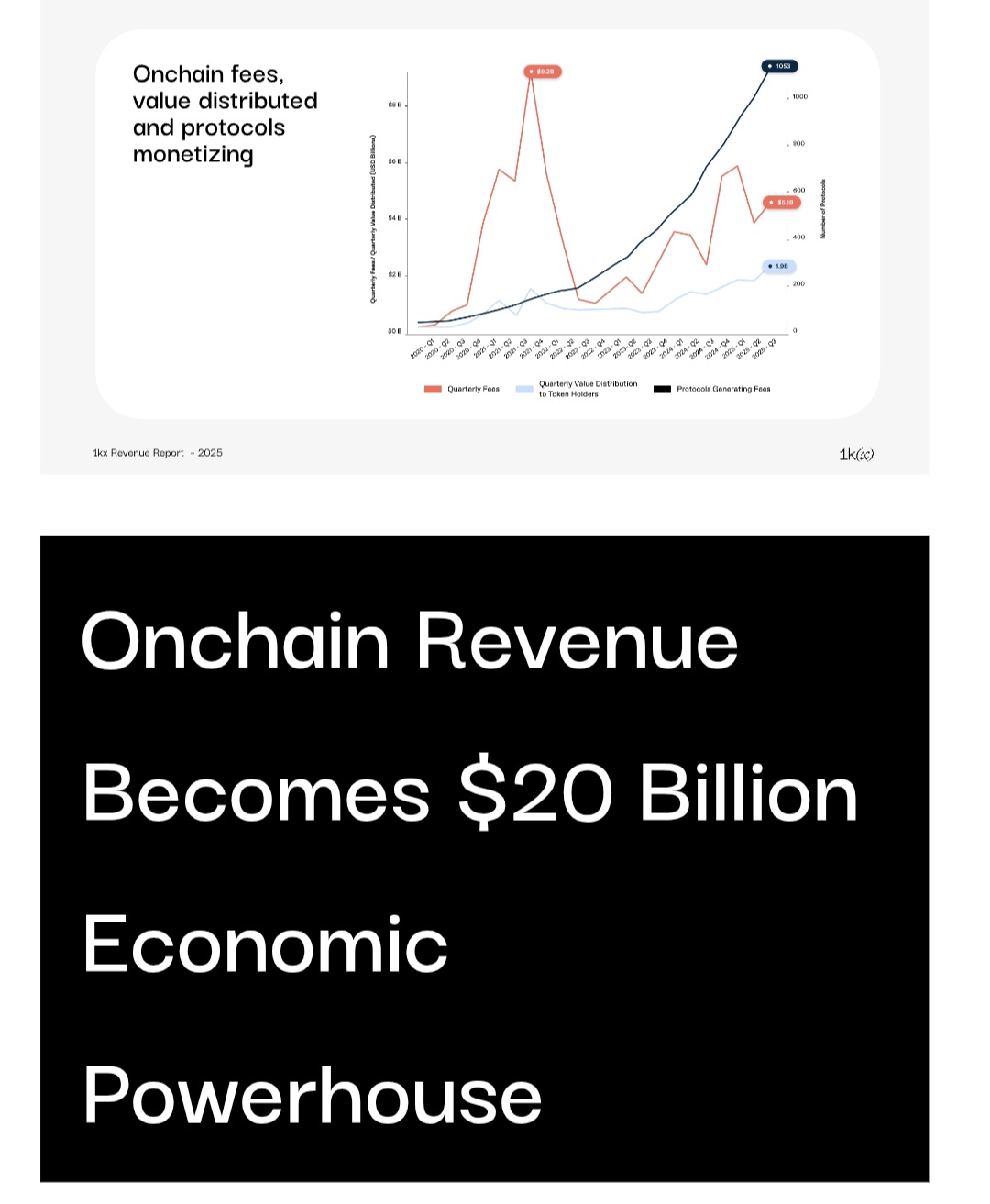

Blockchain venture firm 1kx has released its inaugural Onchain Revenue Report, revealing that users paid a record $20 billion in on-chain fees in 2025. The analysis, covering over 1,000 protocols, shows decentralized finance (DeFi) leading the surge, with applications driving revenue growth while transaction costs have dropped sharply.

DeFi dominates on-chain revenue

According to the report, fees totaled $9.7 billion in the first half of 2025 alone, marking the second-highest level since H2 2021. Unlike previous periods, when high Proof-of-Work costs inflated fees, today’s revenue comes primarily from applications such as DeFi platforms, decentralized infrastructure projects (DePIN), wallets, and consumer-facing apps. Application usage jumped 126% year-over-year, reflecting growing mainstream adoption of blockchain technology.

Robert Koschig, Head of Economics at 1kx, highlighted that “on-chain fee generation provides a clear, quantifiable metric of a protocol’s real-world utility and economic value,” stressing its importance for investors seeking transparency and measurable adoption trends.

Efficiency and innovation fuel growth

The report emphasizes that infrastructure improvements have reduced transaction costs by more than 90% compared to 2021, enabling higher adoption and broader participation. The top 20 protocols accounted for 70% of total revenue, yet the report notes that nimble innovators can quickly disrupt incumbents due to blockchain’s rapid scalability.

High-growth areas identified include tokenization, DePIN, wallets, and consumer applications, while regulatory easing has encouraged institutional participation. Looking ahead, 1kx projects that on-chain fees could grow 60% year-over-year in 2026, exceeding $32 billion, driven largely by applications.

1kx plans to release these reports semi-annually to provide insight into cost efficiency, user engagement, and investor demand, offering a transparent view of on-chain economic activity that is increasingly shaping blockchain valuations.

In parallel, Bybit’s latest DeFi report highlights that real-world assets (RWA) and decentralized exchanges (DEXs) are now key drivers of DeFi growth, signaling a shift from the speculative boom of 2020 toward institutionally-driven, practical use cases.

If you want to read more news articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”