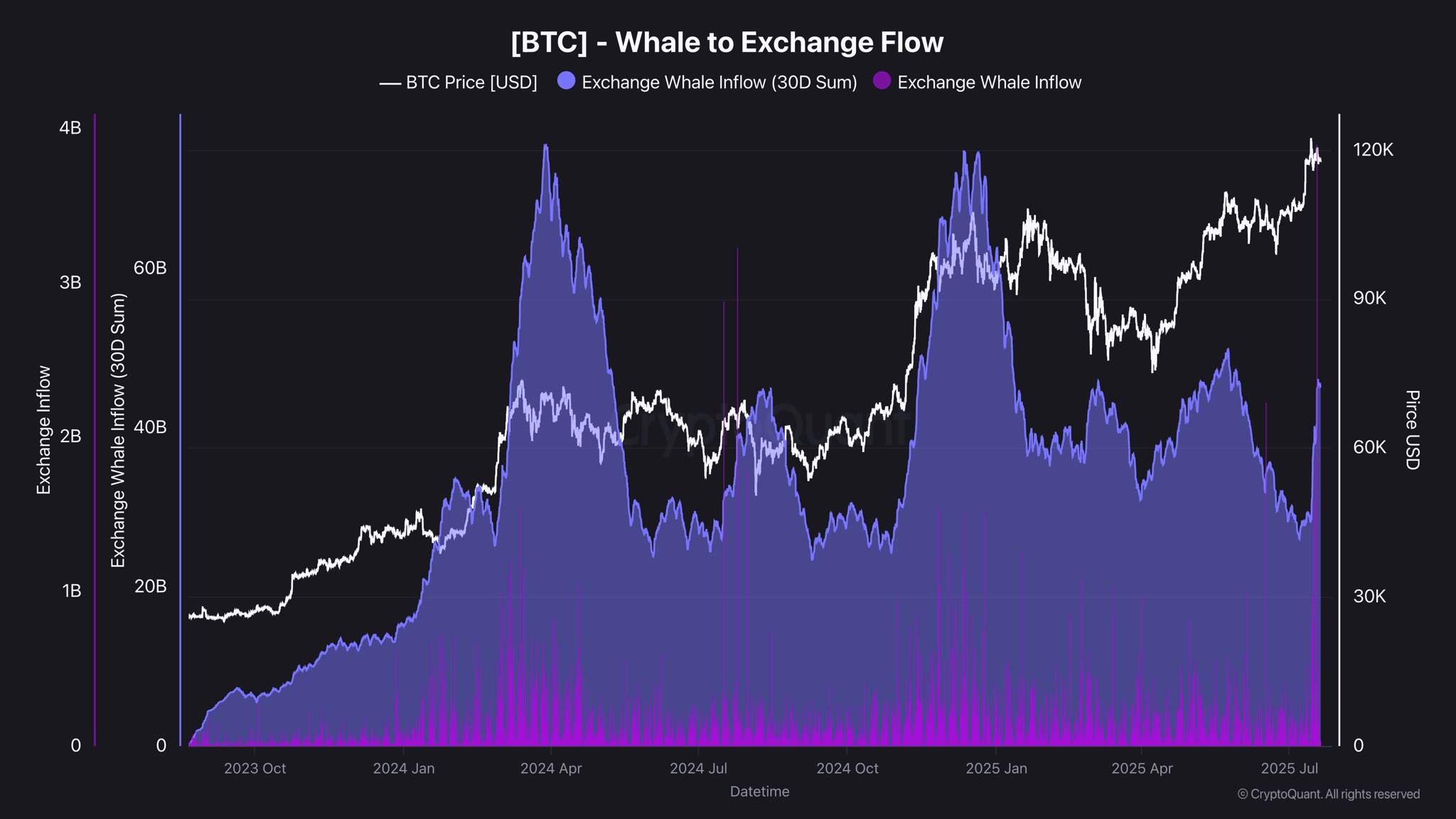

Bitcoin inflows to exchanges from large holders often referred to as “whales”, have seen a sharp uptick, signaling a possible turning point in market dynamics. According to on-chain data analyzed by CryptoQuant contributor Darkfost, the monthly average of whale inflows jumped from $28 billion to $45 billion between July 14 and July 18, a dramatic $17 billion rise in just four days.

This surge is particularly noteworthy because, historically, similar spikes in whale inflows have often preceded major market corrections. In the last two bull market peaks, monthly inflows from whales surpassed $75 billion, coinciding with the beginning of significant price consolidations or even downturns.

Adding to the intrigue, the latest spike may be connected to a massive transaction involving 80,000 BTC. Analysts believe this could suggest that whales are taking advantage of Bitcoin’s recent all-time highs to lock in profits, a familiar pattern in overheated or overextended markets.

However, there may be a shift in sentiment. Despite the initial spike, daily inflow data has shown a notable decline in the days that followed. This drop could point to easing sell pressure from whales. If the trend continues, it may help support price stability and reduce the risk of a deeper correction.

As a result, market watchers are keeping a close eye on whale inflow trends. Historically, elevated inflows have indicated mounting selling pressure, while declining inflows have often signaled a cooling of that activity and potentially, a more balanced market.

Although the long-term implications of this latest movement remain uncertain, it underscores the influence of whale behaviour on Bitcoin’s short-term price direction. Investors are being urged to monitor these trends carefully in the days ahead, especially as the market digests recent volatility.

In a broader context, global brokerage firm FBS has released its mid-year analysis of the cryptocurrency market. The report highlights Bitcoin’s continued dominance throughout the first half of 2025 and outlines key macroeconomic trends expected to shape crypto performance in the months ahead.

If you want to read more news articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”