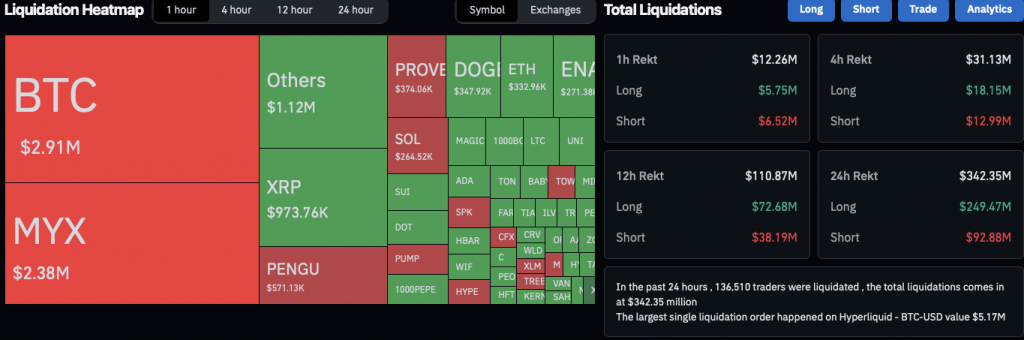

On August 10, 2025, Coinglass data showed that the crypto market faced a huge $343 million liquidation in just 24 hours, impacting Bitcoin, Ethereum, and other major altcoins. This event grabbed attention because it highlighted both the potential rewards and the risks of trading in volatile markets.

But what is crypto liquidation? Crypto liquidation is when an exchange automatically sells a trader’s collateral to cover losses after their leveraged position falls below required margin levels.

Understanding what triggers such crypto liquidations and their effects is essential for anyone involved in crypto, from casual traders to professional investors. This analysis looks at the causes, their impact on market sentiment and liquidity, and the key lessons for managing risk and making informed trading decisions.

What Triggered the Event

The crypto liquidation was precipitated by a sudden market correction, with Bitcoin’s price dropping from over $117,900 to near $106,500, leading to significant liquidations in long positions across various assets. Ethereum also experienced a notable decline, with its price falling from over $4,300 to approximately $4,168.29 during the same period.

These rapid price movements triggered automated liquidations, amplifying the downward pressure on the market.

A substantial number of traders had also taken on high-leverage trading, betting on continued price increases. When the market reversed, these positions were automatically liquidated, exacerbating the price decline.

Data from Coinglass indicated that long positions accounted for a significant portion of the crypto liquidations, highlighting the risks associated with overleveraging in volatile markets.

One of the biggest triggers was the mix of economic and political developments that rattled investor confidence. The Federal Reserve’s decision to keep interest rates unchanged sent a strong signal that the economy may not be as resilient as expected. Commonly, unchanged rates are seen as supportive, but in this case, the move came against the backdrop of disappointing job data.

The Bureau of Labor Statistics reported only 73,000 new jobs in the latest nonfarm payrolls report, far below expectations. The weak data fueled concerns about slowing growth. When President Trump abruptly fired BLS Commissioner Erika McEntarfer over the results, it only deepened the sense of instability in financial markets.

How Crypto Liquidations Cascade

When traders use leverage to amplify their positions, they borrow funds from exchanges, promising to maintain a minimum collateral level. If asset prices fall, this collateral weakens. Once it dips below the required threshold, exchanges automatically issue margin calls and liquidate positions to recover their loans. This process isn’t optional; the selling happens instantly, regardless of market conditions.

The problem is that forced selling doesn’t happen in isolation. On major exchanges and derivatives platforms, a wave of margin calls can trigger a chain reaction. As positions get liquidated, they push prices even lower, which in turn forces more positions into crypto liquidation. This domino effect spreads quickly across exchanges, especially given the interconnected nature of crypto derivatives markets.

Leverage and thin liquidity further amplify the problem. In highly leveraged markets, even a modest price move can wipe out positions, leading to outsized liquidations. Meanwhile, when liquidity is shallow, meaning there are fewer buyers and sellers active, large liquidation orders have a disproportionately large effect on prices. Together, these dynamics turn what might have been a manageable dip into a full-blown cascade, as we saw with the $343 million wipeout.

Impact on Short- and Long-Term Market Sentiment

Large-scale crypto liquidations can significantly impact how traders and investors perceive the market, both in the short and long term.

Immediate Panic and Volatility in the Affected Markets

In the hours following the $343 million liquidation, prices of Bitcoin, Ethereum, and major altcoins swung sharply as traders rushed to exit positions or buy into sudden dips.

This kind of market volatility often creates knee-jerk reactions, with retail investors panic-selling while opportunistic traders try to “buy the dip.” The result is a market volatility that feels unstable and unpredictable, even for seasoned participants.

Influence on Investor Confidence and FOMO/FUD Cycles

Events like this deepen emotional trading cycles. For some investors, the scale of the crypto liquidation fuels fear, uncertainty, and doubt (FUD), leading them to hesitate before re-entering the market.

For others, sharp sell-offs present an opportunity to buy assets at discounted prices, sparking a fear of missing out (FOMO). These opposing reactions create an environment of heightened speculation rather than rational decision-making, which can further destabilize short-term sentiment.

Potential Effects on Longer-Term Trends and Institutional Interest

While short-term panic is familiar, the lasting impact depends on how the market recovers. If liquidations expose fragility, such as thin liquidity or excessive leverage trading, it can deter institutional players who prefer more predictable environments.

On the flip side, institutions may also view these sell-offs as opportunities to accumulate assets at lower valuations.

In the longer term, repeated liquidation cascades can either slow down mainstream adoption or encourage exchanges to tighten risk controls, influencing how both retail and institutional investors approach crypto markets.

Lessons for Traders

Every major crypto liquidation event serves as a reminder that smart trading isn’t just about profits; it’s about protecting capital.

Importance of Risk Management and Position Sizing

Never overextend on leverage or put too much capital into a single trade. Keeping positions manageable helps cushion against sudden price swings.

Effective Use of Stop-Losses and Hedging Strategies

Setting stop-losses and using tools like options or stablecoins can limit downside risk and protect portfolios during unexpected market volatility.

Learning from High-Profile Liquidation Events to Prevent Future Losses

Studying past liquidation waves shows the dangers of chasing trends without safeguards, helping traders make more disciplined choices moving forward.

Conclusion: What This Says About Crypto Market Maturity

The $343 million liquidation highlights how fragile the crypto market can become under stress. Rapid sell-offs, fueled by leverage trading and cascading crypto liquidations, reveal that many traders still underestimate risk. These events expose structural vulnerabilities such as thin liquidity on exchanges and the outsized influence of whale movements.

At the same time, each cycle brings valuable lessons that push the industry toward greater resilience. More sophisticated risk management tools, growing institutional involvement, and better exchange safeguards signal progress toward maturity. While volatility is far from gone, the market’s ability to absorb shocks and adapt will ultimately determine how prepared it is for long-term growth.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”