Stablecoins are quickly becoming a key part of Latin America’s digital economy. Their rise isn’t just about hype, but a practical, people-driven response to long-standing economic challenges in the region.

This article presents a detailed analysis demonstrating that the very instability that has historically plagued the region’s hyperinflation, currency devaluation, and financial exclusion is now serving as a powerful catalyst for its economic modernization.

Cryptocurrency in Latin America

Due to economic difficulties across Latin America, including high inflation in Argentina and currency controls in Venezuela, demand for dollar-pegged stablecoins has surged. These digital currencies are increasingly seen as practical tools for safeguarding savings and streamlining transactions.

A significant indicator of this trend is the upcoming Stablecoin Conference 2025 in Mexico City, which will be the first major event in Latin America dedicated exclusively to stablecoins.

The global crypto ecosystem is increasingly focused on Latin America’s expanding digital finance market, as evidenced by a significant conference held at the World Trade Center.

Spearheaded by Bitso, the region’s largest crypto exchange, the event features major participants like BitGo, Ripple, Polygon, Solana, and Arbitrum. This gathering highlights the deepening integration of stablecoins into mainstream financial services and signifies growing institutional acceptance of their value.

El Dorado Wants to Pioneer Latin America’s Financial Reawakening Through Stablecoin SuperApp Innovation

El Dorado’s creators have claimed it is spearheading a profound financial transformation in Latin America by leveraging stablecoin technology to address the persistent macroeconomic turbulence and infrastructural inadequacies crippling the region. Designed as a stablecoin-powered “superapp,” El Dorado offers seamless peer-to-peer trading, cross-border remittances, and merchant payments, with a primary focus on USDT and MountainUSD (USDM). Its swift rise—boasting over 1 million users and facilitating millions of transactions—reflects the urgent demand for alternatives to fragile local currencies suffering from hyperinflation and lackluster banking networks.

READ MORE: El-Dorado: Can a Stablecoin Superapp Really Fix Latin America’s Broken Financial System?

El Dorado’s holistic ecosystem merges self-custodial wallets, gasless transactions via Tron DAO, and Layer-2 scaling with Arbitrum, optimizing for speed, affordability, and user control.

Worth Mention: Latin America’s Soaring Crypto Exchange Growth

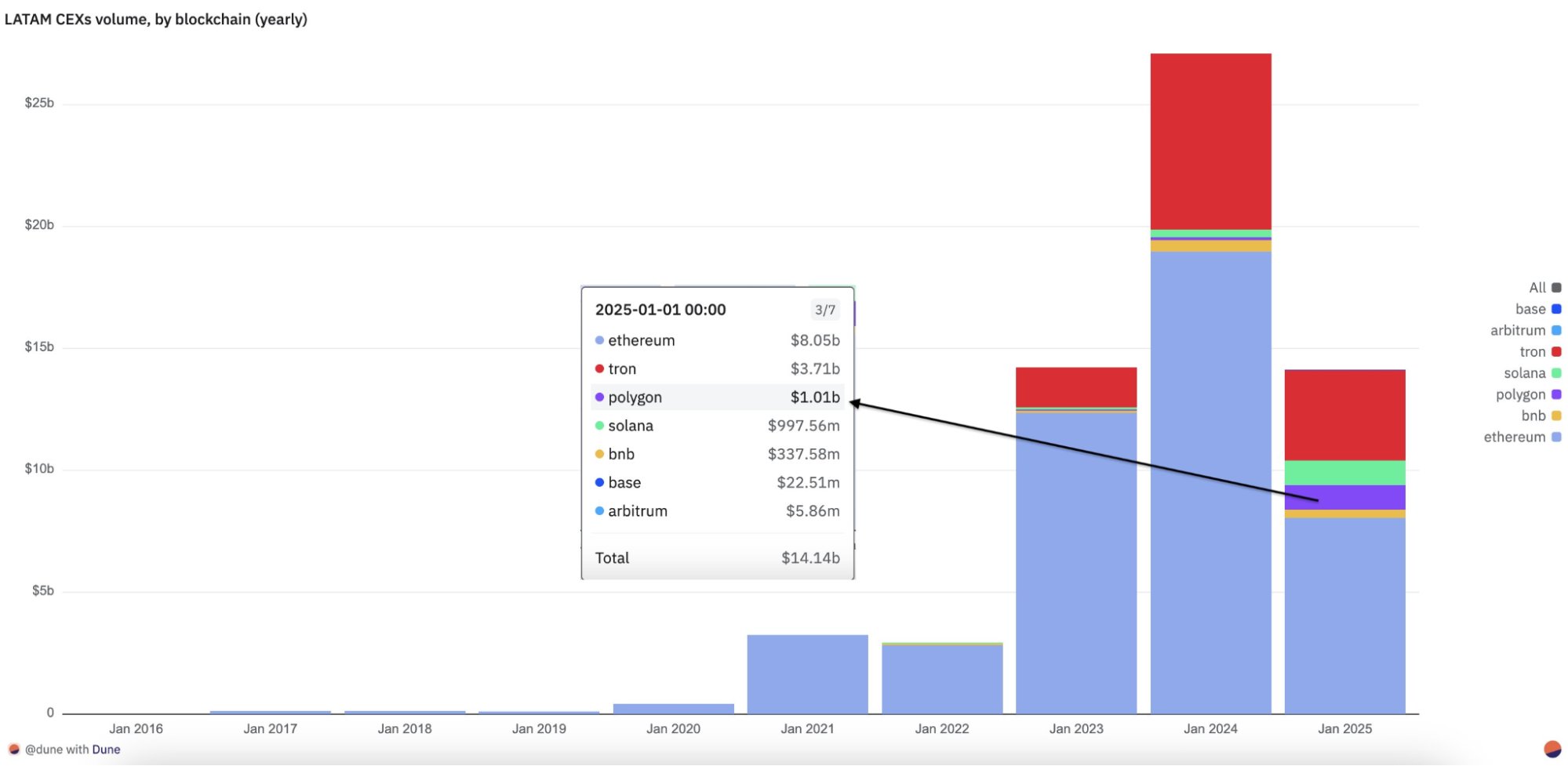

Reports from Dune Research indicate a ninefold surge in total flows, increasing from $3 billion in 2021 to $27 billion by 2024, demonstrating the region’s growing adoption of digital assets. Notably, Bitso has emerged as the dominant player, processing 93% of the LATAM market by 2024, and this expansion is primarily driven by practical applications, such as cross-border payments and currency hedging, rather than a bull market. Polygon, Ethereum and Tron are the leading networks for transactions, with stablecoins like USDC and USDT gaining popularity as a hedge against economic instability.

Security, Compliance, and Enterprise-Grade Infrastructure

Latin American firms are showing remarkable readiness and confidence in adopting stablecoins, with vast portions of businesses reporting adequate infrastructure and partnerships that support integration. Security prioritization is a key regional differentiator; half of enterprise respondents emphasize fraud protection as a top driver for adoption, surpassing global peers.

Complementing this, compliance with AML (Anti-Money Laundering) and KYC (Know Your Customer) remains a foundational requirement, ensuring that growth is sustainable and aligned with global standards.

RELATED: What is AML/KYC in Crypto?

Financial Inclusion: Bridging the Gap for the Unbanked

For the millions of unbanked individuals in Latin America, stablecoins have provided a direct on-ramp to the global financial system. With only a smartphone and internet access, individuals can create a digital wallet and conduct transactions without needing a traditional bank account. This is particularly valuable for gig economy workers and freelancers who can receive payments in a stable currency, bypassing the volatility of their local fiat.

Companies like Chipi Pay in Mexico are actively targeting this population by offering self-custodial stablecoin wallets accessible via email, while others are using stablecoins for compliant payroll solutions to pay remote workers across borders. The ability to receive a salary or save money in a stable, U.S. dollar-pegged asset fundamentally changes the financial security of individuals and small businesses, creating a powerful feedback loop where utility-driven adoption encourages further ecosystem development.

RELATED: Crypto Isn’t Perfect – But it’s the Best Shot We’ve Got at Rewriting Finance

The Future Outlook: Synergies and the Path Forward

The future of stablecoins in Latin America lies in continued integration with traditional finance. Stablecoins are not poised to replace banks but rather to fill the gaps where traditional institutions fall short, offering a more flexible and efficient 24/7 financial system.

From inflation-hedging to lowering barriers for cross-border commerce, stablecoins are not only transforming payments but also promoting financial sovereignty and inclusion. The dialogues and outcomes from Stablecoin Conference 2025 are expected to influence policy, partnerships, and technical development, laying the groundwork for a more inclusive and efficient financial ecosystem across the region.

In sum, gatherings like the Stablecoin Conference 2025 facilitate a nuanced understanding of emerging trends and the evolving media environment, which is essential for tailoring strategies that resonate with Latin America’s unique socio-economic contexts. The increasing prominence of stablecoins in Latin America epitomizes the region’s response to economic adversity with technological innovation.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.