Once known for its rapid growth and innovation, the cryptocurrency industry has recently been marked by significant job cuts across major companies.

Over the past few years, crypto companies have faced mounting pressure to adapt to changing market dynamics. Kraken, one of the largest crypto exchanges, has undergone two rounds of layoffs. In 2022, it reduced its workforce by 30%, affecting 1,100 employees. Now, in 2024, the exchange has let go of an additional 15%, impacting nearly 400 workers, including high-profile executives like Technology Chief Vishnu Patankar and former Operations Chief Gilles BianRosa.

This trend isn’t isolated to Kraken. ConsenSys, a blockchain development company, recently cut over 20% of its workforce, laying off 162 employees to streamline operations and decentralize its business. Decentralized exchange dYdX also announced layoffs affecting 35% of its staff, while Nova Labs, known for its Helium Mobile initiative, reduced its workforce by 36%.

The sheer scale of these layoffs has sparked widespread concern about the crypto industry’s trajectory. Are these cuts a sign of trouble, or do they point to a strategic realignment for long-term growth?

Why Are Crypto Companies Laying Off Workers?

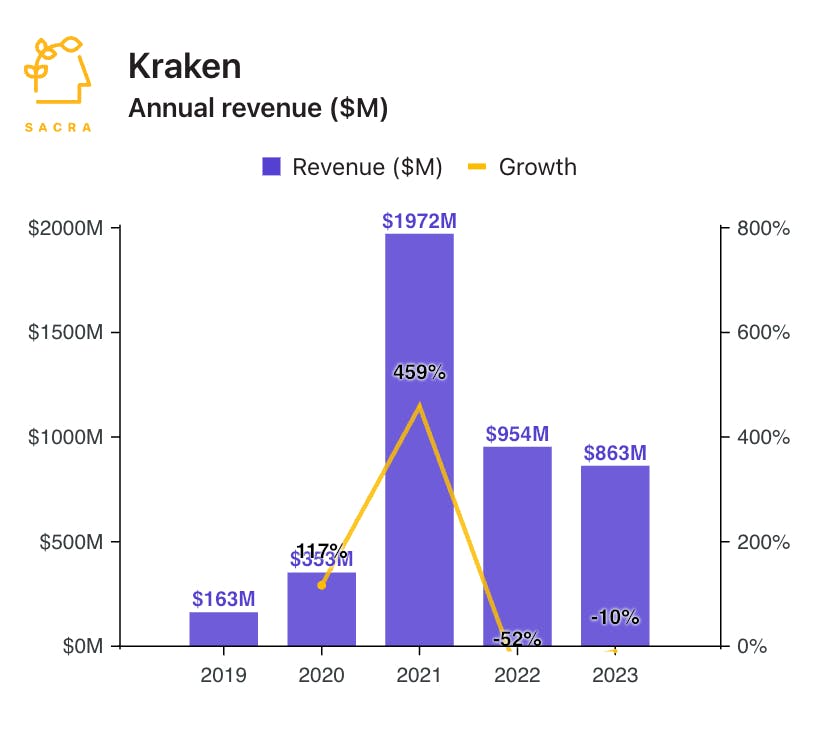

One of the primary reasons for these layoffs is a shift toward operational efficiency. As the crypto market evolves, companies are under pressure to become leaner and more focused on their core objectives. Kraken’s co-CEOs, Dave Ripley and Arjun Sethi, emphasized this in a blog post explaining their latest layoffs. They revealed that while the company achieved $1 billion in global revenue (up from $880 million in 2023), inefficiencies emerged, prompting the need to restructure.

Similarly, ConsenSys CEO Joe Lubin explained that the company’s layoffs aim to streamline operations and achieve long-term financial sustainability. By reducing its workforce, ConsenSys hopes to become a “smaller, more agile organization,” better equipped to navigate market uncertainties.

For Nova Labs, the decision to downsize was tied to a strategic shift toward Helium Mobile, its growing decentralized wireless network. COO Frank Mong highlighted the need to concentrate resources on this expanding venture, ensuring the company remains competitive.

Another key driver behind these layoffs is the need for companies to realign their efforts with their primary goals. dYdX CEO Antonio Juliano stated that the company’s recent job cuts were not due to financial difficulties but were necessary to sharpen focus and bring renewed energy to its vision. This sentiment is echoed across the industry, as firms look to prioritize projects with the highest growth potential.

Can the Crypto Market Benefit from Layoffs?

Though layoffs often bring immediate challenges, they could have positive long-term effects on the crypto industry. Companies are leveraging these restructuring efforts to enhance their financial health, foster innovation, and improve market resilience.

Streamlining operations allows companies to eliminate redundant roles, enabling faster decision-making and greater agility. This can create an environment that fosters collaboration and creativity, leading to the development of innovative products and services. For example, as Kraken refines its organizational structure, it may uncover new ways to deliver value to its users.

By focusing on core objectives, firms can allocate resources more effectively, directing efforts toward projects that align with emerging market trends. This strategic clarity can position companies to seize opportunities in areas such as DeFi, blockchain infrastructure, and Web3 technologies.

Restructuring could also encourage greater collaboration within the crypto space. As companies look to streamline, they may seek partnerships to leverage complementary strengths. Joint ventures and resource-sharing initiatives can lead to groundbreaking projects that drive industry-wide progress.

While layoffs might initially alarm investors, they can ultimately signal a commitment to sustainability. Companies that demonstrate fiscal discipline and a clear strategic direction may attract more confidence from stakeholders, leading to increased investments.

Challenges and Risks of Job Cuts

Despite potential benefits, the wave of layoffs raises concerns about the crypto industry’s stability.

Laying off employees means losing valuable expertise, which could hinder innovation and slow the development of new technologies. Talented workers may migrate to other sectors, benefiting startups or competing industries but leaving established firms at a disadvantage.

Job cuts by major players like Kraken and ConsenSys send a negative signal to investors, prompting fears of instability. This shift in sentiment could reduce investment in cryptocurrencies, affecting market prices and slowing overall growth.

The layoffs may also draw attention from regulators, sparking discussions about job security and employee rights within the crypto industry. Increased regulation could impose additional constraints on how companies manage their teams, potentially reshaping the industry’s operational landscape.

The Bigger Picture: What Does This Mean for Crypto?

The recent wave of layoffs reflects a maturing industry grappling with growing pains. As companies adapt to market challenges, they are making difficult decisions to ensure long-term survival. While job cuts can be disruptive, they also present an opportunity for the industry to evolve, becoming more efficient and focused.

For the crypto market to thrive, companies must balance restructuring efforts with investments in talent, innovation, and partnerships. By doing so, they can build a resilient ecosystem capable of weathering economic fluctuations and delivering value to users.

Ultimately, these layoffs may mark a turning point, signaling a shift from rapid expansion to sustainable growth. Whether this transition will strengthen the industry or expose deeper vulnerabilities remains to be seen. However, the focus on streamlining and innovation suggests that crypto firms are laying the groundwork for a more stable and prosperous future.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more market analyses like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”