Cryptocurrencies may exist in the digital ether, fortified by encryption and blockchain technology, but the risks surrounding them are becoming increasingly tangible. As digital defences grow more sophisticated, criminals are adapting, shifting from online hacks to real-world violence in pursuit of crypto assets. What once felt like a purely virtual risk has evolved into a physical threat with real consequences.

Unlike traditional bank accounts, which are protected by institutional safeguards, crypto wallets rely solely on private keys known only to the holder. Once those keys are compromised, funds can be transferred instantly and irreversibly. Combined with the pseudonymous nature of blockchain transactions, this level of control makes crypto investors especially attractive targets for criminals seeking high-reward, low-reversal opportunities.

Read Also: Security of Crypto Exchanges and Wallets

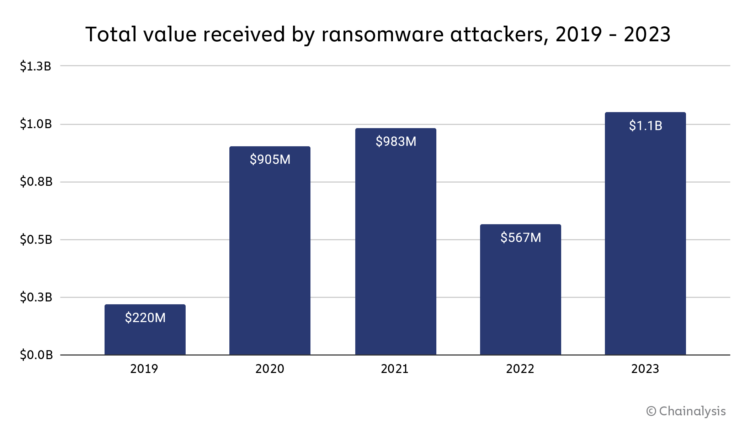

Understanding this growing threat isn’t just a matter of caution—it’s becoming essential for anyone navigating the digital asset space, whether you’re a seasoned trader or a newcomer chasing financial freedom. In 2023 alone, ransomware gangs extorted over $1.1 billion in cryptocurrency payments, according to blockchain analytics firm Chainalysis, a stark indicator of how criminal strategies are evolving alongside crypto’s mainstream rise.

High-Profile Physical Attack Cases

While the digital world of crypto offers immense financial freedom, it also comes with real-world risks that extend beyond screens and servers. Here are some unsettling examples:

Family of Paymium Co-Founder Targeted – May 2025

In a dramatic broad-daylight attack in Paris, the daughter and grandson of Pierre Noizat, co-founder and CEO of the French crypto exchange Paymium, narrowly avoided abduction. This Paymium CEO family kidnapping attempt involved three masked men trying to force them into a van in the bustling 11th district. In a bold act of defiance, Pierre Noizat’s daughter managed to disarm one of the assailants, reportedly tossing his gun aside in the heat of the struggle.

En plein Paris, un homme a été violenté par des individus cagoulés, habillés tout en noir. Ils tentaient de l’enlever. Un homme a surgi, extincteur à la main, pour les faire fuir. →https://t.co/P0qV6PR40v pic.twitter.com/9f4r2Gi7ho

— Le Figaro (@Le_Figaro) May 13, 2025

Bystanders quickly stepped in, forcing the attackers to flee. All three victims were taken to the hospital with injuries, and the incident is now a high-priority case for French authorities.

Paris Abduction – May 2025

In another chilling case, the father of a prominent French crypto investor was kidnapped right off the street. His captors demanded a ransom of €5-7 million and, in a brutal escalation, cut off one of his fingers to pressure his family into complying. Fortunately, French police managed to locate and rescue him, arresting five suspects in the process. This case adds to the growing number of crypto kidnapping cases reported globally and serves as a grim reminder that even the families of crypto investors can find themselves in the crosshairs.

Ledger Co-Founder Attack – January 2025

Even industry insiders aren’t immune. David Balland’s kidnapping shook the crypto community when the Ledger co-founder and his wife were abducted in Vierzon, France. In a disturbing echo of other recent cases, Balland was reportedly mutilated, with one of his fingers severed by his captors. After a large-scale investigation involving over 200 officers, police arrested 10 suspects, highlighting the serious physical risks that high-profile crypto figures can face.

Pascal Gauthier, chairman and CEO of Ledger, expressed relief and gratitude for the safe release of David and his wife.

Las Vegas Host Turned Hostage – November 2024

Physical crypto theft isn’t limited to Europe. In a particularly nerve-wracking case, a crypto investor hosting a private event in Las Vegas was abducted at gunpoint by three teenagers. They forced him to transfer $4 million in crypto before abandoning him in the desert. The victim survived, but the case underscores a troubling trend – as digital defences get stronger, criminals are increasingly turning to physical tactics. This incident is one of the most talked-about Las Vegas crypto investor kidnap cases in recent memory, highlighting how vulnerable even large-scale investors can be.

As digital asset lawyer Sasha Hodder noted in a recent X post, this shift signals a disturbing evolution in crypto crime: “It’s not just social engineering or SIM swaps anymore.”

???????? Nous sommes profondément soulagés d’apprendre la libération de David et sa femme et de les savoir sains et saufs. J’ai pris contact avec David, et nos pensées vont avec lui et sa famille. Nous partageons aussi l’émotion des membres de notre équipe, et en particulier de celles…

— Pascal Gauthier @Ledger (@_pgauthier) January 23, 2025

Criminals are moving beyond purely digital tactics, recognizing the potential for physical coercion to gain access to valuable assets.

This evolving landscape calls for heightened awareness and robust security measures to protect against such threats.

Why Crypto Holders Are Targeted

Crypto holders are particularly attractive to criminals for several reasons:

- High Liquidity: Unlike traditional assets, such as real estate or precious metals, cryptocurrencies can be transferred instantly and globally without intermediaries. Imagine having a briefcase full of cash that you can teleport to any corner of the world with a single click – that’s the appeal of crypto to criminals. The speed and ease of these transactions make them a tempting target for attackers looking for quick payoffs.

- Anonymity and Irreversibility: Once crypto funds are transferred, they are gone for good. Unlike a credit card or bank transaction that can be reversed or disputed, blockchain transactions are final. This means that if a thief gets access to your private keys, the funds are permanently lost, making crypto heists especially attractive. It’s like handing over the only key to a safe that has no spare – once it’s open, there’s no locking it back.

- Lack of Institutional Oversight: Unlike bank accounts, which have regulatory protections like insurance and anti-fraud measures, crypto wallets rely solely on the holder’s vigilance. There’s no customer service hotline to freeze your funds if someone tries to drain your wallet. This self-sovereignty, while empowering, also comes with a heavy responsibility, making crypto holders more vulnerable to coercion.

- Public Profiles and Flashy Lifestyles: Let’s face it, the crypto world loves to show off. Lamborghinis, luxury watches, exotic vacations – many high-profile investors can’t resist the allure of showing off their success. Unfortunately, this digital peacocking makes them prime targets for criminals. Publicly flaunting wealth, revealing expensive purchases, or even casually mentioning gains on social media can attract unwanted attention. It’s like lighting a flare in a dark forest – you’re bound to attract predators. As another observer bluntly noted, “If you’re in crypto and still flaunting it online, you’re not just stupid, you’re putting your family in danger.”

Personal Security Tips for Crypto Investors

To reduce the risk of physical attacks, consider these practical tips:

- Keep a Low Profile: You don’t have to hide in the shadows, but be mindful about what you share. Bragging about your latest 10x crypto win might feel good in the moment, but it’s also a neon sign to potential attackers. Keep your financial triumphs private – your future self will thank you.

- Use Pseudonyms and Secure Wallets: The more anonymous, the better. If you’re using the same handle across platforms or attaching your real name to public addresses, you’re making it easier for someone to connect the dots. Consider using pseudonyms and dedicated wallets for different purposes to add an extra layer of separation.

- Vary Your Routine: Avoid predictability. Changing your daily habits, routes, and even where you access your wallets can disrupt potential surveillance efforts. Criminals love predictability – don’t give it to them.

- Limit Geotagging and Personal Info Online: Posting your luxury vacation or latest conference trip might look great on the ‘gram, but it also gives potential attackers a precise location. Keep your travel plans and expensive purchases off the grid.

- Invest in Personal Security Training: Enrolling in self-defence classes or purchasing personal security devices can make a significant difference if you find yourself in a high-risk situation. Think of it as an investment in your peace of mind, just like your crypto portfolio.

- Protect Your Family’s Privacy: If you have loved ones who aren’t as security-conscious as you, it’s time for a family meeting. Ensure they understand the importance of maintaining a low profile, both online and offline.

Legal Protections and Future Solutions

When it comes to protecting crypto investors, the legal landscape is still catching up to the rapid pace of digital innovation. However, governments and law enforcement agencies worldwide are beginning to acknowledge the real-world risks that come with digital wealth. While it’s promising to see this shift, there’s still a long way to go. Let’s explore some potential solutions:

- Improved Legal Protections – Imagine if attackers faced penalties as severe as those for bank heists or high-stakes fraud. Stricter, crypto-specific laws could significantly deter would-be criminals. This might include harsher punishments for physical threats, extortion, or even the use of violence to gain access to digital assets. In some regions, lawmakers are already pushing for tougher regulations, but broader, globally coordinated efforts are needed to make a truly meaningful difference.

- Collaborative Law Enforcement Efforts – Crypto is a global phenomenon, but law enforcement often operates within strict national boundaries. To combat cross-border crypto crimes, countries must collaborate, share intelligence, and coordinate crackdowns on sophisticated criminal networks. We’ve seen this happen in cases involving ransomware and cyber extortion – why not apply the same coordinated effort to crypto-related physical crimes?

- Education and Awareness Campaigns – Knowledge is a robust defence. If more investors understand the risks and take proactive steps to protect themselves, the pool of easy targets shrinks significantly. This means ongoing public awareness campaigns, industry workshops, and clear, accessible guidance on best practices for crypto security.

Ultimately, the road to safer crypto investing isn’t just about better tech – it’s about building a culture of vigilance and resilience. After all, the best way to outsmart the bad guys is to stay one step ahead.

Finalizing Thought:

The promise of crypto has always been rooted in empowerment, giving people full control over their wealth, independent of traditional financial systems. But that same control comes with a price: responsibility, and now, in some disturbing cases, real-world risk. As cryptocurrency continues to mature and integrate into mainstream finance, investors must also evolve, not just in digital savvy, but in physical vigilance.

This isn’t about living in fear. It’s about understanding that the digital world doesn’t shield us from physical threats—it amplifies them in new and unpredictable ways. From Paris to Las Vegas, the message is clear: if your assets reside in the cloud, your security must be grounded in reality.

In a space defined by innovation, let’s innovate our safety strategies as fiercely as we do our financial ones. Because in the world of crypto, being your own bank also means being your own bodyguard.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”