The growth of Web3 has brought innovation in areas like DeFi, NFTs, and DAO and yet, behind the excitement lies one of the biggest challenges facing the ecosystem: security. Smart contracts, which power nearly every Web3 application, are both a strength and a weakness. They tend to automate trust, but they are also vulnerable to hacks, exploits, and poor coding. As more money flows into crypto systems, the cost of failure becomes massive.

In 2025, Web3 security has evolved from a technical issue to a major area of investment. Understanding smart contract risk, DeFi insurance, audits, and blockchain security investment is key for anyone who wants to see this space grow safely.

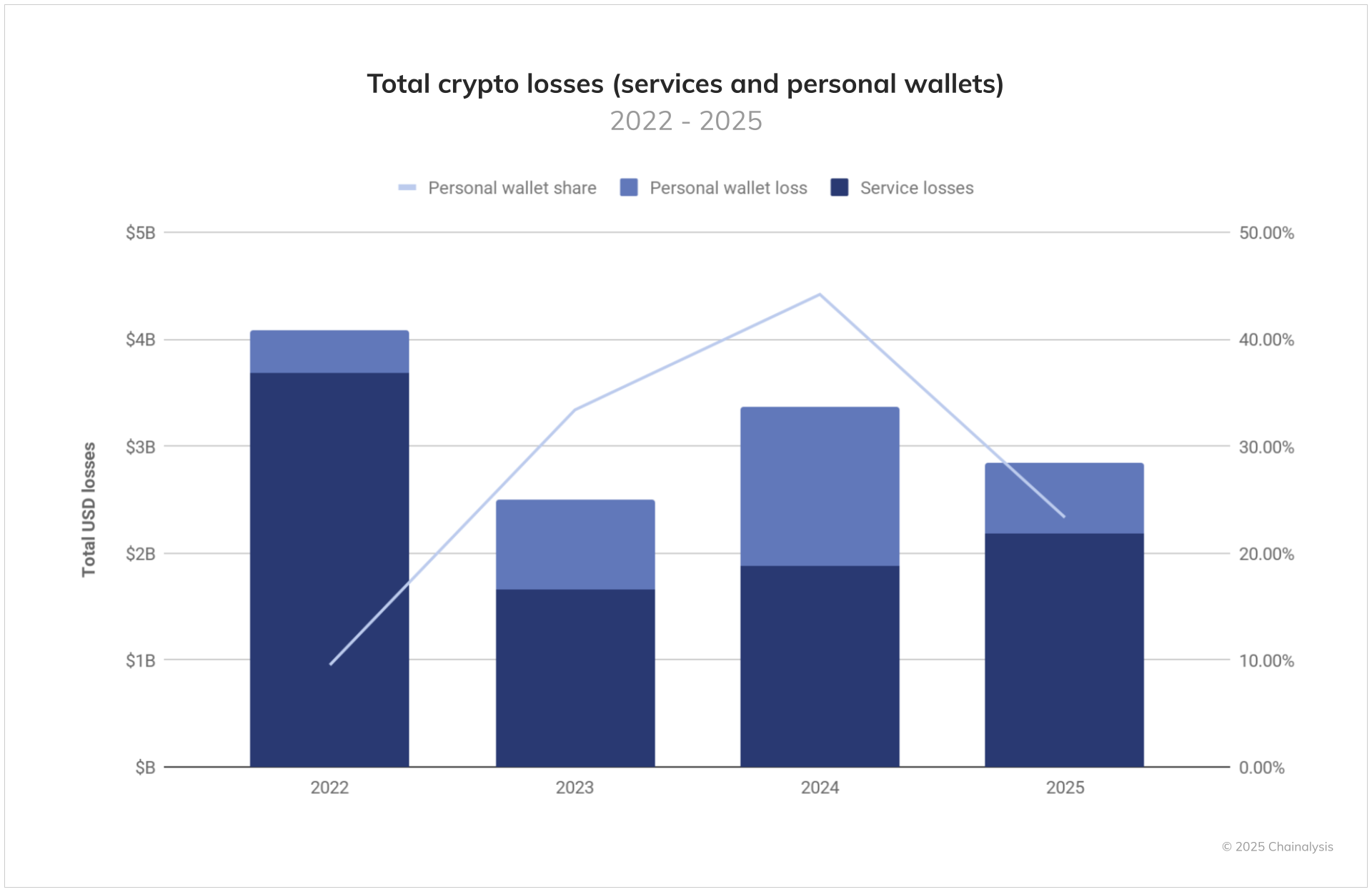

Cost of exploits and hacks in 2025

The numbers tell a very clear story, and in 2025 alone, billions of dollars have been lost to smart contract exploits. Hackers continue to find weaknesses in protocols, often draining funds in minutes. Famous hacks such as the Wormhole and Ronin bridge breaches in previous years showed how vulnerable systems can be, and new incidents keep reinforcing the same lesson.

The single largest incident was the Q1 Bybit hack, in which attackers drained nearly $1.5 billion. The incident alone accounted for 83% of Q1’s total losses, highlighting the catastrophic risks associated with compromised access control systems. In total, access-control exploits dominated the landscape, accounting for approximately 59% of all funds lost, or around $1.83 billion, across DeFi and CeFi platforms.

RELATED: Biggest Hacks and Exploits in DeFi History & What We Can Learn From Them

The cost is not only financial, as every time a hack occurs, trust in the ecosystem takes a hit, and retail investors feel less confident about investing in DeFi protocols, while institutional investors become cautious. Web3 security is now one of the most discussed topics in the industry because without it, adoption stalls.

Smart contract risk arises when a contract is not coded perfectly, unlike traditional software bugs that can be patched; errors in deployed contracts are often permanent. Once a vulnerability is exploited, it cannot be undone. This permanence is part of what makes blockchain powerful, but it also means risk is baked into the system. As a result, risk management is now seen as a crucial part of building sustainable crypto products.

Rise of DeFi insurance providers

With security risks growing, DeFi insurance has started to play a bigger role. Just as traditional finance uses insurance to cover losses, the Web3 world now relies on decentralized insurance providers. These protocols allow users to buy protection against smart contract failures or exchange hacks. If something goes wrong, policyholders receive payouts to cover some or all of their losses.

The rise of DeFi insurance providers reflects the demand for safety nets in the crypto market. Nexus Mutual, Unslashed, and InsurAce are examples of platforms that built this model, and newer players are entering with more advanced products. In 2025, these providers are expanding coverage beyond single protocols to entire categories, such as lending platforms, bridges, or yield farms.

This shift is important because it shows that security is no longer seen only as a technical task, but also as a financial service. Users now want to balance their exposure by combining audits, protocol reputation, and insurance coverage. The growth of DeFi insurance also shows that investors are willing to pay for peace of mind, even in a decentralized world.

RELATED: Can DeFi Insurance Products Solve the Problem of Rug Pulls?

RELATED: Is Web3 Finally Solving Its Risk Problem? A Market Review of DeFi Insurance Models

Investment in security-first protocols

One of the most important changes in 2025 is the focus on security-first protocols. Builders and investors are starting to prioritize blockchain security investment, treating it as the foundation for growth. Projects are raising funds specifically for audits, security reviews, and continuous monitoring systems.

Audits are a key part of this process because, before a protocol goes live, third-party teams analyze the code for errors and vulnerabilities. While audits cannot guarantee safety, they reduce the chances of catastrophic flaws. In 2025, continuous auditing and onchain monitoring tools are becoming standard. Rather than a one-time event, security is treated as an ongoing responsibility.

RELATED: Blockchain Security: The Importance of Smart Contract Audits

Investors are also rewarding projects that demonstrate strong security practices. A protocol with well-known auditors, clear security documentation, and a transparent bug bounty program is more likely to attract funding. Security-first thinking is shaping how capital is allocated across the industry.

The long-term result of this trend is that protocols that take shortcuts on security find it harder to survive. Communities and investors are learning from past mistakes, choosing to back projects that invest in safety from the start. In this sense, Web3 security has shifted from being a cost to being a competitive advantage.

Why this matters for the future

As Web3 matures, the focus on security is proof that the industry is learning. The early years of crypto were marked by speed and experimentation, often at the cost of safety. Now, the size of the market and the value of assets at risk have made risk management a central component of growth.

For users, this means safer choices and better protection, and for developers, it means higher standards and more responsibility. For investors, this means looking at Web3 security as a key part of due diligence.

The future of Web3 depends on trust, and trust can only be built when systems are safe. And by addressing smart contract risk, supporting DeFi insurance, and investing in security-first protocols, the industry is moving toward a more stable and reliable foundation. In 2025, Web3 security is not just a technical detail but the heart of long-term adoption.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”