Ethereum’s price has jumped sharply up more than 50% in the past month and over 150% since hitting its lowest point in April. This rise is mainly due to growing demand from exchange-traded products (ETPs) and companies adding Ethereum to their balance sheets.

According to Matt Hougan, Chief Investment Officer at Bitwise, Ethereum is now seeing the same kind of strong demand that helped Bitcoin rise earlier. Since Bitcoin ETPs launched in January 2024, institutional investors and companies have bought over 1.5 million BTC, even though only 300,000 new coins were mined. With demand much higher than supply, Bitcoin’s price kept going up.

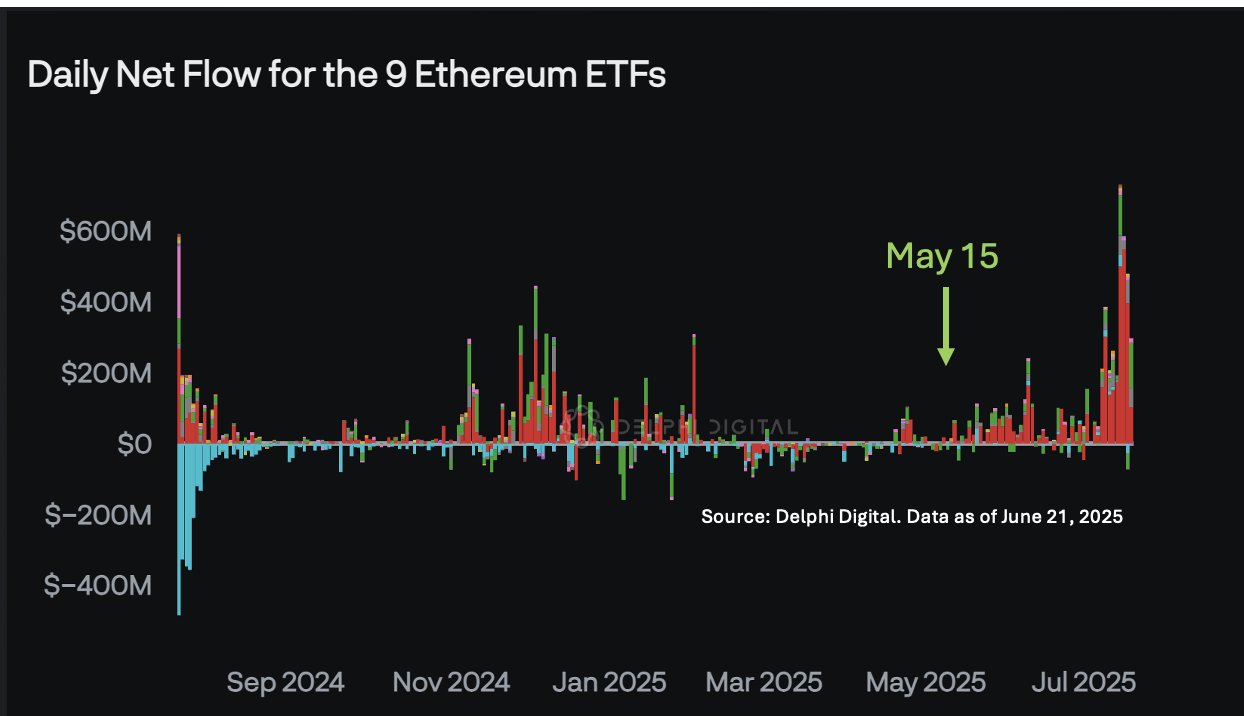

Ethereum didn’t get the same attention at first. ETPs for ETH started in July 2024, but from then until mid-May 2025, they only brought in $2.5 billion, about 660,000 ETH. At the same time, Ethereum’s network created around 543,000 new ETH. Because the numbers were close, there was little pressure on the price.

Things began to change after May 15. Since then, Ethereum ETPs have brought in over $5 billion. Companies like Bitmine and SharpLink also started holding Ethereum in their treasuries, showing more interest in using ETH as a store of value.

This shift is getting stronger. Stocks of companies that hold Ethereum are now trading above the value of the ETH they own. That shows investors see value in ETH exposure. With more money flowing into ETH products, more companies buying, and not much new ETH being created, Ethereum is now in a supply-demand cycle similar to what pushed Bitcoin higher.

Amid this rally, the debate between supporters of Bitcoin and Ethereum has resurfaced. Economist and long-time crypto critic Peter Schiff recently weighed in, advising investors to sell their Ethereum holdings in favour of Bitcoin. His comments came after Ether surged past $3,700, a level not seen since January 2024, bolstered by strong institutional interest and renewed market confidence.

If you want to read more news articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”