Web3 is often described as the next phase of the internet, one where users take back control from centralized platforms. Built on blockchain technology, it promises a more open and democratic digital world, where individuals truly own their data, assets, and online experiences. No more gatekeepers. No more centralized control. Just open peer-to-peer platforms where anyone, regardless of background, could access and grow wealth.

Despite these ideals, a closer look reveals a different reality. Power in Web3 still tends to concentrate in the hands of a few major players, raising a crucial question: Is Web3 truly decentralized? Or is it just decentralization in name, with traditional power structures wearing a new face?

The Concentration of Wealth in Web3

Web3 arrived with a bold promise: to rewrite the rules of finance and distribute wealth more equitably through decentralized systems. But a closer look at the data reveals a very different story—one where power and resources remain concentrated in the hands of a few.

Let’s start with Ethereum, the cornerstone of the DeFi ecosystem. According to CoinCarp, the top 10 Ethereum wallets hold over 60.97% of all ETH in existence. Widen that to the top 100 wallets, and the number jumps to 72.70%.

That means a handful of large holders dominate the network’s wealth, while the vast majority of users, the everyday participants that Web3 claims to empower, are left with crumbs in comparison.

Bitcoin, often touted as the original symbol of financial liberation, isn’t immune either. In fact, if Bitcoin were a country, it would rank as the most unequal in terms of wealth distribution. A small number of addresses holding between 100 and 1 million BTC collectively control about 69% of the entire Bitcoin supply. Even more striking, just four addresses alone hold 662,463 BTC; a massive chunk of the network’s value locked up by a mere handful of wallets.

Related: Bitcoin and Wealth Inequality: Who Truly Benefits from Perpetual Price Increases?

This trend raises an uncomfortable but crucial question: Is Web3 fully decentralized? Is it genuinely democratizing finance, or is it quietly recreating the same inequalities it set out to dismantle? When a system built on decentralization ends up centralizing wealth, the vision of an inclusive financial revolution starts to look more like a rebranding of the old status quo.

Governance: Decentralized in Name Only?

At the heart of Web3’s promise lies the vision of decentralization not just of technology, but of power. Decentralized Autonomous Organizations (DAOs) are often showcased as the ultimate manifestation of this ethos, offering communities the ability to govern themselves through collective voting. In theory, every token holder has a voice, a vote, and a role in shaping the future of a protocol. But in practice? The picture looks very different.

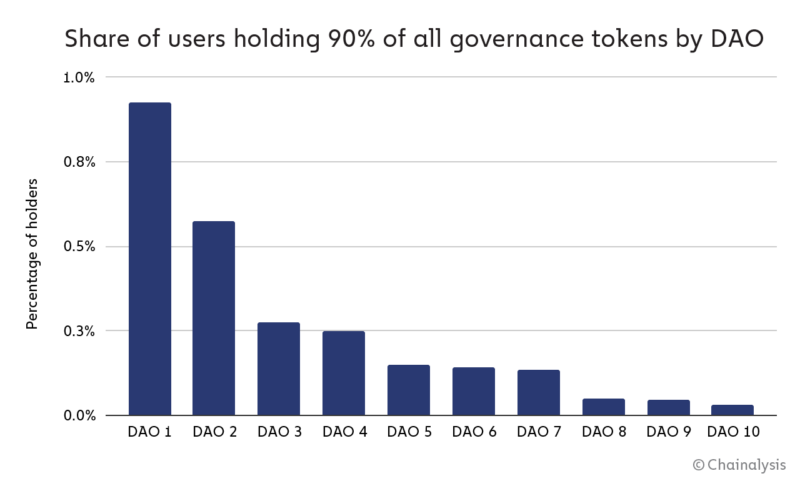

A report by Chainalysis peeled back the layers on ten major DAO projects and revealed a sobering truth: on average, less than 1% of all token holders control 90% of the voting power. That’s right—just a few participants hold nearly all the influence.

This centralization of control doesn’t just contradict the foundational ideals of DAOs; it actively replicates the very power imbalances Web3 was meant to disrupt. It invites scrutiny over DAO centralization and whether this governance structure is more symbolic than functional.

Why does this matter? Because in such a skewed system, governance becomes less about collective will and more about who holds the most tokens. Theoretically, a coordinated effort by a few top holders could override the will of the vast majority, rendering the “democratic” process a mere façade. And for the average token holder, this imbalance has ripple effects. Why participate in governance if your vote barely moves the needle? Why submit a proposal when the odds of it reaching a vote are slim to none?

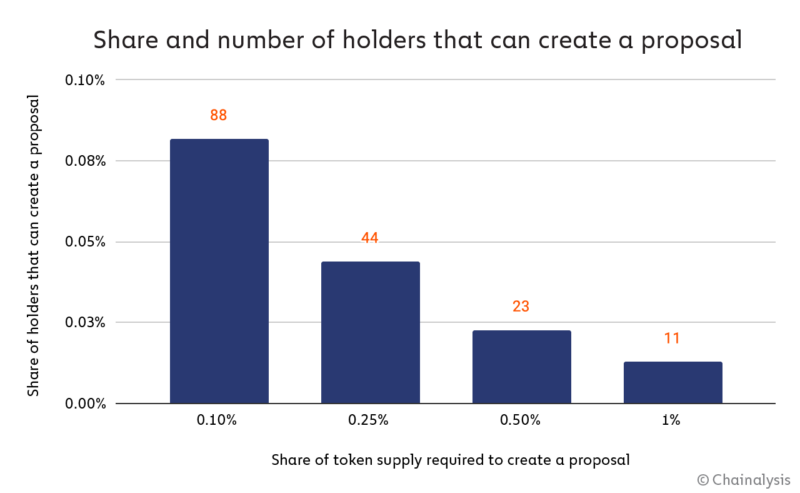

Chainalysis further highlights that within those same DAOs, only between 1 in 1,000 and 1 in 10,000 token holders possess enough tokens to even create a proposal. That’s a far cry from the open, accessible governance model often promised.

And in some cases, this imbalance isn’t just theoretical, it has led to real-world consequences. Consider Build Finance DAO, which fell victim to a hostile takeover. A single actor acquired enough tokens to pass a proposal granting themselves full control of the treasury. They drained the assets, walking away with everything. The rules were followed, but the spirit of decentralization was utterly broken.

These examples raise uncomfortable but necessary questions: What is the main goal of Web3—to decentralize power, or merely to redistribute influence among a new elite? If power continues to pool in the hands of a few, then DAOs may risk becoming new iterations of the old systems they sought to replace, just with a shinier, blockchain-based veneer.

The Role of Venture Capital: Gatekeepers of Web3

Web3 champions the promise of decentralization, touting a future where individuals and communities, not institutions, hold the reins. But in practice, the influence of traditional venture capital (VC) firms within the ecosystem reveals a different reality, one where power is not dismantled, but merely repackaged.

Rather than eliminating gatekeepers, many Web3 projects have simply replaced the old ones with new, well-funded players. Venture capital in Web3 has become a defining force in the industry. Firms like Andreessen Horowitz (a16z) have invested heavily in early-stage protocols, often securing preferential token allocations that grant them disproportionate control over these projects. For example, a16z reportedly holds over 55 million UNI tokens, giving it substantial influence over Uniswap’s governance.

This kind of privileged access is more than just financial—it’s political. With large token holdings, firms like a16z can steer decisions that affect entire ecosystems. One high-profile instance was a16z’s vote against a proposal to deploy Uniswap v3 on the BNB Chain via the Wormhole bridge. That single vote, from one powerful entity, had the potential to shape the future direction of a major DeFi protocol, highlighting just how centralized “decentralized” governance can become.

The implications are clear: instead of truly democratizing access, many token launches have begun to resemble Silicon Valley-style IPOs, only with fewer investor protections and more concentrated benefits. The result? Power in Web3 is often pre-wired, long before the broader community ever gets a seat at the table.

Strategies for Promoting Inclusivity and Reducing Centralization in Web3

If Web3 is to truly live up to its promise of decentralization, it must move beyond mere slogans and actively dismantle the entrenched power structures it aims to disrupt. Creating a more inclusive and equitable Web3 isn’t just about tweaking code; it demands a fundamental rethinking of incentives, governance models, and how people gain access to it. Fortunately, a number of promising strategies are emerging that could help turn these lofty ideals into a tangible reality.

One key approach is progressive decentralization, which tackles the early concentration of power through a phased transition. Rather than handing full control to founders and investors right away, this model allows for a structured early stage with clear governance, gradually shifting control to the community over time. This balance acknowledges the practical need for strong initial coordination, while keeping long-term decentralization firmly in sight.

Take Optimism as a prime example. Instead of distributing tokens to insiders, Optimism introduced its OP token using a retroactive public goods funding model, rewarding contributors who had already added genuine value. By prioritizing impact over influence, Optimism demonstrated how token distribution fairness in Web3 can support more sustainable ecosystems.

Reinventing governance itself is another critical piece. Traditional token-based voting systems often fall prey to the “one token, one vote” problem, giving large holders disproportionate power and silencing smaller participants. Quadratic voting flips this dynamic by making each additional vote increasingly costly, allowing collective support from many small holders to outweigh the clout of a few whales.

Access is equally vital for true inclusivity, yet many users remain locked out or priced out of ecosystems like Ethereum due to high fees or technical barriers. Cross-chain interoperability provides a solution, enabling users to participate across multiple networks without being confined to a single one.

Projects like LayerZero, Cosmos, and Polkadot are actively working to bridge fragmented blockchains, facilitating smoother asset transfers, reduced fees, and improved user experiences. As multichain connectivity strengthens, it opens the door to wider participation, especially from underserved regions and communities that have historically been excluded.

Fairness must also be embedded at the very start of projects, where token launches often set the tone. Too frequently, early token distributions favour insiders and venture capitalists, concentrating power before the broader community even gets a chance.

Redesigning token launches with community airdrops, vesting schedules, and open participation can make these critical early phases more equitable. Some protocols are experimenting with “fair launches” that avoid pre-allocations altogether, while others reward early adopters and contributors based on merit and active involvement rather than sheer investment size.

Finally, the Web3 ecosystem needs to shift its incentives away from short-term speculation toward long-term participation. Currently, the model often rewards quick flips and rapid profits, which can undermine sustainable growth. By introducing mechanisms like staking, reputation systems, and governance incentives that value ongoing engagement and responsible decision-making, protocols can nurture communities built on resilience and collaboration rather than extraction and short-term gain.

Together, these strategies offer a roadmap for making Web3 not just a decentralized ideal, but a genuinely inclusive, fair, and sustainable ecosystem—one where power is distributed, participation is accessible, and long-term value is prioritized

Conclusion: The True Test of Web3’s Promise

As Web3 continues to evolve, the tension between its lofty ideals and the realities on the ground remains striking. While the technology holds immense potential to democratize finance and governance, the persistent concentration of wealth and influence exposes a fundamental challenge: decentralization in name alone is not enough. True transformation requires more than innovative code; it demands intentional design, equitable governance, and accessible participation that dismantle entrenched power structures rather than replicate them.

The future of this ecosystem depends on whether it can move beyond rhetoric and create a space where power is truly shared, not just by design, but by practice. Only then can Web3 fulfil its promise as a decentralized revolution, not just a repackaged status quo.

Disclaimer: This piece is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”