Sending money across borders is one of the most important financial services in the world, with many families relying on remittances for food, healthcare, and education. Migrant workers send billions of dollars each year to support loved ones back home, yet traditional remittance services remain expensive and slow.

Web3 startups are emerging to step in, utilizing crypto payments and blockchain finance to redefine how money flows globally.

High Costs of Traditional Remittance Services

Traditional remittance providers such as banks and money transfer companies often charge high fees. A worker in Europe who wants to send $200 to his family in Africa might pay up to 10% of that amount in fees, and on top of that, exchange rates can be unfavourable, further reducing the amount that reaches the receiver. These services also take time, and in some cases, it can take several days for money to reach its destination.

For people living paycheck to paycheck, every dollar matters because high remittance costs can make it harder for families to cover basic needs. According to the World Bank, the average cost of sending remittances worldwide still hovers around 6%. While this may not sound like much, when billions of dollars are being transferred, it represents a significant barrier.

Crypto-based Remittance Startups are Solving Inefficiencies

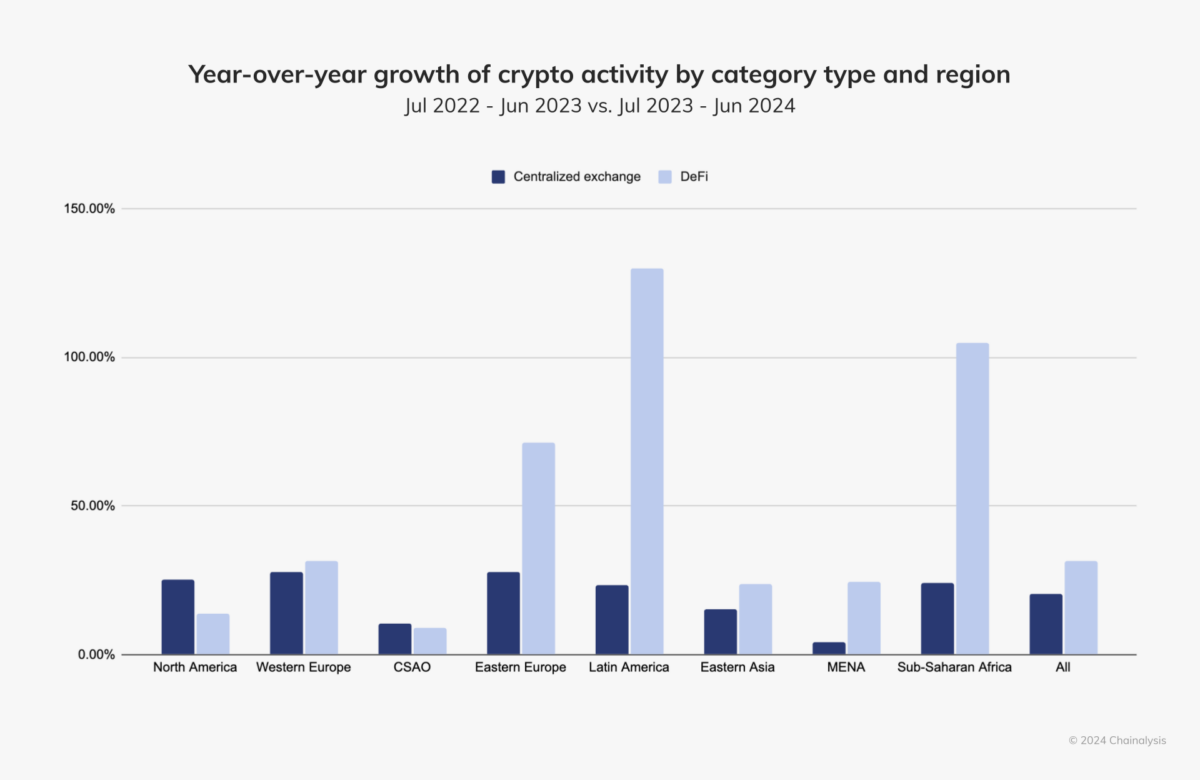

Adoption of crypto remittances in 2025 is accelerating in countries where financial infrastructure is underdeveloped and remittance dependence is high. Sub-Saharan Africa, Southeast Asia, and Latin America have become testing grounds for Web3 remittance solutions.

- Nigeria: Remittance inflows reached over $20 billion last year, and with high youth adoption of crypto, startups offering stablecoin remittances tied to mobile money wallets are scaling quickly.

- Philippines: One of the world’s top remittance markets, the country is seeing rising adoption of blockchain-powered transfers, driven by younger workers abroad who are digitally fluent.

- El Salvador: Having already legalized Bitcoin as legal tender, the government is encouraging startups that use blockchain rails to boost remittance inflows, which account for a quarter of GDP.

These markets demonstrate how blockchain-enabled transfers not only save money but also expand access to financial inclusion, particularly for unbanked populations that heavily rely on mobile money.

Competitive Landscape and Regulation

Traditional players like Western Union and MoneyGram are facing pressure as crypto-native startups undercut fees and settlement times. In response, some incumbents are piloting stablecoin partnerships, while others risk losing market share in regions where Web3 startups have gained traction.

Governments, meanwhile, remain divided, as some regulators view crypto remittances as a means to increase efficiency and attract foreign investment, while others remain cautious due to concerns over AML (anti-money laundering) compliance and currency controls. By 2025, it’s clear that regulation, whether enabling or restrictive, will be a decisive factor in shaping growth trajectories.

Outlook for 2025 and Beyond

The remittance market is valued at over $700 billion globally, and even incremental shifts toward blockchain-powered transfers represent billions in savings for families. If adoption continues at its current pace, Web3 startups could capture a significant share of remittance flows in the next five years, especially in high-volume corridors across Africa, Asia, and Latin America.

Looking ahead, the global remittance market is likely to see even more disruption. If Web3 startups continue to grow, they could challenge the dominance of long-standing providers such as Western Union. The use of stablecoins also plays a big role because, unlike Bitcoin or Ethereum, stablecoins are pegged to national currencies like the US dollar, which makes them less volatile. This stability makes them more attractive for everyday money transfers.

Another important development is the rise of decentralized identity solutions; in traditional finance, opening an account often required plenty of paperwork, but with Web3, identity verification can be tied to blockchain records, making it easier for people without formal bank accounts to access financial services. This could open the door for millions of unbanked people worldwide to participate in the global remittance market.

The combination of blockchain finance, crypto payments, and mobile integration could transform remittances into a faster, cheaper, and more inclusive system. However, challenges remain. Startups need to overcome technical hurdles, win user trust, and navigate regulatory landscapes that vary from country to country. Security is another key concern, as hackers have occasionally targeted cryptocurrency platforms.

Despite these obstacles, the momentum behind Web3 remittances remains strong, with an increasing number of people experiencing its benefits, and adoption is likely to accelerate. Families who once waited days and paid high fees may soon be able to send and receive money in minutes at a low cost.

The global remittance market is not just about numbers on a screen; it represents food on the table, school fees paid, and medical bills covered. By disrupting money transfers, Web3 startups are creating a real-world impact that could improve lives in significant ways. If this trend continues, blockchain finance may not only change how money moves but also reshape global financial inclusion for the better.

The trend is clear: in 2025, crypto remittances will no longer be a niche experiment; they will be a competitive alternative to legacy systems, and the winners in this space will be those who combine regulatory compliance with user-friendly platforms that enable crypto to operate seamlessly in the background.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”