Last updated on August 26th, 2025 at 09:50 am

For years, the crypto market was a no-go zone for institutions—too wild, too risky, and too unpredictable. High-profile collapses and regulatory uncertainty kept Wall Street’s biggest players on the sidelines. Fast forward to today, and the big suits are moving in. Hedge funds, pension funds, and even governments are sliding their chairs up to the table.

With a new U.S. administration setting the stage for clearer regulations and financial giants like BlackRock and Fidelity doubling down on crypto, institutional investors aren’t just testing the waters—they’re getting ready to take the plunge bringing deep pockets, strict regulations, and long-term strategies.

For crypto purists, this might feel like watching your favorite underground band go mainstream. Is the magic gone? Maybe. But with institutional adoption comes perks: more liquidity, less rollercoaster-level volatility, and—gasp—potential legitimacy in the eyes of traditional finance. So, is this shift a disaster or an evolution? Let’s break it down.

Why Institutions Are Entering Crypto

Back in 2021, the market cap of crypto-assets expanded 3.5 times, hitting $2.6 trillion. This boom occurred alongside a significant rise in institutional participation. That year marked a turning point in how crypto was perceived by traditional finance.

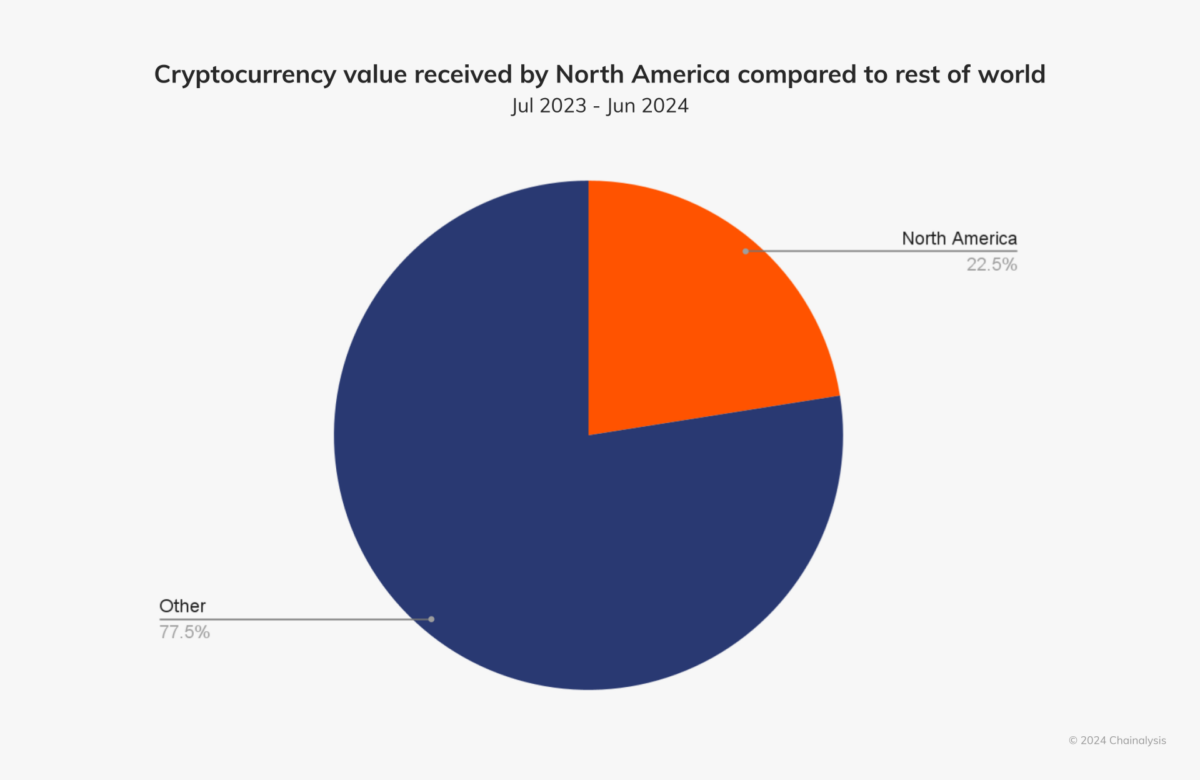

According to Chainalysis, North America’s dominance in the crypto market is largely driven by institutional activity. Between July 2023 and June 2024, the region received an estimated $1.3 trillion in on-chain value, accounting for roughly 22.5% of global activity.

Legacy financial giants such as Goldman Sachs, Fidelity, and BlackRock—firms that have shaped traditional financial markets for decades—are now taking serious positions in the crypto space.

For institutions, clear rules and regulations aren’t just a luxury: They’re a necessity. Over the past few years, financial regulators worldwide have worked to integrate cryptocurrencies into the traditional financial system, making it easier (and safer) for institutions to participate.

A major milestone came in 2024 with the U.S. Securities and Exchange Commission (SEC)’s approval of multiple spot Bitcoin ETFs. BlackRock, Fidelity, and Grayscale now offer regulated exposure to Bitcoin, attracting billions in capital from institutional clients. No institution wants to take on uncontrolled risk, and the growing availability of financial instruments has made crypto a much more appealing asset class.

Other jurisdictions are also raising the bar in other aspects: Hong Kong has introduced a licensing framework for exchanges, while the European Union’s Markets in Crypto-Assets (MiCA) regulation is setting global standards for compliance.

Beyond regulation, infrastructure improvements have also played a major role. Gone are the days of lost private keys and hacked exchanges. Today, institutions can rely on professional-grade services for storage, trading, and custody.

Platforms like Coinbase Institutional, Fidelity Digital Assets, and Bakkt now offer secure custodial services, ensuring that institutional funds are safely stored. At the same time, trading platforms have matured—CME Group and Binance Institutional have developed sophisticated trading environments with deep liquidity and advanced risk management tools.

Even insurance companies have jumped in. Major firms like Lloyd’s of London now offer crypto custody insurance, reducing counterparty risks and giving institutions greater peace of mind. These advancements make crypto feel less like the Wild West and more like a structured financial market.

In short, the crypto market has matured. And institutions are taking notice.

Why Institutionalization Could Be Good for Crypto

Institutional capital has done more than just inject funds into crypto markets, it is reshaping how the markets behave.

Increased Liquidity and Reduced Volatility

One of the biggest advantages of institutional adoption is the injection of liquidity. When large players such as hedge funds and asset managers enter the market, it becomes easier for investors to buy and sell assets without drastically impacting prices.

Crypto markets are infamous for their wild price swings, but institutions take a long-term view and are less prone to panic selling. Unlike retail traders, who often react emotionally to market fluctuations, institutions typically invest based on strategic portfolio management and risk assessments, not Reddit threads or Twitter hype.

Take Bitcoin’s 2020–2021 bull run. Institutional purchases helped sustain upward momentum. Tesla’s $1.5 billion investment and Square’s $50 million Bitcoin buy were seen as validation that the crypto was no longer just for degens and day traders.

This influx of institutional money has also led to a notable reduction in Bitcoin’s volatility and made it a more attractive asset for risk-conscious investors.

Greater Market Credibility

For years, skeptics dismissed crypto as a niche, unregulated, and unreliable market. However, as major financial institutions have entered the space, digital assets have gained legitimacy as a recognized asset class.

JPMorgan and Goldman Sachs—two of the world’s largest investment banks—now offer Bitcoin trading and investment services, a stark contrast to their previous skepticism.

Beyond financial institutions, major payment processors are also embracing blockchain technology. Visa and Mastercard are actively integrating blockchain solutions to streamline cross-border payments, signaling that crypto is not just a speculative asset but a technological advancement that is here to stay.

With institutions come better protections for users, clearer taxation policies, and greater market efficiency. Liquidity deepens, spreads tighten, and price discovery improves. These benefits help all participants—retail included—by reducing manipulation and improving trade execution.

More importantly, legitimacy invites mass adoption. When your pension fund, national bank, or insurance provider treats crypto as a serious asset class, the stigma lifts. Crypto becomes part of the mainstream financial system—not just an outsider’s bet.

Even Bitcoin, often hailed as the ultimate anti-establishment asset, benefits from institutional validation. It’s now viewed not just as a speculative play, but as a legitimate hedge and a long-term store of value.

The Trade-Off: What Happens to Decentralization?

As institutions claim a bigger stake in crypto, critics worry about a loss of decentralization—the very ethos the space was built on.

One major concern is the regulatory influence these institutions may exert. With enough capital and lobbying power, they could shape policies to suit their own interests, potentially sidelining the needs of smaller players.

In proof-of-stake (PoS) networks, large institutional holdings may also lead to outsized control in governance decisions. Even in Bitcoin’s proof-of-work (PoW) model, centralized exchanges like Binance and Coinbase dominate large swaths of transaction volume, introducing points of control.

But decentralization isn’t gone—it’s adapting. DeFi platforms, DAOs, and community-governed protocols still offer an open alternative to corporate-heavy control. The coexistence of centralized and decentralized models may well define the next chapter of crypto’s evolution.

Institutional adoption might exactly kill the ethos of decentralization, instead it will expand crypto’s reach and utility. Innovation in permissionless finance, DAOs, and Web3 can still thrive alongside regulated onramps. In fact, institutional presence might help fund and legitimize these parallel systems. It’s not a binary choice—it’s coexistence.

What This Means for Retail Investors—And the Road Ahead

Retail investors are not being pushed out of the crypto space. If anything, they now have a safer, more structured environment in which to operate. With better infrastructure, less volatility, and new investment products, retail users are seeing barriers to entry fall. ETFs, custodial wallets, and savings products offer exposure without requiring technical know-how or risky trades on shady platforms.

At the same time, institutions are unlikely to explore the more experimental edges of crypto—like early-stage DeFi, DAOs, or niche Web3 ecosystems. That sandbox still belongs to individual users, builders, and communities willing to take bigger risks for bigger potential rewards.

In this evolving dynamic, both sides can thrive. Institutional capital can provide the stability, scale, and regulatory legitimacy the space has long needed. Retail innovation can continue to push the boundaries of what crypto can be.

This isn’t the end of crypto’s original vision—it’s an evolution. The future of crypto might be institutional in structure, but it can still remain decentralized in spirit. And that’s not a bad thing. It might be the balance the industry needs to mature without losing its soul.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”