Quick Breakdown:

- Ray Dalio warns that rising U.S. debt and the risks of Fed intervention could threaten dollar stability.

- Crypto and gold may gain as alternative stores of value amid fiscal pressures.

- Dalio highlights systemic risks from debt, geopolitics, and interventionist policies.

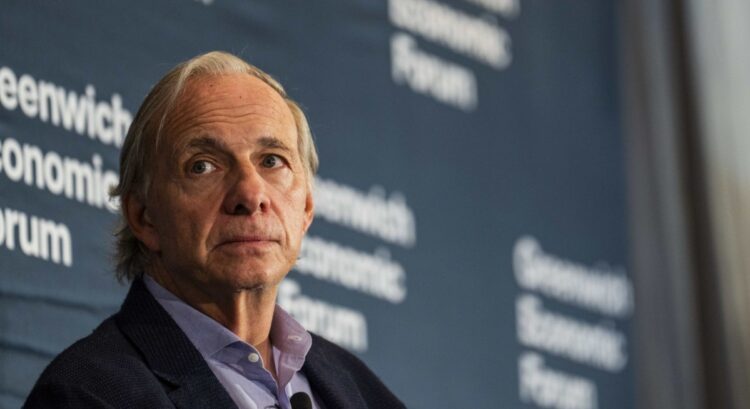

Ray Dalio, founder of Bridgewater Associates, has cautioned that mounting U.S. debt and political interference in monetary policy are accelerating a breakdown in the dollar’s credibility, creating a stronger appeal for alternative assets such as gold and cryptocurrencies.

Dalio made the remarks after criticizing the Financial Times for what he described as “mischaracterizations” of his written interview responses. In a direct release of his answers, Dalio highlighted debt, inflation, and the Federal Reserve’s weakening independence as central risks to the global financial order.

— Ray Dalio (@RayDalio) September 2, 2025

Debt Burden Threatens Monetary Order

According to Dalio, the U.S. faces a looming “debt-induced economic heart attack” within the next three years. He pointed to ballooning interest costs—now around $1 trillion annually—and the federal government’s need to refinance $9 trillion in debt while issuing trillions more to cover deficits.

He warned that this supply-demand imbalance in Treasuries could leave the Federal Reserve with two unpalatable options: allow rates to rise and risk defaults, or monetize the debt by printing money, which would weaken the dollar. Both outcomes, Dalio stressed, erode confidence in the U.S. financial system and diminish the dollar’s role as the world’s primary store of value.

Crypto Emerges as Alternative Store of Wealth

While rejecting the notion that stablecoins pose systemic risks, Dalio said the larger threat is the declining purchasing power of U.S. debt instruments. He argued that fiat currencies tied to heavy debt burdens will continue to lose value relative to “hard currencies” such as gold and cryptocurrencies.

“Crypto is now an alternative currency with limited supply,”

Dalio noted, adding that as dollar issuance rises and investor demand falls, digital assets stand to benefit. He likened today’s environment to the 1930s and 1970s, when traditional monetary orders faltered and investors sought inflation-resistant alternatives.

Notably, on a recent CNBC Master Investor podcast with Wilfred Frost, Dalio reaffirmed his support for Bitcoin, recommending a 15% allocation to either Bitcoin or gold as a hedge against fiscal instability and weakening dollar purchasing power.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”