Quick Breakdown

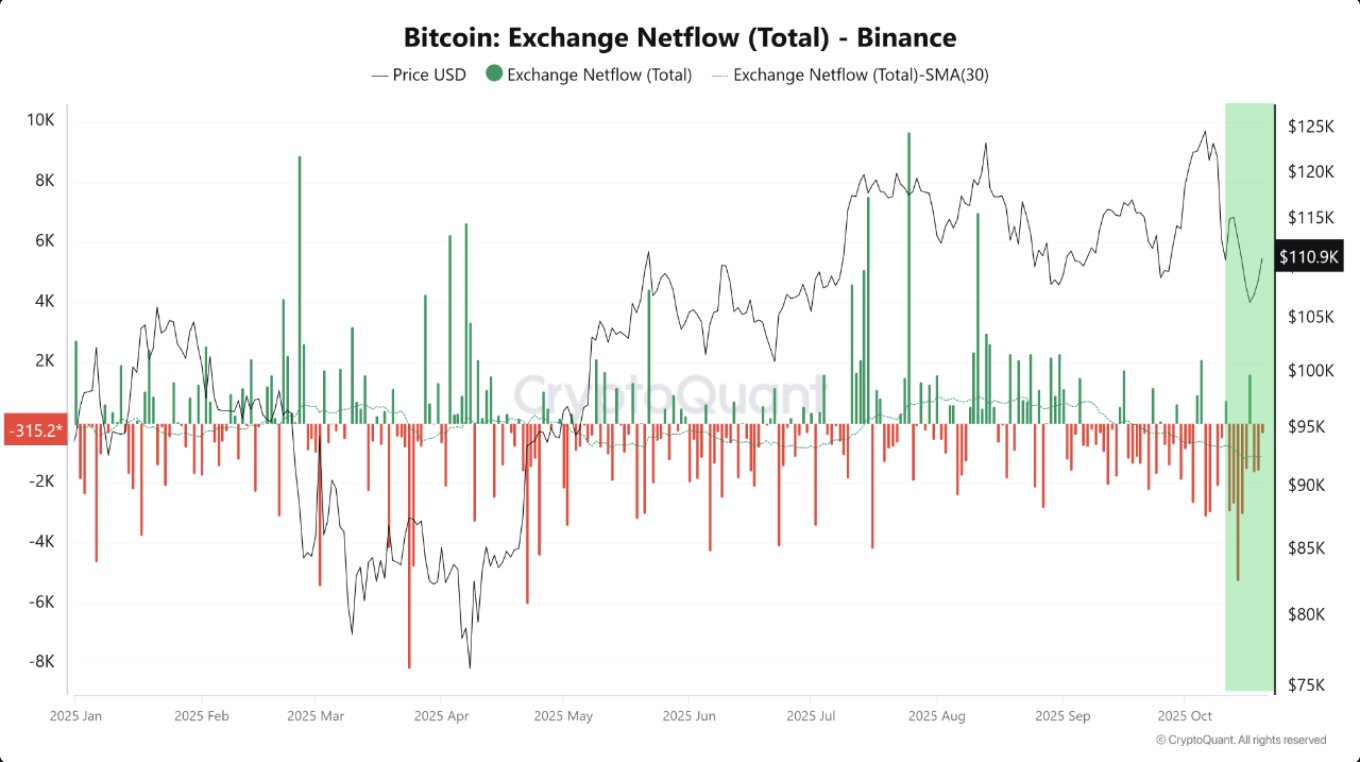

- Bitcoin outflows from Binance surge, signaling reduced selling pressure and strong accumulation.

- The 30-day average shows sustained negative netflows, indicating investor confidence.

- Analysts link this trend to a bullish phase as more BTC holders opt to keep assets off exchanges.

Bitcoin investors appear to be shifting from short-term trading to long-term holding as data from CryptoQuant shows a sharp decline in BTC inflows to Binance, suggesting waning selling pressure and renewed accumulation momentum across the market.

More bitcoin leaving exchanges than entering

According to on-chain data, Binance’s Bitcoin Netflow has remained strongly negative over recent weeks when measured by the 30-day moving average (SMA30). The sustained outflow trend indicates that more Bitcoin is being withdrawn from exchanges than deposited — a signal often interpreted as accumulation behavior.

Analysts note that while daily inflows and outflows can fluctuate, the longer-term moving average offers a clearer picture of investor sentiment. The consistent decline in exchange balances suggests traders are opting to move their holdings into private wallets or long-term storage rather than keeping them available for sale.

Declining selling pressure hints at market confidence

Historically, extended periods of negative exchange netflow have coincided with bullish accumulation phases, often preceding major market uptrends. The current trend implies that investors are positioning for potential future gains rather than short-term liquidation.

Meanwhile, retail and institutional participants appear aligned in the broader move toward holding, as market volatility stabilizes and macroeconomic uncertainty subsides. Analysts see this as a positive signal for Bitcoin’s near-term price trajectory, reinforcing confidence in the asset’s long-term value.

Data from CryptoQuant underscores that the 30-day trend rather than daily fluctuations offers a more reliable gauge of market behavior. At present, that trend points clearly toward continued accumulation. These movements typically reflect coins being transferred into cold storage, staking pools, or institutional custody, reducing liquid supply.

However, Bitcoin may be regaining ground technically. According to CryptoQuant contributor İbrahim Coşar, BTC has reclaimed its 50-day exponential moving average (EMA), a level that has historically marked the start of short-term rallies. If sustained, this could provide bullish momentum to counterbalance the current reserve-driven caution.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”