquidity is low or too costly. Today, they make up roughly 43% of all crypto transaction volumes in Sub-Saharan Africa, clear evidence that they’ve become everyday financial tools rather than speculative assets.

One of the most tangible benefits of how stablecoin works is seen in remittances. Africa is still one of the most expensive regions to send money to, with transfer fees averaging around 8%. Stablecoins tackle this challenge by allowing funds to move across borders within minutes and at a fraction of traditional costs.

Businesses are also embracing the change. Small and medium-sized enterprises now use stablecoins to pay suppliers, manage payroll, and protect themselves against currency risks. Freelancers and remote workers receive international payments faster, bypassing the long delays that come with traditional banks.

Fintech platforms are catching on, too. Many now integrate stablecoins directly into local payment systems, allowing instant conversion between stablecoins, mobile money, and local currency. This is how stablecoin works in practice—connecting the global reach of digital assets to the everyday realities of African commerce.

The Inflation Escape Route: Currency Risk Insurance

For millions across Africa, stablecoin adoption has become a digital safety net—a way to protect hard-earned savings from inflation and currency collapse. Unlike other volatile cryptocurrencies, stablecoins maintain steady value, often pegged to the U.S. dollar. This stability makes them an attractive option for people looking to save in something predictable.

Traditionally, those with means turned to real estate or foreign accounts to preserve wealth, but these options remain out of reach for many. Stablecoins now fill that gap, offering easy, digital access to dollar value without the barriers of traditional finance.

Still, this convenience comes with its own challenges. The trust users place in stablecoins depends on issuers maintaining transparency and full reserves. Any cracks in that trust could undermine the entire system.

Yet, for most everyday users, how stablecoins work is simple: they provide stability in an unpredictable economy. In regions where prices rise faster than wages, holding stablecoins can mean the difference between safeguarding value and watching it vanish.

Why Africa Might Lead the Next Phase of Digital Money

Global financial trends are setting the stage for stablecoin adoption in Africa to lead the next wave of digital transformation. Standard Chartered projects that stablecoin adoption across emerging markets could redirect up to $1 trillion from traditional bank deposits within the next three years.

Global trends suggest that stablecoin adoption in Africa could shape the next major phase of digital finance. Africa, with its strong fintech ecosystem and mobile-first infrastructure, is especially well-positioned for this shift.

Part of what makes stablecoin adoption so appealing is its simplicity. People can hold value in a dollar-pegged token, transfer it instantly, and convert it into local currency whenever needed, without relying on unstable banks or costly middlemen. This practical use case has made stablecoins for remittances a breakthrough innovation, lowering costs and making cross-border payments faster for millions of families who depend on them.

Also Read: How Blockchain Facilitates Global Remittance and International Trade

Beyond individuals, businesses and startups are reaping the rewards of this transformation. Importers settle invoices more easily, and freelancers receive global payments without friction. Stablecoin adoption in Africa is proving to be a bridge between local economies and the global financial system.

Looking ahead, Africa could serve as a model for how emerging markets adopt digital money at scale. If regulators and innovators can strike the right balance between trust, transparency, and inclusion, stablecoin adoption in Africa could do more than reshape its finance; it could redefine how digital money works around the world.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.