It’s easy to roll your eyes at crypto these days. From scam headlines to price volatility that makes roller coasters jealous, the industry hasn’t exactly covered itself in glory. But peel back the noise, and a much deeper truth emerges: crypto isn’t perfect, but it might just be our best shot at building a fairer, faster, and more inclusive financial system.

In this article, we’ll explore how crypto compares to traditional finance, how it’s reaching the unbanked, where DeFi is disrupting the status quo, and what the space needs to improve to fulfil its promise truly.

Traditional Finance vs. Crypto: Who’s More Inefficient?

Let’s be honest — traditional finance is far from efficient. While it’s often upheld as the gold standard of stability, it’s riddled with frictions that disproportionately affect the people who need it most. Cross-border payments are a prime example. Moving money from one country to another through banks or legacy systems can take anywhere from three to five business days. That might be acceptable if we were still mailing checks, but in a digital age, this delay is indefensible. And then there’s the cost: the global average fee for sending remittances stood at 6.18% in Q4 2023, according to the World Bank. That’s more than double the G20’s target of 3.

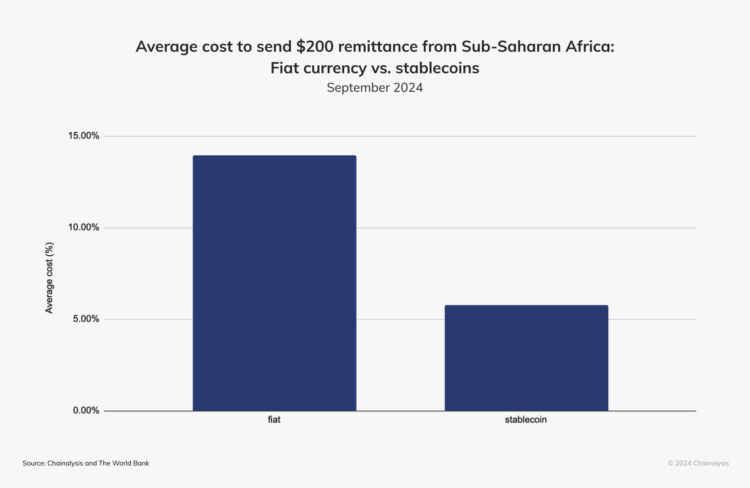

Now contrast that with crypto-powered transfers. Stablecoins for remittances sent over blockchains can land in the recipient’s wallet within seconds or minutes, not days. And instead of coughing up 6–7% in fees, users pay mere cents — or even less. According to Chainalysis, sending a $200 remittance from Sub-Saharan Africa using stablecoins for remittances can be around 60% cheaper than using traditional fiat-based remittance services.

If we’re measuring progress by time saved and money kept in people’s pockets, crypto isn’t just catching up — it’s quietly winning.

Financial Access, Not Just Innovation: Why Crypto Matters Where It Hurts Most

Roughly 1.4 billion adults around the world still lack access to a bank account, according to the World Bank’s 2021 data. For these individuals, barriers such as lacking formal identification, proof of address, or even a nearby bank branch are more than inconveniences; they are dealbreakers that exclude them from participating in the formal financial system. Traditional finance, with its centralized architecture and rigid gatekeeping, has proven both inadequate and inaccessible for the very populations that need it most.

Crypto financial inclusion is not just a buzzword — it’s a real-world solution to this global problem. With just a smartphone and internet connection, people can now send and receive money, store savings, borrow capital, or invest — all without waiting for someone’s approval or submitting documents that may not even exist.

Read Also: Financial Inclusion: Has Crypto Opened the Doors?

At the center of this transformation is DeFi. Unlike traditional financial infrastructure, DeFi relies on smart contracts, which are lines of self-executing code that automatically carry out transactions. No banks are acting as middlemen, no brokers are taking a cut, and no clerks are deciding who gets access.

Through DeFi platforms like Aave and Compound, users can lend their cryptocurrency assets and earn interest, or borrow funds instantly, without filling out forms or undergoing credit checks. These platforms offer speed, borderless access, and neutrality — attributes that traditional financial systems struggle to deliver.

Similarly, decentralized exchanges such as Uniswap and SushiSwap allow people to trade directly with each other using liquidity pools and automated algorithms, eliminating the need for custodians or trusted third parties.

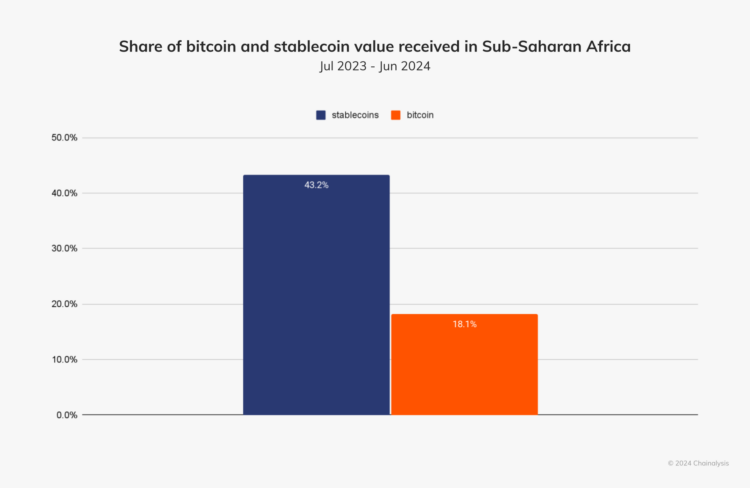

And for those living in countries with volatile currencies or experiencing hyperinflation, crypto as an inflation hedge becomes more than theory — it becomes a matter of survival. In regions such as Sub-Saharan Africa, where U.S. dollars are in short supply and inflation is a daily concern, stablecoins now account for nearly 43% of the region’s cryptocurrency transaction volume, serving as a lifeline for cross-border trade, remittances, and savings.

The impact of these tools isn’t hypothetical. Crypto Adoption in Nigeria has surged not out of speculative mania, but out of economic necessity. Between July 2023 and June 2024, the country received an estimated $59 billion in crypto value, underscoring how DeFi and stablecoins are helping individuals sidestep foreign exchange crises and rising inflation.

Related: From Bans to Licenses: Nigeria’s Crypto Journey in 2024

In El Salvador, the government’s adoption of Bitcoin has sparked a global debate. Still, the facts are clear: over four million people have signed up for its Chivo wallet, more than the total number of Salvadorans with traditional bank accounts. Regardless of one’s view on the implementation, the demand for digital financial alternatives is unmistakable.

Read Also: Lessons Learned from El Salvador’s Bitcoin Experiment

This wave of adoption isn’t isolated. Crypto adoption in developing countries is surging across lower-middle-income nations, where usage has outpaced that of wealthier economies. In 2023, these regions led the world in adoption, and 2024, the trend is extending even further, cutting across socioeconomic classes. The reason is simple: crypto doesn’t require financial history, pristine credit scores, or banking relationships. It just offers access.

The Tech and Ethical Gaps: Let’s Be Honest

Let’s not romanticize crypto; it has some severe growing pains, and pretending otherwise doesn’t help anyone. For all its promises of decentralization and financial liberation, the reality is that crypto still struggles with the basics: scale, security, and trust.

Take scalability, for example. Ethereum — the backbone of DeFi — has faced major congestion issues, especially during bull markets. Indeed, we’ve seen improvements thanks to Layer 2 solutions like Optimism and Arbitrum, which help alleviate the load on Ethereum’s leading network. But let’s be real, adoption is still patchy, and many users don’t fully understand how to bridge assets or navigate these new layers.

Then there are the so-called “Ethereum killers” — Solana, Avalanche, Polkadot — which boast faster speeds and cheaper fees. And yes, they are impressive. But those gains often come with trade-offs in decentralization or network reliability. Solana, for instance, has faced multiple outages that raise serious questions about its long-term dependability.

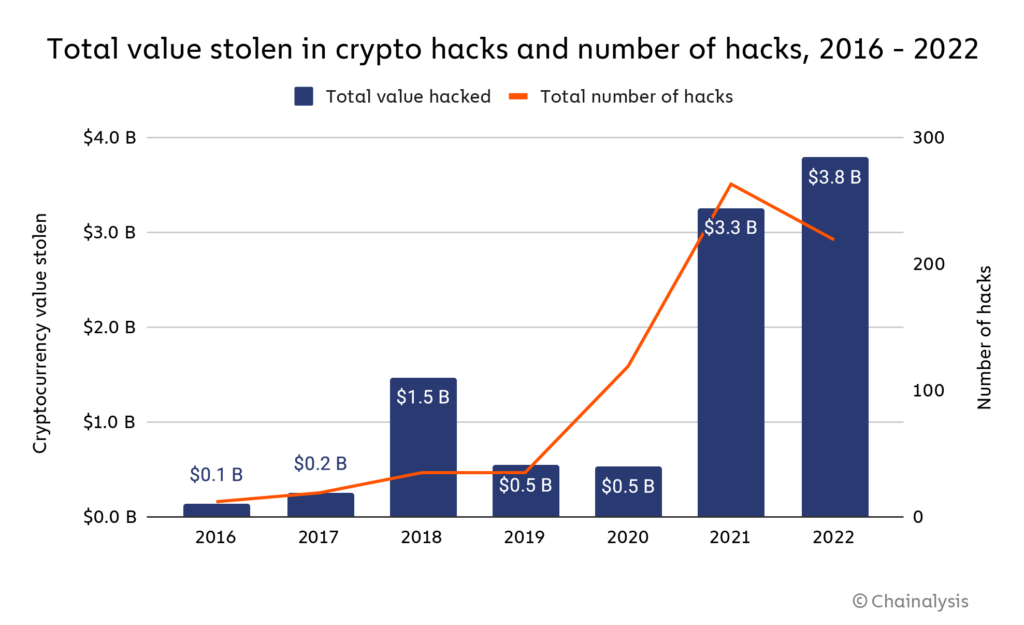

Security remains an urgent and growing concern, as DeFi platforms have become prime targets for malicious actors. 2022 marked the worst year on record for crypto hacks, with a staggering $3.8 billion stolen from cryptocurrency businesses.

The fundamental vulnerability lies in smart contracts: powerful yet fragile, they are only as secure as their underlying code. One unnoticed flaw or loophole can lead to the irreversible loss of funds. Unlike traditional finance, there is no recourse, no safety net, and no institutional backstop to absorb the fallout.

Ethical and environmental issues further complicate the narrative. Bitcoin, with its energy-intensive proof-of-work consensus, continues to consume as much electricity annually as entire countries, such as Sweden, sparking global debates around sustainability.

Ultimately, acknowledging these gaps is not an act of defeat but a step toward legitimacy. Crypto’s future depends not just on its technological brilliance but also on its willingness to confront hard truths and build systems that are not only open but also trustworthy, secure, and fair.

What Crypto Needs to Do Better (And How It Can Get There)

Despite its disruptive potential, the crypto industry still has significant work to do if it hopes to transition from a niche innovation to mainstream infrastructure. One of the most glaring challenges is usability. The average person shouldn’t need to decode technical jargon just to send digital assets or secure a wallet.

To bridge that gap, the industry must prioritize user experience—simplifying interfaces, providing real-time customer support, and investing in accessible educational content. Mobile-first platforms, such as Valora, built on the Celo blockchain, are already demonstrating how intuitive design can bring Web3 into the hands of everyday users. However, there’s still a long road ahead.

Regulation is another area where crypto must shift its approach. Rather than resisting oversight, the industry should embrace the opportunity to help shape regulatory frameworks that protect consumers without stifling innovation.

Countries like Switzerland and Singapore have already laid out clear, forward-thinking policies that serve as models for how regulation and blockchain innovation can coexist. A collaborative mindset, one that views policymakers as partners rather than adversaries, will be crucial in fostering trust and promoting long-term stability in the market.

Interoperability is also essential to crypto’s next chapter. Right now, the ecosystem is fragmented into isolated chains, each with its own rules, standards, and communities. True scalability and user adoption will require seamless movement of assets and information across platforms. Protocols like Cosmos, Polkadot, and LayerZero are pioneering solutions to enable secure cross-chain communication, laying the groundwork for a more connected and coherent Web3 experience.

But most importantly, crypto needs to rediscover its ethical core. The space cannot revolve solely around speculation and quick profits. It must champion values such as inclusivity, environmental responsibility, and human-centered development. Encouragingly, several projects are already leading the way—Gitcoin is fostering open-source funding, ImpactMarket is addressing financial inclusion, and Toucan Protocol is building on-chain infrastructure for carbon offsetting. These efforts prove that crypto can serve more than just markets; it can also serve people.

If the industry can align its technology with a renewed sense of purpose, crypto won’t just survive, it will thrive as a force for meaningful, global transformation.

Final Thought: Crypto Isn’t the Answer — But It Might Be the Question

No one’s saying crypto is perfect. It’s messy. Sometimes reckless. Often confusing. However, it’s a live experiment with global potential, and one of the few tech movements actively trying to address what finance has ignored for decades.

If we want a system that’s faster, fairer, and open to all, crypto is our best shot. The real question isn’t “will it succeed?” but “how do we make it worth succeeding?”

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”