South Korea has long been a major player in the global crypto market. Despite having a relatively small population, the country consistently ranks high in crypto trading volume, adoption rates, and blockchain innovation.

From the days of the “Kimchi Premium,” where Bitcoin traded at much higher prices in South Korea than elsewhere, to the government’s active role in regulating and promoting blockchain technology, South Korea’s actions often set trends across Asia and beyond.

Today, South Korea’s top investors and financial institutions are once again making significant moves into crypto. Whether it’s through increased Bitcoin holdings, strategic investments in blockchain startups, or the adoption of crypto ETFs, these actions reflect a larger shift in sentiment that could signal the start of the next global bull run.

In the past, when South Korean demand for crypto surged, global prices often followed. With renewed energy now building in Korean markets, backed by wealth, policy support, and institutional interest, the signs are hard to ignore. South Korea’s strategic moves could be the first dominoes in a new era of global crypto growth.

Wealthy South Koreans Are Loading Up

A recent Hana Bank report revealed how wealthy South Koreans are managing their money, including their investments in virtual assets like cryptocurrency. The study found that one in three people with over 1 billion won ($800,000 USD) in assets have invested in crypto at some point. On average, they invested 42 million won (~$33,000 USD) in virtual assets.

The survey included 3,010 people: 884 wealthy individuals, 1,545 people in the “mass affluent” group (with 100 million to 1 billion won in assets), and 581 everyday people. Interestingly, wealthy people (those with over 1 billion won) are more likely to own multiple virtual assets, with 34% owning four or more different types. Also, over 70% of the wealthy people who invested in virtual assets have put in more than 10 million won (~$7,800 USD).

Looking ahead, it seems many of these wealthy investors are sticking with their crypto investments, 60% to 70% of them plan to keep investing in the near future. Most say they’re in it for the potential to make money (49%), but there’s also growing interest in how easy it is to invest and the future growth potential of virtual assets.

What Tokens are These Wealthy Investors Targeting?

Bitcoin remains a popular choice among wealthy South Korean investors, evidenced by massive trading volumes on platforms like Upbit and Bithumb.

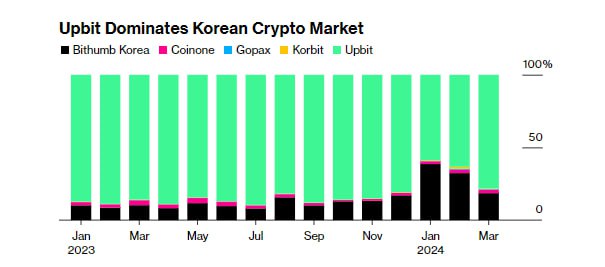

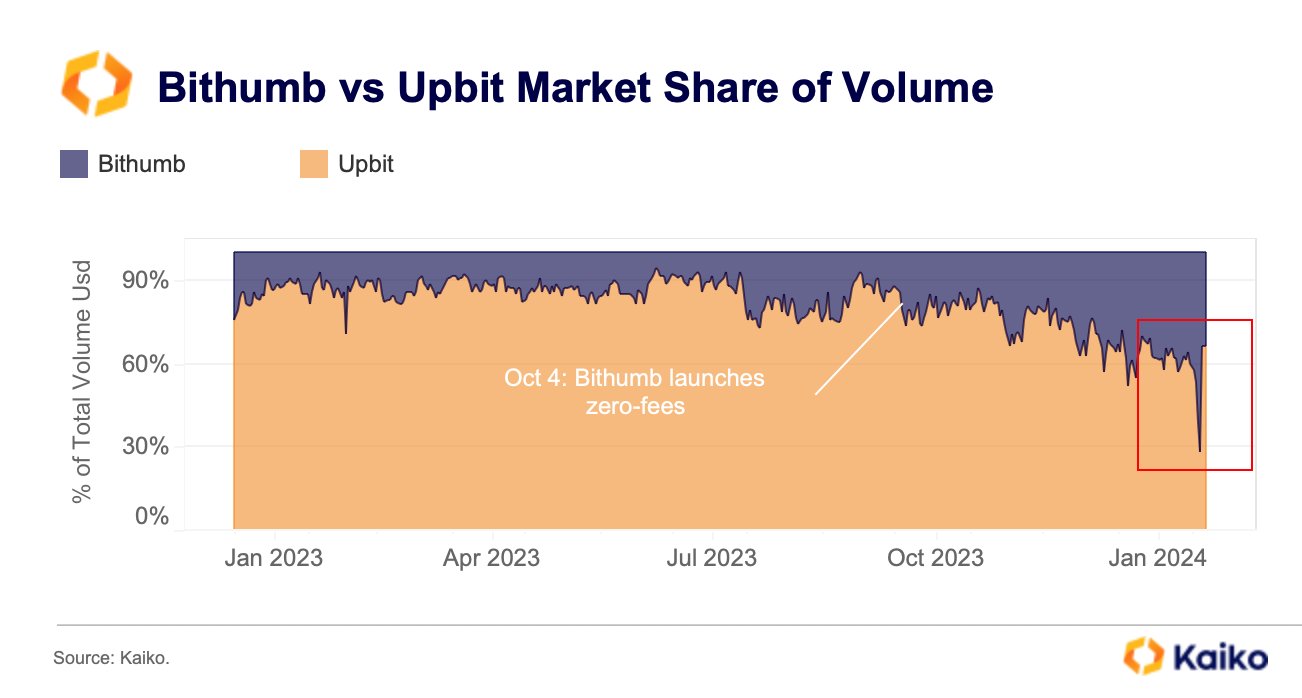

Bitcoin is often viewed as a reliable store of value, especially compared to traditional investments like stocks and real estate. As of early 2024, Upbit captured over 80% of South Korea’s crypto trading volume, with a notable spike in trading activities during periods of market volatility.

In early 2024, Bithumb briefly captured a 72% market share over Upbit, with Bitcoin trading volumes approaching $3 billion in January.

While Bitcoin remains the dominant cryptocurrency, South Korea is rapidly becoming the world leader in altcoin trading. According to Coingecko, in April 2025, altcoin trading volumes on Upbit hit $2.8 billion.

Interestingly, XRP, DeepBook, Official Trump, Walrus, Just and Ardor all lead Bitcoin, signalling the strong demand for these assets. In South Korea, retail investors, particularly those in their 20s and 30s, are increasingly shifting their investments from traditional assets to altcoins.

The popularity of altcoins is driven by the perception that these assets offer greater potential for growth and larger returns, especially in the context of South Korea’s vibrant crypto market. This dynamic shows that South Korea’s wealthy investors are diversifying their portfolios, keen to capture the growth opportunities these altcoins present.

What This Signals for the Market and Its Ripple Effects

As South Korea’s wealthy investors increasingly view virtual assets as a viable long-term investment, the market’s maturity is becoming more apparent.

Wealthy individuals are known for their careful, calculated investment strategies, and their confidence in crypto suggests that the market has reached a level of sophistication that is attracting serious institutional players.

For this reason, South Korea’s Financial Services Commission (FSC) is planning to roll out a set of rules for institutional crypto investment by the third quarter of 2025. They announced this during a meeting with local crypto experts on March 12, 2025.

The FSC’s Vice Chairman, Kim So-young, said that South Korea is speeding up its efforts to grow the country’s cryptocurrency market. He even pointed out that the U.S. government under Donald Trump helped push global discussions about crypto forward.

The new guidelines will help institutions (like banks and big investment firms) navigate crypto by laying down clear “best practices” for things like crypto trading, disclosure (how they report their crypto dealings), and reporting standards.

The ripple effects of this growing sentiment could extend well beyond South Korea. As other markets, especially in Asia, look to South Korea as a barometer for crypto trends, we could see a surge in global investment activity.

With institutional investors and wealthy individuals showing greater interest in the long-term growth potential of crypto, the market may be on the cusp of a new bull run and global market revival.

South Korea’s Crypto Moves: A Bullish Signal for the Market?

As South Korean regulators work to bring cryptocurrency into the mainstream financial system, these efforts could pave the way for a more stable and mature market. This makes South Korea an important market for investors to watch. With increasing demand for riskier investments, strong trading volumes, and a clear regulatory path, South Korea’s crypto sector is poised to play a major role in the next market cycle.

For global investors, especially those seeking early signs of the next bull run, Seoul could be closer to the center of crypto action than traditional hubs like Silicon Valley. As South Korea leads in crypto adoption and innovation, staying informed about trends in the nation could offer valuable insights into global market movements. With its growing focus on blockchain, crypto trading, and regulation, South Korea presents an opportunity for smart investors to get ahead and position themselves for future industry growth.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”