Blockchain technology has fundamentally changed how we understand value, trust, and transparency in the digital age. It offers a world where transactions are recorded immutably, executed without intermediaries, and governed by decentralized protocols. Yet, for all its innovation, one key challenge continues to limit blockchain’s full potential—blockchain interoperability.

Most blockchain networks are built in silos, operating independently with unique rules, consensus mechanisms, and technical standards. A token that exists on one chain often cannot be used natively on another. As a result, moving assets or data between blockchains becomes a cumbersome and fragmented process. To address this problem, developers introduced a critical innovation: cross chain bridge solutions—technological frameworks that connect these isolated ecosystems, enabling interaction across chains.

This article explores why these bridges are necessary, how they function, the risks they carry, prominent interoperability initiatives, and whether bridges represent a permanent fixture or simply a stepping stone toward a more integrated future for Web3.

Why Do Blockchains Need Bridges?

Each blockchain operates like a sovereign nation with its own digital dialect…its own codebase, consensus rules, and asset standards. Bitcoin speaks one language, Ethereum another, and Solana yet another. Without a common protocol, these blockchains struggle to communicate or exchange value directly. This creates a scenario where users, developers, and enterprises are limited to the capabilities of a single chain, missing out on the benefits that others might offer.

Blockchain bridges act as the translators in this fractured landscape. They enable blockchain interoperability—the seamless sharing of information and assets between disparate blockchains. And this isn’t just a matter of user convenience. Interoperability unlocks a host of practical advantages: enhancing scalability, increasing liquidity across networks, and promoting cross-chain collaboration.

For instance, a decentralized finance (DeFi) protocol built on Ethereum might want to tap into liquidity on Binance Smart Chain or Avalanche. Without a cross chain bridge, such interactions would force users to rely on centralized exchanges, undermining the decentralized ethos that blockchain was built upon. Similarly, enterprises using private, permissioned blockchains may seek to integrate with public chains for broader access or functionality. Blockchain bridges create the infrastructure necessary for these synergies to happen.

RELATED: Interoperability and Composability: The New Standard for Blockchain Networks

How Crypto Bridges Work: Mechanisms of Cross-Chain Communication

While the architecture of blockchain bridges may differ based on their specific design goals, their core purpose remains the same: to enable secure and seamless transfers of assets or data between otherwise incompatible blockchain networks. Below are the primary mechanisms that power these vital connections in the crypto ecosystem.

Wrapped Tokens: Expanding Utility Across Chains

One of the most common methods employed by blockchain bridges involves the use of wrapped tokens. A wrapped token is a digital representation of an asset from one blockchain that can be used on another. For instance, Wrapped Bitcoin (WBTC) is an ERC-20 token on Ethereum that mirrors the value of Bitcoin (BTC).

To mint WBTC, a user deposits Bitcoin into a smart contract or a trusted custodial entity. The bridge then issues an equivalent amount of WBTC on Ethereum, while the original BTC is securely locked. This system allows Bitcoin holders to participate in Ethereum’s DeFi ecosystem without relinquishing ownership of their BTC. This significantly broadens the utility and accessibility of Bitcoin across different blockchain platforms—one example of how crypto bridges work in real-world scenarios.

Liquidity Pools: Capital Efficiency Across Chains

Another approach to cross-chain bridging utilizes liquidity pools. In this model, users deposit tokens into a pool on one blockchain and receive equivalent tokens on another chain. Unlike the wrapped token method, which locks assets and mints synthetic equivalents, liquidity pool-based bridges rely on having sufficient token reserves available across multiple blockchains to process swap requests.

This mechanism emphasizes capital efficiency and enables faster, more fluid asset transfers. However, it requires strong liquidity support and well-structured market-making incentives to function reliably, as inadequate reserves can lead to slippage or failed transactions—challenges often discussed when analyzing how crypto bridges work under pressure.

Types of Blockchain Bridges

The Dark Side of Bridges: Hacks and Security Risks

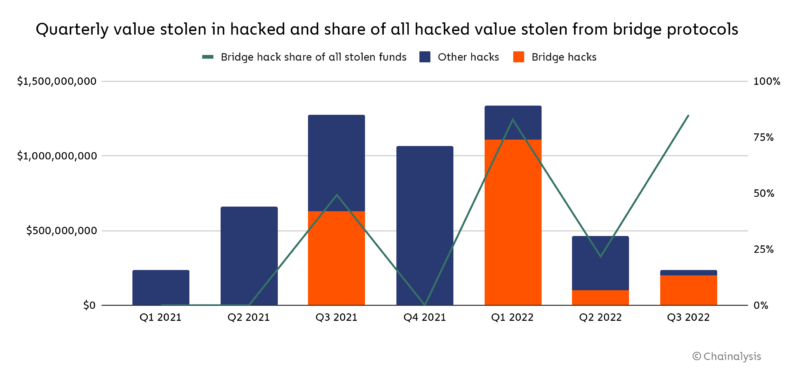

While blockchain interoperability brings enormous value, it also comes with significant risks. In fact, what is bridging in Web3 if not the most vulnerable layer of cross-chain interaction? According to a 2022 report by Chainalysis, over $2 billion in cryptocurrency was stolen across 13 separate bridge hacks, accounting for 69% of all funds stolen that year.

This statistic underscores the immense risk that accompanies these technologies, particularly because bridges often manage large volumes of locked or pooled assets. A single vulnerability in code, key management, or validator coordination can open the door to catastrophic losses.

Several high-profile incidents illustrate just how severe the consequences can be. In March 2022, the Ronin Bridge, which supports Axie Infinity, suffered a $615 million exploit after attackers compromised five of the nine validator keys. The breach highlighted the dangers of overly centralized validator management. Just a few months later, in June 2022, the Harmony Horizon Bridge lost $100 million due to poor key management, with attackers compromising two out of five multisig keys.

The trend continued in 2024. In January, the Orbit Chain exploit saw seven out of ten multisig keys compromised, leading to an $80 million loss. Then, in May, the ALEX Bridge was hit when a protocol upgrade possibly exposed private keys, resulting in a $4.3 million theft. These cases reflect a consistent pattern of security breakdowns, many of which stem from preventable issues.

At the core of these vulnerabilities are several persistent challenges. Centralized control remains one of the biggest concerns, as many bridges rely on multisig wallets or trusted validators, concentrating critical decision-making power in the hands of a few. Private key vulnerabilities further exacerbate the risk, with weak key management practices leaving systems open to both insider threats and external breaches.

Additionally, the lack of finality between chains introduces another layer of complexity. If a transaction is reversed on the source chain but not on the destination chain, the bridge may end up minting unbacked tokens.

Lastly, smart contract bugs, often the result of poorly audited code or overlooked logic errors, present an ever-present risk of exploitation.

Interoperability by Design: Polkadot, Cosmos, and LayerZero

Some projects have taken a more fundamental approach to interoperability by embedding cross-chain communication into their architecture from the start. These platforms aim to eliminate the need for risky third-party bridges altogether.

Polkadot

Polkadot utilizes a central Relay Chain to coordinate and secure multiple parachains, which are independent blockchains tailored for specific use cases. These parachains communicate using XCM (Cross-Consensus Message Format), a flexible messaging format designed to facilitate interoperability between different consensus systems. This architecture allows for scalability and interoperability within a unified ecosystem.

Cosmos

Described as the “Internet of Blockchains,” Cosmos uses the Inter-Blockchain Communication (IBC) protocol to connect sovereign blockchains known as zones. Each zone is free to govern itself, but with IBC, they can securely exchange assets and data, offering flexibility without sacrificing cross-chain functionality.

LayerZero

LayerZero is an omnichain interoperability protocol that enables cross-chain communication through a network of Ultra Light Nodes (ULNs), oracles, and relayers. Unlike traditional blockchains, LayerZero acts as a messaging layer, allowing decentralized applications to operate seamlessly across multiple chains. Projects like Stargate and SushiSwap have integrated LayerZero to facilitate cross-chain swaps and liquidity movement.

These interoperability-first platforms are building a future where cross-chain functionality is native—not an afterthought.

Are Bridges the Future, or Will One Chain Rule Them All?

The future of blockchain infrastructure is at a crossroads: will bridges power a multichain ecosystem, or will one dominant blockchain make them obsolete? As Web3 matures, blockchains are increasingly specialized—for privacy, speed, gaming, and more, making cross-chain communication essential. Bridges enable users to move assets and data across networks without sacrificing functionality or being locked into a single chain.

Technological innovations like zero-knowledge proofs, trustless bridging, and multi-party computation are making bridges more secure and decentralized, addressing long-standing security and centralization concerns. At the same time, Ethereum’s strong developer base and DeFi dominance make it a potential “one chain to rule them all,” especially with Layer 2 solutions like Optimism and Arbitrum reducing reliance on external bridges.

Still, betting solely on one blockchain risks ignoring the innovation across the ecosystem. Solana’s speed and Avalanche’s flexibility show that multiple chains are pushing boundaries in different ways. While a unified chain may offer simplicity, it could curb the diversity and experimentation that drive Web3 forward.

Ultimately, the future may not be either-or. A truly interoperable blockchain landscape—where chains coexist and bridges serve as secure connectors—could offer the best of both worlds: specialization with seamless collaboration.

The Inevitable Future of a Multichain World

Blockchain bridges are not just a temporary fix, they are a necessary evolution in the journey toward a truly interconnected Web3. While the dream of a single, dominant chain is appealing in its simplicity, it contradicts the diversity, specialization, and decentralization that define the blockchain ethos. From wrapped tokens to trust-minimized protocols, bridges enable fluid value transfer and collaborative innovation across ecosystems that would otherwise remain siloed.

Yes, the risks are real. Security vulnerabilities have cast long shadows over the promise of cross-chain communication. But these challenges have spurred innovation, with emerging trustless technologies and interoperability-first architectures like Polkadot, Cosmos, and LayerZero showing that bridges can evolve from brittle infrastructure into robust digital highways.

Ultimately, bridges are not the missing piece, they are the connective tissue of blockchain’s next chapter. Whether through purpose-built interoperability protocols or smarter, more secure bridges, the future lies not in choosing one chain to rule them all, but in embracing the power of many chains working as one.

Disclaimer: This piece is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”